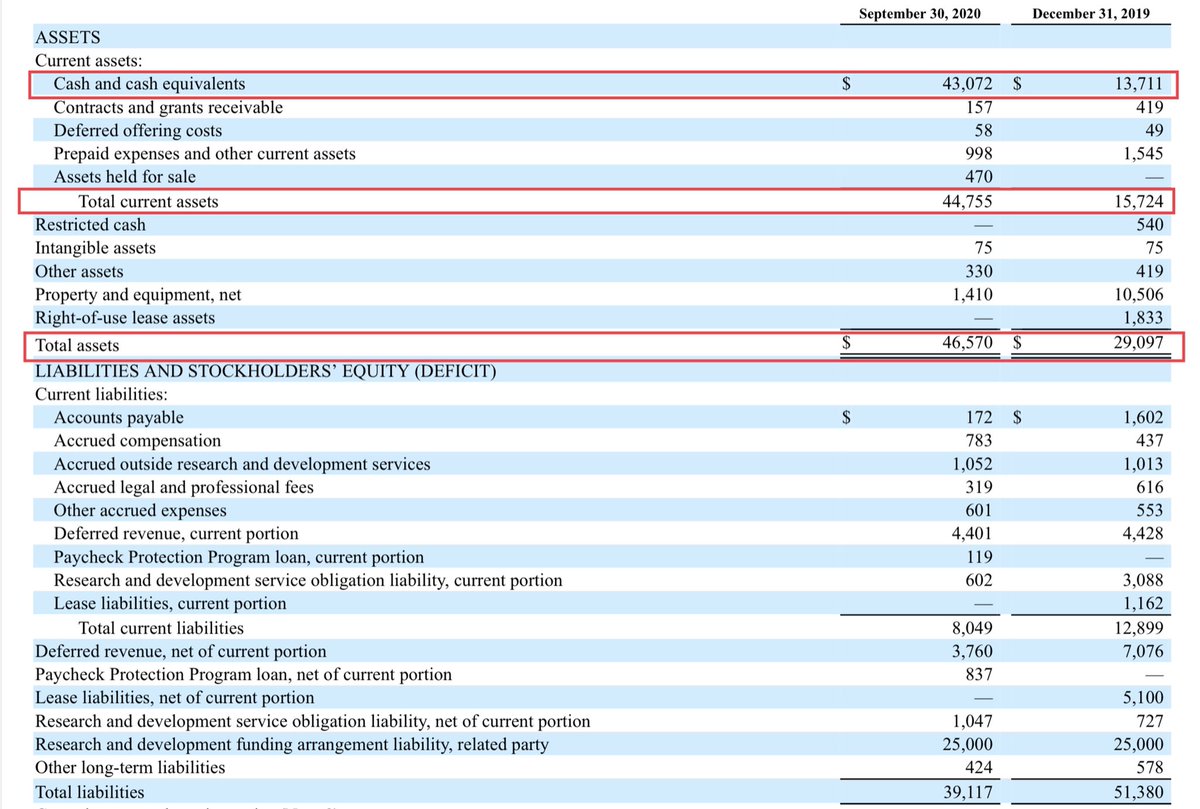

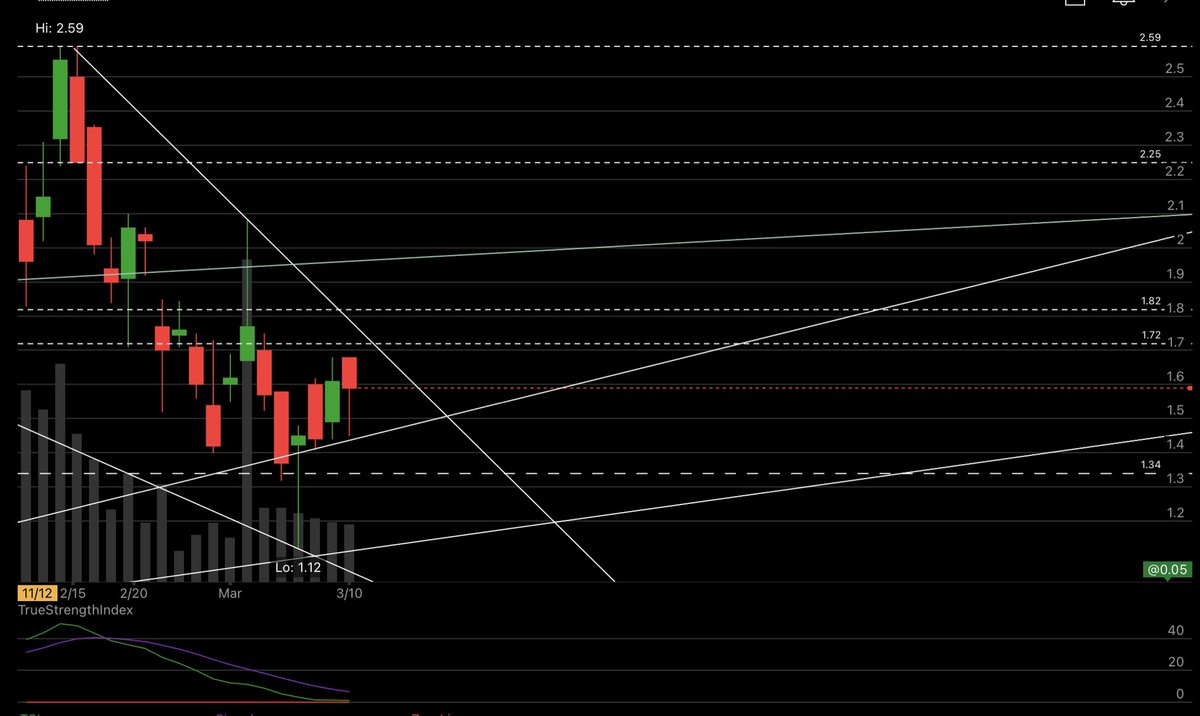

$NOVN TA, part 1

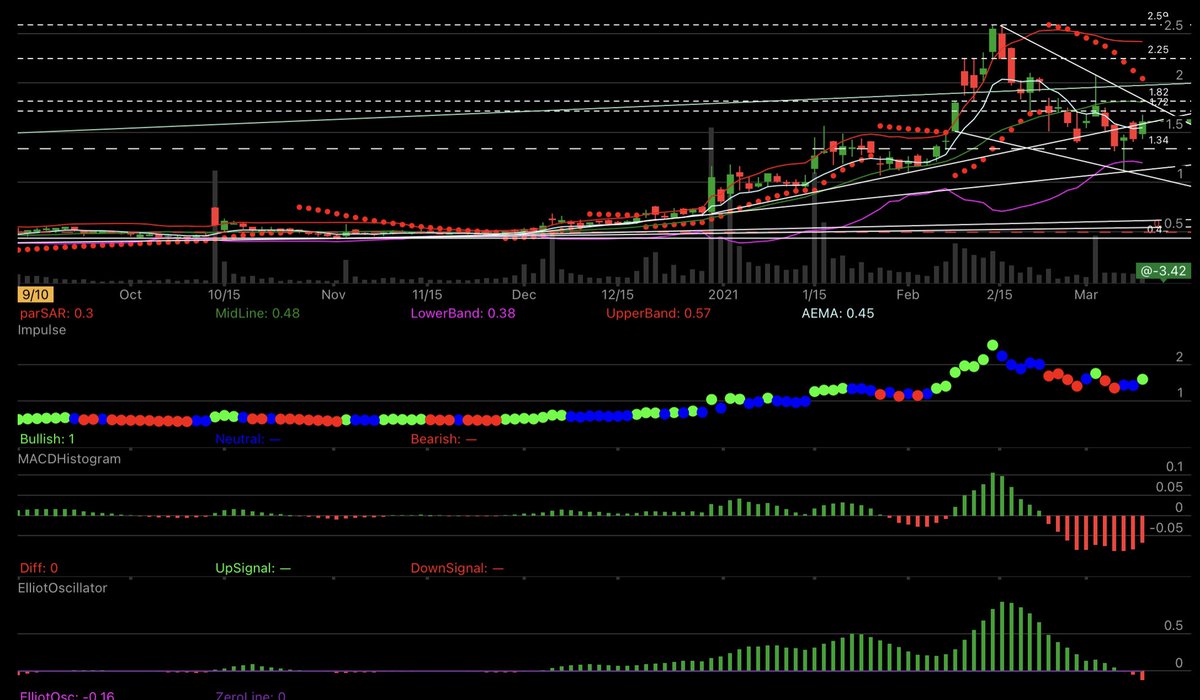

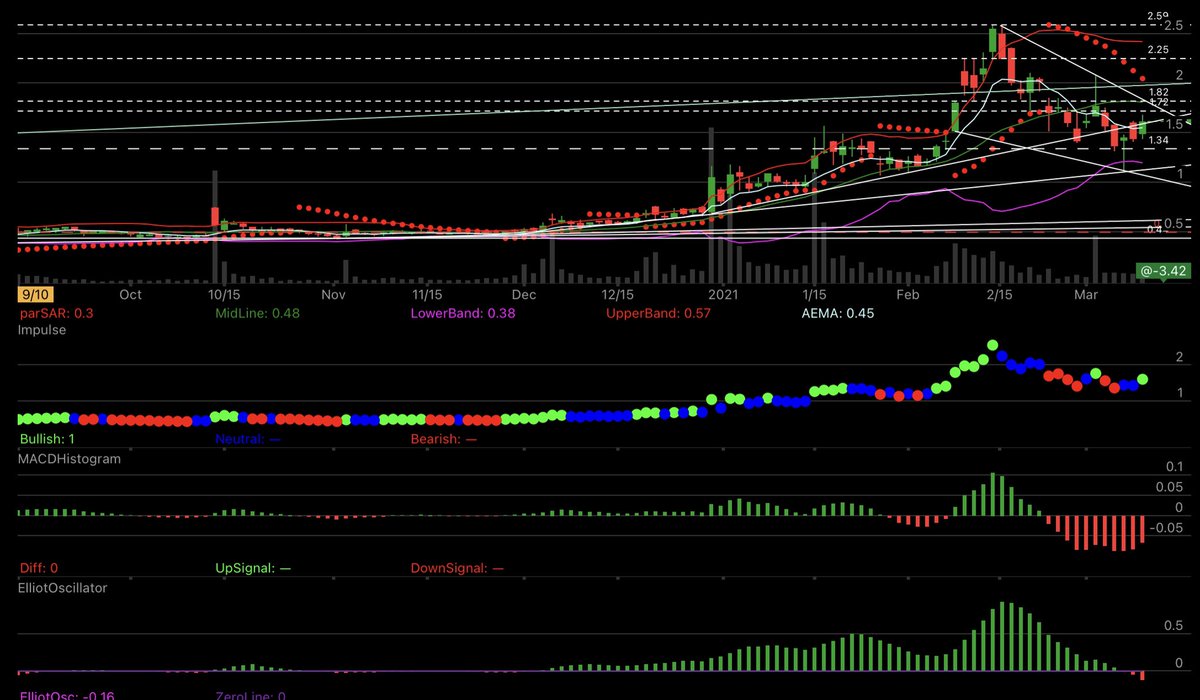

