Over dinner with a seasoned businessman, a friend suggested the services of a business consultant who had a reputation of improving corporate profits

The young consultant studied the business over the next few weeks & recommended 3 new businesses to get into

A thread (1/n)

The young consultant studied the business over the next few weeks & recommended 3 new businesses to get into

A thread (1/n)

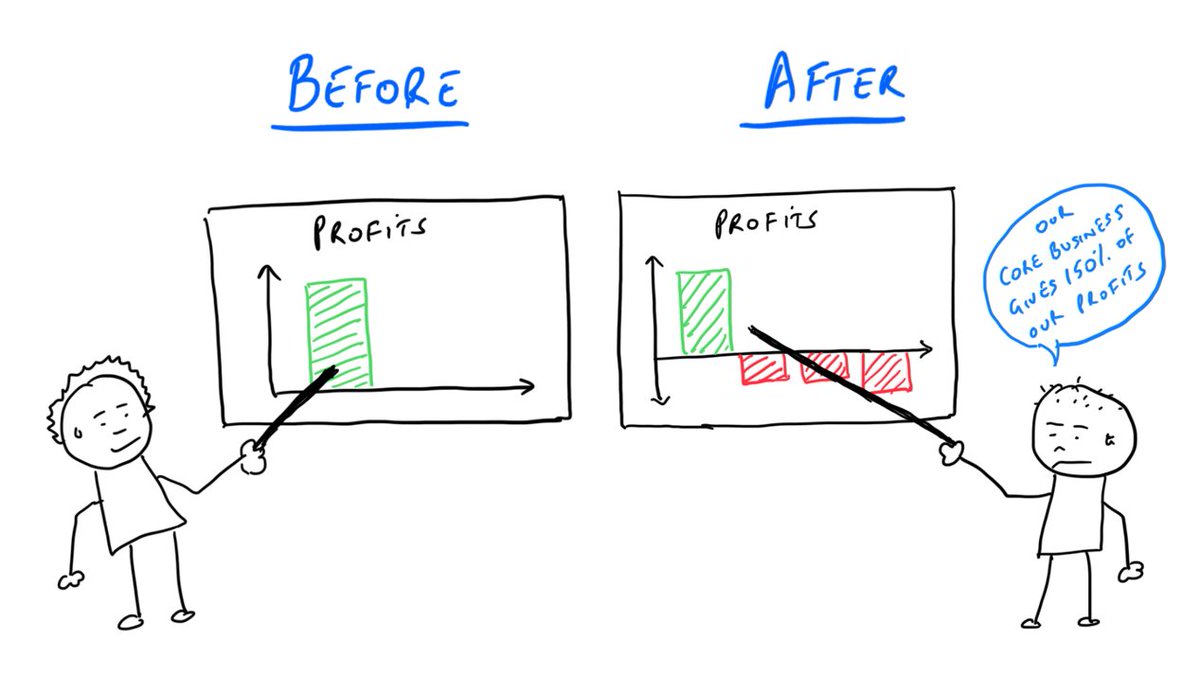

Many years passed. The friend caught up with the businessman & asked : Hey, did that consultant help you improve profits?

The businessman replied : “Yeah somewhat”

What do you mean?

“Earlier 100% of my profits used to come from my core business. Now it gives me 150%” (2/n)

The businessman replied : “Yeah somewhat”

What do you mean?

“Earlier 100% of my profits used to come from my core business. Now it gives me 150%” (2/n)

The term “diworsification” is used to describe the over-expansion of a company into new growth projects & businesses they do not fully understand and are not in alignment with the company’s core competencies

E.g. AOL-Time Warner , Microsoft-Nokia, Videocon in telecom etc.

(3/n)

E.g. AOL-Time Warner , Microsoft-Nokia, Videocon in telecom etc.

(3/n)

Cosmo Films is a 40-year company into films for packaging, labels, lamination & industrial applications

A recent investor presentation (Nov 2020) explains their intent to diversify into the pet care business

A case for diworsification? 🤔

A recent investor presentation (Nov 2020) explains their intent to diversify into the pet care business

A case for diworsification? 🤔

• • •

Missing some Tweet in this thread? You can try to

force a refresh