Cuba semak portfolio Wahed Invest anda, berlaku penurunan macam dekat bawah ni tak?

Jom saya terangkan apa yang berlaku.

Jom saya terangkan apa yang berlaku.

Bila anda log in, cuba scroll homepage Wahed Invest dan pergi ke bahagian positions, lepas tu tekan di bahagian tersebut dan tengok setiap kategori.

Untuk kategori very aggressive macam saya :

US Stocks

Malaysian Stocks

Sukuk

Cash

Kalau kategori lain mungkin akan ada Gold.

Untuk kategori very aggressive macam saya :

US Stocks

Malaysian Stocks

Sukuk

Cash

Kalau kategori lain mungkin akan ada Gold.

Duit kita dilaburkan di :

1. Wahed FTSE USA SHARIAH Exchange Traded Fund (HLAL)

2. MyETS MSCI Malaysia Islamic Dividend

3. RHB Islamic Bond Fund

4. Tradeplus shariah Gold Tracker(tiada dalam gambar)

1. Wahed FTSE USA SHARIAH Exchange Traded Fund (HLAL)

2. MyETS MSCI Malaysia Islamic Dividend

3. RHB Islamic Bond Fund

4. Tradeplus shariah Gold Tracker(tiada dalam gambar)

1. Wahed FTSE USA SHARIAH Exchange Traded Fund (HLAL)

Duit kita sebenarnya dilaburkan di saham-saham US patuh syariah contohnya seperti Apple, Tesla, Johnson & Johnson, Pfizer, Home Depot, Intel, Merck.

Duit kita sebenarnya dilaburkan di saham-saham US patuh syariah contohnya seperti Apple, Tesla, Johnson & Johnson, Pfizer, Home Depot, Intel, Merck.

Apa yang berlaku minggu ni?

Stock market correction di mana kebanyakan saham yang dilaburkan Wahed mengalami penurunan. Kita boleh tengok harga saham tersebut secara individu ataupun kita boleh track HLAL ETF.

Stock market correction di mana kebanyakan saham yang dilaburkan Wahed mengalami penurunan. Kita boleh tengok harga saham tersebut secara individu ataupun kita boleh track HLAL ETF.

Bila kita tengok saham individu pula, Tesla turun sekitar -33% from highest peak. Saham Apple pula turun sekitar -16% from highest peak.

Jadinya, disebabkan Wahed mempunyai pegangan dalam saham tersebut, HLAL ETF pun turun follow pergerakan tetapi perasan tak HLAL ETF turun sedikit saja? Itulah sebenarnya function ETF, diversified dan kejatuhan lebih bersifat kurang aggressive berbanding saham individu.

2. MyETF MSCI Malaysia Islamic Dividend

This one mengalami penurunan sekitar -13% from highest peak in January.

This one mengalami penurunan sekitar -13% from highest peak in January.

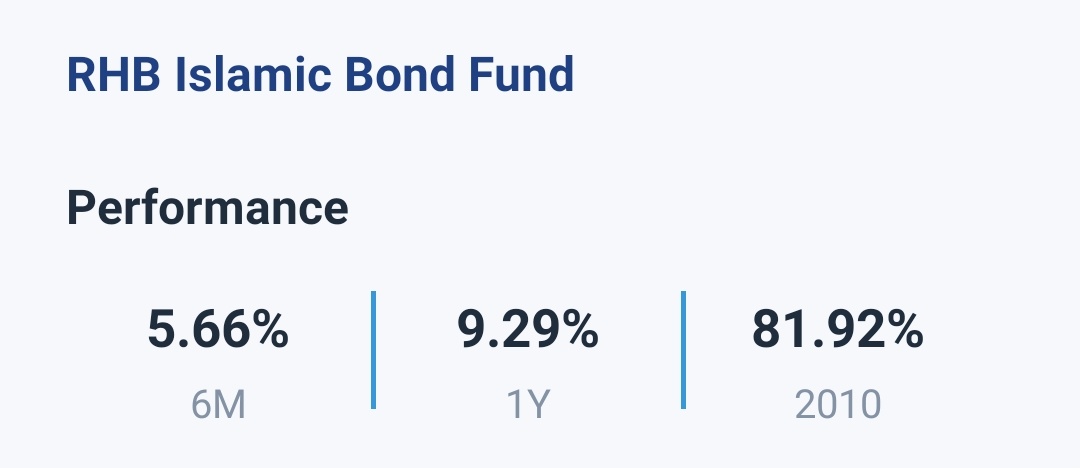

3. RHB Islamic Bond Fund

Fund ini bersikap lebih protective dan selalunya akan bergerak berlawanan dengan stock market. Apa yang kita boleh lihat, this fund setakat 26 February mengalami penurunan sekitar -1% year to date.

Fund ini bersikap lebih protective dan selalunya akan bergerak berlawanan dengan stock market. Apa yang kita boleh lihat, this fund setakat 26 February mengalami penurunan sekitar -1% year to date.

Jadinya, as a pelabur jangka masa panjang. Apa yang anda perlu buat?

Fokus long term! Bila you invest long enough, your risk of losing money is almost 0%

Fokus long term! Bila you invest long enough, your risk of losing money is almost 0%

Jadinya, as a long term Investor. You better stay invested because we don't even know when will the market rebound.

Salah satu strategi adalah Dollar Cost Averaging 👇

Salah satu strategi adalah Dollar Cost Averaging 👇

Sebab apa? Sebab index fund in a very long run, it will move upward and look very smooth.

Just ignore the daily or monthly fluctuations.

Just ignore the daily or monthly fluctuations.

My approach? I will stay invested dan saya jadikan Wahed Invest as my retirement fund 🙌

Saya gunakan strategi Dollar Cost Averaging (DCA) disebabkan limited fund nak masukkan lump sum but yes, Wahed Invest penuhi kriteria yang diterangkan oleh atuk Warren Buffett.

• • •

Missing some Tweet in this thread? You can try to

force a refresh