As my southern grandmother would have said, "What in tarnation?!"

Below is a list of my favorite charts demonstrating the US stock market is bubbly, bubbly, bubbly...

You may not agree, but it should give you pause...and at least reflect!

Any I missed?

Below is a list of my favorite charts demonstrating the US stock market is bubbly, bubbly, bubbly...

You may not agree, but it should give you pause...and at least reflect!

Any I missed?

This will be a big airdrop of charts so strap in!

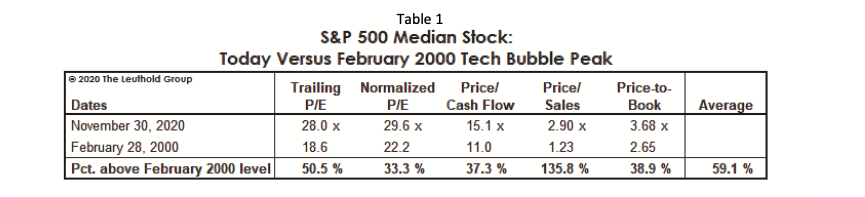

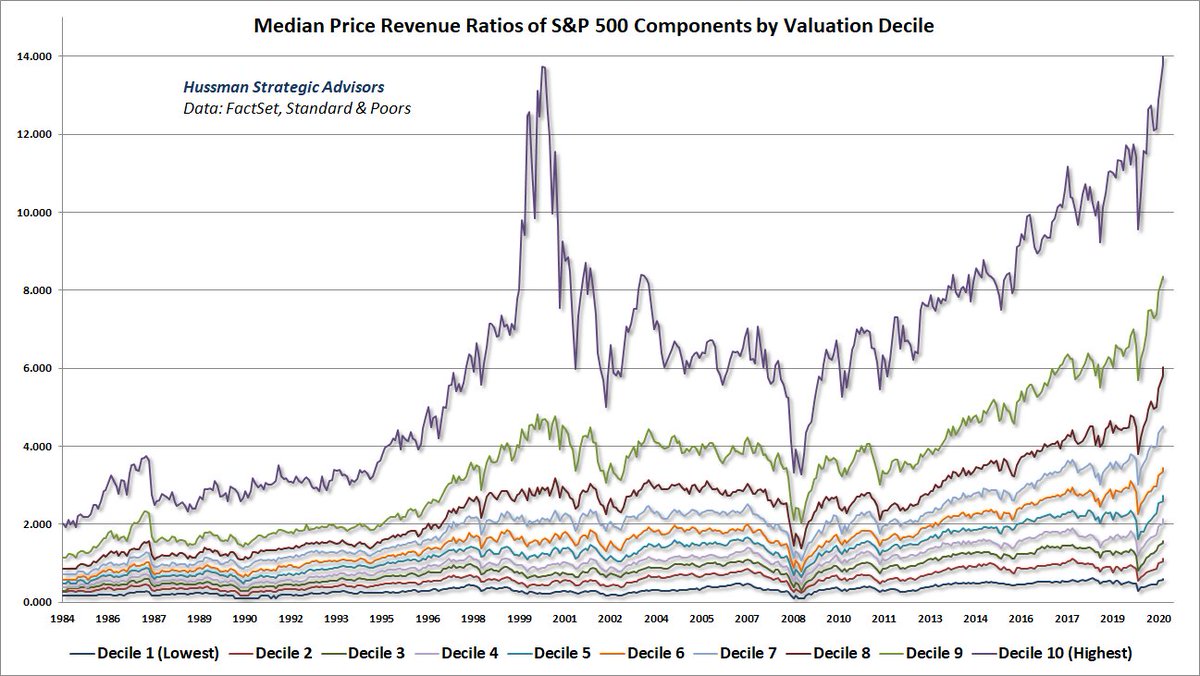

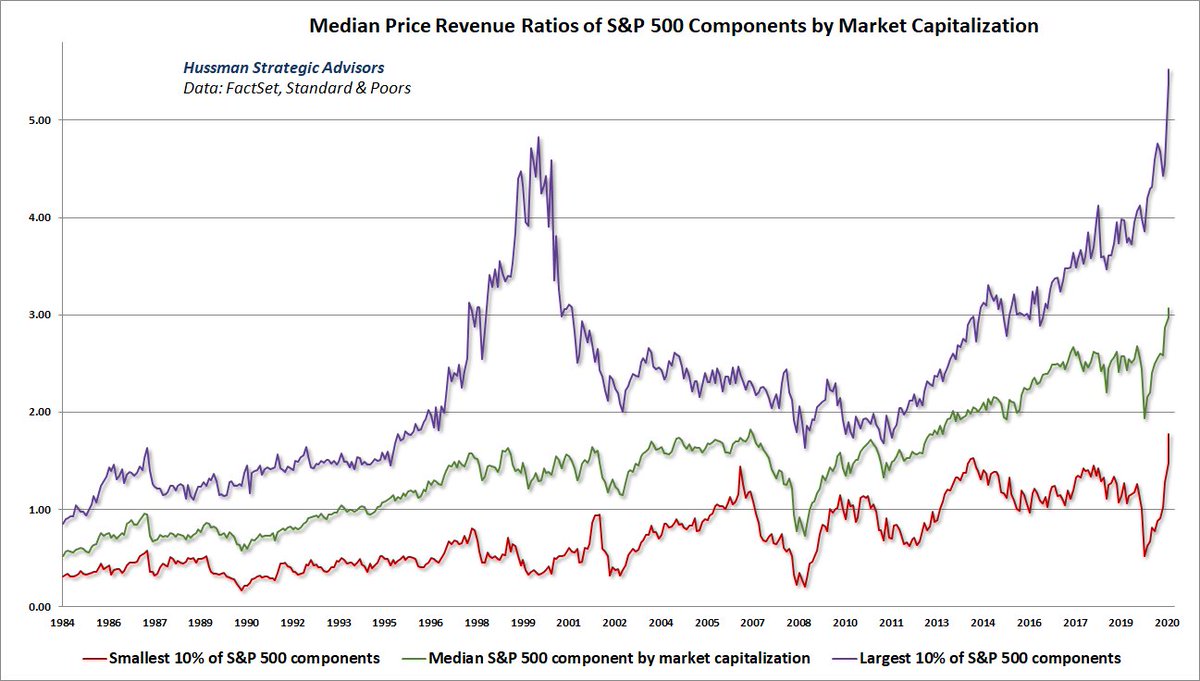

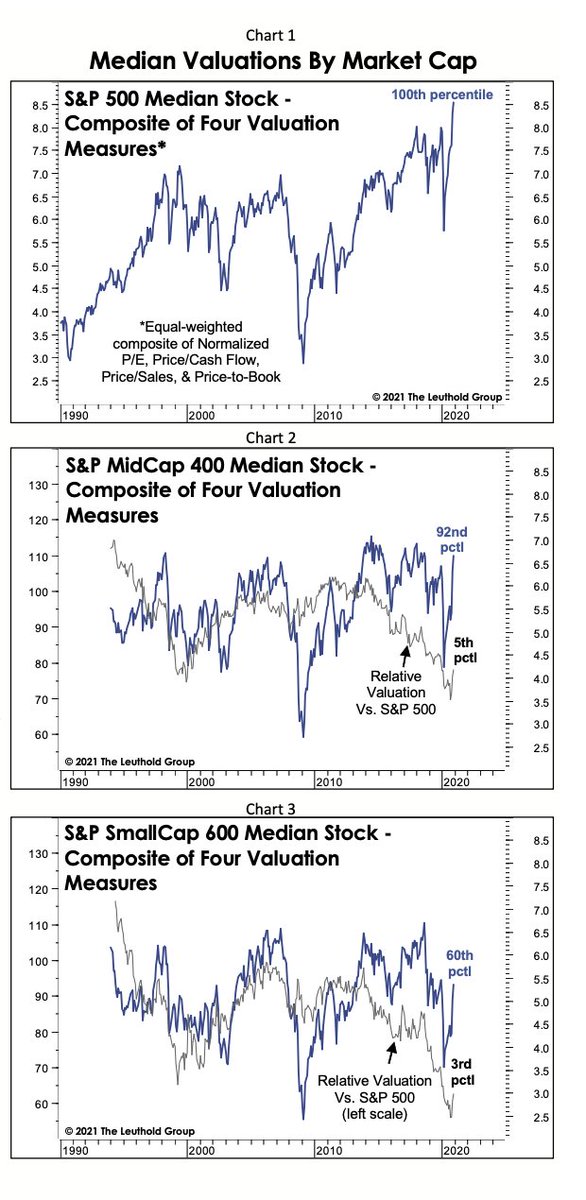

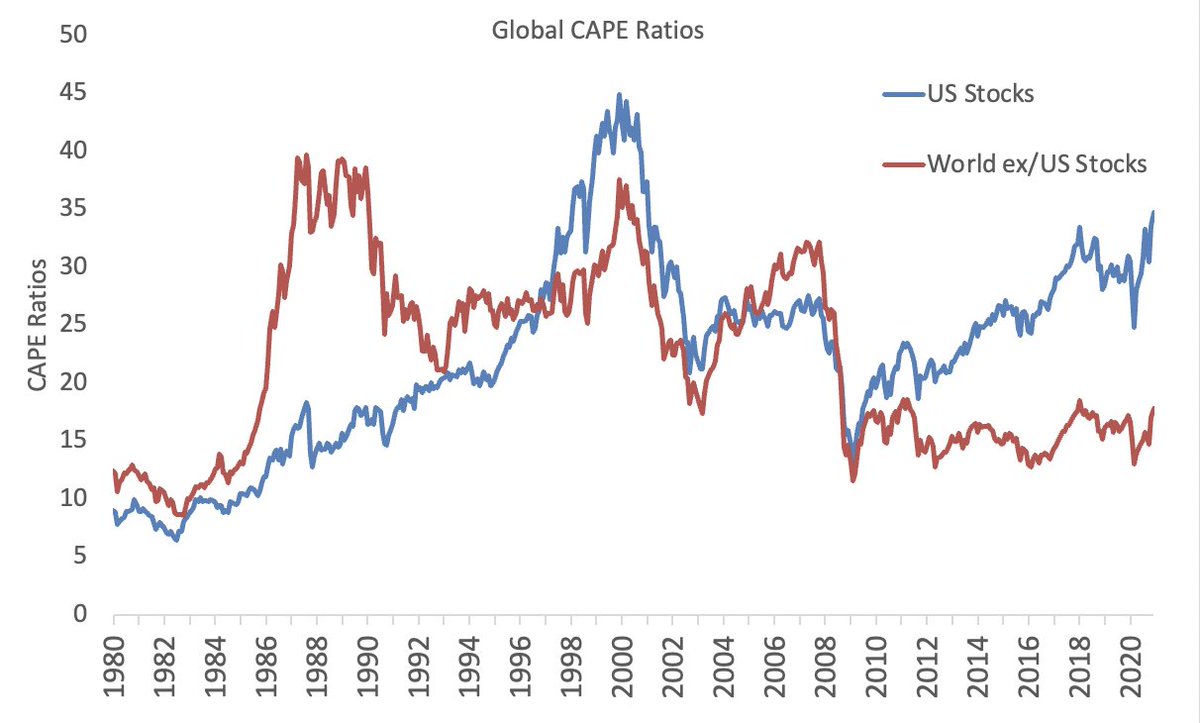

