1/ Impermanent Loss doesn't have to be this mythical phenomenon, such that it may only be explained clearly in a universe where Unicorns might live. No, today we pull back the curtain and present a tool to visualize and analyze impermanent loss by asset & investment time horizon.

2/ First, a quick primer on Impermanent Loss - it occurs when the price of either asset changes after you've initially supplied liquidity (as you hope it does, since price changes are how a liquidity provider actually earns fees). Or, to take it straight from the Unicorn's mouth:

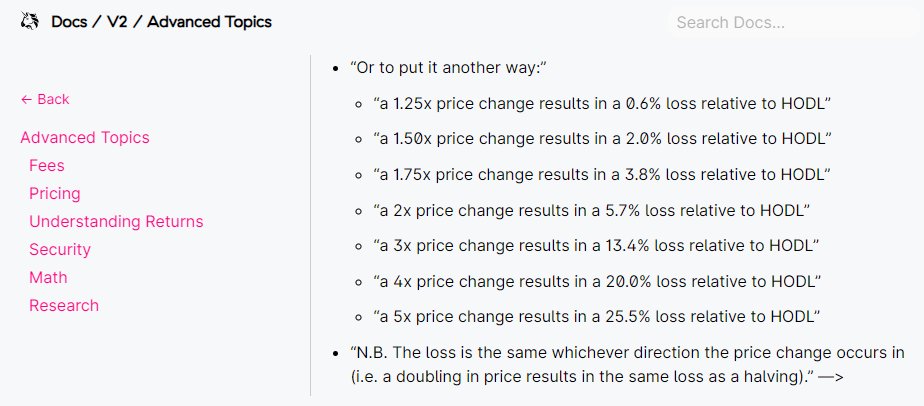

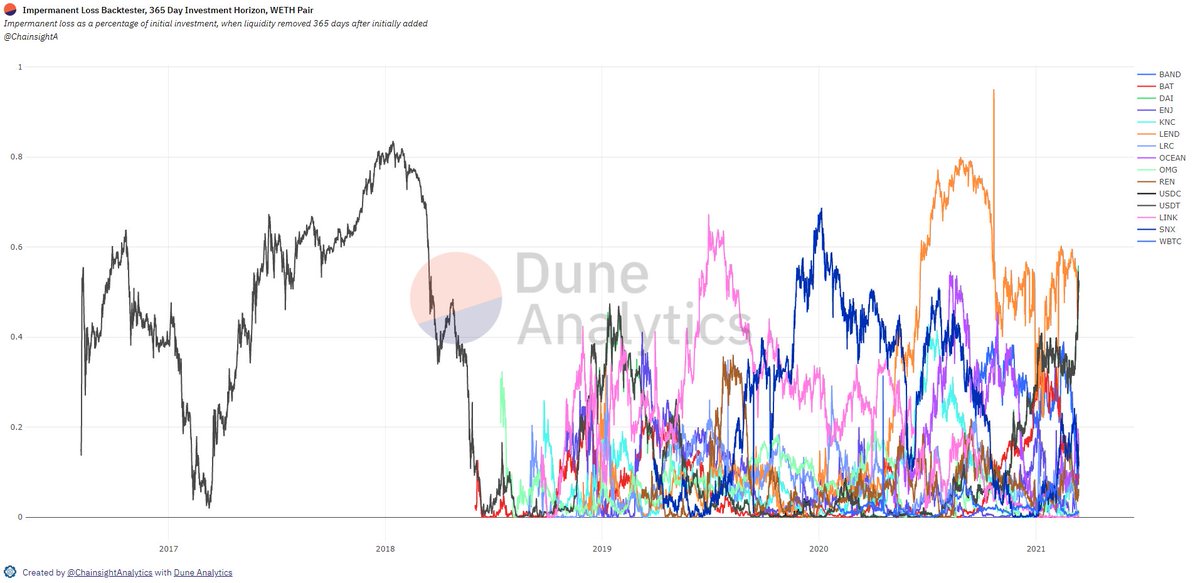

3/ As seen from the above Uniswap documentation, a 5x price change results in a 25.5% loss on your initial investment. But you aren't holding your favorite alt-coin for a mere 5x price appreciation, right, anon? Let's consider if you were supplying LINK/ETH liquidity last year:

4/ If you were to have withdrawn your LINK during the heat of DeFi Summer, you would have been signing yourself up for a loss of approximately 34%, if you had been supplying that liquidity for exactly 1 year. 34% of your initial investment, gone, all due to a Unicorn's friend.

