Revenue finally replied in writing to the questions asked by the Public Accounts Committee about #bogusselfemployment. The reply is dated February 2021 and I will be sharing it on this thread later tonight. It confirms every single word of this thread to date and drops SW in it.

The first question from the PAC was -

"A test case regarding bogus self employment amongst couriers was discussed. Please provide further details in relation to this case including detailing any associated costs"

"A test case regarding bogus self employment amongst couriers was discussed. Please provide further details in relation to this case including detailing any associated costs"

Revenue replied with -

"There is no one specific “test” case.

However, couriers were regarded as self employed for PRSI purposes as a result of a Social Welfare

Appeals OfficerOfficer’s decision. In the interest of uniformity Revenue decided, >

"There is no one specific “test” case.

However, couriers were regarded as self employed for PRSI purposes as a result of a Social Welfare

Appeals OfficerOfficer’s decision. In the interest of uniformity Revenue decided, >

without prejudice, to treat

those couriers as self employed for tax purposes"

Revenue are saying there is no is no one specific test case BUT at the same time Revenue say all couriers are labeled as self employed as a result of a single decision by an Appeals Officer. Just so

those couriers as self employed for tax purposes"

Revenue are saying there is no is no one specific test case BUT at the same time Revenue say all couriers are labeled as self employed as a result of a single decision by an Appeals Officer. Just so

happens that I have the details of that decision made by an appeals officer and used by Revenue and SW and it categorically is a test case, unless of course, Revenue are now claiming that the former Secretary General of the Dept of SW lied to the PAC Chairman in 2000 -

Back in 2000, the then Chairman of the Revenue Commissioners wrote to the Chairman of the PAC and stated that there was only ONE case which was being used to label all couriers as self-employed, nowhere did he say there wasn't one specific test case.

There is only one >

There is only one >

'Test Case' for couriers and that is the 1995 test case. As we will see from the rest of Revenue's replies, it is that test case and only that test case, and the precedents it set, which is being used by Revenue and SW to label all couriers as self-employed by class/group.

"In the interest of uniformity Revenue decided, without prejudice, to treat those couriers as self employed for tax purposes"

As contradictory statements go, this one is a grade A prize winner. If labeling all workers in an industry as self-employed for 'uniformity' is not

As contradictory statements go, this one is a grade A prize winner. If labeling all workers in an industry as self-employed for 'uniformity' is not

considered prejudicial by Revenue, it begs the question what do Revenue think prejudice looks like?

Anyway, put this one to bed real quick with a quote from a decision made by an Appeals Officer in an insurability of employment Appeal which came before the Social Welfare Appeals

Anyway, put this one to bed real quick with a quote from a decision made by an Appeals Officer in an insurability of employment Appeal which came before the Social Welfare Appeals

Office in 2000, 5 years after the test case and 3 years after the special tax agreement reached between courier industry employers, revenue and social welfare.

Here's how prejudice works, in his decision, the Appeal's Officer writes-

"I have also noted in a previous appeal >

Here's how prejudice works, in his decision, the Appeal's Officer writes-

"I have also noted in a previous appeal >

case the Appeals Officer decided that a courier was a self-employed person and that there are special arrangements in place between the Revenue Commissioners and the courier industry for payment of tax and PRSI for couriers"

Despite what Revenue state, Revenue's decision to

Despite what Revenue state, Revenue's decision to

label all couriers as self employed is used by Appeals Officers in the SWAO to label couriers as self-employed as is the use of 'Test Case'.

It's there in black and white, the date of that Appeal Decision was June 2001 and the Appeals Officer's name is also available.

It's there in black and white, the date of that Appeal Decision was June 2001 and the Appeals Officer's name is also available.

In reality, SW is playing cute hoorism back on Revenue. Revenue were way to cute to accept an unlawful test case from SW, instead Revenue opted for acting in 'Uniform' with Social Welfare who were using an unlawful test case, so now SW has thrown it back on Revenue by using

and quoting Revenue's Special Tax Agreement with courier company employers as a determining factor in Appeals.

This set-up, Revenue pointing the finger and Social Welfare and Social Welfare pointing the finger at Revenue is not accidental. It's all pre-planned to avoid

This set-up, Revenue pointing the finger and Social Welfare and Social Welfare pointing the finger at Revenue is not accidental. It's all pre-planned to avoid

responsibility for if and when the shit hits the fan about unlawfully labeling workers by group and class.

Revenue's written reply also states -

"A voluntary PAYE system of tax deduction in respect of self employed couriers >

Revenue's written reply also states -

"A voluntary PAYE system of tax deduction in respect of self employed couriers >

engaged by courier firms was put in place. The voluntary system of PAYE allowed the contracting courier firm to voluntarily operate PAYE 1 on self employed courier income net of expenses (expenses agreed at

40% of income for motorcycle and 10% for cycle couriers)"

40% of income for motorcycle and 10% for cycle couriers)"

I've covered this earlier in this thread but just to point out, couriers played no hand act or part in these negotiations, This deal is industry wide, it affected all couriers. As far back as 1999, the Communications Workers Union, which represented approximately 10% of couriers

was writing to Ministers seeking a meeting to discuss, as the CWU describes it -

'Couriers are, against their will being classified as self employed'

Sidebar on this point, the best place to hide unlawful test cases is out in the open. Former SW Minister Doherty did just that

'Couriers are, against their will being classified as self employed'

Sidebar on this point, the best place to hide unlawful test cases is out in the open. Former SW Minister Doherty did just that

in the Irish Times (below). The Minister admits that the Department SW is acting outside of legislation to label workers by group and class. As for workers having to agree to act outside the legislation, firstly, it's completely untrue. One cannot agree to act outside of the

legislation, SW cannot ask workers to act outside of the legislation. Secondly, and because the 'Reality of the Situation' it paramount, how exactly do you get agreement from all couriers/deliver workers from 1995 to date to agree to act outside of existing legislation. It's

complete horseshit. There never was any agreement from workers to have one supposedly self-employed courier speak on behalf of all courier/delivery workers past, present and future.

Just to press home this point again, the SW Minister admits publicly that the Dept AW is making

Just to press home this point again, the SW Minister admits publicly that the Dept AW is making

unlawful group/class decisions on the employment status of workers.

Back to Revenue's reply to the PAC, Revenue further writes -

"Many courier firms opted to implement that system at the time. Use of the voluntary system by the contracting courier >

Back to Revenue's reply to the PAC, Revenue further writes -

"Many courier firms opted to implement that system at the time. Use of the voluntary system by the contracting courier >

firms was conditional on the courier being self employed. However, in situations where a courier was

employed directly by the courier firm as an employee, PAYE would have been operated as normal"

This is Revenue having a laugh at your expense. Revenue made a decision to label

employed directly by the courier firm as an employee, PAYE would have been operated as normal"

This is Revenue having a laugh at your expense. Revenue made a decision to label

all couriers as self-employed. This represents a circa 30% saving for employers on labour costs. Revenue is expecting the PAC to believe that courier companies would choose not to avail of that saving provided to them on a plate by revenue.