First up, valuations...everyone loves to dunk on me for CAPE ratio valuations, but as you will see these are the least extreme indicator...

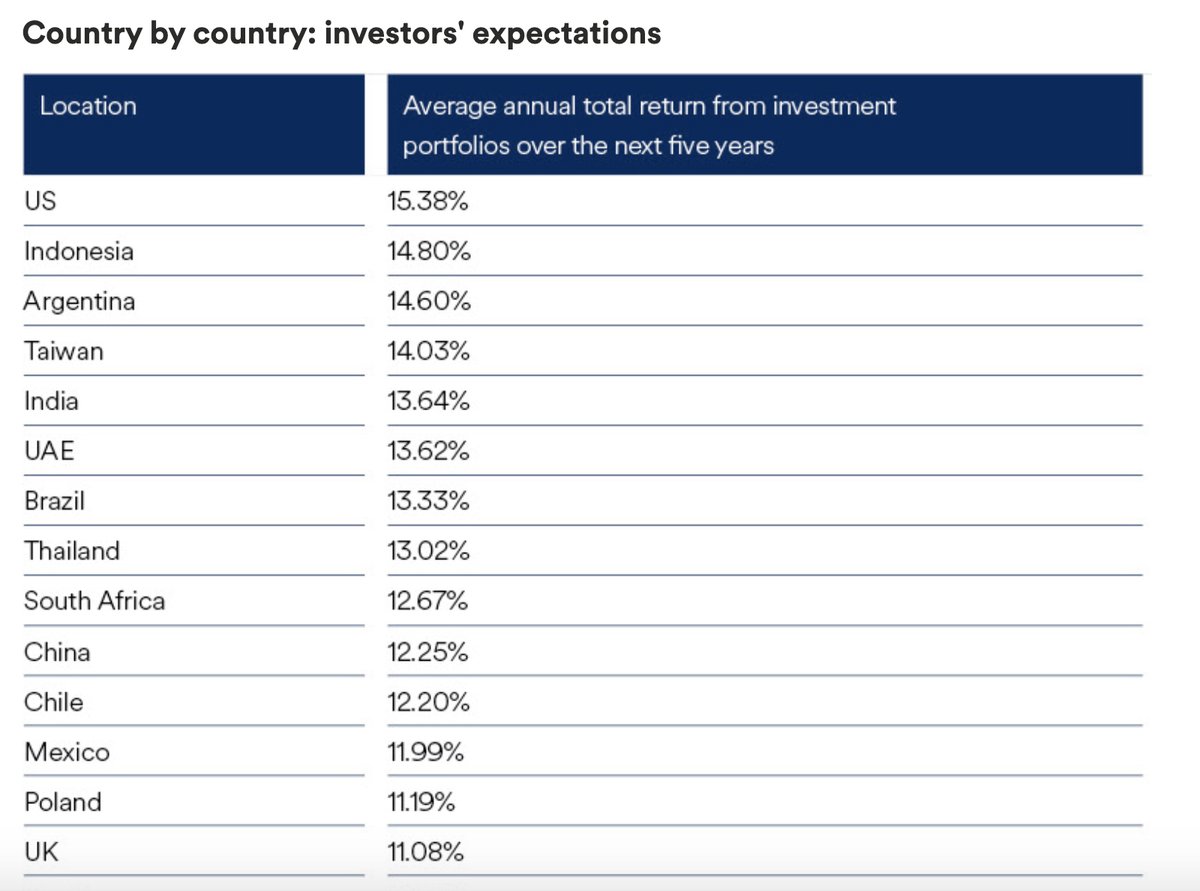

US stocks expensive (rest of world, cheap!)

mebfaber.com/2020/01/10/the…

HT: @GlobalFinData

First up, valuations...everyone loves to dunk on me for CAPE ratio valuations, but as you will see these are the least extreme indicator...

