The hard legal problems with DAOs are not entity formation. They are:

*getting states to grant limited liability to anon members of stateless unincorporated DAOs

*establishing norms of contractual code deference

*taxation

*carving DAO shares out of securities laws

*getting states to grant limited liability to anon members of stateless unincorporated DAOs

*establishing norms of contractual code deference

*taxation

*carving DAO shares out of securities laws

In order to be doing good legal innovation in the blockchain area, you have to honor its roots & purposes, which are fundamentally libertarian and anarchist.

Lawyers should not be coopting & repurposing anarchist concepts to preserve the lawyers' relevancy.

Lawyers should not be coopting & repurposing anarchist concepts to preserve the lawyers' relevancy.

As for DAO/entity mashups, the best shot at getting states to recognize & enforce them lies not in badly drafted prescriptivist technophilic legislation but in experimenting with private contracts in jurisdictions with high respect for freedom of contract.

This is why, in designing MetaCartel Ventures, we opted to use a Delaware LLC. Delaware has a high respect for freedom of contract. We cannot guarantee that every aspect of the MCV LLC agreement is enforceable, but it has its best shot there. github.com/metacartel/MCV…

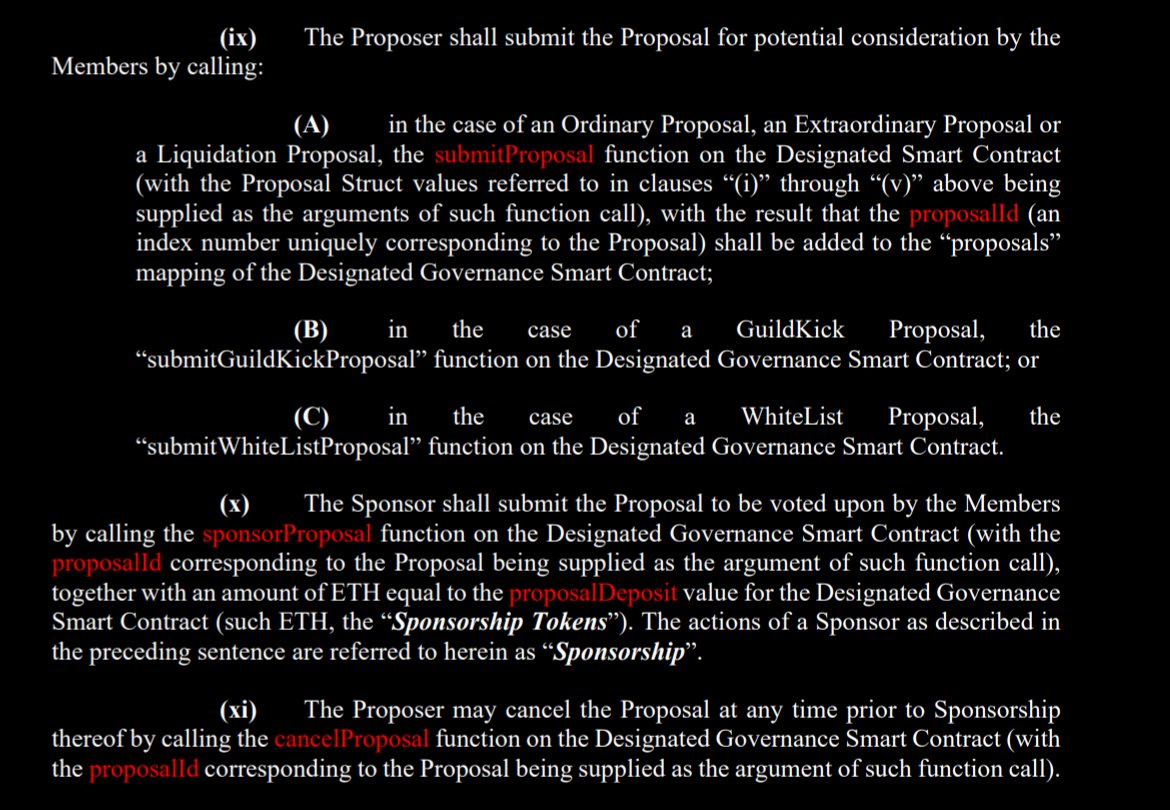

An additional important step in marrying smart contracts to traditional contracts and entities is to be as specific and concrete as possible and avoid any kind of technological fetishism, black box thinking or magical thinking.

A key principle of contract formation is that there be a 'meeting of the minds'. For this to occur, just saying that an organization is "algorithmically managed" or something like that is, in my view, inadequate and opens many chances for post hoc disputes.

Even worse is to say that a smart contract is or reflects or executes an agreement. Then one can always challenge the results of the smart contract by saying that it did not match the agreement. This effect is compounded if that agreement is not written down in advance.

Rather, a smart contract should be viewed as a tool reducing certain forms of discretion. A contract--including an LLC agreement--can specify how & when to use that tool and under what circumstances use of that tool results in legally binding effects.

https://twitter.com/prestonjbyrne/status/1370004329948733443

It is very important that this be specific, otherwise: (a) it may not be enforced by a judge; and (b) people might not understand what they're getting into and there might be no contract.

Thus, rather than saying "our LLC is algorithmically managed," whatever the hell that means, one can write very specific and reasonably clear things in the LLC agreement--this is called code deference:

This approach to the legal agreement is, in my view, necessary and desirable to honor the trust-reducing intentions of using smart contracts in the first place. Using vague, hand-wavey concepts like "algorithmic management" leave too much discretion & power in the hands of judges

Not all "legal innovations" are made equal; some are likely to make the situation worse rather than better--that is the case with the proposed Wyoming DAO law, which mashes together vague concepts to create an unpredictable soup of rules with unclear effects and intentions.

It is not needed, it is worse than having no law about how DAOs relate to LLCs, it is being done for hype, in a rush, without unbiased peer review, and it will narrow rather than preserve or expand the field of valid experimentation.

Here are some more specific problems with the proposed Wyoming DAO bill:

*it is not clear that a Wyoming judge will enforce an LLC's use of a smart contract if the LLC has not opted to be considered a "decentralized autonomous organization"

*it is not clear that a Wyoming judge will enforce an LLC's use of a smart contract if the LLC has not opted to be considered a "decentralized autonomous organization"

if I were a Wyoming judge, I would hesitate to honor such an arrangement, because the law in question has specific prescriptions and limitations for LLCs that opt to use to smart contracts & presumably they are there for a reason -- e.g.

*relatedly, the specific prescriptions and limitations called for by the bill are by turns vague, technologically illiterate, unnecessary and unreasonable

-->there is a requirement that the smart contract "execute the terms of an agreement"; it is not clear how/when this requirement is satisfied but in any case it means only a subset of smart contracts are eligible to be paired with DAOs--but why & how do we know which?

-->if the DAO is "algorithmically managed" then one is supposed to elect to be an "algorithmically managed DAO"; if you are "algorithmically managed" but fail to make the election, then the statute overrules your operating agreement and makes you "member-managed"

-->additional requirements apply to DAOs that are "algorithmically managed"--the smart contract must be upgradeable. Again, why? In MCV, our smart contract is not upgradeable--if we needed to change smart contracts we would deploy a new one and migrate to that. Why prohibit this?

-->"algorithmic management" is not defined and is an inherently nonsensical concept without sentient AI--how does one know whether Wyoming considers one's DAO "algorithmically managed" or not so that one can make the proper election?

-->the drafting and logic are circular; for example, if you parse out this provision it means "the articles of a limited liability company organized under this chapter shall include a statement that it is a limited liability company organized under this chapter"

-->again, what happens if I am something colloquially referred to as a "DAO" & have an LLC that does *not* include such a statement--we don't know, possibly could lose LLC status or have other bad effects, why limit people in this way?

-->the drafting even fails on basic corporate finance principles, for example if the DAO capital consists of 500 DAI ($500) and 500 ETH ($900k) and a member contributed 100 DAI ($100), they get 10% of the equity instead of 0.0111%; makes no sense!

• • •

Missing some Tweet in this thread? You can try to

force a refresh