5/ Let's consider another DeFi Blue-Chip, SNX. If you were to have withdrawn your SNX during DeFi Summer, you would have lost 50% of your initial investment. Ouch!

duneanalytics.com/embeds/22827/4…

duneanalytics.com/embeds/22827/4…

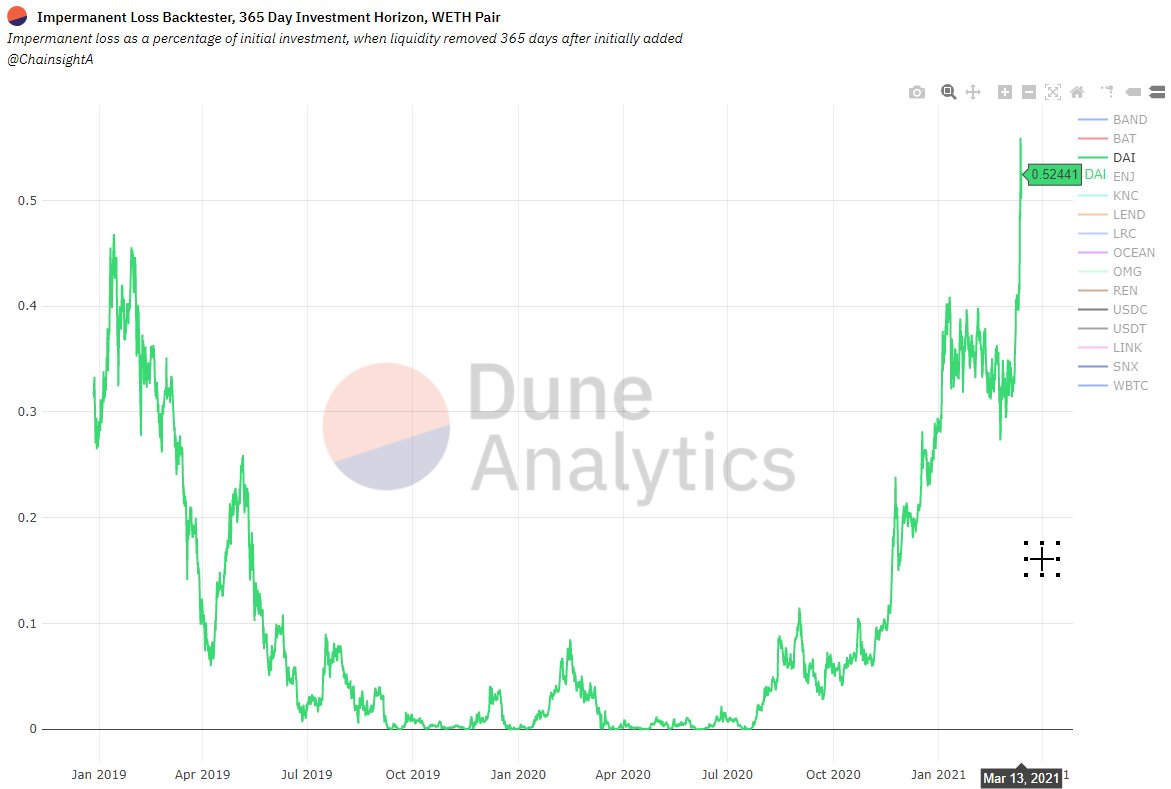

6/ Stablecoins should be safe, right? Sorry, but it actually gets worse. Consider if you supplied DAI/ETH (a 'stable' and a 'safe' asset) for 1 year, and withdrew TODAY. A nice 52% loss on your initial investment.

duneanalytics.com/embeds/22827/4…

duneanalytics.com/embeds/22827/4…

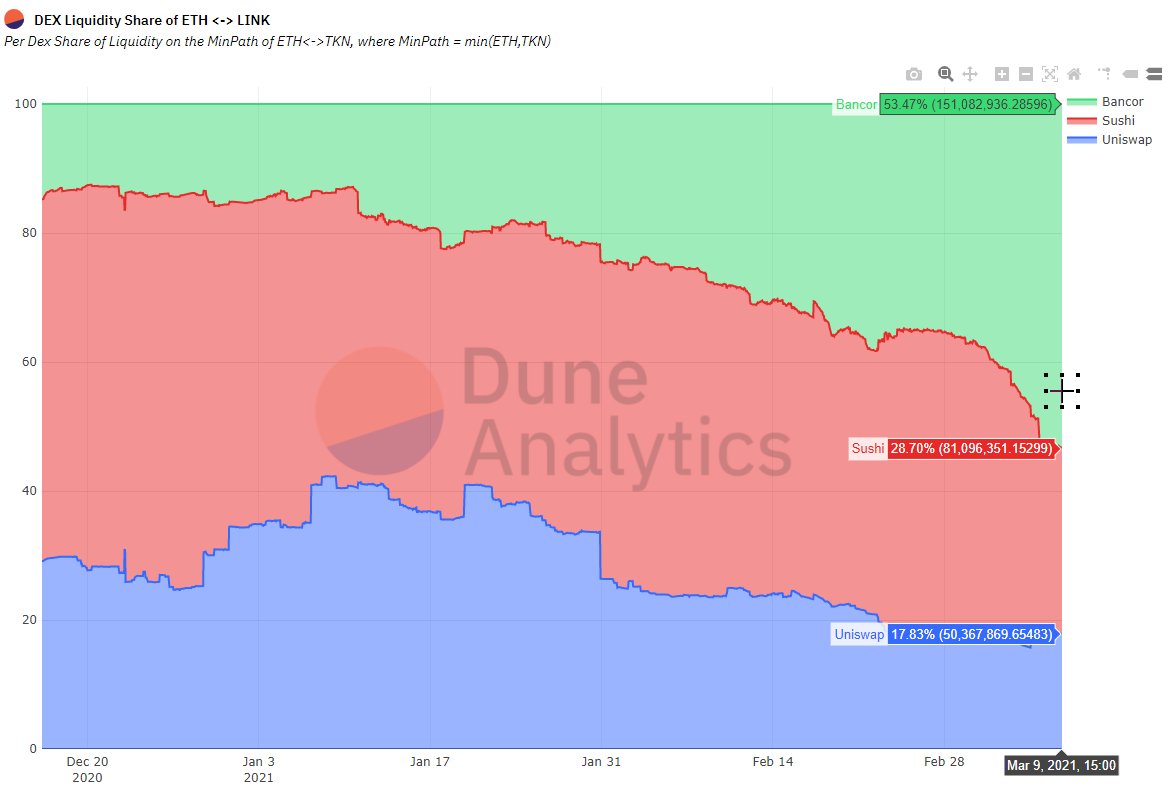

7/ It makes sense that the massive impermanent losses shown above are a big reason why many Liquidity Providers are leaving Uniswap and Sushiswap and moving to other platforms with IL protection. Namely, Bancor now has 53% of all LINK DEX liquidity, mostly gained very recently:

8/ Impermanent loss is now well known in the DEX space, but it is rarely assigned a 'penalty' metric on UX's where users provide liquidity. Rather than assuming malicious intent by these popular DEX applications, we acknowledge that IL is difficult to convey.

9/ By using this Dune Analytics Dashboard, you can adjust your 'investment horizon' variable (how long you've been supplying liquidity), and refresh the query in order to plot the asset's impermanent loss by withdrawal date:

duneanalytics.com/ChainsightAnal…

duneanalytics.com/ChainsightAnal…

10/ To conclude, we suspect that in 2021 a mass migration of LPs from platforms without IL protection is imminent. Bancor will be a likely landing spot for them, given that Bancor provides full IL protection to LPs after providing liquidity for 100 days.

Remember to check out our latest creations on Bancor's Official Dune Dashboard at duneanalytics.com/ashachaf/banco…!

• • •

Missing some Tweet in this thread? You can try to

force a refresh