1/ For those who have not read @danheld article titled “Bitcoin’s Security is Fine” you would do yourself a great service by heading over to blog.picks.co/bitcoins-secur… and reading it now.

2/ This write up came from an exploration of my own ideas surrounding the issue of security and the speculative future surrounding it.

3/ By the end of this thread I will have provided three main scenarios that will define Bitcoin’s long term security and determine whether Bitcoin or Monero is a better store of value. These scenarios are ‘Gold-valued’, ‘Gold-like’ and ‘Status-Quo’.

4/ In reality we may find ourselves anywhere in between. And in fact, since this writing, Bitcoin has moved closer to Gold-valued, which is the most bullish scenario for Bitcoin’s security that I put forth.

5/ All the data and writing was done nearly two years ago in the middle of 2019. I never ended up publishing it because it felt like it abruptly ended and there was more to add, nevertheless, it has sat dormant for so long that I’m just going to post it as is.

6/ To rehash some of the key concerns we should first address what all the fuss around Bitcoin security is all about. The premise is simple: Approximately every four years Bitcoin goes through a very important event often called the Halving.

7/ This is when the block reward subsidy is immediately cut in half, and is often viewed as an era within the bitcoin supply and demand lifecycle.

8/ The original block reward was 50 Bitcoins approximately every 10 minutes and of course back then Bitcoin was essentially worthless so these 50 Bitcoins didn’t mean much.

9/ Now the reward is 12.5, and in less than a year we will witness the third halving event which will cut the reward down to 6.25 per block. [this has now already happened]

10/ The main concern comes from the fact that Proof of Work is secured by the rewards. We often notice that mining is not profitable for the vast majority of participants and finds equilibrium at near break even relative to the purchasing power of the average block rewards.

11/ This means that mining rewards are not rewards at all, they are simply an alternative way to purchase Bitcoins. Said another way, mining is much like a decentralized exchange where the trading pair is simply BTC/Energy.

12/ If the rewards are zero, you would be asking people to buy Bitcoins for more than the market price, and it is only altruistic actors that would care to do this.

13/ We already see this a bit with how retail miners had been pushed out of the market since they could not get the economies of scale, and thus mining today is no longer profitable for them.

14/ As mining rewards approach zero the system becomes much less secure, so insecure in fact that the likelihood of attack approaches 100%.

15/ Because of this, in the event that Bitcoin had no mining rewards whatsoever you should expect that the BTC/Energy decentralized exchange would simply shut down and the users would switch to a Proof of Stake consensus model.

16/ They would have to, because in the event that Bitcoin was attacked continuously the users would elect to fork. Forking would persist again and again such that the economic value of the most valuable chain would be no different than a representation of the holders’ stakes.

17/ Hopefully that lays the foundation of what we’re talking about here, but that was only a small component. The block reward consists of two parts: Subsidy and Fees.

18/ The case I laid out above would only become reality in the event that both the subsidy and the fees approached zero.

19/ Though neither is truly certain, we can safely assume that the subsidy on Bitcoin will approach zero as changing that would be one of the most dramatic ideological changes in Bitcoin.

20/ Therefore, we will assume that Bitcoin security will depend on cumulative fees in the future. How far in the future are we talking?

21/ Since the current Bitcoin mining reward will be ~1.8% in a year, we can further set a threshold date where the subsidy falls below a material value, which I will say is 0.1% for the purposes of discussion. This occurs in the halving event taking place in approximately 2040.

22/ This might be where a lot of people check out, as 20+ years is probably not on the minds of many holders. However, if markets become more efficient then these distant risks could be priced in today

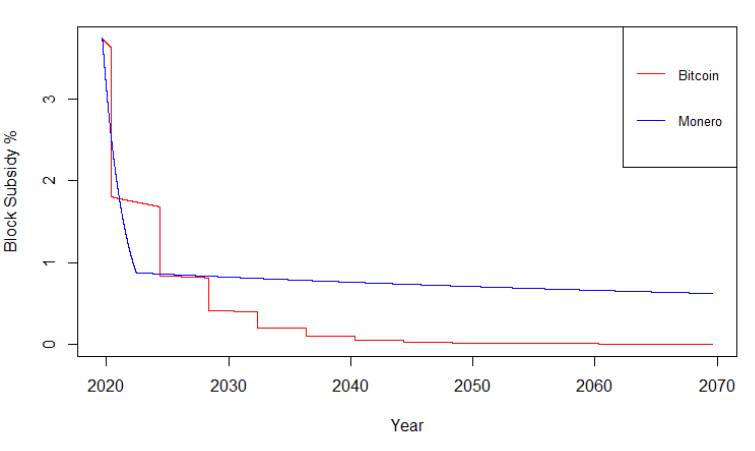

23/ For more clarity on Bitcoin subsidy you can see this plot which shows the time series for the subsidy.

