Testing out @KineProtocol :D

-> Professional Grade Decentralized Derivatives Markets

medium.com/@KineProtocol/…

-> Professional Grade Decentralized Derivatives Markets

medium.com/@KineProtocol/…

Got some free kovan ETH from random CT peeps (thanks!), if anyone wants any drop a reply below 👇

Once at kovan.kine.finance, I clicked on Test Token to get some USDC, Wrapped BTC and USDT

Once at kovan.kine.finance, I clicked on Test Token to get some USDC, Wrapped BTC and USDT

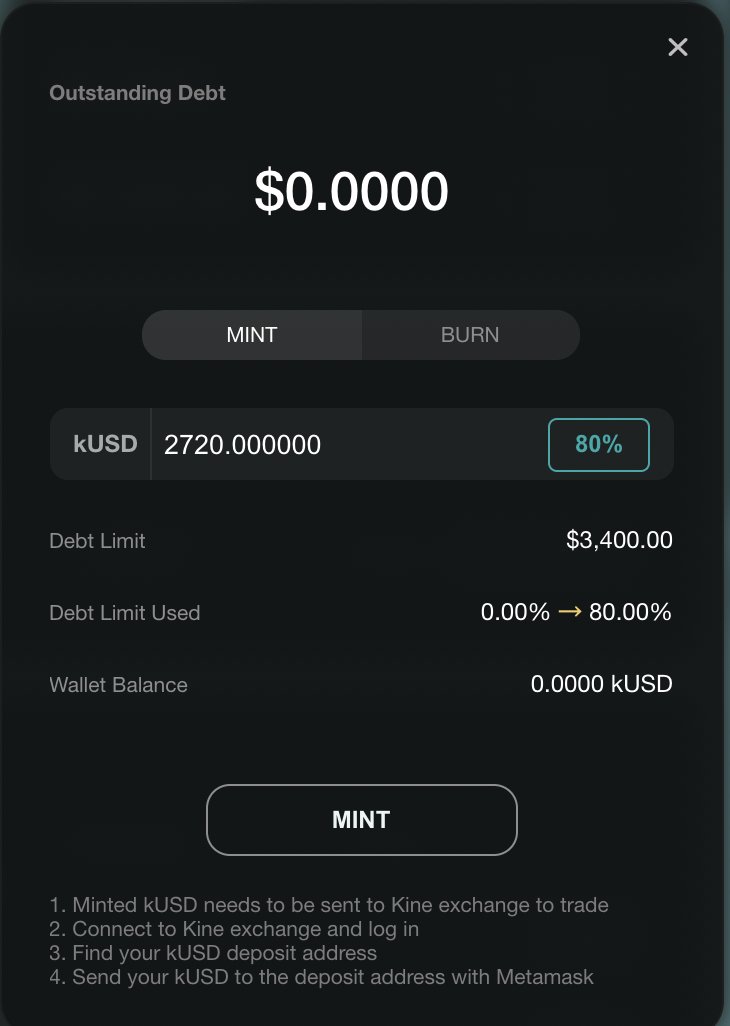

I enabled USDC to use as collateral and then I staked the maximum, staking $4000 gives me a $3400 debt limit

With that debt limit, I minted some kUSD to use on the KINE Exchange kovan.kine.exchange/exchange, which shows a short tutorial of where everything is once you go there.

