Master-Class on Trading Methods

Learn how to

-Start trading

-Build a custom trading system

-How to be in the top 1%

-Capital Preservation

A thread.

Please share if you find it useful.

Learn how to

-Start trading

-Build a custom trading system

-How to be in the top 1%

-Capital Preservation

A thread.

Please share if you find it useful.

The below assumptions apply only to trading and not investments.

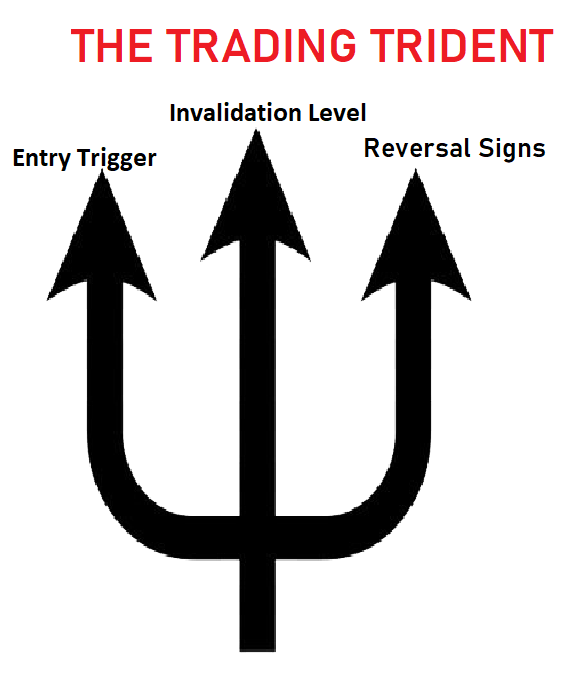

Part A-Trading Trident

-Only enter when you have a clear "Trading Trident"

1. Entry Triggers as per your trading technique

2. Established invalidation levels (Stop loss)

3. Defined reversals (Profit taking)

Part A-Trading Trident

-Only enter when you have a clear "Trading Trident"

1. Entry Triggers as per your trading technique

2. Established invalidation levels (Stop loss)

3. Defined reversals (Profit taking)

1. Entry triggers

Few examples

-Support Confirmation

-Divergences (A bit advanced)

-Triangle break-out with Volume

Study the examples in detail. Don't worry if you don't understand them, it's been explained in detail from the basics later on.

Few examples

-Support Confirmation

-Divergences (A bit advanced)

-Triangle break-out with Volume

Study the examples in detail. Don't worry if you don't understand them, it's been explained in detail from the basics later on.

2. Invalidation levels (SL)

The level (or event) at which the reason for entry gets invalidated and the trade MUST BE EXITED IMMEDIATELY at a loss.

This is called the stop loss level.

Note- I personally exit (stop loss) manually to prevent fake stop outs due to volatility.

The level (or event) at which the reason for entry gets invalidated and the trade MUST BE EXITED IMMEDIATELY at a loss.

This is called the stop loss level.

Note- I personally exit (stop loss) manually to prevent fake stop outs due to volatility.

3. Reversal Signs

This is where ALL the beginner traders fail.

Finding reversal levels to EXIT a trade in profit i.e. deciding when to exit a trade.

I have covered the topic in detail earlier here but here are some examples. t.me/EmperorbtcTA/2…

This is where ALL the beginner traders fail.

Finding reversal levels to EXIT a trade in profit i.e. deciding when to exit a trade.

I have covered the topic in detail earlier here but here are some examples. t.me/EmperorbtcTA/2…

Part A. Trading Trident conclusion

Enter a trade ONLY when you have a CLEAR 'Trading Trident ' established as per your method and style of trading

Rule of Trading Trident

1. Entry trigger

2. Invalidation level (Stop Loss)

3. Reversal Signs (Profit taking AKA Exit)

Enter a trade ONLY when you have a CLEAR 'Trading Trident ' established as per your method and style of trading

Rule of Trading Trident

1. Entry trigger

2. Invalidation level (Stop Loss)

3. Reversal Signs (Profit taking AKA Exit)

Part B- Capital Preservation.

