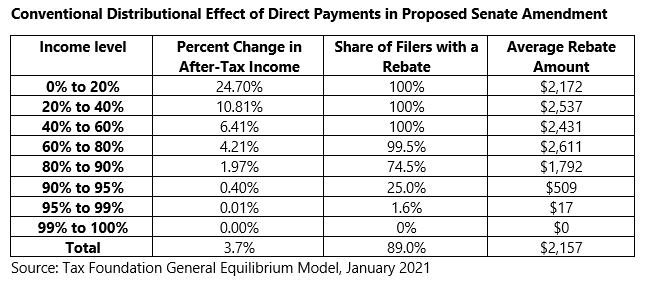

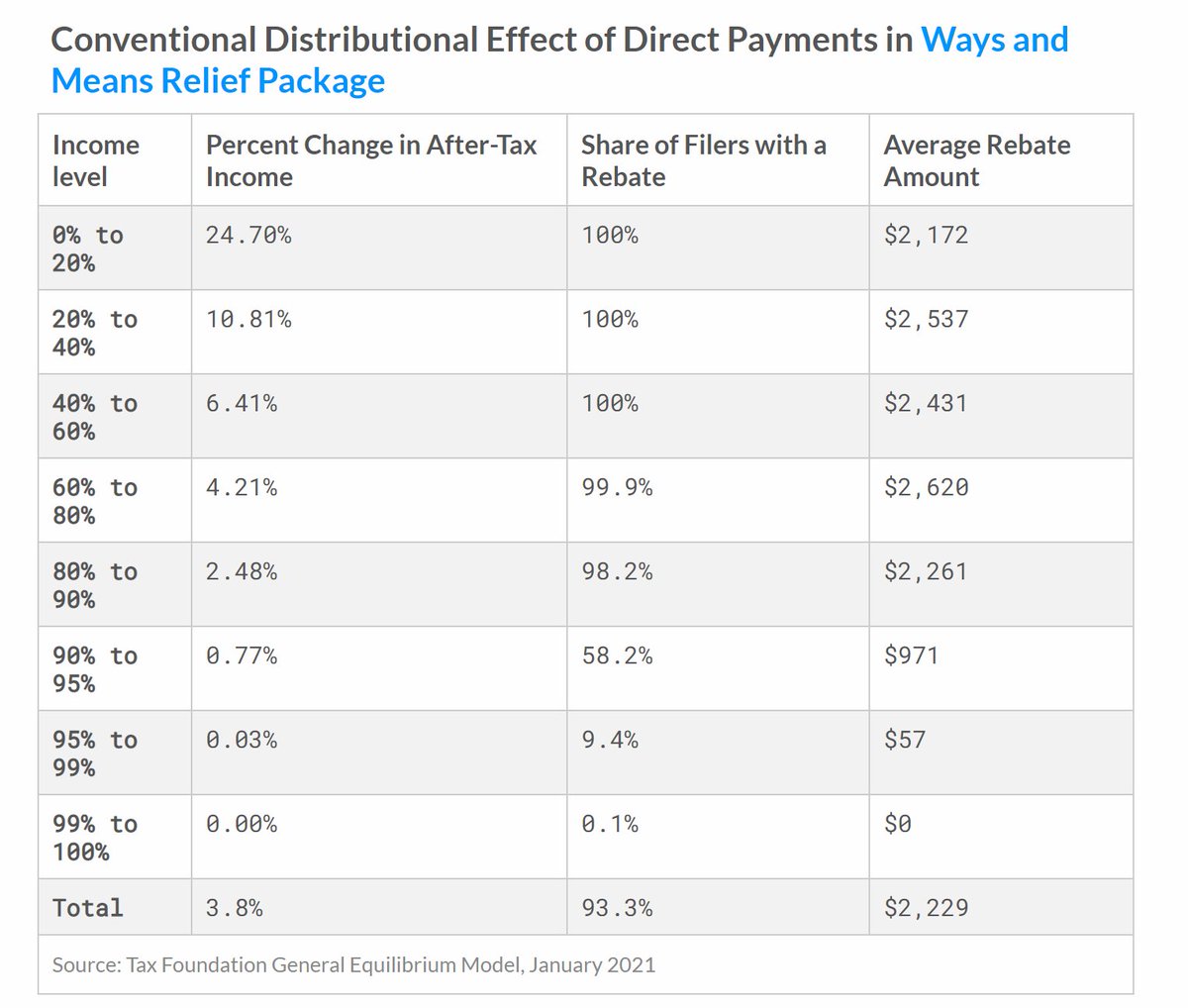

New @TaxFoundation estimates on the distribution of the modified stimulus design proposed in the Senate with lower income thresholds.

The change would reduce the cost by $15 to $20 billion and at least 6.5 million fewer filers would receive a partial payment.

The change would reduce the cost by $15 to $20 billion and at least 6.5 million fewer filers would receive a partial payment.

The @TaxFoundation estimate for the House proposal projects ~93 percent of filers receiving payment, compared to about 89 percent of filers under the Senate proposal. taxfoundation.org/ways-and-means…

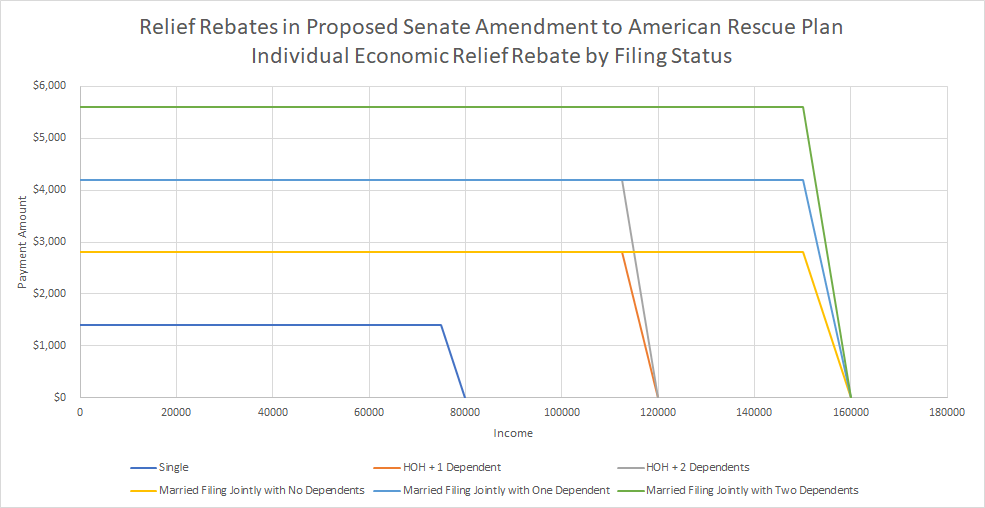

The proposal would reduce the maximum income for receiving any payment from $150K to $80K for single filers, $200K to $160K for joint filers, and $150,000 to $120,000 for Head of Household filers.

As others have pointed out, these phase-outs create large implicit marginal tax rates, ranging from 28 percent for single filer to 56 percent for a HOH filer w/ 2 dependents.

Add in payroll tax, income tax, and phased-out tax credits, and the marginal rate could reach 100%.

Add in payroll tax, income tax, and phased-out tax credits, and the marginal rate could reach 100%.

• • •

Missing some Tweet in this thread? You can try to

force a refresh