Remember to add the kUSD to Metamask, there's an option on the front page

Remember to add the kUSD to Metamask, there's an option on the front page

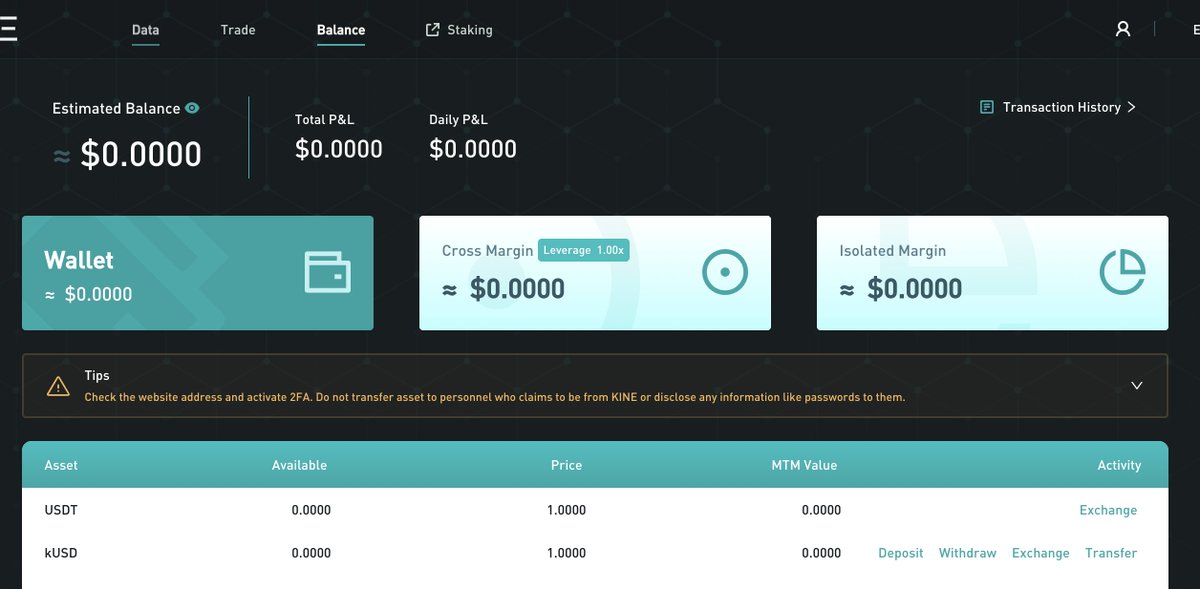

Similar to a CEX, you need to deposit kUSD into the exchange to use, so go to kovan.kine.exchange/account/finance and click on Deposit at kUSD.