If you can participate in the market long enough while preserving your capital, you will generate enormous wealth just by doing it.

Capital preservation is your utmost priority

-Removes all stress

-Prevents Total Loss

If you can participate in the market long enough while preserving your capital, you will generate enormous wealth just by doing it.

Capital preservation is your utmost priority

-Removes all stress

-Prevents Total Loss

Premise- Most and even the best traders are right only 45-50% of the time. IT IS A GIVEN that a trade will go wrong 50% of more times.

How do we ensure profitability and survival even after being wrong so often? This is explained below.

How do we ensure profitability and survival even after being wrong so often? This is explained below.

Your aim is to survive with ease even when you're wrong.

This will be done through Risk Management.

Risk management will reduce all trading stress and prevent losing the capital.

You want to get rich without stress.

If you don't manage risk, YOU WILL GO BANKRUPT, for sure.

This will be done through Risk Management.

Risk management will reduce all trading stress and prevent losing the capital.

You want to get rich without stress.

If you don't manage risk, YOU WILL GO BANKRUPT, for sure.

I've shared my Masterclass on risk management.

It's common sense, not rocket science. Follow it. Every time.

I personally have blown my accounts because of not following risk management. It's simple math, no risk management = Full Rekt

It's common sense, not rocket science. Follow it. Every time.

I personally have blown my accounts because of not following risk management. It's simple math, no risk management = Full Rekt

Part C- Learning to Trade

Trading can only be learnt by doing it.

You can read 100s of books on playing basketball but you won't truly learn it till you play.

How to start?

Learn the basics here .

And Practice, over and over again.

The more, the bettert.me/EmperorbtcTA/2…

Trading can only be learnt by doing it.

You can read 100s of books on playing basketball but you won't truly learn it till you play.

How to start?

Learn the basics here .

And Practice, over and over again.

The more, the bettert.me/EmperorbtcTA/2…

How much should you trade?

As much as you can. Trade more. More frequently and let the market give you a feedback.

Participate in the market, let it give you feedback, be flexible with your opinions. Enter only when you have a Trading Trident established.

As much as you can. Trade more. More frequently and let the market give you a feedback.

Participate in the market, let it give you feedback, be flexible with your opinions. Enter only when you have a Trading Trident established.

The more you play, the better you get.

Be sure to enter only on a Trading trident. Be sure to follow risk management and EXIT as soon as you find any reversal or invalidation.

Repeat this a million times and that's all you need.

Be sure to enter only on a Trading trident. Be sure to follow risk management and EXIT as soon as you find any reversal or invalidation.

Repeat this a million times and that's all you need.

Conclusion.

1. Enter a trade only when you have the trading Trident in place. Entry. Stop Loss and Exit.

2. Follow the rules of Risk management to avoid any fear of losing capital. NO RISK MANAGEMENT = SURE FAILURE. GUARANTEED .

Risk management = No fear.

1. Enter a trade only when you have the trading Trident in place. Entry. Stop Loss and Exit.

2. Follow the rules of Risk management to avoid any fear of losing capital. NO RISK MANAGEMENT = SURE FAILURE. GUARANTEED .

Risk management = No fear.

3. Learn to trade from beginner to advanced here. This is all you need. and participate in the market.

4. Trade more. Trade as often as you can. Let the market give you live feedback on your technique. The more frequently you trade, the more you learn.t.me/EmperorbtcTA/2…

4. Trade more. Trade as often as you can. Let the market give you live feedback on your technique. The more frequently you trade, the more you learn.t.me/EmperorbtcTA/2…

I hope you found the above thread useful.

Please share it if you found it useful.

Remember.

Trading Trident + Risk Management +More frequent trading is all you need.

We will learn "High Probability Entry" setups in the next thread.

Please share it if you found it useful.

Remember.

Trading Trident + Risk Management +More frequent trading is all you need.

We will learn "High Probability Entry" setups in the next thread.

• • •

Missing some Tweet in this thread? You can try to

force a refresh