A country like Nigeria, producing oil at 2 million barrels per day (BPD) & still having nothing to show for it is down to either bad/inadequate regulatory institutions & framework or witchery.

My bet is on the former

It's a thread

#NNPCAudit

My bet is on the former

It's a thread

#NNPCAudit

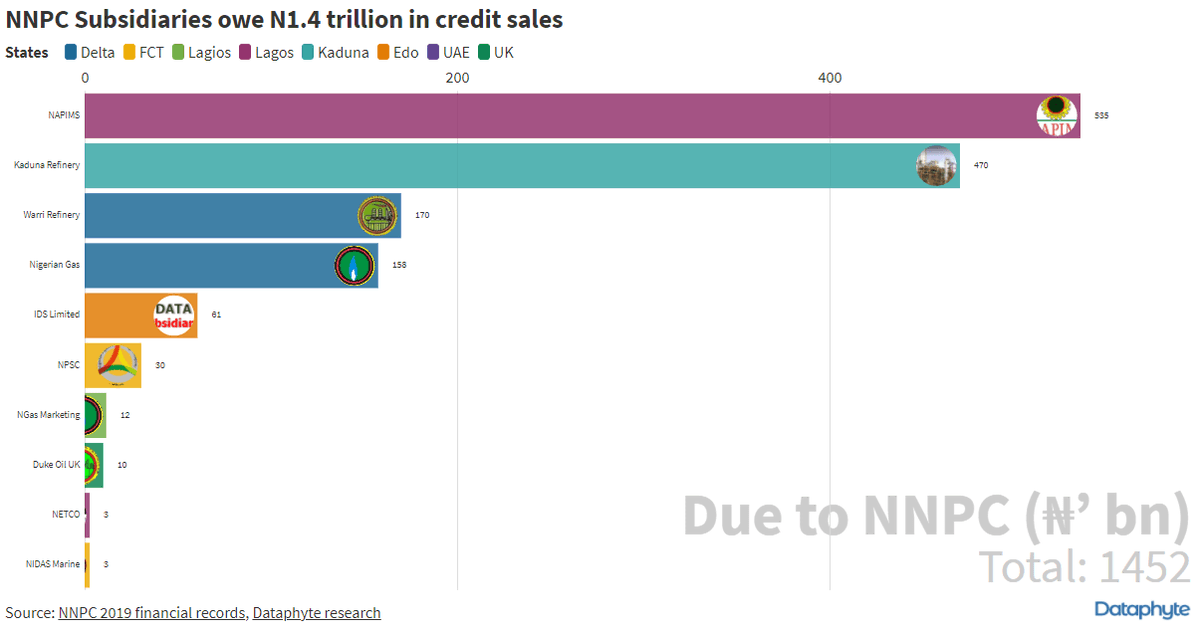

@Dataphyte analysed @NNPCgroup financial report & discovered that credit sales amounting #1.45 trillion made to its subsidiaries are still unpaid.

#NNPCaudit

#NNPCaudit

@Dataphyte went further to analyse the financial records of the 22 subsidiaries of the @NNPCgroup & revealed that 12 of them owes @NNPCgroup trillions of Naira.

#NNPCAudit

#NNPCAudit

Nigeria having trillions of Naira unremitted where the country is scrambling to finance her own budget is highly irresponsible & has detrimental effects on the economy

#NNPCAudit

#NNPCAudit

The main source of income of the nation is petroleum, unrecovered debts will lead to shortfalls in revenue & the knock-on effect of this is increased borrowing.

#NNPCAudit

#NNPCAudit

The financial burden incurred by the @NNPCgroup due to these unrecovered debts is evident in its 2019 financial account.

NNPC reported a loss of #16.3 billion & the overall group reported a loss of #20.2 billion in 2019

#NNPCAudit

NNPC reported a loss of #16.3 billion & the overall group reported a loss of #20.2 billion in 2019

#NNPCAudit

Over 10 years, the corporation had lost a whooping sum of #474 billion while the overall Group recorded a total sum of #1.55 trillion

#NNPCAudit

#NNPCAudit

Although, the General Managing Director of NNPC promised increased efficiency & revenue, the NNPC recently recorded a N423 billion revenue shortage when writing of the debt of Pipelines & Product Marketing Company

#NNPCAudit

#NNPCAudit

Credit sales is an effective way to finance business operations, but the absence of an effective mechanism to recover such debts, will lead to it becoming bad debts (as is the case of Nigeria)

#NNPCAudit

#NNPCAudit

These humongous figures for overdue payments & credit sales shows the dismal & inefficient management of oil resources in Nigeria. Seeing as the Oil & Gas sector is the main driver of the economy, this inefficient & ineffective management should be tacked heads on

#NNPCAudit

#NNPCAudit

A more frequent audit by the Office of the Auditor General of the Federation on @NNPCgroup will go a help to plug the leakages (responsible to have cost losses in trillions) in the oil & gas sector

Cc: @BudgITng @codwa @Dataphyte @extractive360 @PLSInitiative

#NNPCAudit

Cc: @BudgITng @codwa @Dataphyte @extractive360 @PLSInitiative

#NNPCAudit

• • •

Missing some Tweet in this thread? You can try to

force a refresh