More of Revenue's written reply -

"It was accepted that compliance issues existed with self employed couriers at the time and the

system was to the benefit of both the couriers and Revenue by way of improved compliance and a

simplified system for couriers to be tax compliant"

"It was accepted that compliance issues existed with self employed couriers at the time and the

system was to the benefit of both the couriers and Revenue by way of improved compliance and a

simplified system for couriers to be tax compliant"

The compliance issues raised by Revenue in the Special Tax Agreement were EMPLOYER compliance issues. Employers were refusing to make returns on every person they paid over 3000 punt per year. This Special Tax Agreement is clearly not to the benefit of courier/delivery workers,

it beggars belief that Revenue have the neck to say that couriers/deliver workers are better off being labeled as self-employed. They were de facto employees in every way, PAYE employees with tax and PRSI deducted at source by their employers yet none of the protections nor

benefits of being employees, no holiday pay, no sick pay, no redundancy, no maternity/paternity pay etc.

More from Revenue -

"The conditions for courier companies to operate

the voluntary PAYE system, and for self employed couriers to be included in the system, >

More from Revenue -

"The conditions for courier companies to operate

the voluntary PAYE system, and for self employed couriers to be included in the system, >

were that they met all the conditions to be classified as self employed as follows:"

Before I get into the 'as follows', let me just quote to your the real 'conditions' for courier companies as set out by Revenue in the Special Tax Agreement -

"5.2 As previously stated, >

Before I get into the 'as follows', let me just quote to your the real 'conditions' for courier companies as set out by Revenue in the Special Tax Agreement -

"5.2 As previously stated, >

return compliance and tax/PRSI obligation were never "put on hold". Consequently, courier firms which do not opt for the voluntary PAYE and who have not made a return of all couriers who were paid in excess of £3000 gross will be visited shortly after 5 April 1997 to obtain that>

list for 1995/96"

In effect, the 'conditions' imposed by revenue were a threat that courier companies would be audited for their non compliance if they didn't agree to a PAYE arrangement. Not that courier companies needed a threat, they were delighted to be let off the hook.

In effect, the 'conditions' imposed by revenue were a threat that courier companies would be audited for their non compliance if they didn't agree to a PAYE arrangement. Not that courier companies needed a threat, they were delighted to be let off the hook.

Next up - "the conditions to be classified as self employed as follows" but it's been a long night so I'm going to come back to this over the weekend. You won't want to miss it, 'the conditions' are where the dark heart of this saga lie.

Thanks for reading.

Thanks for reading.

Recap - Revenue reply to the PAC question "A test case regarding bogus self employment amongst couriers was discussed. Please provide further details in relation to this case including detailing any associated costs", and we're on to the last part of the reply to that question >

Revenue's reply -

"The conditions for courier companies to operate

the voluntary PAYE system, and for self employed couriers to be included in the system, were that they met all the conditions to be classified as self employed as follows:

"The conditions for courier companies to operate

the voluntary PAYE system, and for self employed couriers to be included in the system, were that they met all the conditions to be classified as self employed as follows:

1. that the vehicle was owned by the courier

2. that all the outgoings in relation to the vehicle were paid by the courier

3. the courier was engaged under the standard contract

4. A basic wage was not paid in addition to a "mileage" rate.

2. that all the outgoings in relation to the vehicle were paid by the courier

3. the courier was engaged under the standard contract

4. A basic wage was not paid in addition to a "mileage" rate.

The only 'conditions' which apply to insurability of employment (employed or self-employed) decisions and appeals of those decisions, are those legislated for in the Oireachtas and on the legal principles handed down from the Courts.

Decisions are based on established facts,

Decisions are based on established facts,

not assumptions and as such, THERE IS NO BASIS FOR CATEGORISATIONS PURELY BY OCCUPATION. Each case is assessed on its merits in accordance with the general principles of Irish Law. Operations which seem to be the same may differ in actual terms and conditions in any given case.

That Revenue are telling the PAC, in writing, that they are, and have been, acting outside of the Law to label couriers as a group as 'self-employed' since at least 1995, is off the hook insane. Regardless of what the SWAO & the Dept. of Social Welfare, do and have done,

the Revenue Commissioners CANNOT decide to act outside of the Law 'in uniform' with the Dept. SW and the SWAO. It was never the law that decisions could be made by group and class, not in 1995 and certainly not now. In the 1998 Denny Case ruling, Keane J specifically ruled that >

each case MUST be determined in light of its particular facts and circumstances. The Revenue Commissioners (and SWAO and Dept SW) are specifically precluded from making insurability of employment decision on a group/class basis.

There is no way around this for Revenue. Revenue

There is no way around this for Revenue. Revenue

cannot decide to benefit one set of employers over another with a Special Tax Agreement based on 'conditions' which are outside of the Law.

Revenue state in a 1997 letter to the Accountancy Firm who lobbied Revenue on behalf of Courier employers -

Revenue state in a 1997 letter to the Accountancy Firm who lobbied Revenue on behalf of Courier employers -

"The arrangements governing couriers should not be taken as a precedent for other cases you may have with the Revenue Commissioners"

Fact - This is an admittance by the Revenue Commissioners that there is a 'Precedent' specifically for Couriers.

Fact - This is an admittance by the Revenue Commissioners that there is a 'Precedent' specifically for Couriers.

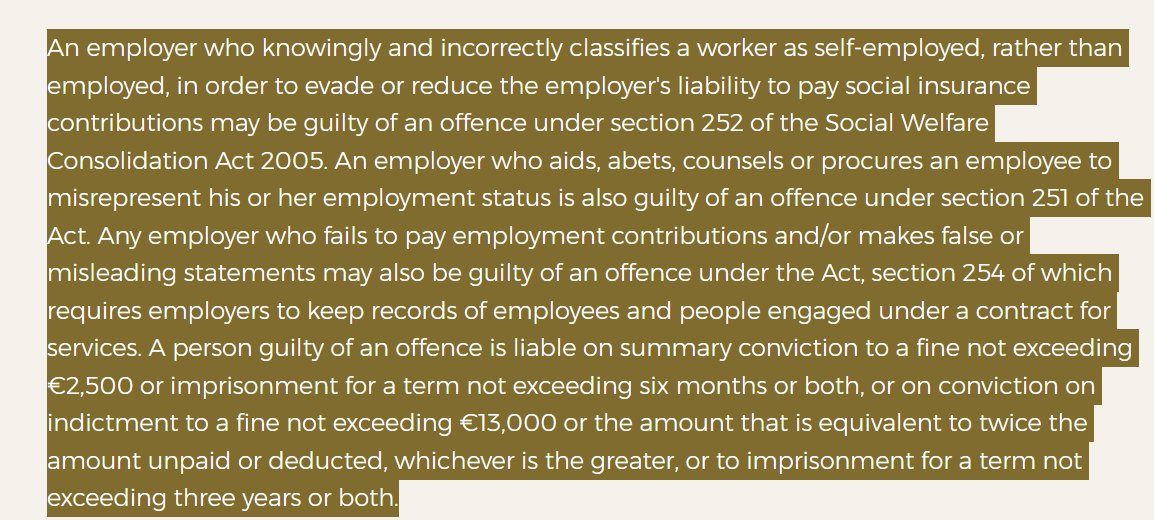

Fact - For at least 26 years, Revenue have acted outside the law to grant selected employers a PRSI exemption based on unlawful precedents set in an unlawful test case, an exemption which is specifically denied to all other employers by Revenue. It grants one group of employers

a financial advantage over all other employers.

