Matt has a paywalled piece arguing that examination-based elite schools aren't actually better than regular schools. I found this interesting because it cuts strongly against my own intuitions. I think people might be misreading the studies on this. slowboring.com/p/the-misguide…

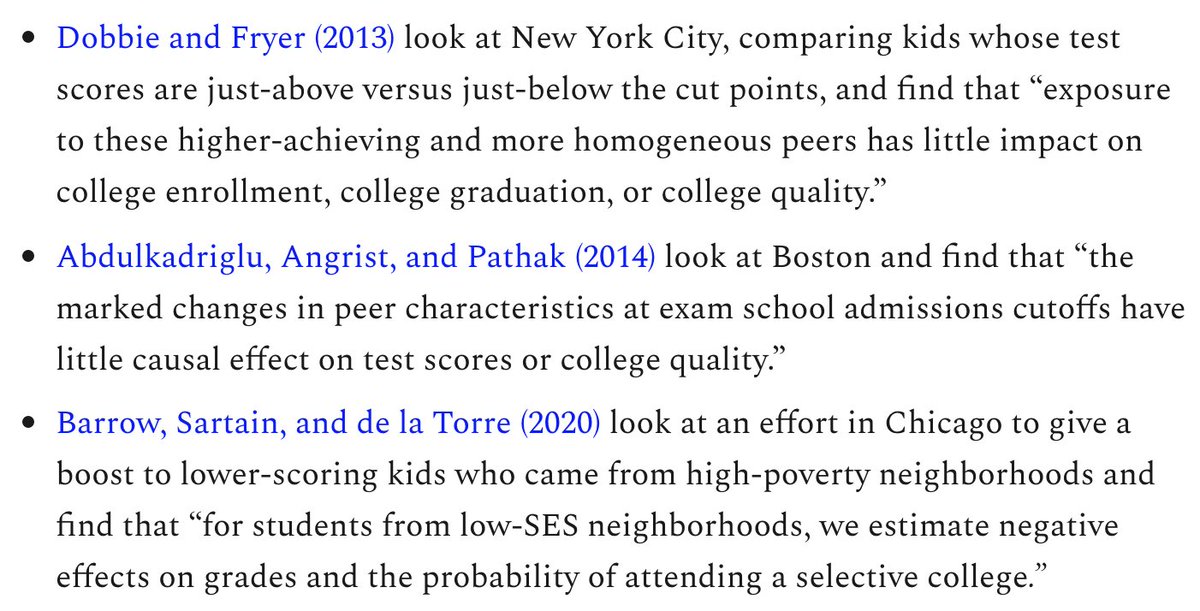

As Matt summarizes here, studies on the value of selective high schools compare the results of students who were just above the admissions cutoff to those who were just below, and finds little difference.

This seems like convincing evidence that going to a selective school isn't that valuable for a student at the margins of the admission criteria. But that's a different claim than saying the school isn't good for its average student.

Another hypothesis might be that students benefit from going to a school with other students at about the same level. The strongest students in any classroom get bored, while the weakest ones struggle to keep up. Ideally you want to be near the middle of the distribution.

So it might be that admission to a selective school benefits most of its students but not the ones near the admission cutoff.

If you're a kid at the 75th percentile of ability, it might be better for you to be in the top half of your class at a non-selective school than to struggle to keep up at the selective school.

Whereas if you're a kid at the 95th percentile of ability, you'll get a lot out of the more advanced material at the selective school, whereas the coursework at the non-selective school might be so easy that you get bored and check out.

A big question here is how much you care about promoting equality as opposed to achievement at the high end. A kid at the 95th percentile is likely to do well in life regardless, so if you primarily care about equality you might not worry about maximizing her learning.

Whereas if your goal is to maximize your school's chance of producing students who go on to cure cancer or write the great American novel, then failing to give your most talented students challenging material would be a waste.

• • •

Missing some Tweet in this thread? You can try to

force a refresh