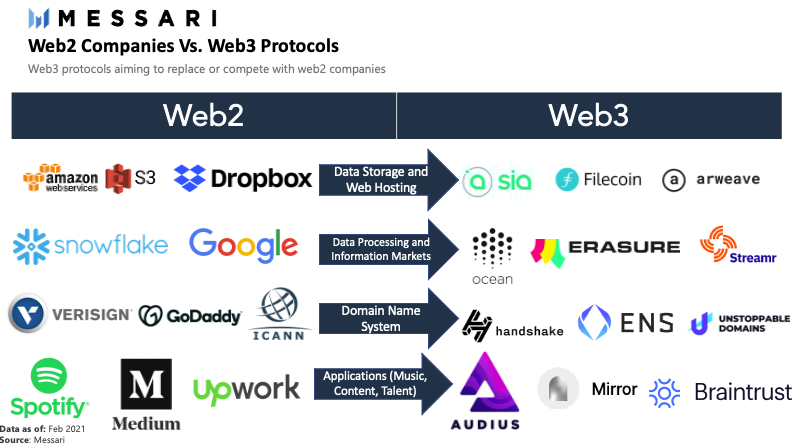

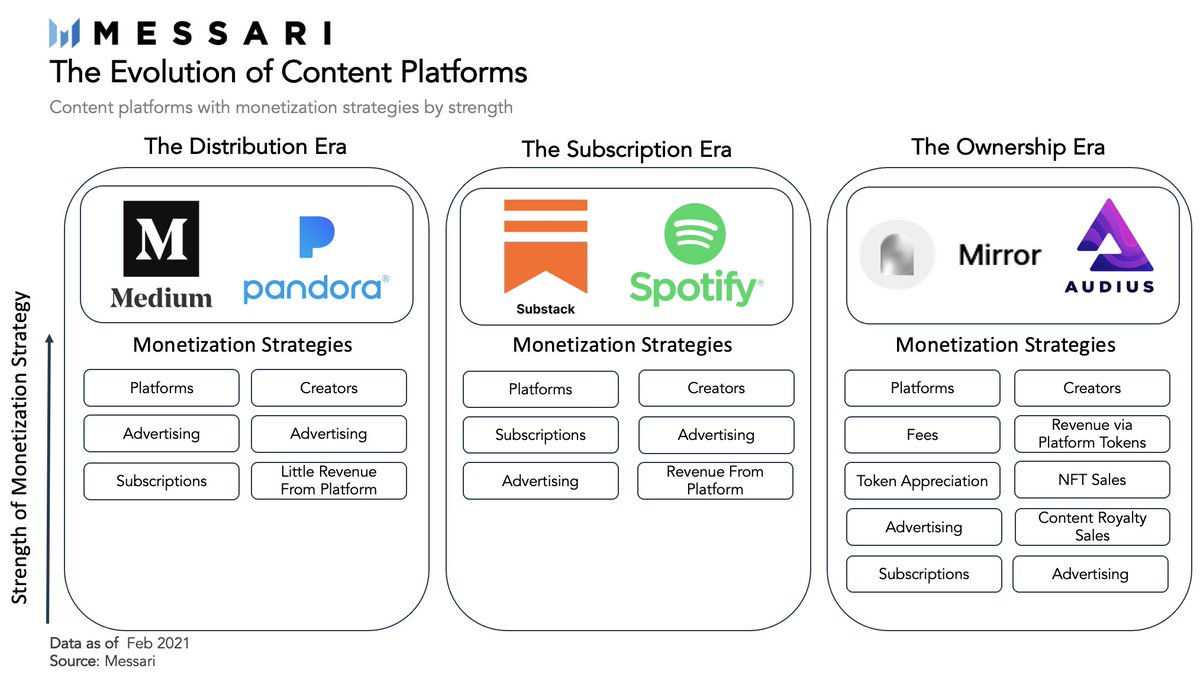

The next evolution of content platforms is starting.

Using crypto primitives – like NFTs, permissionless protocols, programmable royalties – content creators are set to control the next era of content – The Ownership Era.

A quick thread on the eras of content 👇

Using crypto primitives – like NFTs, permissionless protocols, programmable royalties – content creators are set to control the next era of content – The Ownership Era.

A quick thread on the eras of content 👇

“Content is where I expect much of the real money will be made on the Internet, just as it was in broadcasting.” - Bill Gates

messari.io/article/the-ev…

messari.io/article/the-ev…

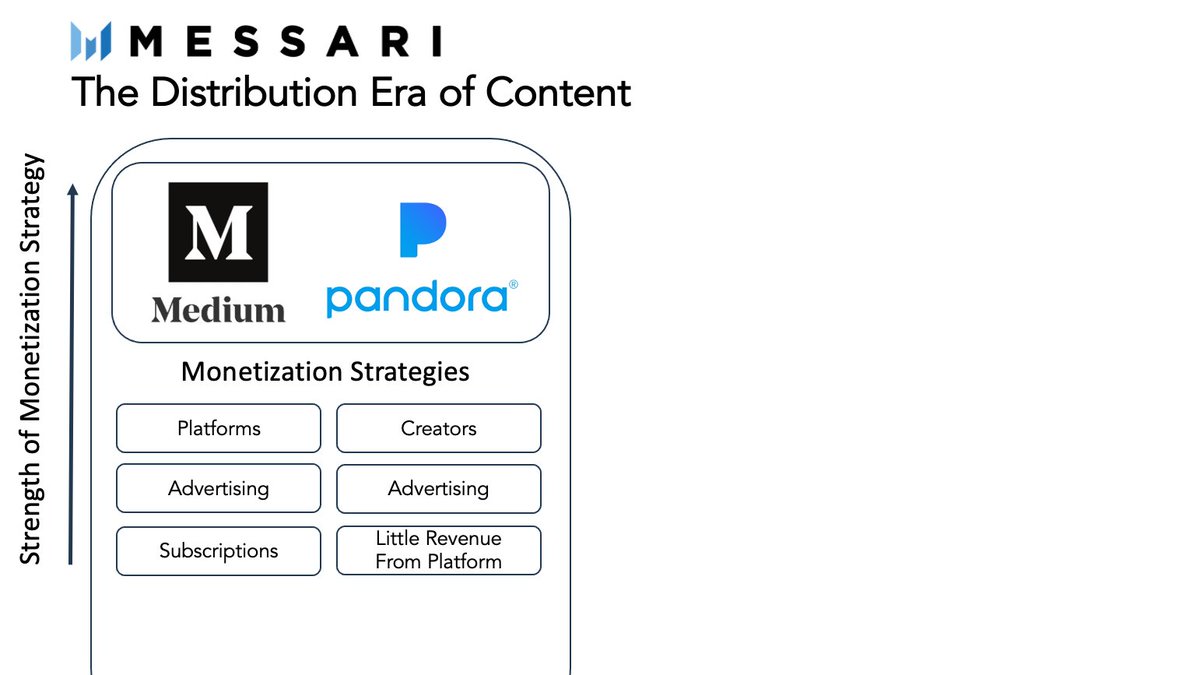

The Distribution Era

The key value in this era for consumers was aggregation while creators received wide distribution of their content(e.g. songs). However, as users realized that their content had value, beyond views and likes, individuals started to create their own brands.

The key value in this era for consumers was aggregation while creators received wide distribution of their content(e.g. songs). However, as users realized that their content had value, beyond views and likes, individuals started to create their own brands.

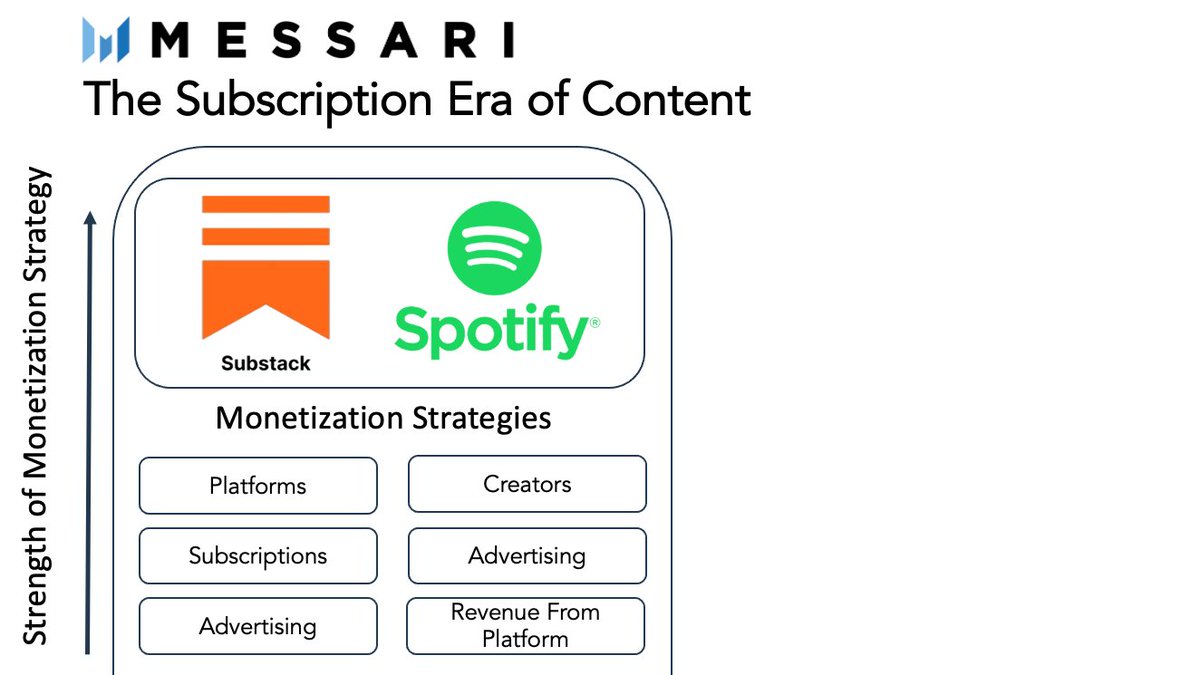

The Subscription Era

Distribution is no longer worth the tradeoff. Personal websites are ubiquitous. Influencers host their own podcasts where advertising is the key form of revenue or have transitioned to Substack/Patreon where they directly monetize their connections to users.

Distribution is no longer worth the tradeoff. Personal websites are ubiquitous. Influencers host their own podcasts where advertising is the key form of revenue or have transitioned to Substack/Patreon where they directly monetize their connections to users.

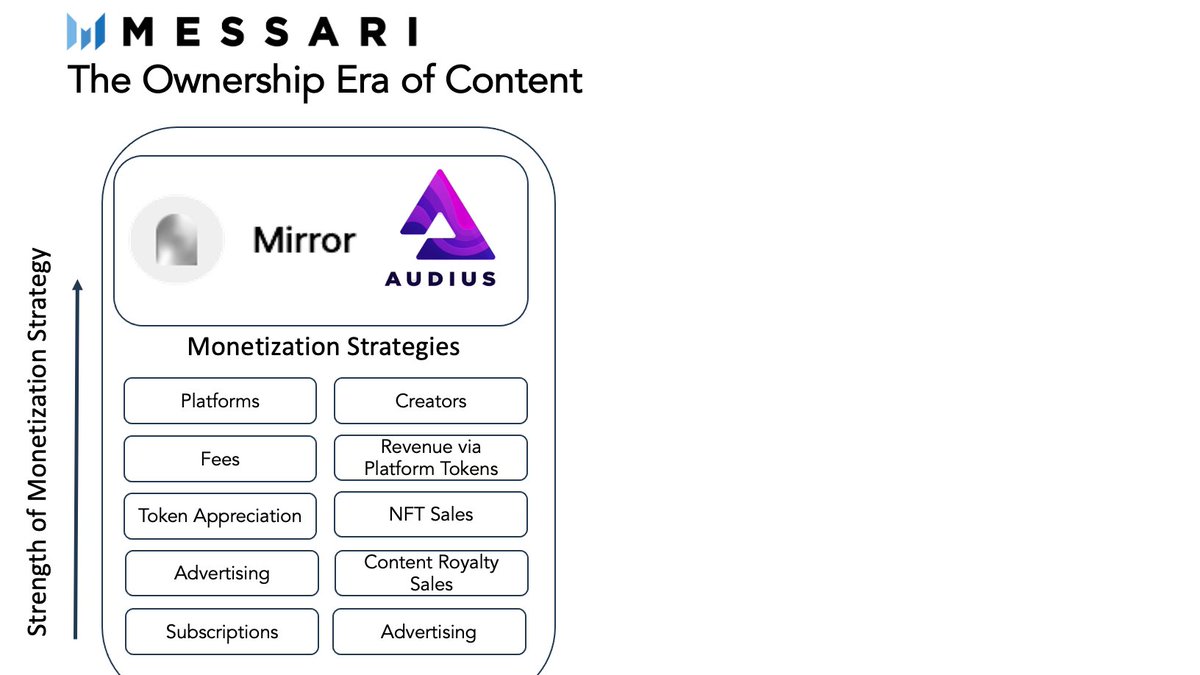

The Ownership Era of Content

In the ownership era, platforms are partially owned by their content creators. The creators earn tokens for their work which provides ownership in the network. The platform-creator relationship becomes more synergistic as opposed to parasitic.

In the ownership era, platforms are partially owned by their content creators. The creators earn tokens for their work which provides ownership in the network. The platform-creator relationship becomes more synergistic as opposed to parasitic.

Content will remain king, but this time creators, not corporations, will control the reigns.

As society shifts from valuing firms to individuals, creators who leverage these new web3 platforms will be poised for greater success.

messari.io/article/the-ev…

As society shifts from valuing firms to individuals, creators who leverage these new web3 platforms will be poised for greater success.

messari.io/article/the-ev…

• • •

Missing some Tweet in this thread? You can try to

force a refresh