Bitcoin supply disruption - The endgame

A short thread on why bitcoin lending is the final spark to trigger a bitcoin nuclear reaction.

I was mindblown when I realized this, so prepare for impact.

👇

A short thread on why bitcoin lending is the final spark to trigger a bitcoin nuclear reaction.

I was mindblown when I realized this, so prepare for impact.

👇

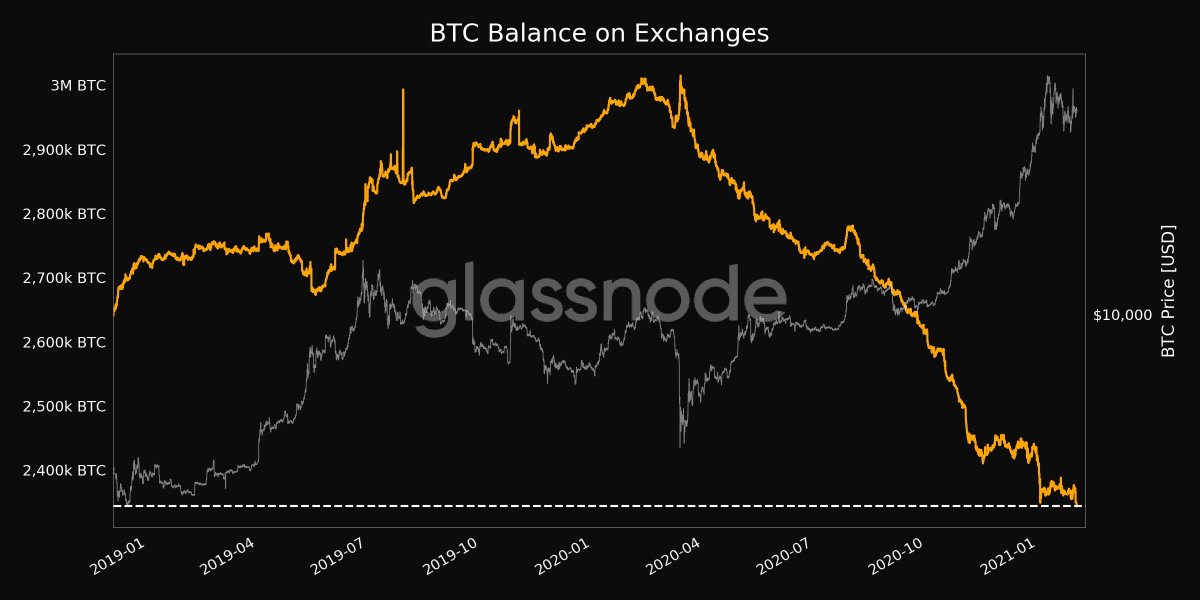

1\ Onchain analytics show that Bitcoin balance on exchanges has been steadily declining throughout this cycle and the downtrend shows now signs of reversal, as hodlers have been increasingly removing bitcoin from circulation and into cold storage. @glassnode @woonomic

2\ In fact, institutions like Grayscale and MicroStrategy have been making Bitcoin purchases in unprecedented sized batches that surpass the mining rate by orders of magnitude, effectively creating a supply deficit. @michaelsaylor @MicroStrategy

3\ As of today, most miners are still financing operational costs (i.e. electrical bills) via Bitcoin sales revenue. Miners also happen to be the main source of new Bitcoin into circulation. As long as miners keep selling price may increase due to reduced supply but we're good.

4\ Now consider this: Bitcoin lending platforms such as @BlockFi allow users to post their Bitcoin as collateral and earn yields of up to 6% on it or even get USD loans via overcollateralization. Listen to @PrestonPysh and @BlockFiZac on this subject.

theinvestorspodcast.com/bitcoin-fundam…

theinvestorspodcast.com/bitcoin-fundam…

5\ Soon enough - or perhaps even as we speak - miners are realizing that they can post their mined Bitcoin as collateral in these and other lending platforms and pay for the operational costs WITHOUT having to sell their hard earned Bitcoin.

6\ As it becomes evident that selling Bitcoin is an inefficient and expensive way to finance mining operations, miners will effectively shut the tap for new supply. As a result, Bitcoin balance in miner wallets will increase gradually, then steeply as outflow comes to a stop.

7\ When this happens at scale, Bitcoin flow into exchanges will dry out and we will witness an unprecedented hyperbolic price movement as desperate buyers search for almost nonexistent sellers. Supply squeeze is an understatement and it is hard to grasp the implications of this.

8\ This is the endgame. Time is running out. Act accordingly.

• • •

Missing some Tweet in this thread? You can try to

force a refresh