More later.

More later.

On the 4 'conditions' listed by Revenue as 'Conditions to be classified as self-employed.

Revenue is telling the PAC that Revenue has taken decades of legislation, scores of Court rulings and distilled them down to 4 simple tick box criteria. This is not just ignoring the >

Revenue is telling the PAC that Revenue has taken decades of legislation, scores of Court rulings and distilled them down to 4 simple tick box criteria. This is not just ignoring the >

Higher Courts and the authority of the Judiciary in this matter, the use of these 4 'conditions' by the Revenue Commissioners to label a group/class of worker as self-employed, is the Revenue Commissioners acting IN DEFIANCE of the Higher Courts. >

3 of the 4 'conditions' listed by Revenue are identical to the 'criteria' listed by the Secretary General in his letter of 2000 to the PAC regarding the test case for couriers.

The 'Condition' listed by Revenue but not by the Dept. is -

The 'Condition' listed by Revenue but not by the Dept. is -

"The courier was engaged under the standard contract".

The assertion by @RevenueIE that a contract is dererminative of self-employed status has been roundly rejected by the Higher Courts.

In the Denny case, the contract between the parties was in writing and was >

The assertion by @RevenueIE that a contract is dererminative of self-employed status has been roundly rejected by the Higher Courts.

In the Denny case, the contract between the parties was in writing and was >

@RevenueIE in writing and was drafted with considerable care with a view to ensuring that the putative employee was regarded in law as an independent contractor. Nevertheless, both the High Court and the Supreme Court affirmed that the person was in fact an employee. >

@RevenueIE Revenue is fully aware that the existence of a contract is not an indicator of self-employment. Keane J ruled that one must look beyond what is written in a contract. It is the reality of the situation which determines employment status not merely the existence of a contract. >

@RevenueIE I don't know how the existence of a contract became one of the 'conditions' of Revenue's unique and unlawful precedents. It was first listed in 1997 in the Special Tax Agreement.

It could have been taken from another test case in another area, after all, this 'Test Case' is the

It could have been taken from another test case in another area, after all, this 'Test Case' is the

@RevenueIE only one ever revealed by Revenue, Dept. SW and the SWAO, but it is not the only Test Case in existence which was confirmed in an email from the Social Welfare Appeals Office dated 9th January 2019 which states -

@RevenueIE "On occasion over the years the approach of having 'Test Cases' has been taken or considered by the Social Welfare Appeals Office"

It must be of serious concern to the PAC that the approach of having test cases has been taken by the Social Welfare Appeals Office which are then

It must be of serious concern to the PAC that the approach of having test cases has been taken by the Social Welfare Appeals Office which are then

@RevenueIE accepted by the Dept. SW and the Revenue Commissioners in areas other than couriers.

However, in this particular circumstance, I believe Revenue just add the 'Contract' condition because it's a very low bar for employers to meet. >

However, in this particular circumstance, I believe Revenue just add the 'Contract' condition because it's a very low bar for employers to meet. >

@RevenueIE On the other 3 'conditions' listed by Revenue to the PAC, 2 of the 3 are directly related to the ownership of a vehicle as follows -

That the vehicle was owned by the courier,

That all the outgoings in relation to the vehicle were paid by the courier,

Back in 2000, >

That the vehicle was owned by the courier,

That all the outgoings in relation to the vehicle were paid by the courier,

Back in 2000, >

@RevenueIE the Social Welfare Minister sought legal advice on the matter. The Minister was told, in no uncertain terms, that ownership of a vehicle was not an indicator of self-employment as per the Denny case. The Minister chose and still chooses to ignore the Denny case and legal advice.

@RevenueIE This is the legal advice given to the Social Welfare Minister by Mark Connaughton SC in 2000.

There is no doubt that Revenue are demonstrably incorrect to accept ownership of a vehicle as 2 of the 4 secret precedents they use to label workers as self employed.

So far, on the 4

There is no doubt that Revenue are demonstrably incorrect to accept ownership of a vehicle as 2 of the 4 secret precedents they use to label workers as self employed.

So far, on the 4

@RevenueIE 'conditions' listed by Revenue, 'conditions' listed by Revenue, any employee in the state who has a contract and owns a car, a motorbike, a bicycle or electric scooter can be labeled as self-employed by Revenue.

On the fourth and final 'condition' listed by Revenue -

On the fourth and final 'condition' listed by Revenue -

@RevenueIE (Forgot the screenshot of the Legal advice from the Chief State Solicitors delivered by Mark Connaughton SC given to the SW Minister in 2000, this is it below).

Back to the 4th and final 'condition' listed by revenue -

'a basic wage was not paid in addition to a "mileage' rate'

Back to the 4th and final 'condition' listed by revenue -

'a basic wage was not paid in addition to a "mileage' rate'

@RevenueIE This 'condition' was ruled upon by a 3 person tribunal in the Employment Appeals Tribunal Chaired by Ms. M Faherty SC as follows -

'While the case is being made that the claimant (courier/delivery worker) could earn as much or as little as he liked, the reality of the case was

'While the case is being made that the claimant (courier/delivery worker) could earn as much or as little as he liked, the reality of the case was

@RevenueIE that the claimant worked a full day almost every day at a rate set by the respondent company. In this the claimant was no different to a piece work employee".

Being paid by the piece ie. by delivery, by brick laid, by potato picked, is not and never was an indicator of >

Being paid by the piece ie. by delivery, by brick laid, by potato picked, is not and never was an indicator of >

@RevenueIE self-employment.

All of the 4 'Conditions' listed to the PAC by Revenue have been comprehensively rejected by the Higher Courts as indicators of self-employment.

The very last line of Revenue's written reply to the PAC on this question is -

All of the 4 'Conditions' listed to the PAC by Revenue have been comprehensively rejected by the Higher Courts as indicators of self-employment.

The very last line of Revenue's written reply to the PAC on this question is -

@RevenueIE "These requirements would indicate that the particular couriers to whom the “voluntary PAYE system was applied were in fact self employed individuals"

As I have shown, the 4 'conditions' or 'requirements' to be deemed self-employed by the Revenue Commissioners DO NOT and

As I have shown, the 4 'conditions' or 'requirements' to be deemed self-employed by the Revenue Commissioners DO NOT and

@RevenueIE CANNOT indicate self-employed status. The true factual position is that the 4 'requirements' deemed by Revenue to indicate self-employment have been rejected by the courts, a fact the Revenue Commissioners are fully aware of. >

@RevenueIE The 2nd question the PAC asked of Revenue is as follows -

"What is the basis, legal or otherwise, for couriers being deemed self employed if they primarily work for one company?"

Revenue replied with -

"An individual’s liability to Irish income tax is determined by reference

"What is the basis, legal or otherwise, for couriers being deemed self employed if they primarily work for one company?"