24/ Now with that background in mind, let’s go through a few of the arguments put forth in @danheld's article. First with the key points in the TLDR:

“The larger the Bitcoin network grows, the more secure it becomes.”

“The larger the Bitcoin network grows, the more secure it becomes.”

25/ In isolation this may not be true. It needs more context. If we are isolating to a post-subsidy Bitcoin economy then I agree as long as block size is not increased. A low and stable block size would be important for creating a fee economy with more demand than supply.

26/ Increasing the blocksize as some Bitcoin forks have done would actually hasten the pace of the security risks I am laying out, because they essentially allow for an environment with no fee end-game, and thus both subsidy and fees trend toward zero.

27/ If the sum of fees collected is constant then Bitcoin’s price must double every 4 years to maintain constant security. But this itself is not great because twice as much wealth being protected at the same numeric security level.

28/ As the Bitcoin network grows, it becomes a larger attack target so it is not enough to keep the security constant as the value stored grows.

29/ If you were a new buyer looking to store $1 you would have preferred to store it in the prior subsidy era because your $1 would have received more proportional security.

30/ Said another way, if cumulative fees stay constant and the price only doubles every four years, the security fee as a percentage of assets will be cut in half every four years.

31/ Therefore for Bitcoin to become more secure the larger it gets it can only achieve this goal through higher cumulative fees collected.

32/ The investment decision is complicated by alternative cryptocurrencies existing where a new buyer making that decision to store wealth can choose networks that provide greater security relative to their risk.

33/ @danheld says "an organic security tradeoff will occur between the block subsidy and transaction fees. As network effect becomes larger, demand for block space increases, thus decreasing the need for a block subsidy. We have empirical evidence that this is occurring"

34/ Empirical evidence does not support this. We do have evidence that fees have increased from near zero, as we would expect from blocks being full, but we do not have any evidence that high fees can persist for long periods of time.

35/ If we look at the period of time when Bitcoin fees reached their peak on December 23, 2017, we could make a special note that this was after its cycle’s all-time-high.

36/ This is important because it reveals something about those high fees worth considering. Why was Bitcoin transacting in such high and urgent demand to warrant the $50 fees?

37/ It is because the risks of Bitcoin price changing unusually in the near term exceeded the known costs of the transaction fee. People were willing to pay $50 now to ensure that they wouldn’t suffer the downside risks of Bitcoin price changing.

38/ This is why we should expect to see high fees for Bitcoin during periods of irrational exuberance (both during rapid bubbles and collapses).

39/ Fortunately we can account for this in some way by looking at how fees have looked since the blocks became mostly full in 2017.

40/ Using bitinfocharts.com/comparison/bit… to approximate the date that Bitcoin blocks became full, I estimate the date at approximately March 3, 2017.

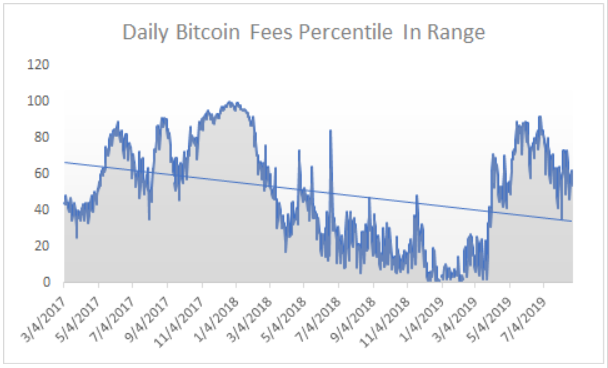

41/ Then using blockchain.com/charts/transac… and collecting the cumulative daily fees since that date we can get a better picture of the relevant trend.

42/ We also can plot the daily fees as a percentile of the fees within this date range. If fees are increasing, we would expect the trend of this plot to be that percentiles of daily collected fees is increasing.

43/ It is the volatility of price that is driving fees, which is intuitive because as prices change dramatically bystanders who previously had no impact on block space demand are suddenly clamoring to buy and sell Bitcoin.

44/ To further support this idea I plot the 60-day trailing volatility percentile against the daily fees percentile.

46/ Since Bitcoin fees are driven by volatility we can use some interesting techniques to model the fee structure. Other assets that are priced by their volatility are options.

47/ We can think of the desire to transfer on chain bitcoin as purchasing an option because it gives the user the right but not the obligation to sell.

48/ The time it takes to deposit the bitcoin is approximately the term of the option. The larger value of bitcoin you are interested in transferring the higher value the option becomes.

49/ The higher volatility in price between time 0 and time 1 would push the acceptable fee you are willing to pay for the option.

