The most simplest way of identifying stocks for your momentum swing trading. Something which has worked for me for years now and hence we have added the model in @mystockedge for individual investors.

This is also part of my Golden Strategy.

Thread (1/5)

This is also part of my Golden Strategy.

Thread (1/5)

Fourth

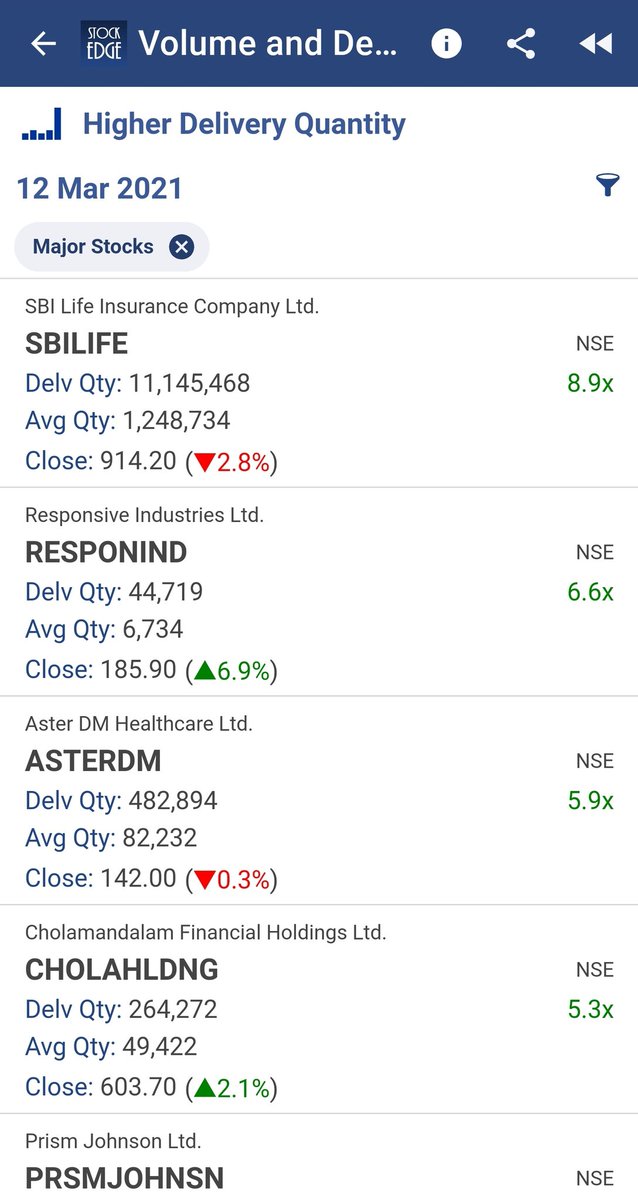

Get the list of Stocks where there is high delivery activity.

Go through each and every stock.

You may like to use filter to reduce number of stocks if you are a beginner.

But I suggest SEE ALL Stocks, if you can. It will take you max 1 hour on end of the day.

Get the list of Stocks where there is high delivery activity.

Go through each and every stock.

You may like to use filter to reduce number of stocks if you are a beginner.

But I suggest SEE ALL Stocks, if you can. It will take you max 1 hour on end of the day.

Fifth

See chart of each Stock in the list and check if the stock is performing better than the market.

For that use RS market indicator. If RS>0 keep buying bias and if RS<0 keep selling bias.

Use price levels to enter and exit. Trade only when important levels are breached.

See chart of each Stock in the list and check if the stock is performing better than the market.

For that use RS market indicator. If RS>0 keep buying bias and if RS<0 keep selling bias.

Use price levels to enter and exit. Trade only when important levels are breached.

Conclusion:

Try this for few days and let me know. It is working fine for me. Should note:

I trade less and only lookout for major price levels for big moves.

This cannot be used for intraday trading.

This is my best model for any PART TIME TRADERS.

Try this for few days and let me know. It is working fine for me. Should note:

I trade less and only lookout for major price levels for big moves.

This cannot be used for intraday trading.

This is my best model for any PART TIME TRADERS.

• • •

Missing some Tweet in this thread? You can try to

force a refresh