Revenue replied with -

"An individual’s liability to Irish income tax is determined by reference

@RevenueIE to the source of his/her

income. A worker’s employment status is not a matter of choice, it will depend on the terms and

conditions of the job"

This is the first bit of honesty in Revenue's replies and it made me laugh because it shows that somebody in Revenue is reading this >

income. A worker’s employment status is not a matter of choice, it will depend on the terms and

conditions of the job"

This is the first bit of honesty in Revenue's replies and it made me laugh because it shows that somebody in Revenue is reading this >

@RevenueIE thread. It also made me laugh because it marks a departure in Revenue's thinking and this is why -

Back in 2002, I got a telephone call, out of the blue, from the Chief Inspector of Taxes, Mr. Bob Dowdall. Bob is also the author and architect of the Special Tax Agreement with

Back in 2002, I got a telephone call, out of the blue, from the Chief Inspector of Taxes, Mr. Bob Dowdall. Bob is also the author and architect of the Special Tax Agreement with

Courier Company employers.

Bob and I spoke for well over an hour. We debated the pros and cons of me challenging 'Test Cases' and the employment status of ALL couriers. I was, at the time, due in the Employment Appeals Tribunal where I was claiming that I was an employee not >

Bob and I spoke for well over an hour. We debated the pros and cons of me challenging 'Test Cases' and the employment status of ALL couriers. I was, at the time, due in the Employment Appeals Tribunal where I was claiming that I was an employee not >

self employed and that I had been constructively dismissed for seeking a Scope Section decision on my employment status.

Bob explained to me, the thinking in Revenue surrounding the Special Tax Agreement. It goes like this, the Courier industry was operating in the black >

Bob explained to me, the thinking in Revenue surrounding the Special Tax Agreement. It goes like this, the Courier industry was operating in the black >

economy. Couriers were getting paid cash in hand and courier companies were refusing to declare payments of over 3000 punt to the Revenue Commissioners.

Revenue believed that it was better to get some tax out of the situation than to get none as it was operating at that time. >

Revenue believed that it was better to get some tax out of the situation than to get none as it was operating at that time. >

Revenue were also eager to get everybody into the 'tax net' as Bob called it. What he meant was that there would be data where before, nobody in Revenue knew what kind of money was moving in the industry, not profits, payments, wages ... nothing, it's not called the 'Black

Economy' for no reason.

Bob was insistent that everybody was 'Happy' with the situation. I was adamant that couriers were not and that their employment rights were being sacrificed so that employers could evade PRSI.

We didn't come to agreement but it was an amiable enough

Bob was insistent that everybody was 'Happy' with the situation. I was adamant that couriers were not and that their employment rights were being sacrificed so that employers could evade PRSI.

We didn't come to agreement but it was an amiable enough

conversation.

That 'Happy' narrative is still relied upon by the Department of Social Welfare to this day, the department insists that couriers/delivery workers 'agree' to be self-employed. Revenue's reply confirms that it doesn't matter a damn if you're 'Happy' or 'agree' or

That 'Happy' narrative is still relied upon by the Department of Social Welfare to this day, the department insists that couriers/delivery workers 'agree' to be self-employed. Revenue's reply confirms that it doesn't matter a damn if you're 'Happy' or 'agree' or

'consent to act outside of legislation', none of that matters a jot, it's all down to legislation and precedents handed down from the Courts. Only the Oireachtas can legislate and only the judiciary can hand down Case Law. The Social Welfare Appeals Office is neither. It does

not have the power nor the authority to legislate nor to create precedent. This is just an indisputable fact.

Before I move on, Bob Dowdall's opinion about a courier group/class decision wasn't particular to Revenue. I was also in communication with the Auditor and Comptroller

Before I move on, Bob Dowdall's opinion about a courier group/class decision wasn't particular to Revenue. I was also in communication with the Auditor and Comptroller

or I should say the Comptroller and Auditor General. He replied to my letter informing him that Revenue, Dept SW & SWAO were facilitating PRSI evasion with test cases as follows

“All concerned recognise that it is far from being an ideal system and there is room for improvement”

“All concerned recognise that it is far from being an ideal system and there is room for improvement”

In the 19 years since the C&AG wrote this letter, no improvements ever came. The ‘far from being an ideal system’ has become the norm.

more tomorrow, ty for reading.

more tomorrow, ty for reading.

One last thing for tonight. I won that Employment Appeals Tribunal Case, unanimous decision.

I'm on the second question Revenue was asked -

'What is the basis, legal or otherwise, for couriers being deemed self employed if they primarily work for one company?'

I was going to tweet more tonight but as @LeoVaradkar has just tweeted an interest in why Deliveroo >

'What is the basis, legal or otherwise, for couriers being deemed self employed if they primarily work for one company?'

I was going to tweet more tonight but as @LeoVaradkar has just tweeted an interest in why Deliveroo >

workers are complaining about why their working conditions are so bad, I'll continue right now.

The second part of Revenue's reply to the PAC question is -

"A contract of employment applies to an employee/employer relationship while a >

The second part of Revenue's reply to the PAC question is -

"A contract of employment applies to an employee/employer relationship while a >

contract for service applies in the case of an independent or self employed contractor. While it is usually clear whether an individual is employed or self employed, it is not always obvious. However, case law has established tests to determine whether contracts >

are contracts for service (ie. self employed contractor) or contracts of service (i. employee) and generally, these tests are applied to

determine employment status along with a review of the evidence available regarding the nature of

the relationship"

That's what I've been

determine employment status along with a review of the evidence available regarding the nature of

the relationship"

That's what I've been

all along, but it is most certainly not what Revenue are doing as they have told the PAC in black and white.

Revenue go on to say -

"Revenue’s position is that each case is individual and needs to be considered on its own merits"

This is just Revenue gaslighting the PAC. >

Revenue go on to say -

"Revenue’s position is that each case is individual and needs to be considered on its own merits"

This is just Revenue gaslighting the PAC. >

How can u take Revenue seriously when they say -

"Revenue’s position is that each case is individual and needs to be considered on its own merits"

& what they do is -

"In the interest of uniformity Revenue decided, without prejudice, to treat those couriers as self employed"

"Revenue’s position is that each case is individual and needs to be considered on its own merits"

& what they do is -

"In the interest of uniformity Revenue decided, without prejudice, to treat those couriers as self employed"

It's not just Revenue's position, it is the position of the Oireachtas and Case Law that each case be taken on its own merits.

That Revenue have told the PAC that they are making group and class determinations on an industry wide basis, at the stroke of a pen, is outrageous.

That Revenue have told the PAC that they are making group and class determinations on an industry wide basis, at the stroke of a pen, is outrageous.

Revenue then add insult to injury with -

As self employed individuals, couriers ar e subject to self assessment for the filing and collection of

tax returns and the resulting tax. The fact that the couriers in question provided their own

transport >

As self employed individuals, couriers ar e subject to self assessment for the filing and collection of

tax returns and the resulting tax. The fact that the couriers in question provided their own

transport >

were responsible for insurance, tax and maintenance, were free to accept or refuse work as he or she wished and were not bound by fixed hours is strongly indicative of self employment"

Couriers are only self-employed individuals because Revenue decided to label all couriers as

Couriers are only self-employed individuals because Revenue decided to label all couriers as

self-employed by group/class.

Revenue go on to list extra 'conditions' ie. 'responsible for insurance, tax and maintenance, free to accept or refuse work as he or she wished and were not bound by fixed hours'.

I've already covered vehicle ownership and costs of running a

Revenue go on to list extra 'conditions' ie. 'responsible for insurance, tax and maintenance, free to accept or refuse work as he or she wished and were not bound by fixed hours'.