50/ If volatility was low (urgency to act declines) you would be more willing to wait many blocks to confirm and thus you would not be willing to pay much of a fee at all.

51/ The price of bitcoin itself is irrelevant beyond how large and high liquidity affects volatility. To determine what a fair long term average fee might be, we can use the Black Scholes option pricing model to price the option of transferring Bitcoin.

52/ As an individual your price would be your transfer size with an equal strike price, but for the network as a whole we use the median transaction size.

53/ This is because while a large holder may be willing to pay thousands of dollars for fees, it is still a competitive market and the vast majority of users would not be willing to pay that fee.

54/ Median participants will give us a better picture of the aggregate sum of fees collected at equilibrium.

55/ We can use the bitinfocharts median transfer size metric as an input into the Black Scholes model. At the time of writing the median transaction value was $174.35.

56/ The risk free interest rate used in the model has very little impact because our time horizon is only one confirmation, but we will use 2% as the proxy.

57/ The time to expiration is really the time it takes to transfer and earn the right to sell. For some exchanges it can be 3 confirmations or more. We can use a range of confirmation times, but the lower bound is certainly 1 confirmation, or ten minutes.

58/ Lastly we need the volatility of Bitcoin’s price. For the past year the daily volatility of Bitcoin has been 3.7%.

59/ The below plot shows the equilibrium median fee for bitcoin for confirmations between 1 and 60. The number of confirmations can also be interpreted in minutes by multiplying by ten.

60/ Based on this model, what would we expect fees to look like if Bitcoin replaced gold? That is to say, that bitcoin had the same market cap and volatility of gold?

61/ With the increased value but constrained space, we should assume that the median transfer size will increase equivalently.

62/ With approximately 6 billion troy ounces priced at $1,534.20, gold’s market cap is ~$9.2 Trillion. Bitcoin’s market cap is currently $184 billion, or approximately 1/50 the size of gold. If we take our median transfer size of $174.34 and multiply by 50, we get $8717.

63/ On the other hand, urgency to sell declines substantially with reduced volatility. Historically gold’s annual volatility has been 15.8%.

64/ Using these new inputs in our model, and assuming 70 minutes execution time, we find that median future Bitcoin fees would be approximately $6.33 if Bitcoin were to become similar to gold.

65/ If, on the other hand, we assume its volatility stays the same as today in the future, we would expect next block fees to find equilibrium at $28.75.

66/ In reality, it’s likely that Bitcoin’s volatility would be somewhere between the two so we can analyze Bitcoin’s security at both ends for completeness.

67/ Now the thesis: Bitcoin will cease to be the most secure cryptocurrency in the future. Any statement like this would always be speculation, but we can use the data and concepts laid out before to create a rational bound for the value and security for Bitcoin in the future.

68/ So what is missing? Tail emission.

69/ Currently Bitcoin and every other proof of work cryptocurrency makes use of a subsidy. In some cases like with Bitcoin the subsidy disappears in the hope that the fees will be material enough to pay for security.

70/ Others intend to retain a small subsidy, often called tail emission, indefinitely. There are obvious trade offs here. For one, without a tail emission the supply becomes truly capped whereas with a tail emission the supply continues to grow a sub-percent year after year.

71/ The additional scarcity may make Bitcoin more appealing to hold, but only if it maintains material security. We can think of a tail emission as a fee paid by holders and transaction fees paid for by traders.

72/ There are logical reasons to have a holder fee, the most obvious being that currency that hasn’t been transferred in many blocks becomes cumulatively secure from the ongoing proof of work.

73/ A freshly created cold storage balance with one confirmation is less secure than one with hundreds, and therefore some of this security benefit can be paid for by a holder fee, or tail emission.

74/ On the other hand, we could instead assume the transaction fee paid to move balances to cold storage were equivalent to the present value of all future blockchain storage costs.

75/ How much does it cost thousands of nodes to store 100kb indefinitely? If you were to buy a perpetuity that paid income matching that storage cost, how much would it cost today?

76/ This is not the right way to look at it because it is the users that define the transaction fees not the hosts. If we focus instead on what a fair holder security fee would be, how would we determine that?

77/ One rational way to price that is to determine how much someone would need to pay to buy insurance on the same balance. If you stored $1000 on a blockchain and it was attacked and destroyed because of weak proof of work, you’d be out $1000.

78/ You prefer the work to be material enough that this doesn’t happen, and so you pay the miners a subsidy, the holder fee, as a type of insurance. One comparison we can make is the cost of scheduled jewelry insurance, which normally costs $1 to $2 per $100 of jewelry.

79/ For example if you had $10000 worth of jewelry, you’d need to pay $100 to $200 for insurance on it. We can use this range of 1% to 2% to be reasonable for a tail emission because it acts as an insurance payment to keep the blockchain secure from value destroying attacks.

