$OPEN a short thread.

In anticipation of $RDFN 's earnings this week, I thought I would expand my knowledge of some of the main competitors. Here's what I learned on $OPEN...

*Full overview to come after March 4th (Earnings)*

a thread 👇👇👇

In anticipation of $RDFN 's earnings this week, I thought I would expand my knowledge of some of the main competitors. Here's what I learned on $OPEN...

*Full overview to come after March 4th (Earnings)*

a thread 👇👇👇

1) Who are $OPEN?

Leaning on the shift in consumer behaviour towards ‘digital’, OpenDoor provides a completely online, contactless option to buy and sell a home.

Leaning on the shift in consumer behaviour towards ‘digital’, OpenDoor provides a completely online, contactless option to buy and sell a home.

The current model of buying and selling your home is dated and filled with inefficiencies that lose YOU money. $OPEN aim to solve this by becoming a digital one-stop shop to move.

2) What do they do?

$OPEN have three distinguishing aspects to their business model...

🔹Digital user experience

🔹Instant cash offering

🔹Lower fees

Overall, they centralize the home buying journey which offers customers convenience, certainty and efficiency.

$OPEN have three distinguishing aspects to their business model...

🔹Digital user experience

🔹Instant cash offering

🔹Lower fees

Overall, they centralize the home buying journey which offers customers convenience, certainty and efficiency.

3) How does it work?

To sell, you submit your house to $OPEN, who assess it using various Machine Learning algorithms alongside crowdsourcing tech (such as Re-Captcha) which take into account various factors like…

To sell, you submit your house to $OPEN, who assess it using various Machine Learning algorithms alongside crowdsourcing tech (such as Re-Captcha) which take into account various factors like…

🔹The quality of the home

🔹The neighbourhood

🔹Price of neighbouring homes

🔹Features of the house

Data gathered from this loops back into the algorithm to improve accuracy in the future.

🔹The neighbourhood

🔹Price of neighbouring homes

🔹Features of the house

Data gathered from this loops back into the algorithm to improve accuracy in the future.

Listing with $OPEN

🔹Fees are low 5% (1% less than traditional)

🔹Get an instant cash offer or help with listing

🔹Cost efficiencies when supported by local industry experts

🔹Maximise sale price with $10k interest free advance for renovations

🔹Fees are low 5% (1% less than traditional)

🔹Get an instant cash offer or help with listing

🔹Cost efficiencies when supported by local industry experts

🔹Maximise sale price with $10k interest free advance for renovations

Buying from $OPEN

🔹Easy user interface to search homes within your desired area

🔹Explore homes from your phone with virtual tours

🔹Cost savings up to 1.5%

🔹Easy user interface to search homes within your desired area

🔹Explore homes from your phone with virtual tours

🔹Cost savings up to 1.5%

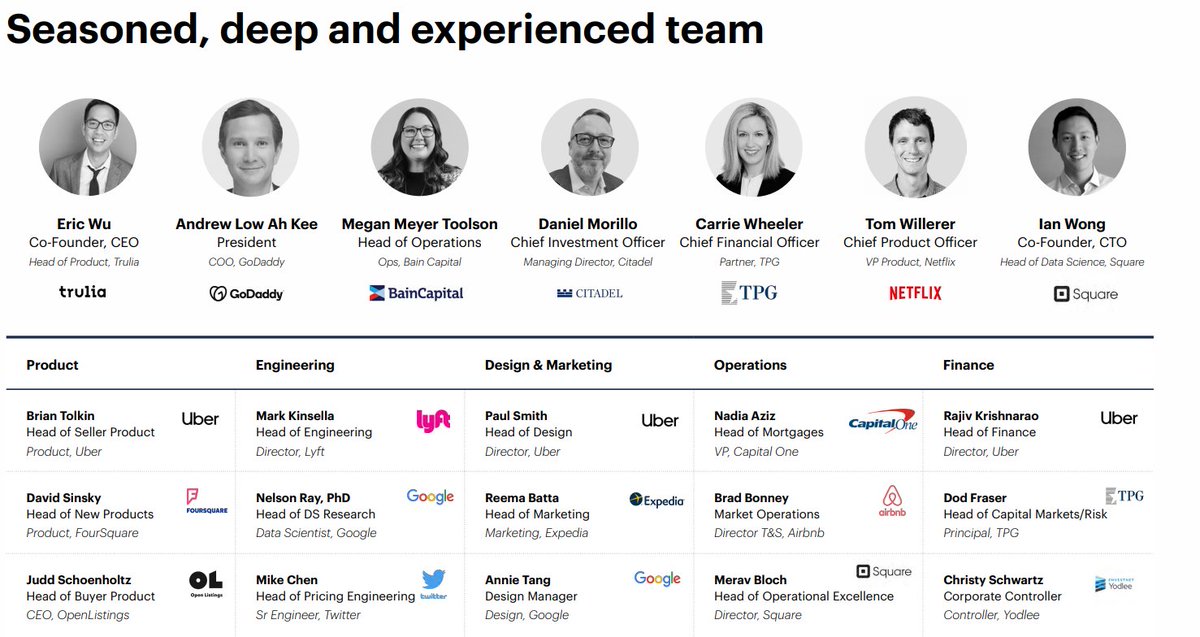

4) Management

Founder led.