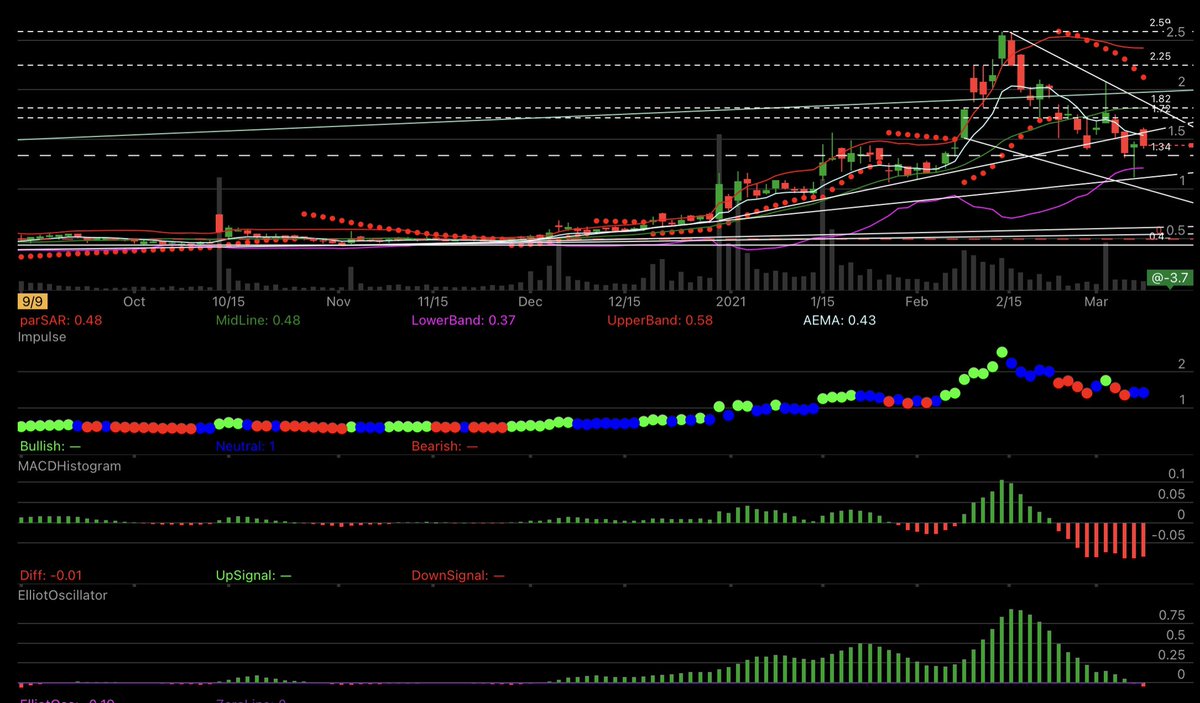

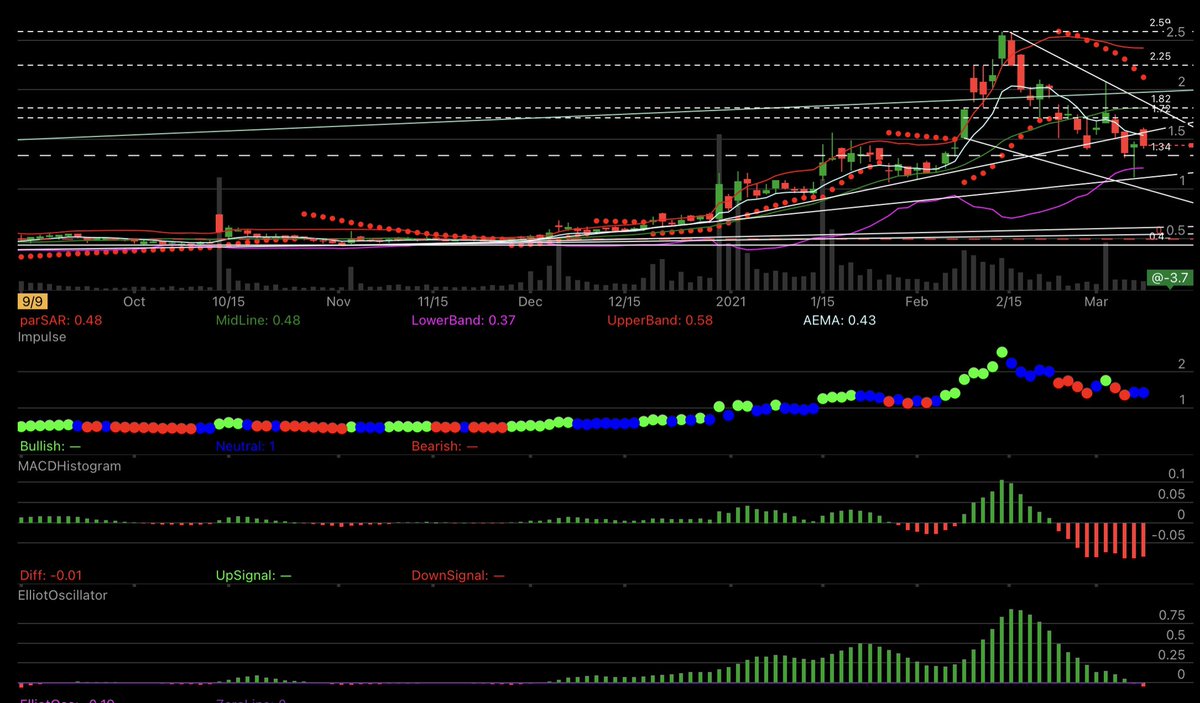

- Closed below parSAR but above MT, 13, 50, 100 and 200 AEMA at 1.59 on a bullish candle. Controlled price movement in a given acc. channel (increased support level (1.48)). Accumulation takes place in waves with targeted manipulation of the price...

- Closed below parSAR but above MT, 13, 50, 100 and 200 AEMA at 1.59 on a bullish candle. Controlled price movement in a given acc. channel (increased support level (1.48)). Accumulation takes place in waves with targeted manipulation of the price...

