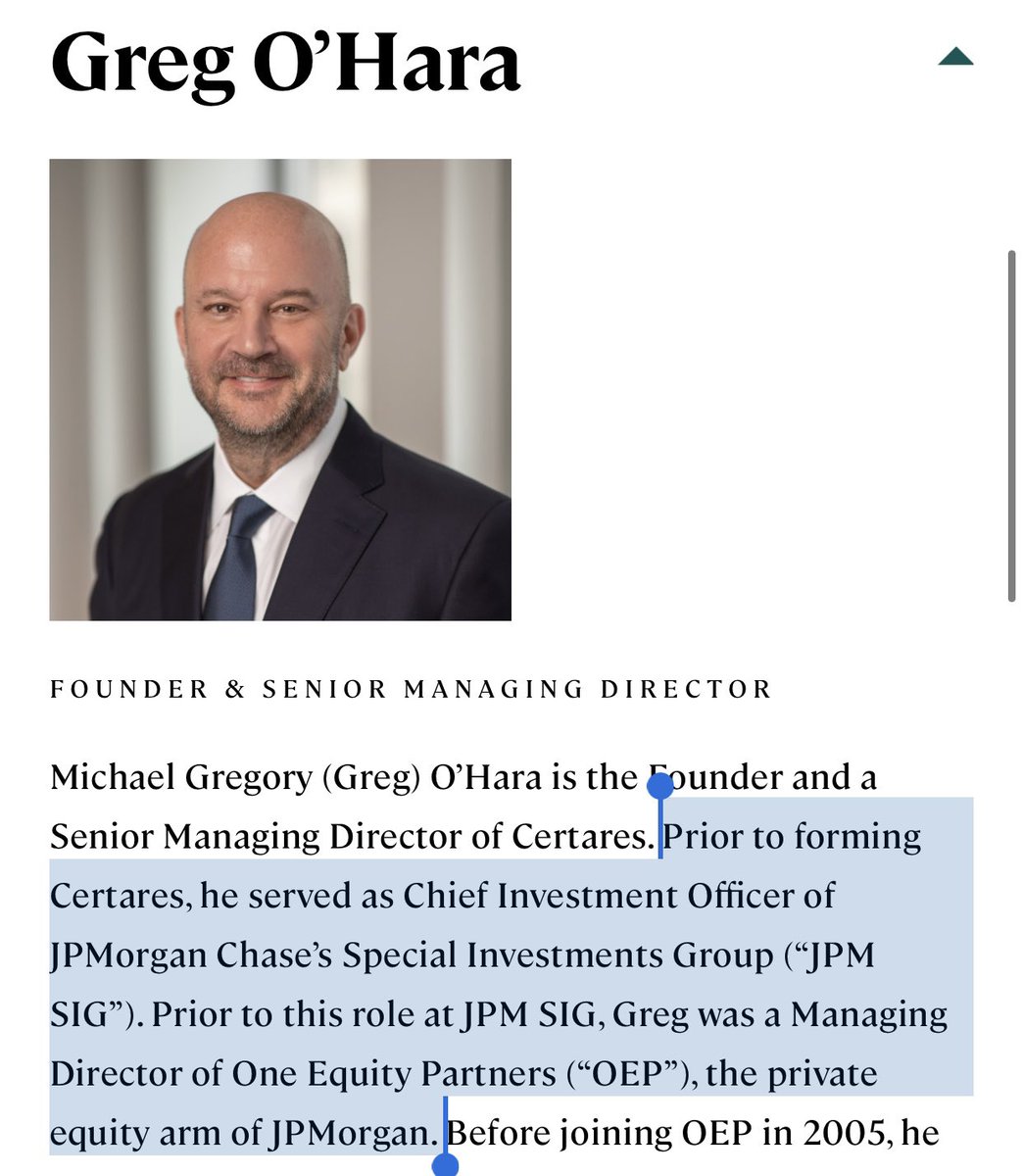

Friendly Reminder: Greg O'Hara is the CEO of $GOAC

https://twitter.com/lowrytom/status/1362079049523290112

The more I read, the more I like.

Greg O’Hara is one of the biggest heavy weights in the global travel industry. $GOAC

Greg O’Hara is one of the biggest heavy weights in the global travel industry. $GOAC

https://twitter.com/PaulByrne66/status/1329827376117800966

“And so if you can identify good companies right now that have good management teams and good plans, all we are really doing is providing working capital, advice, investment” $GOAC

Greg was one of the speakers at the global G20 conference last October on travel and tourism.

wttc.org/COVID-19/G20-R… $GOAC

wttc.org/COVID-19/G20-R… $GOAC

• • •

Missing some Tweet in this thread? You can try to

force a refresh