I've already covered vehicle ownership and costs of running a

vehicle. Every vehicle owner in the country has the same costs, postmen and post women, nurses, teachers, journalists, and on and on, it is not an indicator of self-employment and the SW Minister's legal advice says so as does case law.

The 'Free to refuse' bullshit has been

The 'Free to refuse' bullshit has been

comprehensively proven as bullshit. Every worker has a right to refuse work, happens all the time, both organised in 'work to rule' union protests and casually in offices and workplaces the country over.

'Are not bound by fixed hours' is another 'condition' Revenue are

'Are not bound by fixed hours' is another 'condition' Revenue are

sneaking in there which has no basis at all. Again, many employees, even civil servants, have flexible hours, it is not an indicator of self-employment, and it's not one of the 4 'conditions' Revenue has listed to the PAC which Revenue are using to label workers as self-employed

by group/class.

I spoke about Revenue's 'Defiance' of the authority of the Oireachtas and the Higher Courts earlier, but this next part of Revenue's reply brings us right into the 'Defiance', not just by Revenue, but by the Department of Social Welfare and the SWAO >

I spoke about Revenue's 'Defiance' of the authority of the Oireachtas and the Higher Courts earlier, but this next part of Revenue's reply brings us right into the 'Defiance', not just by Revenue, but by the Department of Social Welfare and the SWAO >

Revenue's reply to the PAC further states -

"In order to determine the status of a courier, it is necessary to examine each case by reference to the Code of Practice for Determining Employment or Self Employment Status of individuals. Whilst the >

"In order to determine the status of a courier, it is necessary to examine each case by reference to the Code of Practice for Determining Employment or Self Employment Status of individuals. Whilst the >

the facts of each case will determine whether an individual is either an employee or self employed, Revenue historically held the view that, in general, motorcycle and bicycle couriers were engaged >

under a contract for service i.e. they are self employed individuals. A similar view is taken in relation to the status of van owner driver couriers, who are also considered self employed"

Important stuff to unpack here for the PAC. First up, 'In order to determine the status >

Important stuff to unpack here for the PAC. First up, 'In order to determine the status >

of a courier'. Revenue are again completely ignoring that they cannot make determinations by group/class. The case law obligates Revenue (and everybody else) to examine each case individually, the occupation of the person is not what determines employment status. >

The term 'Courier' has no legal standing in insurability of employment determinations. The term 'courier' covers a vast array of workers engaged in a wide variety of work.

I'll come back to the 'Code of Practice' in a moment, but first, Revenue openly admit that Revenue >

I'll come back to the 'Code of Practice' in a moment, but first, Revenue openly admit that Revenue >

has 'Historically held the view' that all couriers are self-employed. Revenue don't get to 'hold a view' on the employment status of individuals working as couriers, historic or otherwise. As the Revenue Chairman told the PAC, Revenue act merely as collection agents for the

Dept SW., Revenue's 'opinion' has no bearing except to comprehensively prove that Revenue's 'Without Prejudice' labeling of couriers was not without prejudice. The true factual position is that Revenue are, and always have been, extremely prejudicial on the issue of employment >

status of couriers (and other workers).

The true factual position is that individuals working as couriers never stood a chance of fair treatment by Revenue. >

The true factual position is that individuals working as couriers never stood a chance of fair treatment by Revenue. >

Now I get to the eye-watering 'defiance' of the Oireachtas and the Judiciary by Revenue.

Revenue state -

"it is necessary to examine each case by reference to the Code of Practice for Determining Employment or Self Employment Status of individuals"

No it is not >

Revenue state -

"it is necessary to examine each case by reference to the Code of Practice for Determining Employment or Self Employment Status of individuals"

No it is not >

necessary to refer to the Code of Practice. As previously confirmed by Revenue to the PAC in this reply, it is case law and only case law which determines employment status.

So why are Revenue referring to a 'Code of Practice' to determine employment status?

Pull up a chair >

So why are Revenue referring to a 'Code of Practice' to determine employment status?

Pull up a chair >

'cause this is about to get devious beyond anything you could imagine.

The importance of the Code of Practice is not what it is, but instead, where it came from and why.

As recently as a few weeks ago, the current Minister for Social Welfare, Heather Humphreys, in a Dail >

The importance of the Code of Practice is not what it is, but instead, where it came from and why.

As recently as a few weeks ago, the current Minister for Social Welfare, Heather Humphreys, in a Dail >

reply to questions raised by @paulmurphy_TD, referred to the Code of Practice and also where it came from and why -

"This approach was a precursor to the subsequent development on a tripartite basis of the Code of Practice for Determining Employment or Self-Employment >

"This approach was a precursor to the subsequent development on a tripartite basis of the Code of Practice for Determining Employment or Self-Employment >

@paulmurphy_TD Status of Individuals under the Programme for Prosperity and Fairness, a code which was subsequently updated in 2007 under the Towards 2016 Social Partnership Agreement"

None the clearer? Thought not.

Ok, let's move onto what the Chief Appeals Officer of the Social Welfare >

None the clearer? Thought not.

Ok, let's move onto what the Chief Appeals Officer of the Social Welfare >

@paulmurphy_TD Appeals Office has to say about the Code of Practice, where it came from, and why, on the 5th of December 2019 at the Oireachtas Committee on Bogus Self-Employment -

"Our deciding officers are guided by their own statutory powers and the case law that has >

"Our deciding officers are guided by their own statutory powers and the case law that has >

@paulmurphy_TD evolved in the courts over many decades. An important guide for them is the code of practice

for determining employment or self-employment status of individuals, which was originally

developed in the early 2000s and has been amended since"

What both the Minister and the CAO

for determining employment or self-employment status of individuals, which was originally

developed in the early 2000s and has been amended since"

What both the Minister and the CAO

@paulmurphy_TD are getting at, is that at sometime in 2000, under the auspices of the PPF, a group met. This group concocted a 'Code of Practice'. The Code of Practice, somehow, was a 'development' on the use of the test case as described by the Secretary General to the PAC in 2000. >

@paulmurphy_TD The Chief Appeals Officer went on to describe just how influential the Code of Practice is on insurability of employment Appeals -

"In the case of appeals on the insurability of employment, consistency is achieved by applying the precedents emerging from >

"In the case of appeals on the insurability of employment, consistency is achieved by applying the precedents emerging from >

@paulmurphy_TD the case law of the courts and by reference to the code of practice for determining employment and self-employment status of individuals"

Now this raises questions, and I'm sure a few eyebrows. As we've seen all through this thread, it's case law which determines employment

Now this raises questions, and I'm sure a few eyebrows. As we've seen all through this thread, it's case law which determines employment

@paulmurphy_TD status. Once case law is applied to the reality of the situation, the decision is what the decision is. Consistency is only achieved through rigid application of case law.

Consistency of decision making is an internal SW matter and should have no impact on an individual's

Consistency of decision making is an internal SW matter and should have no impact on an individual's

@paulmurphy_TD right to have their case assessed on its own merits.

Consistency of outcome is a different matter altogether, to make decisions which differ from case law in order to achieve a particular consistent outcome, that is to deny an individual the right to have their case asses on >

Consistency of outcome is a different matter altogether, to make decisions which differ from case law in order to achieve a particular consistent outcome, that is to deny an individual the right to have their case asses on >

@paulmurphy_TD its own merits.