US stocks expensive (rest of world, cheap!)

mebfaber.com/2020/01/10/the…

HT: @GlobalFinData

People love to justify high valuations due to interest rates, but at least historically, dark times ahead...

mebfaber.com/2021/01/06/sto…

mebfaber.com/2021/01/06/sto…

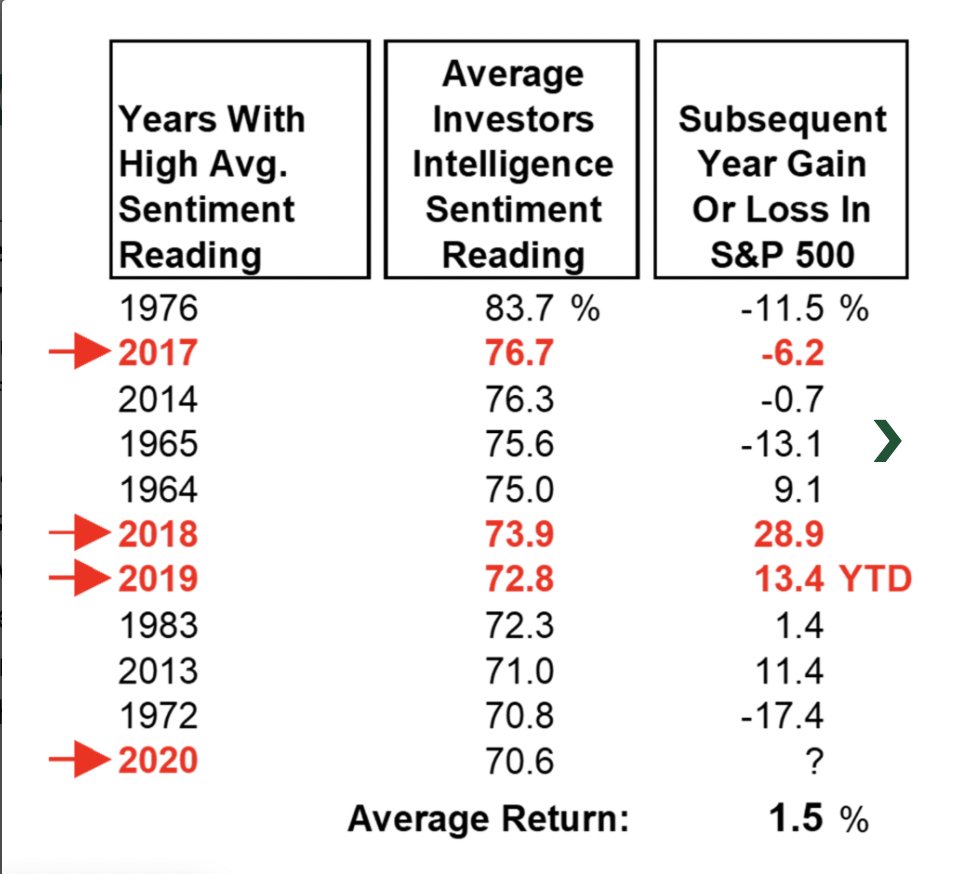

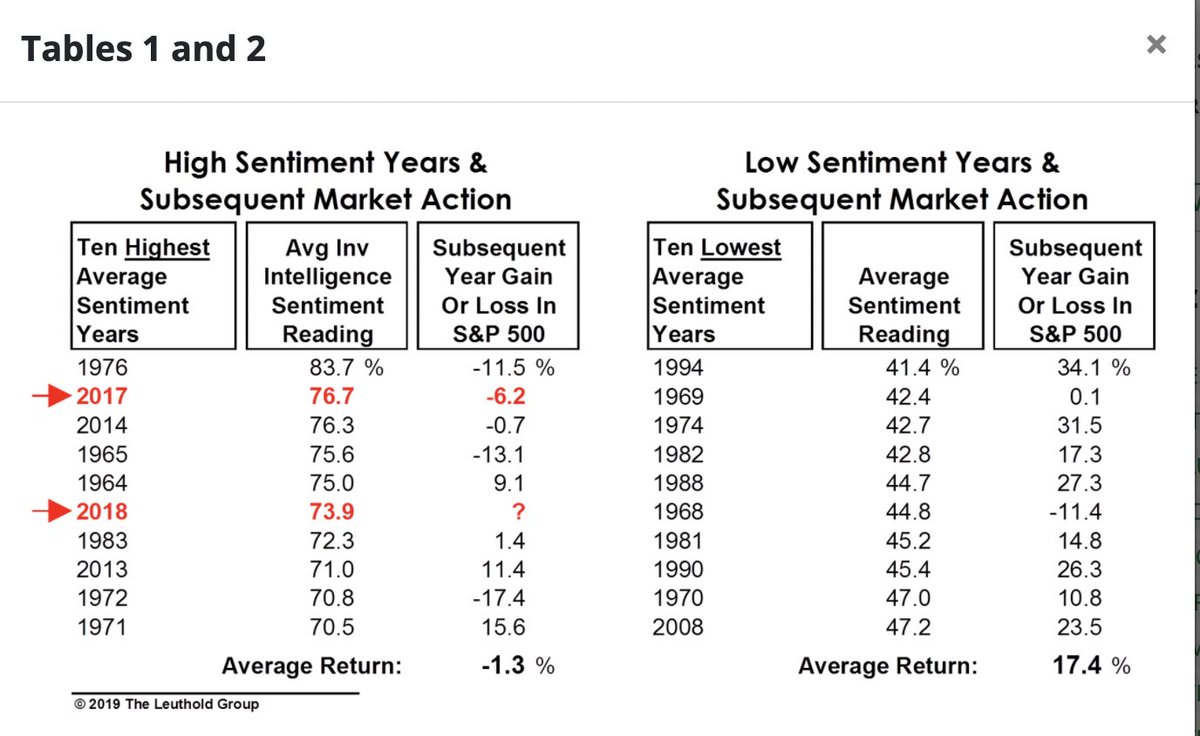

And average sentiment on II (since 1950s) has been high for last few years...which is usually awful time to invest

HT: @LeutholdGroup

HT: @LeutholdGroup

which, given the flows, is a bit like this

https://twitter.com/MebFaber/status/1344091775850299397?s=20

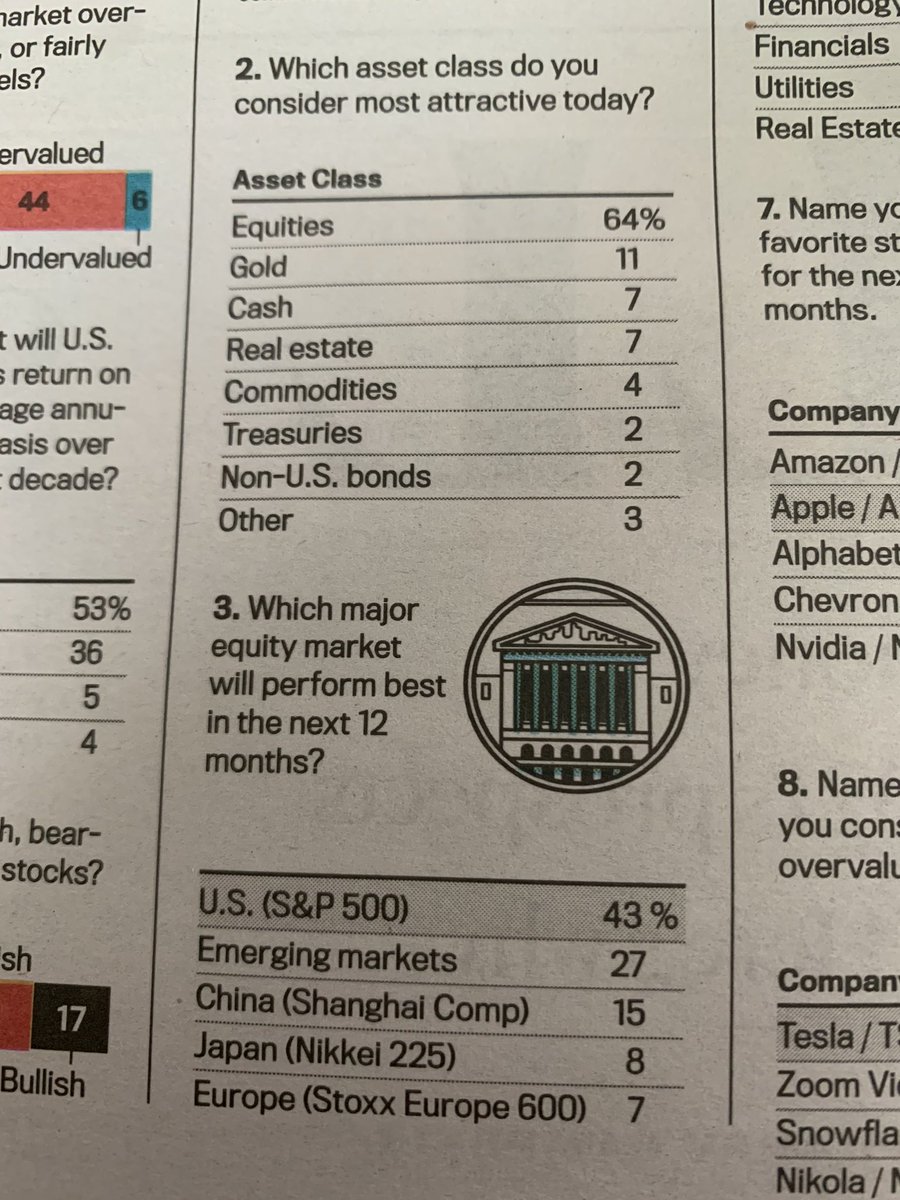

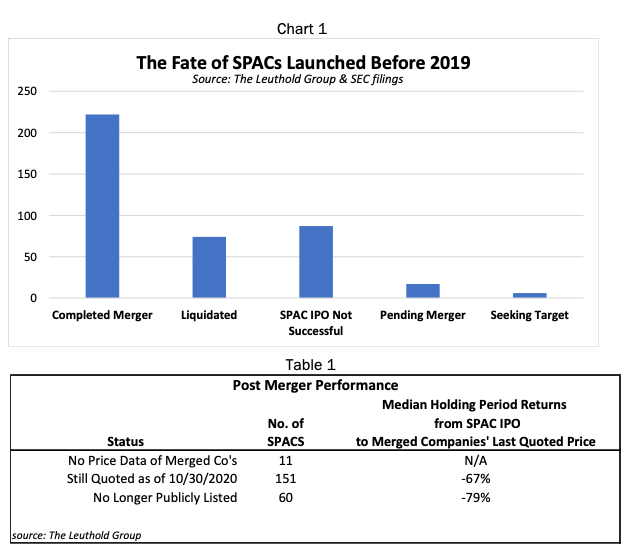

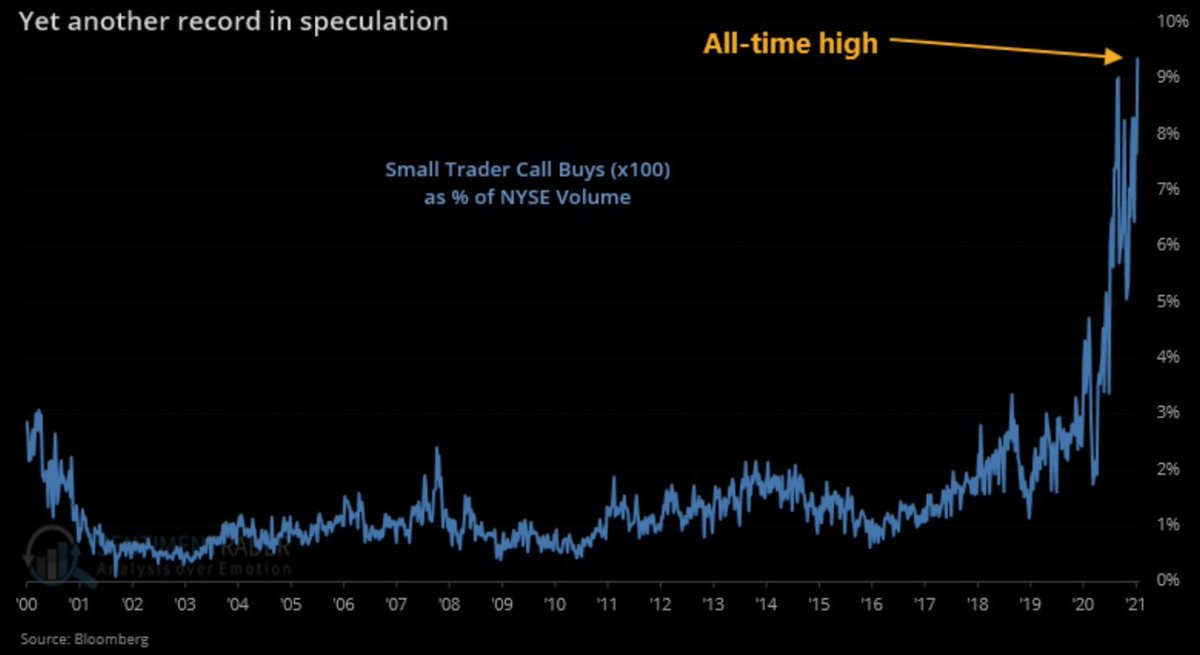

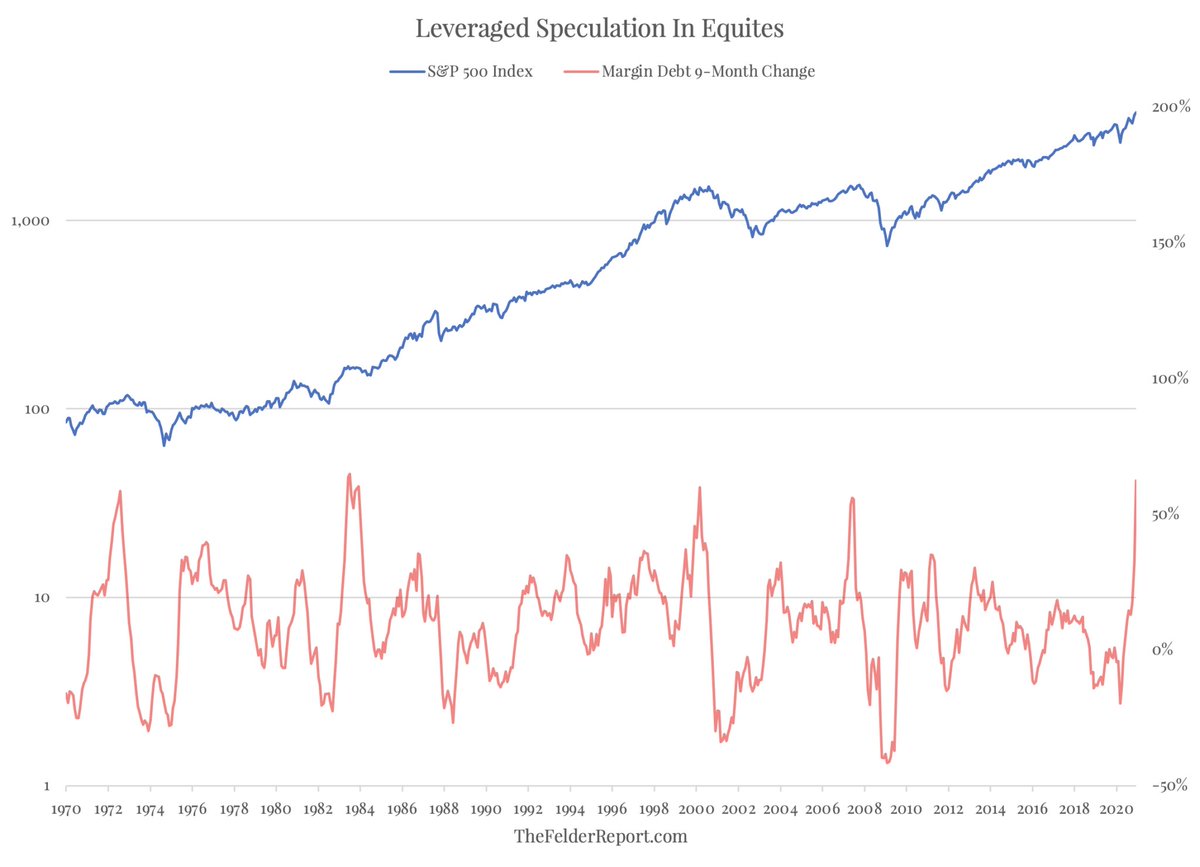

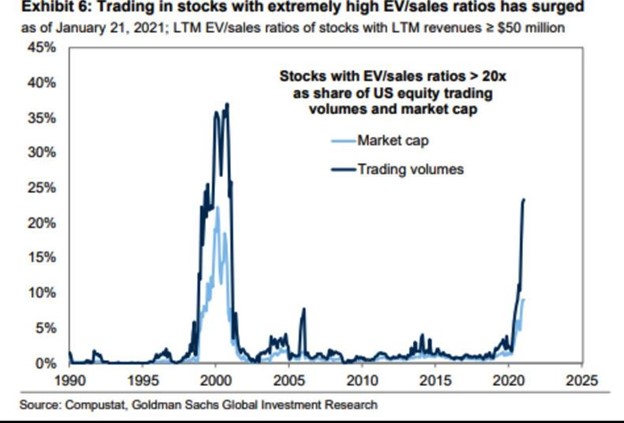