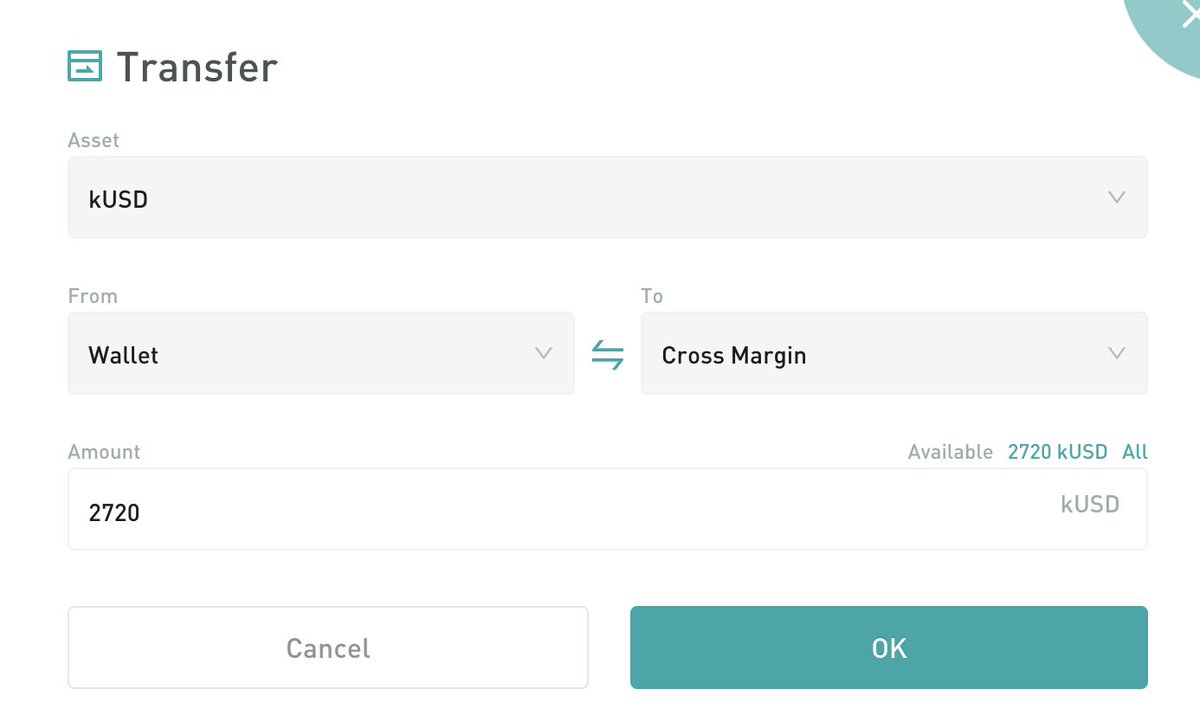

Once that's done, I transferred it to my Cross Margin Account

Once that's done, I transferred it to my Cross Margin Account

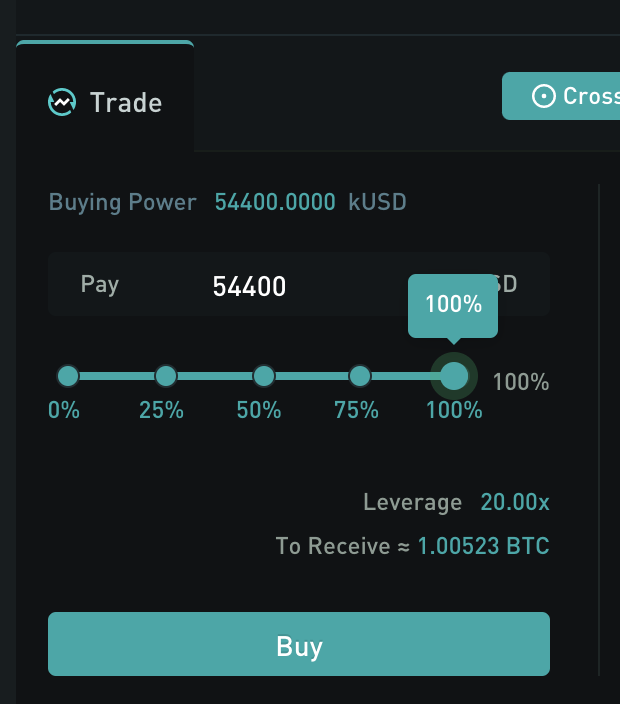

Back at kovan.kine.exchange/exchange!

Looks like the max is 20x Leverage ~ 54.4k buying power, so I'm just gonna do that since it's a testnet

Looks like the max is 20x Leverage ~ 54.4k buying power, so I'm just gonna do that since it's a testnet

My position then shows up at the top and I can choose to close it whenever I want to, let's see how this does 👀

Here's a few resources

Kine Introduction

medium.com/@KineProtocol/…

Testnet Launch post

medium.com/@KineProtocol/…

Kine LBP

medium.com/@KineProtocol/…

If anyone wants some kovan ETH, drop a reply 👇 Big thanks to all those that sent it to me previously :)

Kine Introduction

medium.com/@KineProtocol/…

Testnet Launch post

medium.com/@KineProtocol/…

Kine LBP

medium.com/@KineProtocol/…

If anyone wants some kovan ETH, drop a reply 👇 Big thanks to all those that sent it to me previously :)

Will try to do more frequent testing of different projects, lemme know if you have any suggestions👀

PSA Retro Airdrop 👀

https://twitter.com/KineProtocol/status/1369952390099570689

• • •

Missing some Tweet in this thread? You can try to

force a refresh