Bottom line, only case law applies. The code of practice is not case law.

Late in December 2019, just before the FG led govt pulled the plug, Minister Doherty added something else to the picture in another Dail reply to @paulmurphy_TD. She wrote -

Bottom line, only case law applies. The code of practice is not case law.

Late in December 2019, just before the FG led govt pulled the plug, Minister Doherty added something else to the picture in another Dail reply to @paulmurphy_TD. She wrote -

"The Chief Appeals Officer has advised me that the discussion in relation to the use of 'test cases' before the Joint Committee on Employment Affairs and Social Protection on 5th December 2019 related to a particular set of circumstances dating back to the early 1990s where a >

where a number of cases involving a number of employers in a particular sector were selected as so called 'Test Cases'"

Both former Minister Doherty and Minister Humphreys have used 'so called' when referring to test cases. There is no 'so called; about it, so why are they >

Both former Minister Doherty and Minister Humphreys have used 'so called' when referring to test cases. There is no 'so called; about it, so why are they >

trying to distance themselves from what clearly is the policy of the department, we'll get to it.

Minister Doherty went on to say -

"This approach was a precursor to the subsequent development on a tripartite basis of the Code of Practice for Determining Employment or

Minister Doherty went on to say -

"This approach was a precursor to the subsequent development on a tripartite basis of the Code of Practice for Determining Employment or

Self-Employment'.

To be very clear, Minister Doherty is saying that the use of test cases was a precursor to the Code of Practicce which was established on a 'Tripartite Basis'.

So what does the former Minister mean by 'Tripartite Basis'?

For that answer, we go back to

To be very clear, Minister Doherty is saying that the use of test cases was a precursor to the Code of Practicce which was established on a 'Tripartite Basis'.

So what does the former Minister mean by 'Tripartite Basis'?

For that answer, we go back to

the Chief Appeals Officer in the Oireachtas Committee in Dec. 2019 where she states -

"On test cases and what changed, I wish to be clear that I will speak on my understanding. >

"On test cases and what changed, I wish to be clear that I will speak on my understanding. >

I cannot speak for the Department. I have only gleaned these documents in the past two or three weeks. I do not know what happened in 1993 and 1994 on the test cases. It may have been done in consultation with trade union representatives but I cannot be certain >

about that as I was not there then. From the letter that the Secretary General wrote to the Committee on Public Accounts, it seems that the outcome of the later discussions some time between 1995 and 2000 was the establishment of the >

employment status group under the Programme for Prosperity and Fairness, PPF, and that the product of that was the code"

"I am open to correction, but from what I can see, the change was the establishment of the group in 2001, which itself drew up the code on a tripartite basis"

"I am open to correction, but from what I can see, the change was the establishment of the group in 2001, which itself drew up the code on a tripartite basis"

Now we know things we didn't know before. The Chief Appeals Officer and both Ministers are saying that test cases were used until 2001 and that the use of test cases stopped after the establishment of the Employment Status Group under the auspices of the PPF and it's 'Tripartite'

because unions were involved.

More tomorrow, ty for reading.

More tomorrow, ty for reading.

That begs the questions -

Were unions involved in discussions some time between 1995 and 2000 around the use of test cases?

Did unions discuss or were they part of a test case process to label all couriers as self employed?

>

Were unions involved in discussions some time between 1995 and 2000 around the use of test cases?

Did unions discuss or were they part of a test case process to label all couriers as self employed?

>

Were unions part of the employment status group?

An answer to this, comes from no less than former Finance Minister Noonan on the 23rd of June 2015 as follows -

"Guidance on that matter (bogus self employment) is provided in the code of >

An answer to this, comes from no less than former Finance Minister Noonan on the 23rd of June 2015 as follows -

"Guidance on that matter (bogus self employment) is provided in the code of >

practice for determining employment or self-employment status of Individuals which was prepared jointly by the Irish Congress of Trade Unions, business representative bodies and relevant State agencies".

So the answer is yes, ICTU was involved. As was IBEC, as was Revenue, as

So the answer is yes, ICTU was involved. As was IBEC, as was Revenue, as

was the department of social welfare and by extension, as was the social welfare appeals office.

I think it would be useful to get ICTU's first hand account of what the ESG (Employment Status Group) was all about.

I think it would be useful to get ICTU's first hand account of what the ESG (Employment Status Group) was all about.

To find out what the Employment Status Group really was and why it is so important to Revenue, Dept. SW and the Social Welfare Appeals Office, you have to go all the way back to the 9th of August 2000 and the letter from the Chairman of the Revenue Commissioners to the Chairman >

of the Public Accounts Committee which states -

"The issue of couriers was also raised at a recent inaugural meeting of an 'employment status' group set up under the auspices of the Programme for Prosperity & Fairness"

This timeline conflicts with the timeline provided by the >

"The issue of couriers was also raised at a recent inaugural meeting of an 'employment status' group set up under the auspices of the Programme for Prosperity & Fairness"

This timeline conflicts with the timeline provided by the >

Chief Appeals Officer who said the Employment Status Group was established in 2001, small point, but important enough to point it out.

Context is everything here. On the 25th of July 2000 the PAC Chairman wrote the Revenue Chairman asking why all couriers were labeled as

Context is everything here. On the 25th of July 2000 the PAC Chairman wrote the Revenue Chairman asking why all couriers were labeled as

self-employed. 15 days later, the Revenue Chairman states that there has been a first meeting of an ESG (employment status group) where the issue of couriers was raised.

The next line from the same reply from Revenue is -

"I understand Mr. McMahon has formally taken up the >

The next line from the same reply from Revenue is -

"I understand Mr. McMahon has formally taken up the >

question of his insurability status with the Dept. of Social, Community and Family Affairs"

And I had. I was a motorcycle courier working for Securicor. I knew nothing about the special tax agreement or why Securicor was labeling me as self-employed. On the 15th of July 2000,

And I had. I was a motorcycle courier working for Securicor. I knew nothing about the special tax agreement or why Securicor was labeling me as self-employed. On the 15th of July 2000,

I wrote to the Scope Section of the Department of Social Welfare and requested a formal insurability of employment decision. I gave detailed reasons why I believed I was an employee and not self-employed.

To this day, I am very very annoyed that a group of civil servants, >

To this day, I am very very annoyed that a group of civil servants, >

trade union representatives and business lobbyists met to discuss courier employment status after I had requested a formal insurability of employment decision and long before the decision issued.

