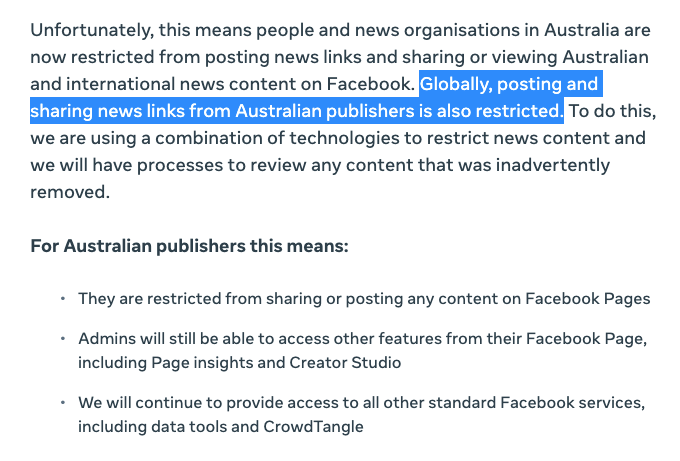

Facebook just blocked the sharing of news in Australia. about.fb.com/news/2021/02/c…

Focusing on the Facebook Oversight Board is a shiny object when the real question is Facebook engaging in censorship on behalf of advertising money. All those idiotic corrupt elites who sit on that board - Facebook just censored AUSTRALIA. about.fb.com/news/2021/02/c…

This has been a long time coming, the Australian competition chief Rod Sims is one of the more forward-thinking antitrust enforcers in the world. mattstoller.substack.com/p/australia-st…

Facebook censoring all of Australia shows why Mark Zuckerberg absolutely needs to arrested for fraud and price-fixing. If you don't apply law and order to the powerful, eventually the powerful begin writing the laws and giving the orders. mattstoller.substack.com/p/crime-should…

• • •

Missing some Tweet in this thread? You can try to

force a refresh