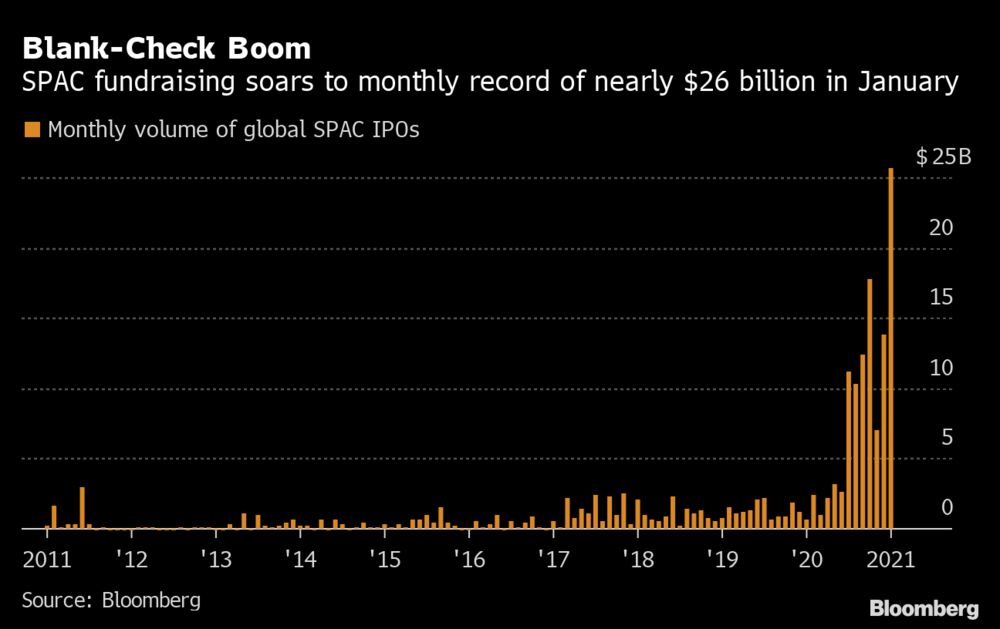

People are increasingly getting pushed out the risk curve, or said more technically, doing really stupid shit.