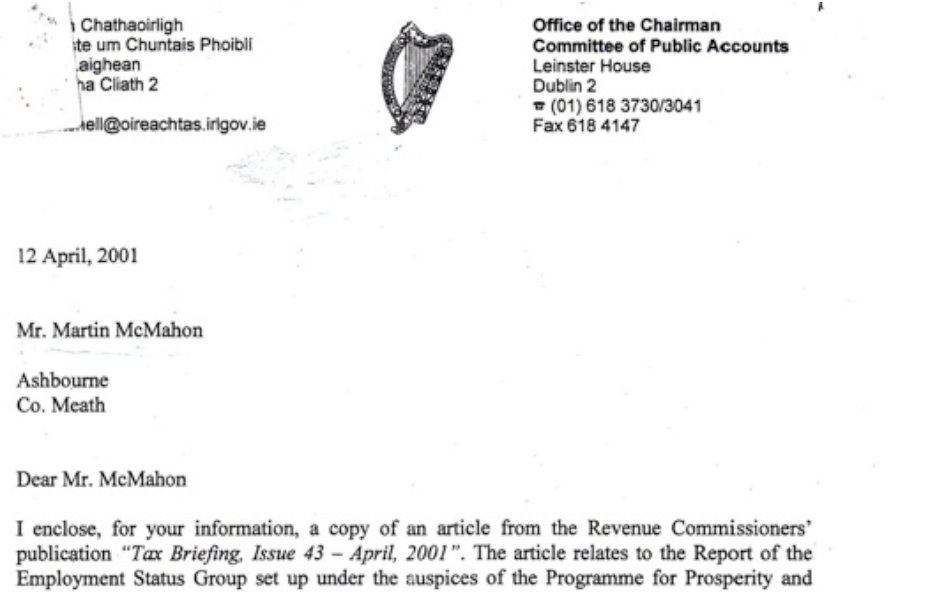

But it was this letter from the Secretary to the Chairperson of the Public

But it was this letter from the Secretary to the Chairperson of the Public

sent to me in April 2001 which finally shows exactly what the Employment Status Group was and why it was set up -

"I believe your case was one which gave rise to this group's formation and I know it was certainly discussed at some of the Group's meetings!"

"I believe your case was one which gave rise to this group's formation and I know it was certainly discussed at some of the Group's meetings!"

Quick recap - Revenue told the Public Accounts Committee that "In order to determine the status of a courier, it is necessary to examine each case by reference to the Code of Practice for Determining Employment or Self Employment Status of individuals"

Both former Minister

Both former Minister

Doherty and Minister Humphreys have stated on the Dail record that 'Code of Practice' came about directly because of the Department's use of a test case to determine the employment status of all couriers in 1995. A test case which is still used today by Revenue to label all

individuals working in a courier capacity as 'self-employed'.

The inference by both Ministers is that the use of unlawful test cases ceased because of meeting in 2000 between Business Lobbyists, State Departments and Union Representatives.

However, the true factual position

The inference by both Ministers is that the use of unlawful test cases ceased because of meeting in 2000 between Business Lobbyists, State Departments and Union Representatives.

However, the true factual position

as revealed in the above letter from the Public Accounts Committee, is that the Code of Practice came about as a result of a hastily convened meeting between sometime between the 15th of July 2000 and the 9th of August 2000 in direct response to my request for a formal

insurability of employment request.

My request for a formal insurability of employment request threatened the existing 'Test Case' used to label all couriers as self-employed and also the Special Tax Agreement between Revenue and Courier Company employers to label all couriers

My request for a formal insurability of employment request threatened the existing 'Test Case' used to label all couriers as self-employed and also the Special Tax Agreement between Revenue and Courier Company employers to label all couriers

as self-employed.

Just 2 years previously, the Denny case had confirmed long standing case law which specifically precluded Revenue, Dept. SW and the SWAO from making decisions on a group and class basis.

>

Just 2 years previously, the Denny case had confirmed long standing case law which specifically precluded Revenue, Dept. SW and the SWAO from making decisions on a group and class basis.

>

So what happened at the Employment Status Group, how did the Employment Status Group resolve the unlawful use of test cases by Revenue & SW. If the unlawful use of test cases was resolved by the ESG with a 'Code of Practice', why is Revenue still labeling couriers self-employed?

The shocking answers to these questions later tonight. TY for reading.

I made a data access request to the Communications Workers Union upon receipt of the letter from the PAC informing me that the Employment Status Group was set up because of my formal request for an insurability of employment decision and that my sub judice case was discussed by

the Employment Status Group. The CWU were part of the ICTU team at the Employment Status Group.

In reply to my access request, the CWU sent me a document which revealed exactly who was at the ESG and what exactly was discussed. This is a first-hand account from a Mr. Chris

In reply to my access request, the CWU sent me a document which revealed exactly who was at the ESG and what exactly was discussed. This is a first-hand account from a Mr. Chris

Hudson who was the Organising Officer with the CWU.

Participants at the Employment Status Group -

Revenue - Mr. Bob Dowdall, author and architect of the 'Special Tax Agreement with Courier Company Employers.

Social Welfare - Mr. Vincent Long. Mr. Long served as the Assistant

Participants at the Employment Status Group -

Revenue - Mr. Bob Dowdall, author and architect of the 'Special Tax Agreement with Courier Company Employers.

Social Welfare - Mr. Vincent Long. Mr. Long served as the Assistant

Chief Appeals Officer until 2009 when he returned to the Department of Social Welfare.

IBEC - The IBEC representative is not named.

ICTU - Ms. Patricia Donovan, Assistant General Secretary.

IBEC - The IBEC representative is not named.

ICTU - Ms. Patricia Donovan, Assistant General Secretary.

Was my specific sub-judice case discussed?

Yes it was, as follows -

"In this case Martin McMahon claimed to be an employee and not self-employed and took an appeal to the Scope Section of Social Welfare against his alleged employer, Securicor Omega. Martin's case was upheld

Yes it was, as follows -

"In this case Martin McMahon claimed to be an employee and not self-employed and took an appeal to the Scope Section of Social Welfare against his alleged employer, Securicor Omega. Martin's case was upheld

and now Securicor Omega are appealing this through the Social Welfare Appeals Board (Office)".

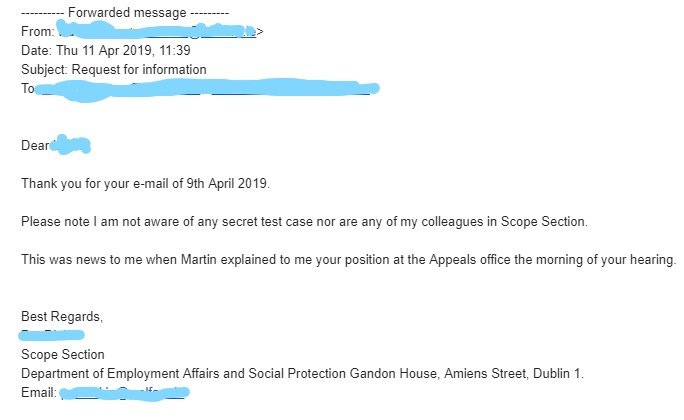

My case that I was an employee and not self-employed had indeed been upheld by the Scope Section. The Scope Section have always been of the position that test cases are unlawful and

My case that I was an employee and not self-employed had indeed been upheld by the Scope Section. The Scope Section have always been of the position that test cases are unlawful and

were completely unaware that the rest of the Dept of SW, Revenue and the Social Welfare Appeals Office were using 'test cases' to make unlawful group/class decisions until I informed the Scope Section about it at a separate Appeal in the Appeals Office in 2019 (Below).

The Scope Section was unaware that the 1995 overturning of one of their decisions has been used as an unlawful 'test case' by Revenue, the Social Welfare Appeals Office and the senior management of the Dept. Social Welfare, until I told them and showed them the 2000 letter >

from their own Secretary General. In fact, I don't think they actually believed me until I advised the worker I was representing in 2019 to walk out of an Appeal if the Appeals Officer refused to give us sight of all 'Test Cases' and precedents set by those cases in order for us

to know on what unlawful basis the workers Appeal would be judged.