Strong management is an often underrated aspect of a company’s ability to succeed long-term. As @BackpackerFI said earlier today “I’ll take a B company with A management over an A company with B management” which is a sentiment I can relate to.

Founder led.

Strong management is an often underrated aspect of a company’s ability to succeed long-term. As @BackpackerFI said earlier today “I’ll take a B company with A management over an A company with B management” which is a sentiment I can relate to.

Eric Wu is the Co-Founder and CEO

🔹Co-Founder of Rentadvisor.com

🔹Founder of Motivity.com

🔹Head of Geo/Social products at Trulia.com

In and around the real estate industry for the best part of a decade. Very capable.

🔹Co-Founder of Rentadvisor.com

🔹Founder of Motivity.com

🔹Head of Geo/Social products at Trulia.com

In and around the real estate industry for the best part of a decade. Very capable.

Ian Wong is the Co-Founder and CTO

🔹Stanford Graduate in Electrical Engineering + Statistics

🔹2.5 years spent at $SQ developing ML applications

🔹Time spent at Prismatic doing similar things

🔹Stanford Graduate in Electrical Engineering + Statistics

🔹2.5 years spent at $SQ developing ML applications

🔹Time spent at Prismatic doing similar things

Andrew Low Ah Kee is President

🔹~7 years as director at KKR Capstone

🔹~7 years at GoDaddy in growth roles and CRO + COO

🔹Experience in making growth happen

🔹~7 years as director at KKR Capstone

🔹~7 years at GoDaddy in growth roles and CRO + COO

🔹Experience in making growth happen

Carrie Wheeler is CFO

🔹Extensive experience within finance

🔹TPG Global for 21 years as partner and head of retail + consumer investing

🔹Sits on various boards (Glensons, J.Crew, API Group, Dollar Tree Stores…)

🔹Extensive experience within finance

🔹TPG Global for 21 years as partner and head of retail + consumer investing

🔹Sits on various boards (Glensons, J.Crew, API Group, Dollar Tree Stores…)

5) What is the Market Op?

TAM is huge ($1.6T) with majority of the market being made up of traditional models. The market has been stagnant for years, however we are beginning to see transformation.

TAM is huge ($1.6T) with majority of the market being made up of traditional models. The market has been stagnant for years, however we are beginning to see transformation.

🔹The market is fragmented and has low digital penetration.

🔹Total R-E service transactions up 23% y/y

🔹$7.2 billion run rate prediction for Q1 2020 with a 3.2% market share.

🔹Very early market in digital transformation for real-estate

🔹Total R-E service transactions up 23% y/y

🔹$7.2 billion run rate prediction for Q1 2020 with a 3.2% market share.

🔹Very early market in digital transformation for real-estate

6) Competition

I strongly believe we’re going to see more than one winner in this space. The competition is fierce, and there's plenty of market share to go around. $RDFN are my favorite at the time of writing.

I strongly believe we’re going to see more than one winner in this space. The competition is fierce, and there's plenty of market share to go around. $RDFN are my favorite at the time of writing.

7) Finances

Compared to the other companies operating in the ibuying space, the Financial performance of $OPEN over the first 9 months of 2020 is disappointing.

Whilst others are growing ($RDFN +17% y/y and $Z +41.8%), $OPEN is facing a shrinkage in revenues (-33%).

Compared to the other companies operating in the ibuying space, the Financial performance of $OPEN over the first 9 months of 2020 is disappointing.

Whilst others are growing ($RDFN +17% y/y and $Z +41.8%), $OPEN is facing a shrinkage in revenues (-33%).

Comparing margins within the industry is also an interesting exercise. There is evidently a disparity between these competing business models.

8) Challenges

Margins are likely to become tighter in the industry as competitors jostle for business with competing fees. $RDFN already offers a 2% discount for selling qualified homes. $OPEN ‘s model is low margin and highly capital intensive relative to $RDFN and $Z...

Margins are likely to become tighter in the industry as competitors jostle for business with competing fees. $RDFN already offers a 2% discount for selling qualified homes. $OPEN ‘s model is low margin and highly capital intensive relative to $RDFN and $Z...

...

The success of iBuying is largely driven by the state of the housing market. In a downturn, how will $OPEN deal with increased overheads compared to the traditional business models?

The success of iBuying is largely driven by the state of the housing market. In a downturn, how will $OPEN deal with increased overheads compared to the traditional business models?

9) Conclusion

Early days for this sector.

Low interest rates and high propensity to move in 2021/22 should drive record sale volumes. With consumers waking to the possibility of making this process digital – there is a long runway for $OPEN (and companies alike).

Early days for this sector.

Low interest rates and high propensity to move in 2021/22 should drive record sale volumes. With consumers waking to the possibility of making this process digital – there is a long runway for $OPEN (and companies alike).

Thanks for reading! Leave a like and a re-tweet if you find this useful. It really helps me out.

Check out my Substack for more deep-dives on growth companies like...

$RDFN

$NIO

$TTCF

$FVRR

$CURI

and many more.

innovestor.substack.com

Check out my Substack for more deep-dives on growth companies like...

$RDFN

$NIO

$TTCF

$FVRR

$CURI

and many more.

innovestor.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh