March 12, 2020 was the hardest* day** of my life. A year later, it sticks out more clearly as the most interesting situation I've ever been faced with -- and one from which I've learned a ton. Here are a few lessons I learned directly from March 12:

*tied with the time in 9th grade when I was forced to play on a baseball team and managed to strike out vs. a pitcher who walked everyone else and would have walked me 4-0 if I had not swung once

**really the 3ish days around then, but it felt like a month so IDK

**really the 3ish days around then, but it felt like a month so IDK

ADAPT

Pre-COVID, crypto was its own thing. Mostly divorced from the traditional markets, BTC (for instance) really did not have a beta to SPY, for instance -- it was totally its own thing.

Pre-COVID, crypto was its own thing. Mostly divorced from the traditional markets, BTC (for instance) really did not have a beta to SPY, for instance -- it was totally its own thing.

It's hard to imagine now, but there was actually a TON of speculation before this that BTC would serve as a safe haven asset, of sorts, in the event that the broader markets crashed. Not the case this time!

E.g.: forbes.com/sites/cbovaird…

E.g.: forbes.com/sites/cbovaird…

We noticed in the days leading up (when markets were falling, just slowly) that BTC *had* picked up a beta to SPY. It was slow (30s+ on average for BTC to follow) and only happened on biggish moves -- but it was real and it was obvious.

So we mobilized to get this into our models -- we had to, as we were getting picked off a ton to others who added it first (this is a huge problem when you're MMing for large size pretty tight, which we were and are). And thank god, because March 12 hit and this became critical.

BTC lagging 30bp SPY moves by 30s is doable by hand, if need be. BTC lagging 5% SPY moves by 2s is NOT, and that's what started happening all at once -- adapting quickly matters to first order, but WAY more to second order, giving you outs to nail bigger follow-on changes.

And we've learned our lesson here. Now, we track all kinds of possible signals for crypto which aren't *currently* useful but which *could* be -- even when we don't always have a great understanding for why.

https://twitter.com/AlamedaTrabucco/status/1325934153183891456?s=20

ADJUST FOR RISK

Alameda holds lots of positions -- some short-term when we expect some premium to revert fast, say, but some longer-term. For instance, if we sell a future expiring in a month 6% rich to make 20bp/day, we'll (often) gladly just hold for the whole month.

Alameda holds lots of positions -- some short-term when we expect some premium to revert fast, say, but some longer-term. For instance, if we sell a future expiring in a month 6% rich to make 20bp/day, we'll (often) gladly just hold for the whole month.

Doing that, though, requires posting collateral with the exchange. You can increase position size at the cost of more collateral or more risk to get liquidated, both of which are very real costs! Capital is useful for lots of stuff, and liquidation costs a LOT when it happens.

So putting on a long spot / short futures position for 20bp/day isn't quite so simple -- for any real size, there's some chance of liquidation. Let's say we were 4x-levered or so, and a 25% move would cause us to get liquidated ...

... well, on March 12, we would have been! And in some cases, we were. For a lot of our positions we *were* able to get more collateral in time, but not all of them -- we had to pick and choose which were the most valuable to salvage at the time.

But this highlights just how important it is to consider risk of ruin in putting spreads on. 20bp/day is NOT what we were making in EV on that futures spread -- if we had a 1% chance per day of liquidation and would then lose 10%, we were only making 10bp! Half the EV gone.

We're a lot more careful, now, than we used to be about really explicitly deciding our chances to have a given position liquidated, and close weaker stuff down much more aggressively. Median PNL suffers but EV is always king.

https://twitter.com/AlamedaTrabucco/status/1329129943838584832?s=20

MAXIMIZE

With everything in freefall, futures spreads got INSANE on March 12 -- many %s for many hours in delta-neutral spreads. OKEx and Huobi quarterlies -- close to identical products -- had a 10% spread at many points. So much $ to make, just buy one sell the other!

With everything in freefall, futures spreads got INSANE on March 12 -- many %s for many hours in delta-neutral spreads. OKEx and Huobi quarterlies -- close to identical products -- had a 10% spread at many points. So much $ to make, just buy one sell the other!

But to do that for real size, you had to lever up and risk liquidation -- and how safe was that? This shit was all happening with BTC down 20% -- what if it fell another 20%? Am I comfortable risking a 30% loss if that happens just to lock in 10% of profit?

It turned out that, no, probably I shouldn't have been! It was crucial to do one of two things: bet small s.t. your collateral was ROBUSTly safe, or restrict to just the very best trades. The latter was the way to go!

Figuring out that, yeah, there's $ to make in OKEx vs. Huobi -- but we need all our collateral on BitMEX because it's limited and BitMEX has the potential to print 50% good (and it did!) -- was ALL that mattered to maximize profit during this particular hour.

Very often it's easy to make some $ -- maximizing how much you make and making your best bet your biggest separates the good traders from the best.

https://twitter.com/AlamedaTrabucco/status/1349538525218127872?s=20

Also, we did know about them before, but March 12 is when we REALLY figured out liquidation cascades and how to predict momentum as a result of them, especially in low-liquidity environments.

