1/ It's hard not being optimistic when looking at what's been happening in crypto in the last few months. Narratives are important but data always tells the story much better. I spent a long time to put together this thread to illustrate the growth so please spread it!

2/ First let’s look at market structure.

Spot volume reached another all-time high of more than $1T last month. More than 3 times higher than 2017 top. When it comes to exchanges supporting fiat, Coinbase comfortably leads, followed by Kraken, Upbit, LMAX Digital and Bitfinex.

Spot volume reached another all-time high of more than $1T last month. More than 3 times higher than 2017 top. When it comes to exchanges supporting fiat, Coinbase comfortably leads, followed by Kraken, Upbit, LMAX Digital and Bitfinex.

3/ Web traffic of crypto exchanges reached 432M in February, which is still 20% lower than in January 2018. This only goes to show that a lot of this rally is being driven by institutional capital and there isn’t that much retail yet. 56% of traffic is from Binance and Coinbase

4/ Google search volume for Bitcoin is still lower than it was in 2017 top but for Ethereum, the searches are actually already higher than during the previous mania.

5/ The fact that there is less retail participants is also apparent from new Twitter followers of crypto exchanges. The current numbers still haven’t reached what we saw in 2017.

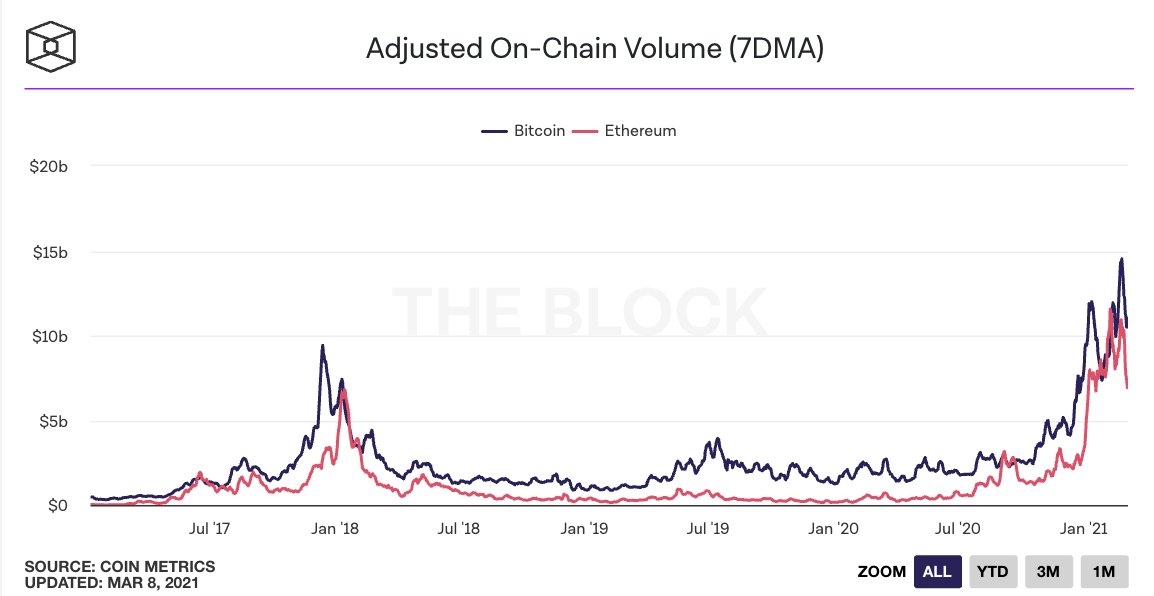

6/ On any given day, Bitcoin’s volume is still about three times higher than Ethereum’s. And at least three times as liquid, which helps

7/ Decentralized exchanges had $73 billion of volume in February, which is about 7% of total spot volume. Uniswap leading here with almost 50% of the total volume.

8/ Futures now have around $15 billion of open interest for Bitcoin, which is more than four times higher than just a year ago. Binance leads the way, followed by OKEx, Bybit and CME. BitMEX now far away

9/ Similarly to spot volume, futures volume also much higher than before in the last two months. Now hovering around $2 trillion a month - about twice higher than spot volume.

10/ People like sharing this chart and some think hedge funds are short Bitcoin. In reality, it’s just hedge funds playing the basis trade, i.e. hold long spot BTC, short CME contracts and collect yield. This is now less profitable than last month so short exposure decreasing

11/ Options have seen massive growth in the last year as well - to the point that now the large expiries actually play a role in price discovery. Deribit still destroying everyone else when it comes to market share. Open interest not even twice smaller than futures.

12/ Grayscale is currently in a cash cow mode - generating $70M a month from just from the fees and because there is no redemption mechanism, that’s unlikely to change. Grayscale now has 655.5k BTC and 3.17M ETH.

13/ Because of no redemption mechanism, the premium of GBTC has started to tank in the recent weeks and is now negative. This is because funds have been arbing the premium with 100s of millions and because there are now alternative ways to get exposure.

14/ Now let’s look at what’s goin on on-chain.

There is 1.1 million daily active addresses on Bitcoin and about 500k on Ethereum.

There is 1.1 million daily active addresses on Bitcoin and about 500k on Ethereum.

16/ Bitcoin and Ethereum mining is a massive industry. In the past few weeks, both Bitcoin and Ethereum miners have been generating more than $50 million a day in revenue.

17/ There is now more than $50 billion of stablecoins. While stablecoins are still mostly used by traders, they still settled $380 billion last month, which is more than a third of last year combined.

18/ There is now $45B locked in DeFi. While TVL is not a perfect metric by any means, it still allows us to compare across different DeFi categories to see which ones are achieving product market fit. Unsurprisingly DEXs ($20B) and Lending ($17.5B) protocols are leading.

19/ DeFi protocols are now generating $210M a month in revenue. Most of this revenue is not getting distributed to token holders - only about 15%. Uniswap is leading the way for supply-side revenue, SushiSwap, Maker and Compound for protocol revenue.

20/ NFTs have absolutely exploded this year. The weekly volume of NFT projects reached $200M two weeks ago - largely dominated by NBA Top Shot and CryptoPunks.

21/ When it comes to number of users, NBA Top Shot is dominating due to not being restricted by Ethereum’s scalability. It had 350,000 users last week while the trailing Axie Infinity had 8,200 and CryptoPunks 1,200.

22/ If you made it this far, I totally lied in the first tweet. This thread took me 20 minutes to put together because I used The Block's free data dashboard. Try it, bookmark it and start using it every day to get a data edge over others.

theblockcrypto.com/data/

theblockcrypto.com/data/

• • •

Missing some Tweet in this thread? You can try to

force a refresh