The Appeals Officer in the Appeal confirmed the existence of Test Cases (not just case, cases) and refused to give us sight of them. We walked, we won, and the Scope Section finally believed me.

The Appeals Officer in the Appeal confirmed the existence of Test Cases (not just case, cases) and refused to give us sight of them. We walked, we won, and the Scope Section finally believed me.

So what was the magic formula of words used by the Employment Status Group to address the unlawful use of test cases as both @ReginaDo and @HHumphreysFG claim, what was the magic formula of word Michael Noonan claims dealt with Bogus Self Employment? What was the magic formula of

@ReginaDo @HHumphreysFG word which elevated the Code of Practice above case law as described by Revenue to the PAC with -

"In order to determine the status of a courier, it is necessary to examine each case by reference to the Code of Practice"?

What magic formula of word could possibly excuse

"In order to determine the status of a courier, it is necessary to examine each case by reference to the Code of Practice"?

What magic formula of word could possibly excuse

@ReginaDo @HHumphreysFG the formation of the ESG to discuss an ongoing and sub judice case which had left the 'Test Case' in tatters, not worth the paper it was written on?

The answer later tonight.

The answer later tonight.

@ReginaDo @HHumphreysFG So here it is, this is the decision of the Employment Status Group which has since become the basis for the Code of Practice which Revenue have told the PAC must be adhered to above case law -

"The View of IBEC, Finance & Revenue was that the 'Status Quo' should remain"

The >

"The View of IBEC, Finance & Revenue was that the 'Status Quo' should remain"

The >

@ReginaDo @HHumphreysFG 'Status Quo' is unlawful test cases used to determine the employment status of workers by group and class.

Just so there's no misunderstanding, the first hand account from the CWU who were present in the ESG goes on to say -

"The Status Quo is where a worker has a disagreement

Just so there's no misunderstanding, the first hand account from the CWU who were present in the ESG goes on to say -

"The Status Quo is where a worker has a disagreement

@ReginaDo @HHumphreysFG over his/her employment status they can take a case to the High Court"

This first hand account of the ESG proves an incredible piece of conspiracy. It doesn't matter what case a worker makes to the Scope Section, >

This first hand account of the ESG proves an incredible piece of conspiracy. It doesn't matter what case a worker makes to the Scope Section, >

@ReginaDo @HHumphreysFG the defined policy of the State is to overturn any Scope Section decision in the Social Welfare Appeals Office, regardless of evidence and case law, and to force the worker to go to the High Court to challenge their employment status.

At the same time, wealthy industrialists can

At the same time, wealthy industrialists can

@ReginaDo @HHumphreysFG classify workers as self-employed, en mass, in private hearings, in free secret courts like the Social Welfare Appeals Office or over lunch in the Burlington Hotel.

This is the 'Code of Practice' IBEC took back to its clients. This is the 'Code of Practice' Revenue enforce on

This is the 'Code of Practice' IBEC took back to its clients. This is the 'Code of Practice' Revenue enforce on

@ReginaDo @HHumphreysFG workers to this day. This is the 'Code of Practice', the SW representative at the ESG, Mr. Vincent Long took personally to the Social Welfare Appeals Office where he rewrote the original Scope Section decision in my case and instructed the Appeals Officer on how the Appeal was

@ReginaDo @HHumphreysFG to be handled (Copy of this document signed by V Long available to whomsoever wants it).

In Revenue's reply to the PAC, Revenue stated -

"In order to determine the status of a courier, it is necessary to examine each case by reference to the Code of Practice"

"THE STATUS QUO

In Revenue's reply to the PAC, Revenue stated -

"In order to determine the status of a courier, it is necessary to examine each case by reference to the Code of Practice"

"THE STATUS QUO

@ReginaDo @HHumphreysFG SHOULD REMAIN" is the first instruction of the 'Code of Practice' and forcing the worker to the High Court if their Scope Section decision threatens a pre-existing unlawful test case is the second.

@ReginaDo @HHumphreysFG The Employment Status Group did not stop the use of unlawful test cases, instead it overruled all existing case law, in particular the Denny case, and placed the instruction 'The Status Quo Should Remain' above all other considerations.

Case Law does not determine employment

Case Law does not determine employment

@ReginaDo @HHumphreysFG status in Ireland. Employment status is instead decided on the whims of Revenue and the SWAO.

Revenue directly OVERRULED the Higher Courts in the Employment Status Group. The rule of law no longer applies in regard to insurability of employment. At the Appeal of the Scope

Revenue directly OVERRULED the Higher Courts in the Employment Status Group. The rule of law no longer applies in regard to insurability of employment. At the Appeal of the Scope

@ReginaDo @HHumphreysFG Section decision in my case, Securicor argued that the Denny Case did not apply. Scope insisted that it did. The Social Welfare Appeals Office ruled in favour of Securicor.

The unlawful Status Quo was protected and remains as confirmed by Revenue who still classify all

The unlawful Status Quo was protected and remains as confirmed by Revenue who still classify all

@ReginaDo @HHumphreysFG couriers as self-employed based on the 1995 test case.

Securicor were kind enough to list all the Scope Section decisions that couriers were employees which had been overturned by the SWAO since 1993 (when the approach of test cases began) as follows -

>

Securicor were kind enough to list all the Scope Section decisions that couriers were employees which had been overturned by the SWAO since 1993 (when the approach of test cases began) as follows -

>

@ReginaDo @HHumphreysFG Thunder v Roadrunner Couriers (Claim Number SC 2443/1993)

Prizeman v Mayday Couriers

(Claim Number SC 0401/2000)

Then there was my Socpe decision overturned in 2001.

You'll notice that Securicor did not include the now infamous 1995 test case. For the reason why, you have to

Prizeman v Mayday Couriers

(Claim Number SC 0401/2000)

Then there was my Socpe decision overturned in 2001.

You'll notice that Securicor did not include the now infamous 1995 test case. For the reason why, you have to

go back to the Employment Appeals Tribunal in 2001 where the General Manager of Securicor was asked to explain the 1995 test case. His reply (matter of public record btw)

"The respondent company had in fact put forward one of its own drivers as a test case. While >

"The respondent company had in fact put forward one of its own drivers as a test case. While >

a deciding officer with Social Welfare had decided that this driver was an "employee" there had been no definitive outcome to

this test case as the driver in question had emigrated in the meantime. However a second test case using a driver from another courier company >

this test case as the driver in question had emigrated in the meantime. However a second test case using a driver from another courier company >

had settled the matter. In that case an Appeals Officer had found the person in question to be self-employed"

Twice in the period of 8 years, individuals working as couriers with Securicor, the company who lobbied Revenue to have all couriers classified as self-employed >

Twice in the period of 8 years, individuals working as couriers with Securicor, the company who lobbied Revenue to have all couriers classified as self-employed >

had been found by the Scope Section, to be employees. Every single 'condition' Revenue listed to the PAC to label couriers has already been rejected by Case Law which the Scope Section are duty bound to apply. There were no other 'Test Cases' for couriers. The true factual

position is that no courier was present in the SWAO in 1995. Only courier company owners and directors were present.

More tomorrow.

More tomorrow.

• • •

Missing some Tweet in this thread? You can try to

force a refresh