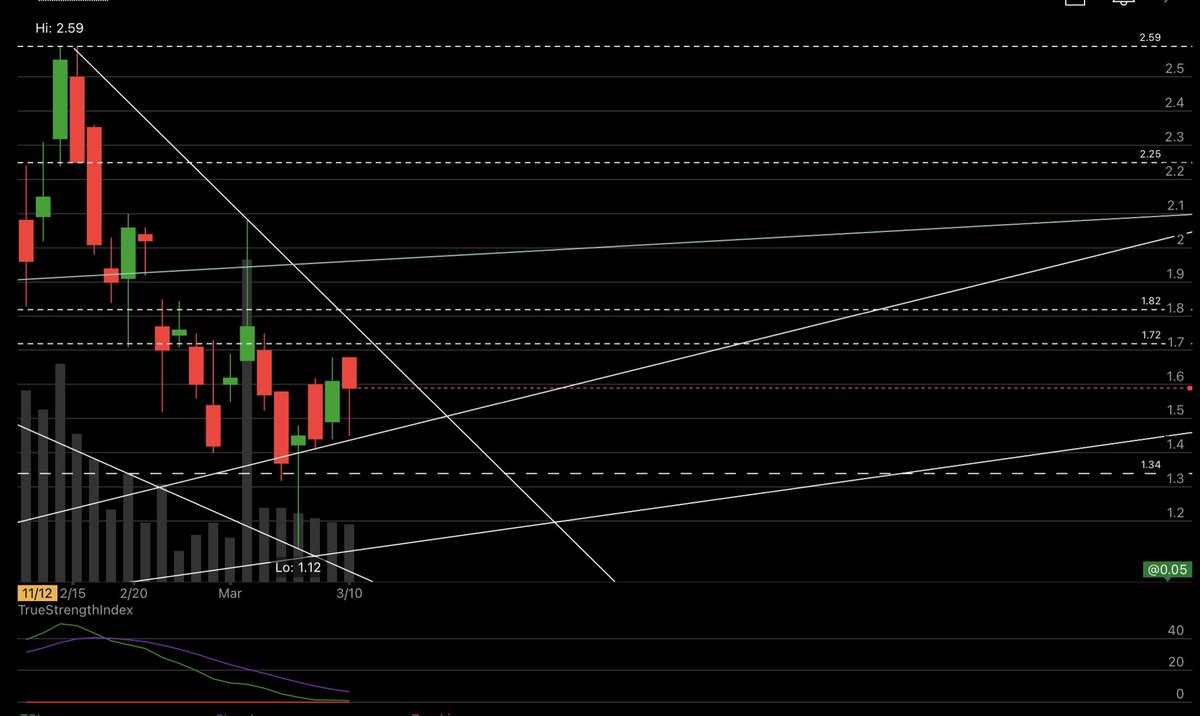

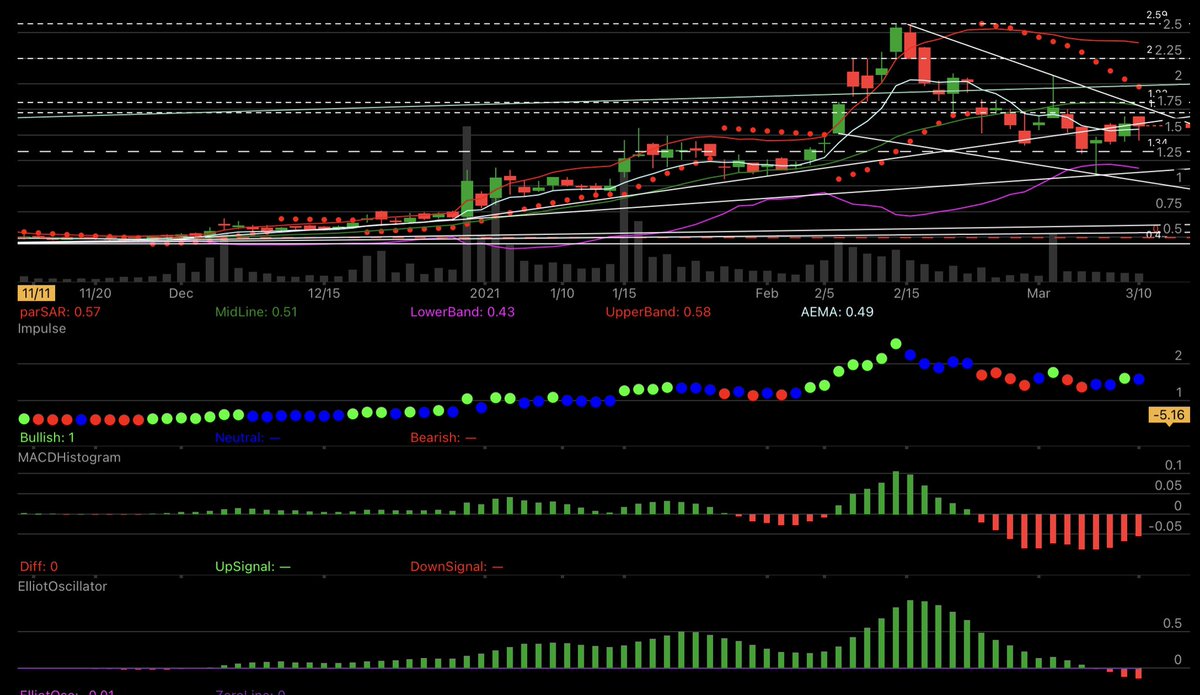

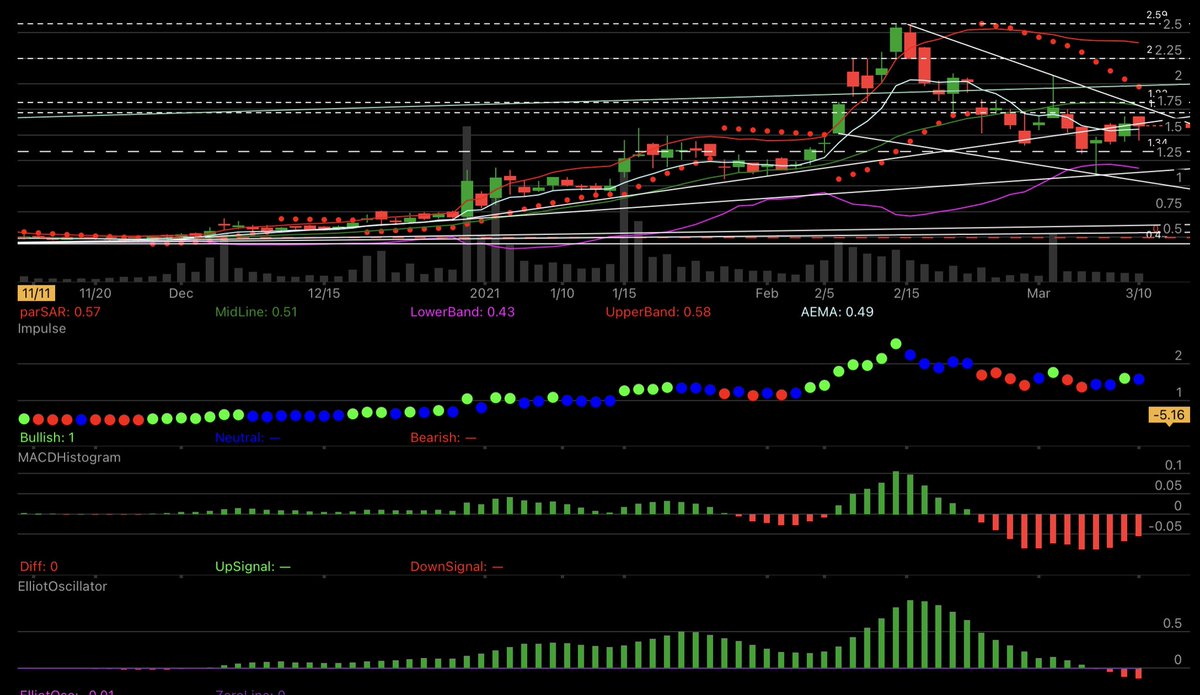

$NOVN TA, part 2

...Consolidation is under pressure.

- Low volume (8,21M, below avg. vol.) with unchanged buying pressure, increased acc. and positive money flow (block trades detected, Algo Orders).

- Solid RSI (consolidation zone), reduced HV. Decreased BB.

- Correlating...

...Consolidation is under pressure.

- Low volume (8,21M, below avg. vol.) with unchanged buying pressure, increased acc. and positive money flow (block trades detected, Algo Orders).

- Solid RSI (consolidation zone), reduced HV. Decreased BB.

- Correlating...

