Small thread on how I build positions after defining a good range to entry either longs or shorts.

Some do's and don'ts - hope it helps one or two.

Some do's and don'ts - hope it helps one or two.

1/ Needless to say by now you should never bid your entire account size into one order. This simply locks your hand and disables the possiblity of dollar cost averaging your entry. I'm sure most of us would like to market long the exact top or bottom but this is rarely the case.

2/ Second advice that doesn't have much to do with the guide itself is to never bid money you can't afford to lose.

Pretty self-explanatory - emotions lead to poor decisions especially in a market that is as volatile as crypto. Newbies aren't used to wild portfolio swings.

Pretty self-explanatory - emotions lead to poor decisions especially in a market that is as volatile as crypto. Newbies aren't used to wild portfolio swings.

3/ Won't be explaining how I define entry ranges, but if you've been following me long enough you've seen me talk about supply, demand, S/R flips and order blocks. These are key tools for me to create a thesis around a setup where I can minimize risk and maximize reward.

4/ I'm usually more confident with bigger position sizes in coins with higher volume such as Bitcoin, Ethereum etc.

I rarely put anything above five digits into coins with low liquidity.

I rarely put anything above five digits into coins with low liquidity.

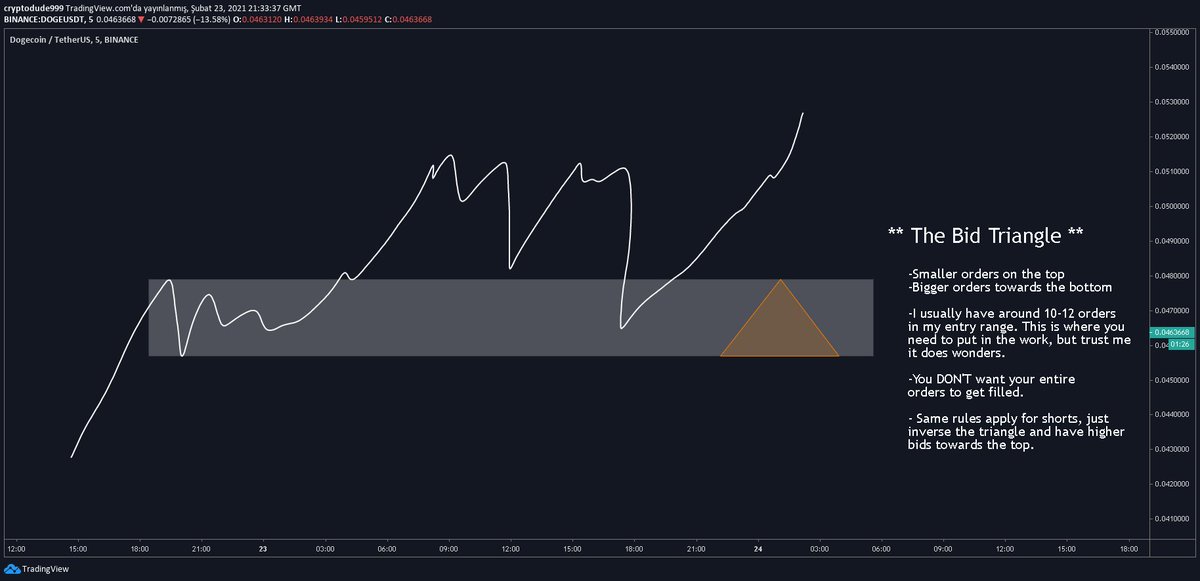

5/ THE BID TRIANGLE. This is a self made tactic I've created that helped me immensely.

The idea is very simple. After defining a good entry range for longs I put bigger bids towards the bottom of the range and smaller at the top. This allows me to dollar cost average -

The idea is very simple. After defining a good entry range for longs I put bigger bids towards the bottom of the range and smaller at the top. This allows me to dollar cost average -

6/ and profit faster after a bounce. You DON'T want your entire orders to get filled. Once again this tactic will only work to perfection if you can properly establish decent entry ranges. If price nukes through your bids chances are likely that something with your TA was flawed.

7/ If market does dip into my bids and bounce while filling only some of it - I LET IT GO.

I don't add more until I see another setup arise. I know that the Risk : Reward of the trade I'm taking is only adequate at the levels I see as key.

I don't add more until I see another setup arise. I know that the Risk : Reward of the trade I'm taking is only adequate at the levels I see as key.

8/ Most newbies are attracted to the idea of fast money.

Don't get persuaded into ideas of quickly doubling or tripling your capital.

Instead, focus on properly managing your risk and making constant gains. You'd be surprised at how far you can go in a couple of months / years

Don't get persuaded into ideas of quickly doubling or tripling your capital.

Instead, focus on properly managing your risk and making constant gains. You'd be surprised at how far you can go in a couple of months / years

9/ Little by little the fish becomes the whale.

Protect your capital at all costs. If you improperly use leverage you might make good money in 2-3 trades, but chances are likely that the next one will flush you out. Don't force into trades. Let them come to you.

Protect your capital at all costs. If you improperly use leverage you might make good money in 2-3 trades, but chances are likely that the next one will flush you out. Don't force into trades. Let them come to you.

• • •

Missing some Tweet in this thread? You can try to

force a refresh