thread on selling parabolic moves / market tops

- ppl have asked me how to sell tops so I'm making this to show some of the things that I look for

- ppl have asked me how to sell tops so I'm making this to show some of the things that I look for

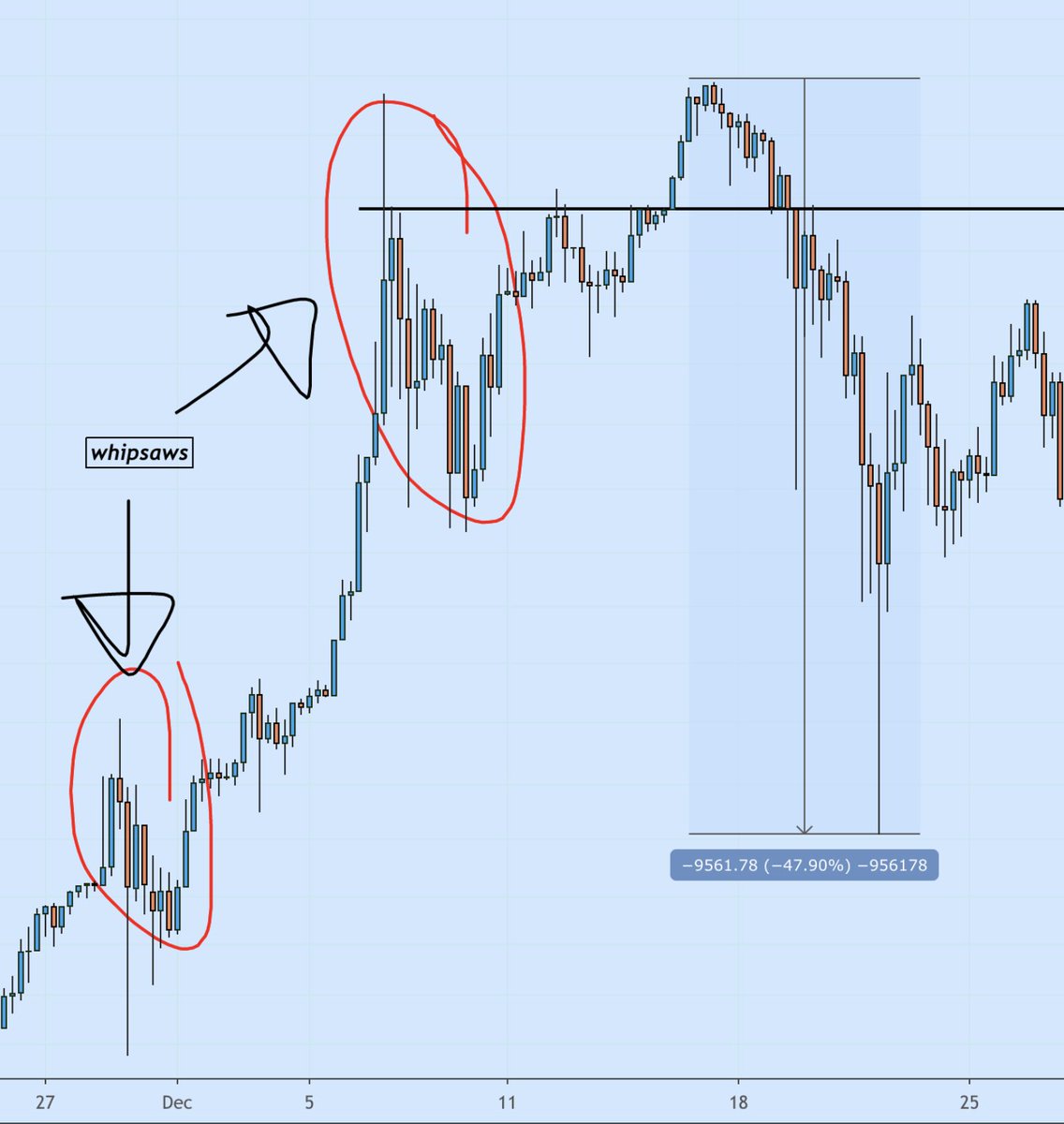

first you need to identify whether the asset is parabolic or not, best way to do this for me is to use trendlines. if you get three drives breaking upper resistance trendlines you're usually nearing the end of a parabola

when we're up in this area is where you should be cautious, either start using trailing stops or start preparing a plan for what you'll do if we do get a deeper selloff. It's really easy to sell too early here and watch price keep going up because it can stay parabolic for awhile

another sign is when you see volatility increase & you get to look for these whipsaw like moves, another sign that a deeper pullback is coming soon

it's nearly impossible to sell the top of these moves in real time, but you almost always get a throwback close to where the asset sold off from, which is your opportunity to de-risk and get out. nobody knows at the time whether that'll be a local lower high or a macro top

If you sell this bounce & you're wrong, you know what your invalidation is to get back in and you don't miss a large % of the move

In December 2017, you didn't necessarily get a throwback all the way to the origin of the selloff, but you did get a retrace back to the last H12 supply block. I'm usually looking at the H6+ candles to see where to get out

TLDR: dont panic sell the dip, sell the following bounce and go from there 👍

• • •

Missing some Tweet in this thread? You can try to

force a refresh