Now that Andrew Austin has made his 1st deal at #KISTOS, time to evaluate it. Seems that FinTwit doesn't consider it a bargain, and we don't have all the info yet, but indeed we can do some research

Brief: AA DID IT AGAIN

Time for a thread 🧵 #KIST $KIST.LN

((PART 1))

👇🏽👇🏽👇🏽

Brief: AA DID IT AGAIN

Time for a thread 🧵 #KIST $KIST.LN

((PART 1))

👇🏽👇🏽👇🏽

I've read different opinions so far, but it seems that the general opinion is that €220M+€163M earn outs, isn't too cheap for €31M EBITDA'20, or 5.5m boepd, 19mm boe 2P and 78mm boe 2C. Seen like this, it's fair. It doesn't seem very cheap.

Only positive view I've read about, is from @mgrahamwood saying "this looks to be one hell of a deal". I didn't know if it was only because he's an AA fan, but now having analyzed the asset, I think he's just right:

This is one HELL of a deal

This is one HELL of a deal

After our experience in #RRE, we were fortunate to add #KIST to our "seeds" sub-portfolio (uncertain risk, very high potential) in our fund #AccionGlobalFI on the first day of trading at 105p.

Fortunately, this story did not make much noise the first days and we were able to join at practically the same price as the rest of the institutions that were able to attend the IPO.

Recently, due to stock performance, some think that it was pointless to pay a +90% premium on cash. I believe that money is not worth the same depending on which hands it is in, and I am trying to show why the money was indeed worth what it cost in the hands of our jockey AA.

I guess other institutions that are on this name (and all those who could not join while it was a "cash shell" but will be able to join in the readmission) are doing their work here. Because what I'm going to explain next is public information that anyone can check.

Tulip Oil has a bond listed in the market and for this reason it is obliged to publish semi-annual reports, quarterly updates and various presentations from exploration, during construction and now in the production phase of the asset.

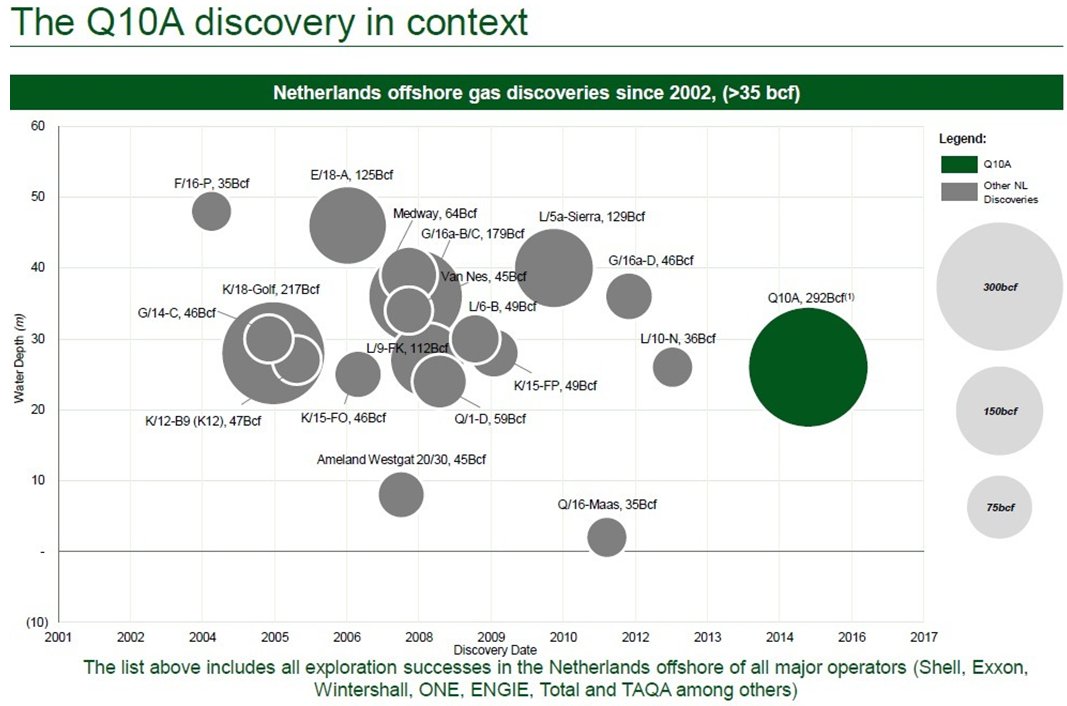

So, let's go with the dive. Description of the asset. We are talking here about the biggest discovery in the dutch offshore in the last 20 years:

We are talking about a field located just 20kms away from The Nederlands coast, in very calm and very shallow waters:

We are talking about an platform controlled from the coast, in an area with large energy infrastructures...

