THIS IS THE MOST INTERESTING MOMENT FOR THE ECONOMY I'VE SEEN IN MY CAREER

In today's @markets newsletter, I wrote about how this is the first time in my career, it's seemed like there was potential for the economy to go in a new trajectory bloomberg.com/account/newsle…

In today's @markets newsletter, I wrote about how this is the first time in my career, it's seemed like there was potential for the economy to go in a new trajectory bloomberg.com/account/newsle…

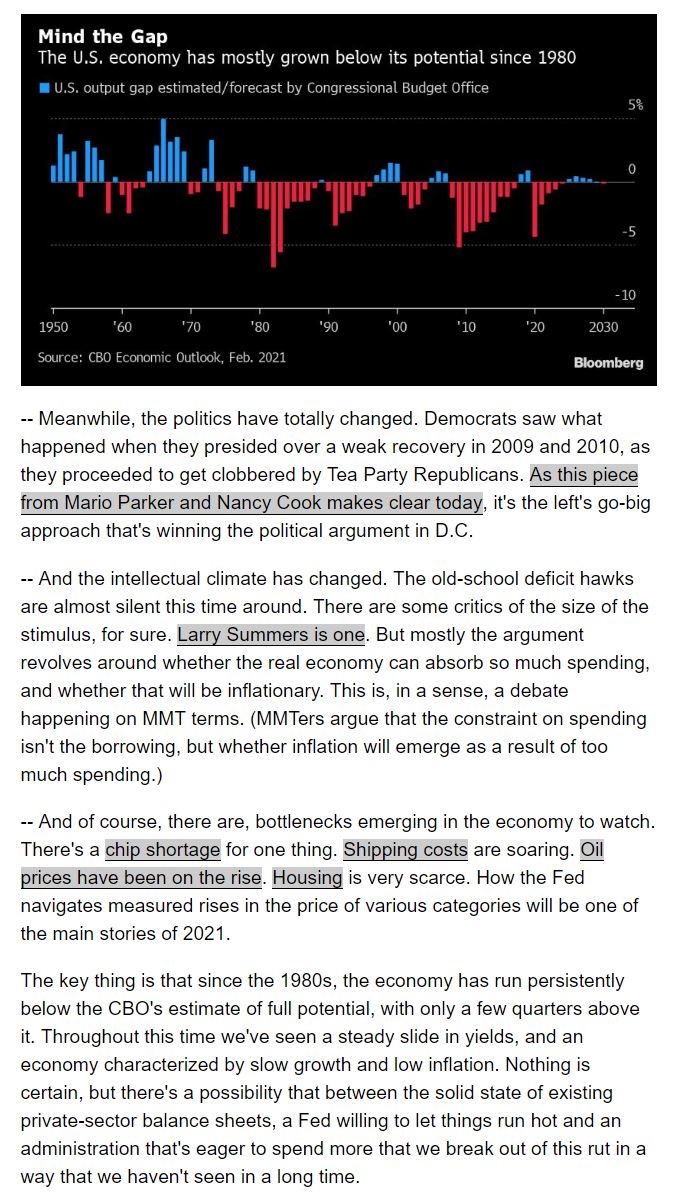

@markets Between the actual economic conditions on the ground, the emerging political consensus, and the shift in the intellectual debate over the last decade, this is the first time it's felt like there's potential to break out of the long rut of slow growth, low rates etc.

@nancook @MarioDParker Good chart here from Adam, on aspect of household balance sheet conditions. Every quintile of the economy currently has more cash on hand than they did pre-crisis. Not your typical situation coming out of a downturn

https://twitter.com/ModeledBehavior/status/1358770764523184130

Anyway! Sign up for the newsletter here. Might write something about the Fed and Bitcoin tomorrow. Or maybe about the recovery in NYC bloomberg.com/account/newsle…

Yep, increasingly the entire fiscal policy debate is happening on MMTers terms.

https://twitter.com/RomanchukBrian/status/1359147981556056064

Just to add onto the thread, this is exactly what makes this moment different. The fact that Bernie Sanders and Goldman Sachs are roughly on the same page on macro

https://twitter.com/Birdyword/status/1359172461321809922

• • •

Missing some Tweet in this thread? You can try to

force a refresh