Massy Group Q1 Dec 2020

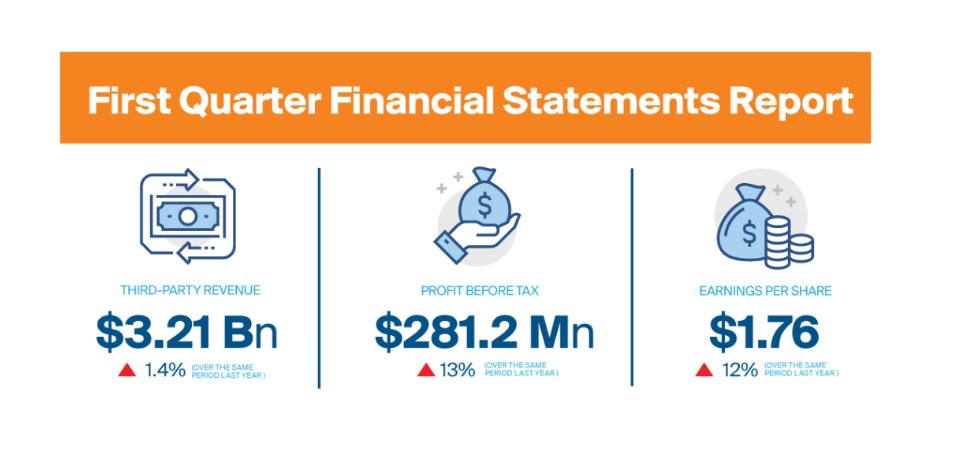

🔲Revenue⬆️1.4% to TT$3.2b

🔲Profit⬆️13% to TT$188m

Massy Group is an investment holding / management company with three main investment portfolios:

🔲Integrated Retail

🔲Gas Products &

🔲Motors & Machines

🔲as well as other legacy lines of business

🔲Revenue⬆️1.4% to TT$3.2b

🔲Profit⬆️13% to TT$188m

Massy Group is an investment holding / management company with three main investment portfolios:

🔲Integrated Retail

🔲Gas Products &

🔲Motors & Machines

🔲as well as other legacy lines of business

🔲Geographically, 38% of revenue came from T&T, Barbados 22%. Jamaica only 4%

🔲Over 60% of the group's revenue this qrtr came from Integrated retail

🔲Business has positive Operating Cash Flow, but Free Cash Flow may be negative due to its Investing Activities (not broken out)

🔲Over 60% of the group's revenue this qrtr came from Integrated retail

🔲Business has positive Operating Cash Flow, but Free Cash Flow may be negative due to its Investing Activities (not broken out)

Integrated Retail includes

🔲Stores - 47 retail locations in 5 markets in the Caribbean

🔲Distribution - services supermarkets, groceries, pharmacies, hospitals, variety stores etc

🔲Trading - manages the distribution of various product lines

🔲Stores - 47 retail locations in 5 markets in the Caribbean

🔲Distribution - services supermarkets, groceries, pharmacies, hospitals, variety stores etc

🔲Trading - manages the distribution of various product lines

The next big contributor is the Motors and Machines segment

This includes

🔲Massy Motors - automotive dealerships

🔲Massy Machinery - leading supplier of products and services in the construction, marine, energy, industrial, commercial, automotive and agricultural sectors

This includes

🔲Massy Motors - automotive dealerships

🔲Massy Machinery - leading supplier of products and services in the construction, marine, energy, industrial, commercial, automotive and agricultural sectors

The stock is

🔲🔻-1.46% since Jan (TTSE Index up 0.08% YTD)

🔲2020 it was 🔻-0.02%

🔲But 2019 it had a big year ⬆️30%

View more about this and other stocks online. Link in bio

🔲🔻-1.46% since Jan (TTSE Index up 0.08% YTD)

🔲2020 it was 🔻-0.02%

🔲But 2019 it had a big year ⬆️30%

View more about this and other stocks online. Link in bio

• • •

Missing some Tweet in this thread? You can try to

force a refresh