If you’re one of the millions of Americans groaning because you don’t want to buy in at record highs...

I have a little pep talk for you.

👊

I have a little pep talk for you.

👊

Stocks are back at record highs, and you missed out.

GRRR. FOMO sucks. I know.

GRRR. FOMO sucks. I know.

Here's a free tip from your friendly neighborhood Twitter nerd:

Now may be the best time to invest.

Now may be the best time to invest.

Why?

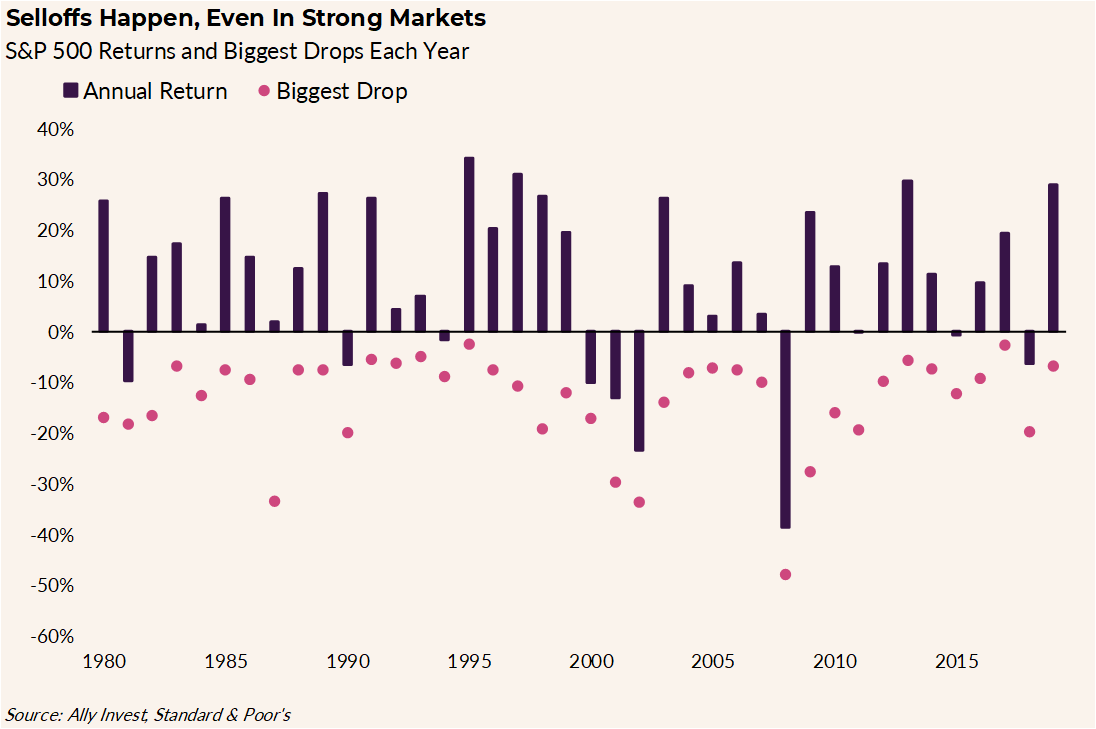

Well, for one, that big pullback you're waiting on? It could happen tomorrow, but it also may take years to happen. The stock market is weird like that.

Well, for one, that big pullback you're waiting on? It could happen tomorrow, but it also may take years to happen. The stock market is weird like that.

One example:

From 1990 to 1997, the S&P 500 gained more than 200% without falling more than 10% at any point.

If you wait until stocks fall and the environment feels right, you may miss out on some big gains. And you may never see today's price again.

From 1990 to 1997, the S&P 500 gained more than 200% without falling more than 10% at any point.

If you wait until stocks fall and the environment feels right, you may miss out on some big gains. And you may never see today's price again.

ALSO.

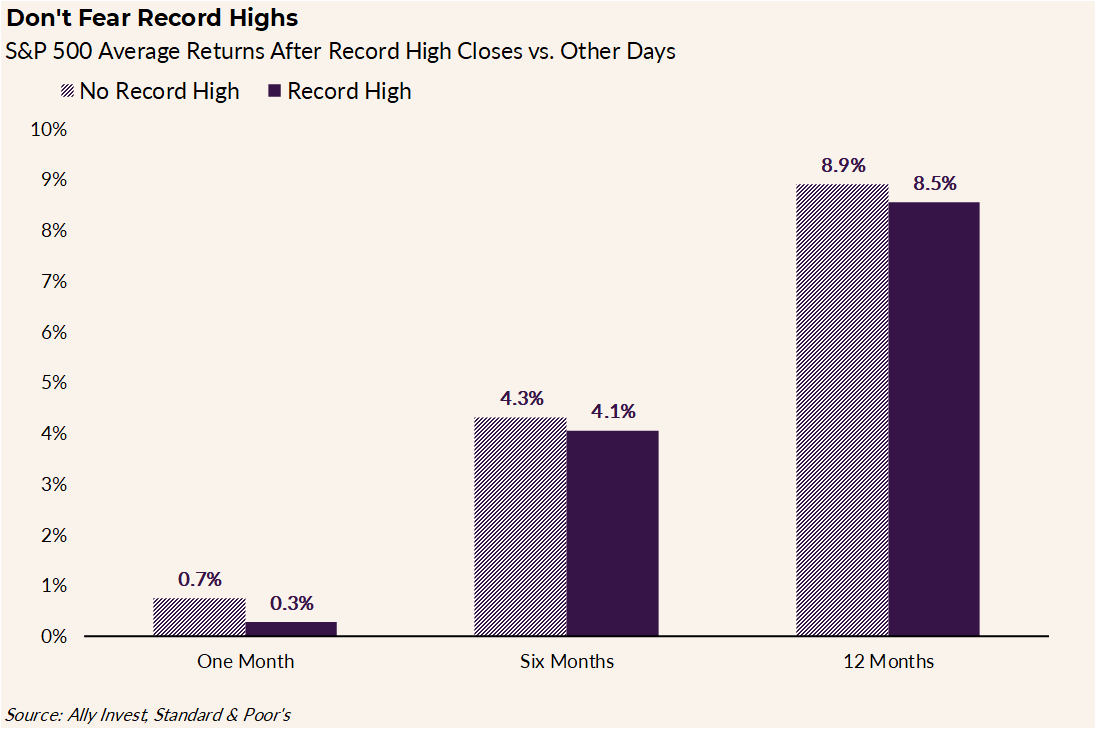

Don't let record highs scare you away.

Don't let record highs scare you away.

https://twitter.com/callieabost/status/1339689464159989765?s=20

I know what you're thinking. Gah Callie, what if I buy at a market top? Those things do happen every once in a while, and things feel a little crazy?

Well...I have another good thread for you.

Well...I have another good thread for you.

https://twitter.com/callieabost/status/1349794014241976329?s=20

There are also steps you can take to protect your money when stocks fall.

📉barbell strategies (loading up on both aggressive and conservative assets)

📉hedges (like bonds)

📉keeping some cash handy (bonus: cash can also help you buy quickly when others are selling!)

📉barbell strategies (loading up on both aggressive and conservative assets)

📉hedges (like bonds)

📉keeping some cash handy (bonus: cash can also help you buy quickly when others are selling!)

(also can we talk about why the stocks down emoji is blue? wth?!?)

• • •

Missing some Tweet in this thread? You can try to

force a refresh