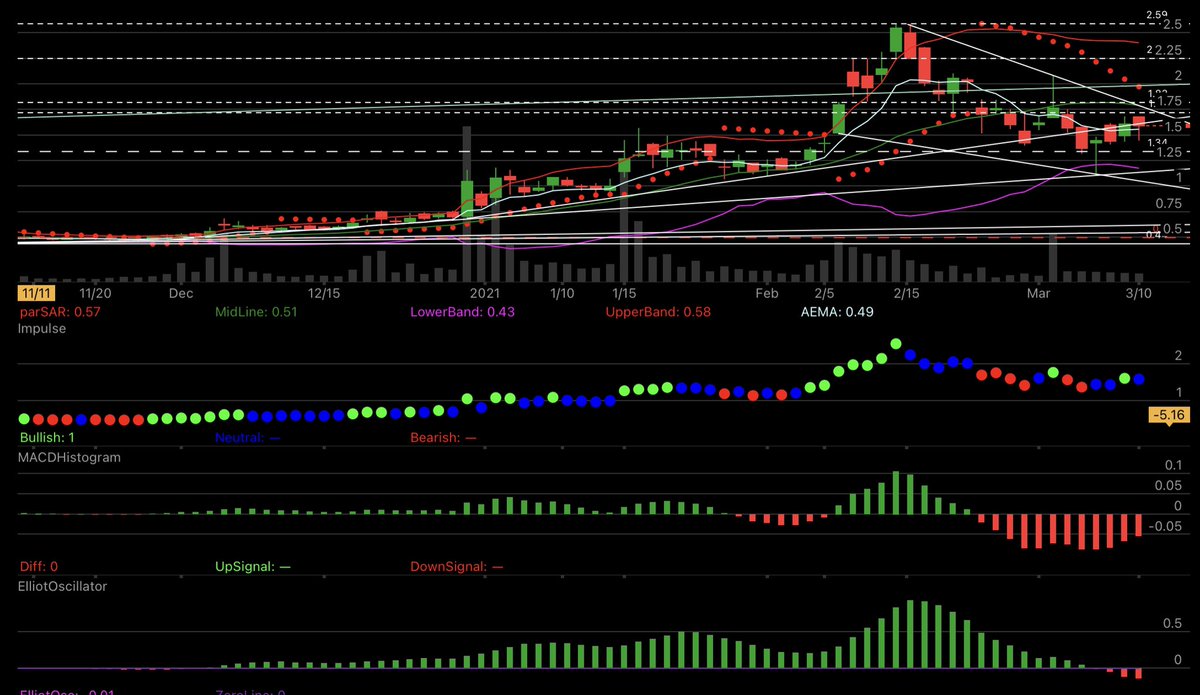

$NOVN TA, part 3

...momentum indicators are trying to realignment (aim is to continue the overall trend). Sleeping momentum. Stagnant MACD (reduced bearish divergence). VI is gaining strength. ElliotOsc. with increased bearish divergence. Stagnant W/DPPO. Step-like WPR.

...momentum indicators are trying to realignment (aim is to continue the overall trend). Sleeping momentum. Stagnant MACD (reduced bearish divergence). VI is gaining strength. ElliotOsc. with increased bearish divergence. Stagnant W/DPPO. Step-like WPR.