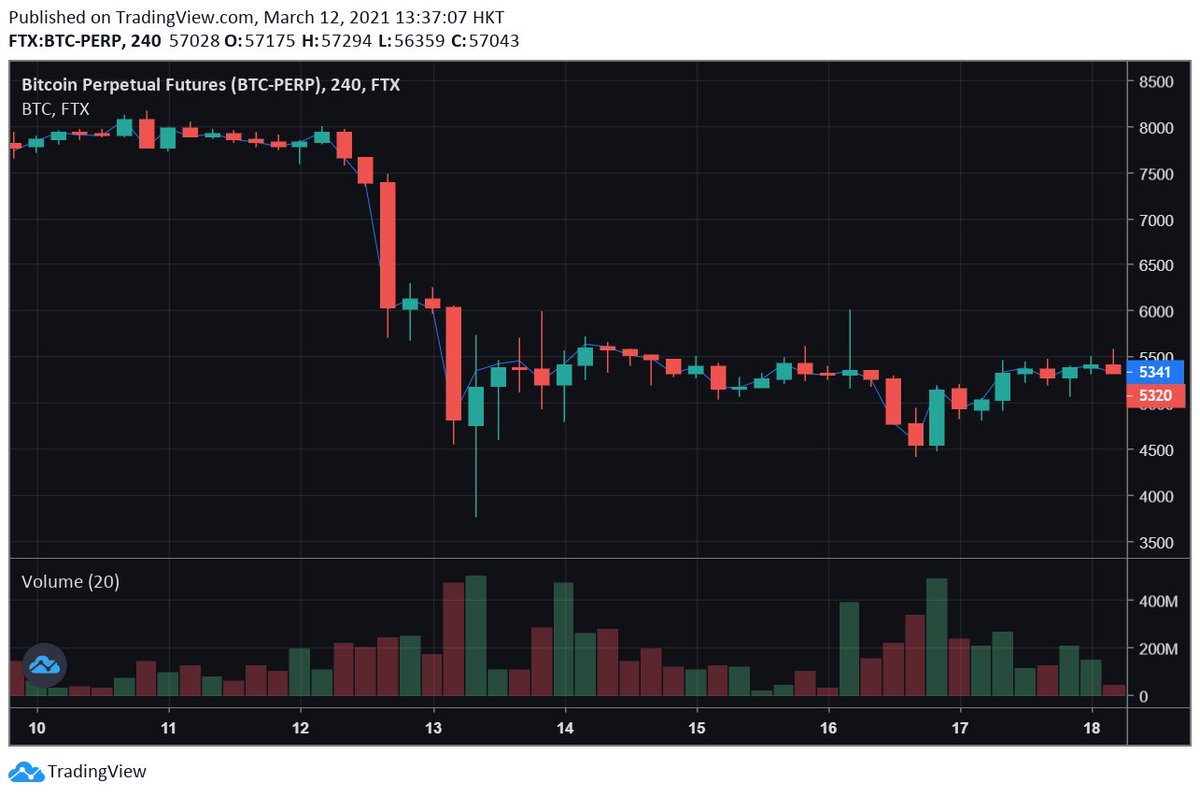

Of course, it was extreme -- but seeing BTC gap down 50% when the "organic" selling was probably closer to 20% (SPY analogue) gave us a ton of info about how to handle similar spots in the future ...

... spots like Thanksgiving, when we DID nail the "big rally -> small organic downturn -> LOTS of liquidations causing a BIG downturn" effect.

https://twitter.com/AlamedaTrabucco/status/1332104264051687425?s=20

BE COOL

When you've been awake for 36 hours, the market's finally been calm enough for you to sleep, and then you get woken up 20 minutes later because BTC fell 20% and you're hemorrhaging $ ... how do you remain rational?

When you've been awake for 36 hours, the market's finally been calm enough for you to sleep, and then you get woken up 20 minutes later because BTC fell 20% and you're hemorrhaging $ ... how do you remain rational?

It was truly testing! And honestly, it didn't always seem like I could -- hour 37 there was one where I thought pretty hard about making it someone else's problem. But the game drew me back in like always, and I got back into the zone.

Years of big wins and losses got me used to the idea that, yeah, maybe I'm about to lose big -- but everyone around me knows I'm +EV right now, and trusts that my decisions make sense. And no one's gonna win big without risking a lot -- I know I never have.

THINK FAST

Above all else, what market moves like this reward is the ability to move quickly. Our trading is mostly automated, but let's just say we did not trust our bots to nail the events of March 12 -- they're optimized for significantly less volatility.

Above all else, what market moves like this reward is the ability to move quickly. Our trading is mostly automated, but let's just say we did not trust our bots to nail the events of March 12 -- they're optimized for significantly less volatility.

So we needed our people to step up, and we had to rely on intuition. It was exciting! Many new things are, and there was so much uncertainty that it was kinda fun just to see how things would shake out.

We often had seconds to make huge decisions -- how big can our BitMEX perp position be? Big big should our OKEx/Huobi spread be? Where do we send our ETH? How much USDT can we deliver USD for right now? Where should we send out last available BTC collateral?

Seconds mattered here because *someone* was gonna close these spreads, *someone* was gonna make all this $ -- making it *us* was ALL we cared about, and it was so exciting to see our team figure all this out and gel in such a stressful situation.

We always have to make these fast, crucial decisions -- it's what crypto trading is, really. And we got a lot better on March 12! It prepared us for trading a super-volatile election, trading the quick and huge $20k moves, trading XRP's 50% moves from the SEC, etc. etc.

And if I know crypto, I know the vol will keep up, and the ability to keep making strong, fast decisions will keep mattering maybe more than anything else (on the biggest days, for sure).

blog.ftx.com/monthly-digest…

blog.ftx.com/monthly-digest…

March 12 was the hardest day of my life -- but it was also one of the most fun, and the most edifying. I walked out harrowed but also a WAY better trader -- and thinker, and doer -- and I'm excited for more March 12s to keep growing. It's what we live for at Alameda!

• • •

Missing some Tweet in this thread? You can try to

force a refresh