80/ Using this analogy, we would want the sum of subsidy + fees to be in the range of 1-2% of market capitalization at maturity.

81/ In the past year, Bitcoin has received a total of $4.4 billion in miner revenue, of which nearly 700,000 bitcoins were distributed at varying prices as a subsidy from the 12.5 bitcoin block reward subsidy.

82/ For the fee portion, Bitcoin has received approximately $250,000 per day in transaction fees, which is approximately $100 million per year.

83/ The market cap of Bitcoin is currently $182 billion, so the total miner revenue of $4.4 makes up 2.4% of the value of Bitcoin. This helps explain why Bitcoin is so healthy. The 2.4% value is pretty close to our ideal range for security insurance.

84/ But as we know, Bitcoin goes through a subsidy halving event every four years. How do we expect the security percent to evolve over time?

85/ For the first scenario we will create a simple glide path for Bitcoin value to approach gold over a 30 year period. We will see a total of eight halving events during this period, and Bitcoins price will increase 50 fold for an annualized return of 14% per year.

86/ The block subsidy will have declined from 12.5 bitcoins to 0.048 Bitcoins. Using the high end of volatility and increasing median transfer size in the Black Scholes model, average fees will have increased to $28.75.

87/ Cumulative daily fees collected will increase from $250K to $9.5M. Total annual transaction fees would be $3.46B and block subsidies of 0.048 Bitcoins over 52,560 blocks will provide a block subsidy of 2,566 Bitcoins, at a value of $500K each, worth $1.28B.

88/ Total block rewards come to $4.74B. This value is virtually identical to today’s security in absolute terms, but in this case Bitcoin is worth 50 times more so the security as a percent of value stored drops to 0.052%.

89/ The case is more grim if you assume Bitcoin’s volatility declines. In the case of gold-like volatility the expected security drops to just 0.011%. And these are the bullish scenarios.

90/ If we assume the status quo where Bitcoin holds value at $10K with current volatility, fees remain unchanged near $0.56 and so security drops to shockingly low 0.001%.

91/ This increasing risk can be resolved by forking to add a small tail emission to bitcoin, and has been discussed by some in the community and is highly contentious, where almost certainly any fork of Bitcoin that introduced a tail emission would become a low value altcoin.

95/ Fortunately, we don’t need to speculate on the ability of Bitcoin to implement tail emission because there is already a high value cryptocurrency with tail emission as part of its economics.

96/ It is most likely that users demanding tail emission would switch to Monero before a Bitcoin fork of similar quality existed.

97/ Monero is a Proof of Work cryptocurrency designed for dynamic block sizes, mandatory privacy for improved fungibility, ASIC resistance, and a planned tail emission of ~0.8% per year.

98/ The important aspect here are the use of dynamic block sizes, which is certain to restrict transaction fees from increasing except in the event of spam attacks, and the tail emission, which will provide consistent security to value for the duration of its life.

99/ Currently, Monero is approximately 1/125 the value of Bitcoin and it has not yet reached tail emission so the existing subsidy is similar to Bitcoin’s at around 3.5% (as of 2019)

100/ Monero does not have any halving events as the block reward declines with every block until reaching the tail emission in 2023.

101/ Its market cap relative to Bitcoin reached a peak near 3% in 2018, but for the past few years has floated around 1.5%. The relative value of these networks is very important for comparing the change in relative security between Bitcoin and Monero over time.

102/ A comparison of Bitcoins supply schedule verus Moneros can be found on a bitcointalk thread found here: bitcointalk.org/index.php?topi…. This gives a good visualization of how the different designs in inflation impact the supply curve.

103/ It is the year 10 notch in the Inflation over Time chart that users will begin to feel the impacts of these design decisions. This occurs in 2023, though will be felt more explicitly during the following Bitcoin halving in 2024.

104/ Since we know the tail emission for Monero will be ~0.8%, we can approximate where the market value ratios need to be for security equilibrium using our three cases for Bitcoin: Gold-Valued, Gold-Like, and Status-Quo.

105/ The results of security to value for Bitcoin were 0.052%, 0.011% and 0.001%, respectively. The breakeven for security is found by dividing these values by Monero’s tail emission value of 0.8%, and we find XMR/BTC ratio breakevens at 6.5%, 1.4%, and 0.125%, respectively.

106/ Monero is currently at 0.7%. Bitcoin is expected to maintain security dominance in the event that it becomes Gold-like or Gold-Valued, and Monero maintains status quo in its ratio, but Monero will become security dominant to Bitcoin under the status quo for both coins.

107/107 The end.

• • •

Missing some Tweet in this thread? You can try to

force a refresh