Potential target companies for SPACs on the prowl --> privately held unicorn companies in hot sectors.

A thread 👇

A thread 👇

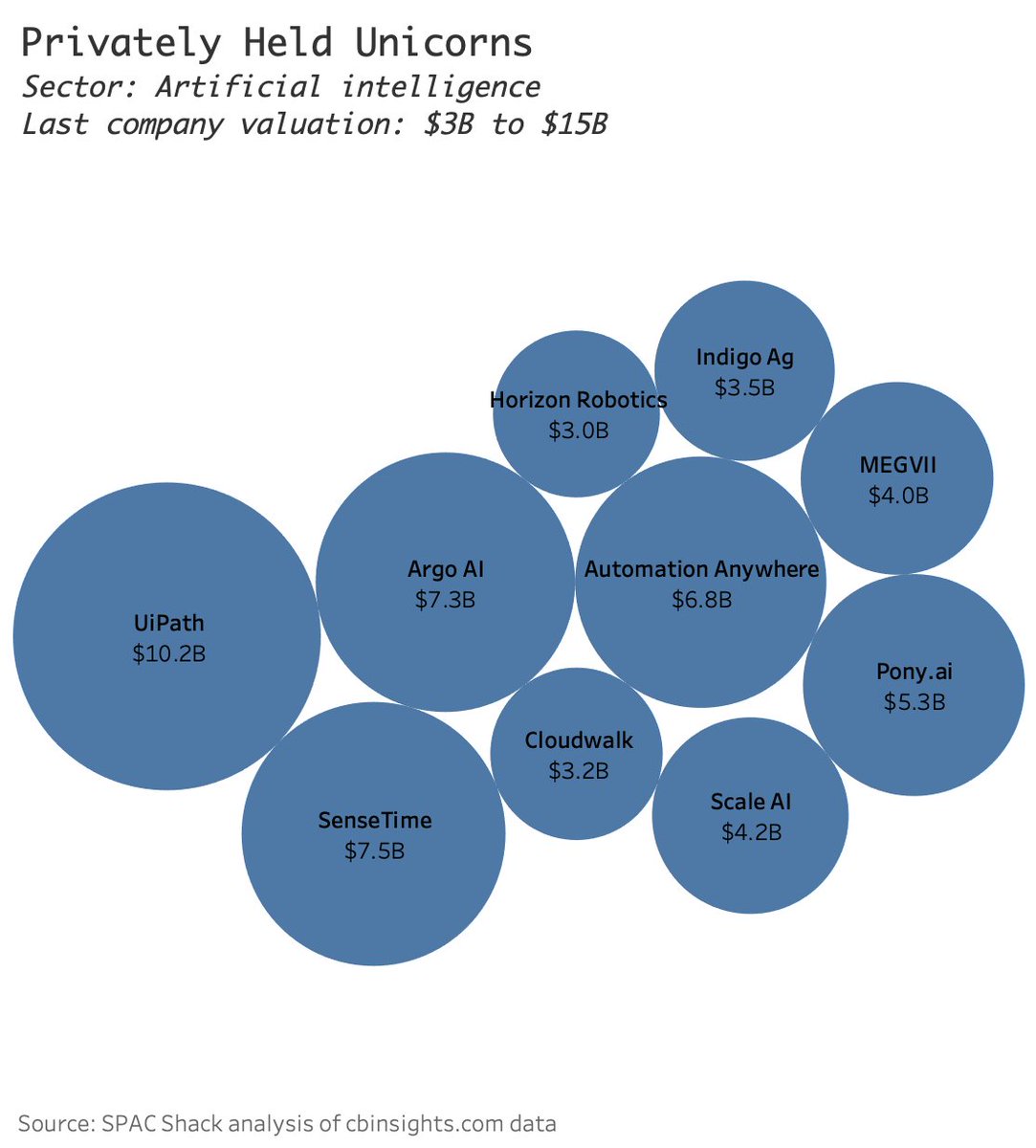

I put together a few charts to document the landscape of unicorns in

-Internet & software 💻

-Artificial intelligence 🤖

-Data & analytics 📈

-eCommerce 📦

-Edtech 🧑🎓

-Fintech 💵

-Auto & transportation 🚗

-Internet & software 💻

-Artificial intelligence 🤖

-Data & analytics 📈

-eCommerce 📦

-Edtech 🧑🎓

-Fintech 💵

-Auto & transportation 🚗

Based on CB Insights data, I narrowed down the universe of unicorns to companies with valuations between $1B and $2.9 billion and $3 billion to $15 billion.

The sweet spot for recent DAs seems to be in the $3B to $5B valuations range, but it varies. $15B companies are unlikely targets because only a few massive SPACs w/ PIPEs could even pull off that kind of deal. But I included those companies to show the high growth landscape.

Important to note: not all companies want to go public. And there are other options: traditional IPOs and direct listings.

Still, it is helpful to see potential targets out there, especially if there are dots you can connect between investors, mgmt teams, SPAC focus, etc etc.

Still, it is helpful to see potential targets out there, especially if there are dots you can connect between investors, mgmt teams, SPAC focus, etc etc.

This data is NOT exhaustive. Someone already pointed out that Lucid is not on here. Pendo is another one that should be on here. Just comment in the thread if you think one is missing or check the source data linked below.

With all that said, here are the charts 👇

With all that said, here are the charts 👇

automotive & transport (1/2) - not sure why some of the recent EV SPAC targets are missing from from the source data. Perhaps excluded because they have a DA in place. Or could be that many are pre-revenue and didn't make the cut.

Source data for these charts 🔥🔥🔥 cbinsights.com/research-unico…

Something broke in this thread, but charts are here:

https://twitter.com/ShackSpac/status/1357946186846601216?s=20

This data is NOT exhaustive. I realize some companies are missing: Lucid, Pendo, and I'm sure there are plenty of others.

Comment in this thread if you know of an obvious one that should be here, what sector, etc.

Comment in this thread if you know of an obvious one that should be here, what sector, etc.

• • •

Missing some Tweet in this thread? You can try to

force a refresh