…and connected through pipelines to the P15 compression facility, owned and operated by TAQA, from where the gas is delivered on shore:

Q10-A platform has solar panels and wind turbines, which reduces costs making it totally self-sufficient, and reduces C02 emissions to only 10gr/boe VS 21*KG*/boe of North Sea avg...

...which can make the asset (#KIST bonds or equity) fine for ESG or exclusive energy mandate funds, who want to "wash their face" with assets in the transition.

So here we are talking here about one of the best energy assets of Europe, in a jurisdiction as safe as the Netherlands, with very low costs, very high margin and low needs for capex.

To understand it better, let's do some quick numbers. The field produced in 2019 revenues of €47.8M and an EBITDA of €36.7M, so costs of €11.1M to produce 620MSm3 gross of gas (372M net), with an equivalent of 170Sm3 per BOE, this is 2.2M BOE net production.

And 2020 revenues of €33.3M and an EBITDA of €23.2M, that is, costs of €10.1M to produce 526MSm3 gross of gas (315M net), that is, 1.9M BOE net production.

So yes, we are talking here about production costs of $6/BOE in 2019 and about $6.5/BOE in 2020.

So yes, we are talking here about production costs of $6/BOE in 2019 and about $6.5/BOE in 2020.

This makes EBITDA margin of 60% in its first period with only a few wells pumping (later increased to 70-75% EBITDA margin) and where the capex basically volatilizes upon completion the construction of the platform.

Future prospects of the asset, as AA usually likes...

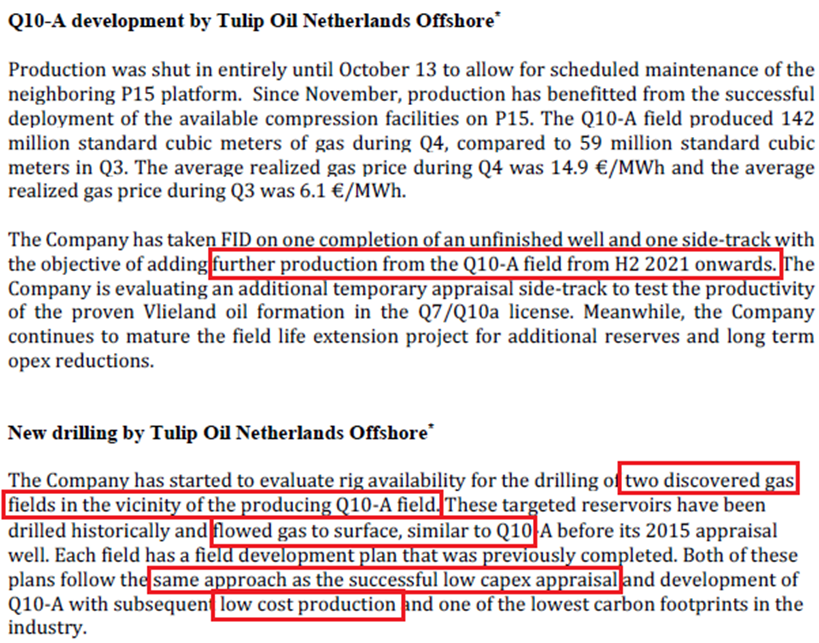

Life extension and increased production is coming:

Life extension and increased production is coming:

I believe negotiations for life extension will end well.

Why we talk about gross production and net production?

TONO has a 60% interest in the asset.

And who owns the remaining 40%?

To the Dutch State.

Why we talk about gross production and net production?

TONO has a 60% interest in the asset.

And who owns the remaining 40%?

To the Dutch State.

The State participates on all platforms. Having the regulator on board can make things easier. Just one example, recently depletion costs have been significantly reduced, because now it will be possible to simply remove the platform and clean, but leave the pipeline where it is:

This is very good for our asset. So remember, when we talk about production for TONO-KIST, we will always be talking about 60% net for us, production, revenues, EBITDA, all figures already counting ONLY our 60%.

So we have a high quality asset, in a safe jurisdiction, with very low production costs, the regulator on our side, low capex needs, ESG OK flag, and with favorable prospects for its useful life and increased production.

• • •

Missing some Tweet in this thread? You can try to

force a refresh