HT: @business

HT: @business

and despite GME situation, most stocks have very low short interest (largely due to short sellers going extinct)...

HT: @business

HT: @business

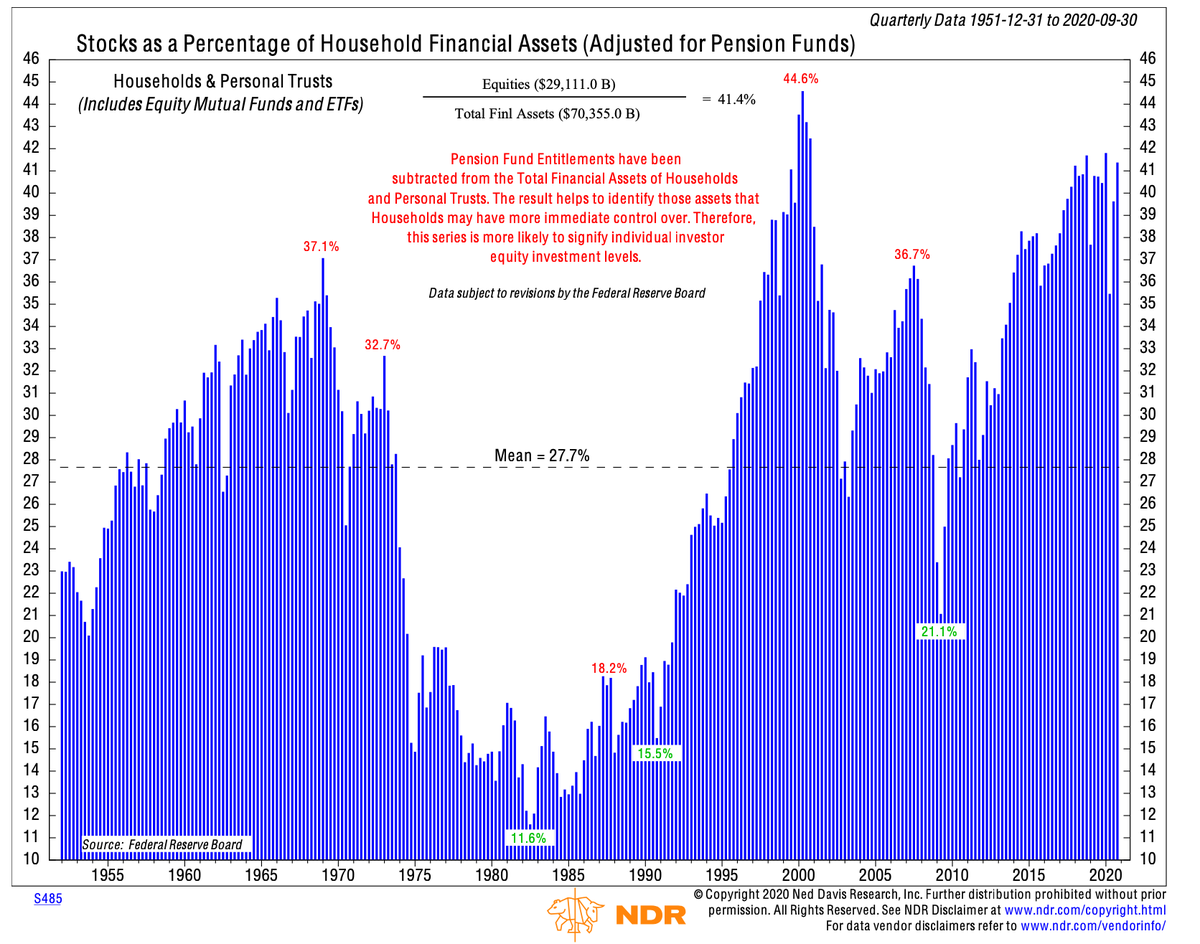

@Jesse_Livermore old favorite indicator, stocks as a % of household assets near or at all time high...

HT: @NDR_Research

HT: @NDR_Research

I'll add to this thread in the coming days, weeks, and months as things get sillier. In the meantime, you may like my old paper on tail risk and hedging the bad times, if they ever come again!

PDF

cambriainvestments.com/wp-content/upl…

cambriainvestments.com/wp-content/upl…

I love valuation charts where the turning points are obvious and get the big ones correct (early 80s cheap, late 90s bubble, GFC cheap, and now ¯\_(ツ)_/¯)

via @LeutholdGroup with Price to peak cash flow, Green Book my single favorite monthly read!

via @LeutholdGroup with Price to peak cash flow, Green Book my single favorite monthly read!

cannabis stocks are up, checks phone twice, over 50% in the past week.

no money mo problems via @LeutholdGroup

via @LeutholdGroup

• • •

Missing some Tweet in this thread? You can try to

force a refresh