It’s time to update one of the most popular stay at home names in the market. Here is the breakdown on $PTON, otherwise known as Peloton.

Current Price: $108.31

52/Wk High: $171.09

52/Wk Low: $21.78

Market Cap: $31.9 Billion

Read below for the breakdown! 🔥

Current Price: $108.31

52/Wk High: $171.09

52/Wk Low: $21.78

Market Cap: $31.9 Billion

Read below for the breakdown! 🔥

Peloton is one of the most popular providers of a digital fitness platform that not only provides the digital experience but most importantly the Bike and Tread itself.

Just a few months ago, Peloton announced the acquisition of Precor, a fitness equipment company for a whopping $420 million.

“By combining our talented and committed R&D and Supply Chain teams with the incredibly capable Precor team and their decades of experience, we believe we will be able to lead the global connected fitness market in both innovation and scale," President William Lynch said.

Given the stock's strong 330% rally in the past year, investors are left wondering if the stock continues to be a buy given the reopening of the country and the original “stay at home” story of Peloton.

Digging into the numbers Peloton beat Q2 2021 expectations with an EPS of $0.18, much better than the analysts EPS consensus estimate of $0.09. On a year over year basis, EPS improved 190%.

Revenues were strong as well, with total revenues totaling $1.0648 billion for the quarter, representing a solid 128% gain year over year. Breaking down revenues, the connected fitness segment turned out $870.1 million, representing a 124% increase in the segment's revenues.

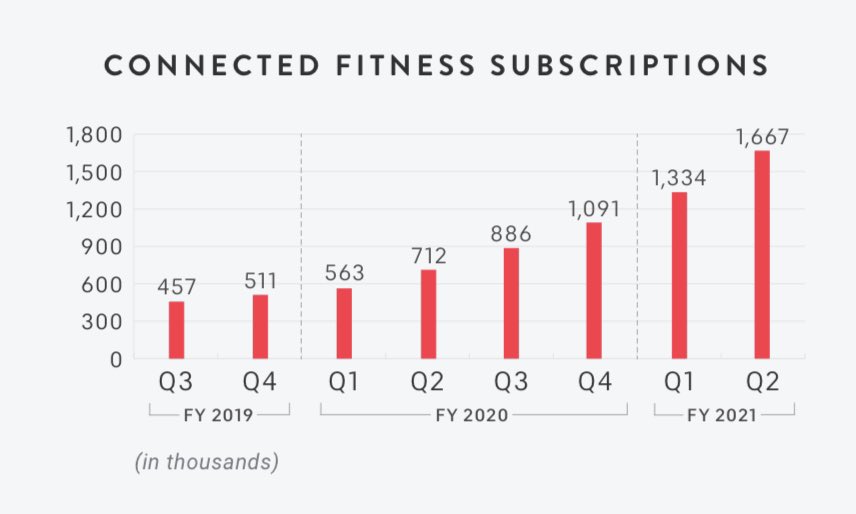

As for subscriptions, subscription revenues jumped 152% year over year to a solid $194.7 million. Taking a look at the subscription user base, Peloton reported a subscription base of 1.67 million users at the end of Q2, representing growth of 134%.

Rounding out Pelotons users, the company also reported 625,000 paid digital subscriptions, representing a 472% increase year over year. In all, total members grew to an impressive 4.4 million.

Shifting into margins, management reported a Q2 gross margin of 39.9% along with a connected fitness product gross margin of 35.3% and subscription gross margin of 60.3%.

Net income also improved, with Peloton reporting a net income level of $63.6 million along with an adjusted EBITDA of $116.9 million.

On a final earnings note, Peloton reported a gross profit of $424.8 million for Q2, representing a large 115% gain in gross profit on a year over year basis. It is important to note that gross profit represented 39.9% of revenues.

As for guidance, management is bullish with Q3 revenues expected to land around $1.10 billion and connected fitness subscriptions to total around 1.980 million.

For the full year, management raised expectations, now projecting a FY 2021 total revenue level around $4.075 billion.

Shifting into the balance sheet the numbers are solid.

Total Debt: None

Total Liabilities: $1.982 Billion

Total Assets: $3.911 Billion

Cash & Short Term Inv: $2.111 Billion

Total Debt: None

Total Liabilities: $1.982 Billion

Total Assets: $3.911 Billion

Cash & Short Term Inv: $2.111 Billion

On a valuation basis, Peloton does trade at a premium.

Price to Earnings: 205.07x

Forward Price to Earnings: 142.89x

Price to Sales: 10.80x

Price to Book: 15.59x

Prices to Cash Flow: 98.74x

Price to Earnings: 205.07x

Forward Price to Earnings: 142.89x

Price to Sales: 10.80x

Price to Book: 15.59x

Prices to Cash Flow: 98.74x

Leadership has been effective as well.

Return on Equity: 9.58%

Return on Assets: 5.12%

Return on Invested Capital: 7.27%

Return on Equity: 9.58%

Return on Assets: 5.12%

Return on Invested Capital: 7.27%

Given the numbers the analysts are bullish with a mean price target of $166.62/share, representing 53.84% upside.

The high price target is $200/share, representing 84.55% upside while the low price target is $45.00/share, representing a -58.45% loss.

The high price target is $200/share, representing 84.55% upside while the low price target is $45.00/share, representing a -58.45% loss.

The big money is quite involved as well with 74.98% of Peloton being owned by institutions. Top holders include The Vanguard Group, Baillie Gifford & Co., and Jennison Associates.

On a technical basis Peloton looks to be presenting opportunity. According to the six-month charts the MACD is attempting to cross back to the upside within a tight range around -8.3944.

The six-month charts are also indicating an RSI of 40.93 and CCI of -79.0473, both of which are on the low end.

In short, peloton is a solid company with a growing subscription base, improving margins, expanding revenues, and has more room to grow in the years to come.

runningwiththemoney.com/post/is-peloto…

EAT - SLEEP - PROFIT 💰

Disclaimer: This is not direct financial advice, simply an opinion based on independent research.

EAT - SLEEP - PROFIT 💰

Disclaimer: This is not direct financial advice, simply an opinion based on independent research.

• • •

Missing some Tweet in this thread? You can try to

force a refresh