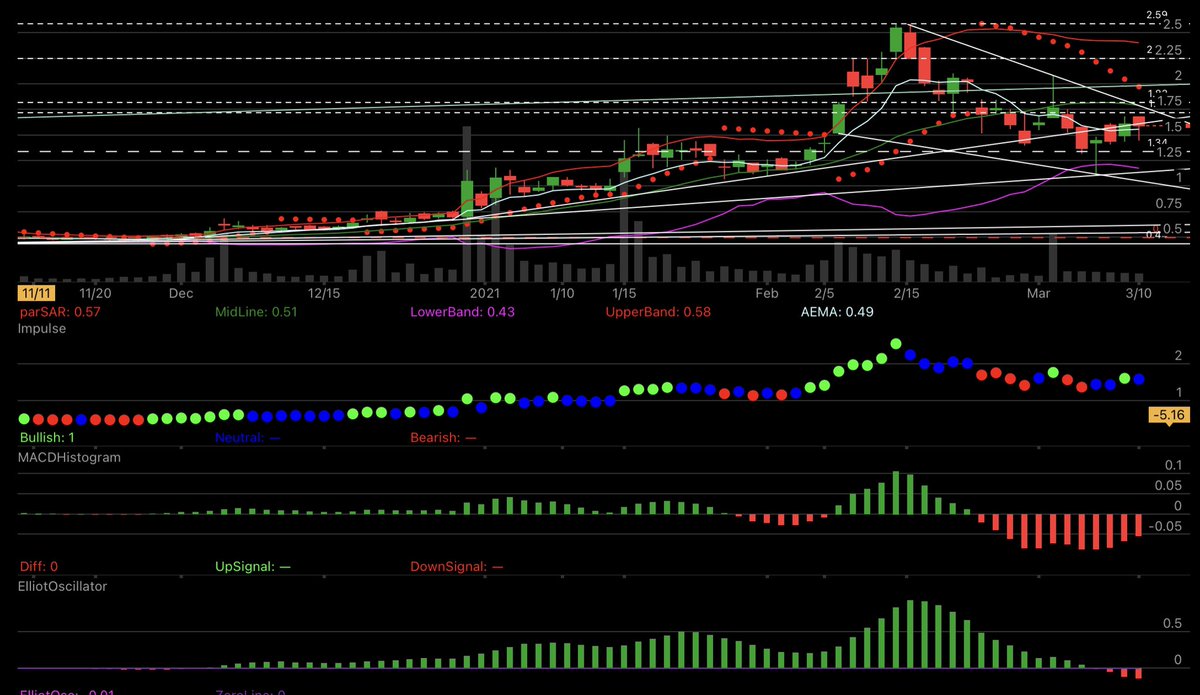

$NOVN TA, part 4

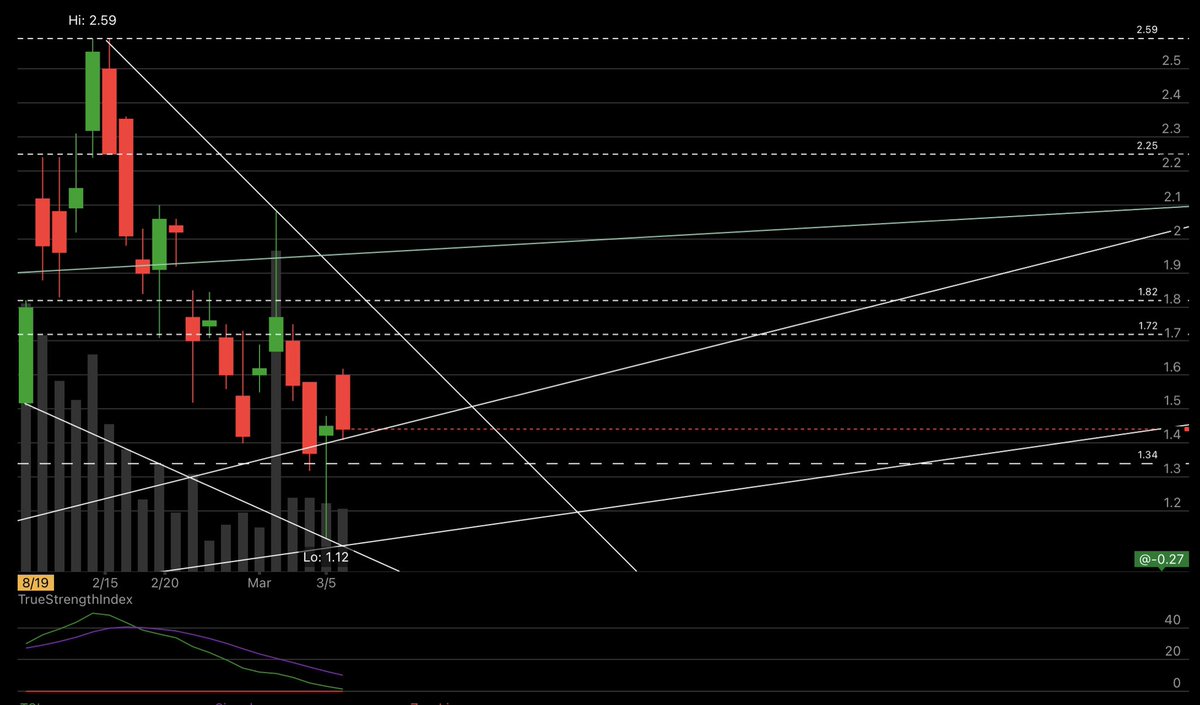

- Higher lows for four consecutive days. Highs, opening and closing prices with fluctuations. Overall trend with weakness. Sustainable trend; ADX: 28.63.

- Impulse signal = neutral (4d without bearish signals).

- Higher lows for four consecutive days. Highs, opening and closing prices with fluctuations. Overall trend with weakness. Sustainable trend; ADX: 28.63.

- Impulse signal = neutral (4d without bearish signals).

• • •

Missing some Tweet in this thread? You can try to

force a refresh