Crypto Day-Trading Secret Strategy.

SIMPLE. HIGH PROFIT. NO NONSENSE.

One of the best strategies for Scalping crypto.

Share it to help all beginners.

(A THREAD)🚀🚀

SIMPLE. HIGH PROFIT. NO NONSENSE.

One of the best strategies for Scalping crypto.

Share it to help all beginners.

(A THREAD)🚀🚀

We will use three basic indicators.

1. Pivot Points

2. Stoch RSI

3. VWAP

Note- This strategy will have a MUCH higher probability of success if basic Price action, volume and Candlestick pattern is kept in mind.

1. Pivot Points

2. Stoch RSI

3. VWAP

Note- This strategy will have a MUCH higher probability of success if basic Price action, volume and Candlestick pattern is kept in mind.

USE THE STRATEGY:

I will introduce the tools and then explain the strategy.

I Will talk about the calculations to arrive at the indicators separately.

IMPORTANT- Don't use the indicators alone.

Eg. Stoch RSI has less than 26% hit rate so you can't use it alone to trade.

I will introduce the tools and then explain the strategy.

I Will talk about the calculations to arrive at the indicators separately.

IMPORTANT- Don't use the indicators alone.

Eg. Stoch RSI has less than 26% hit rate so you can't use it alone to trade.

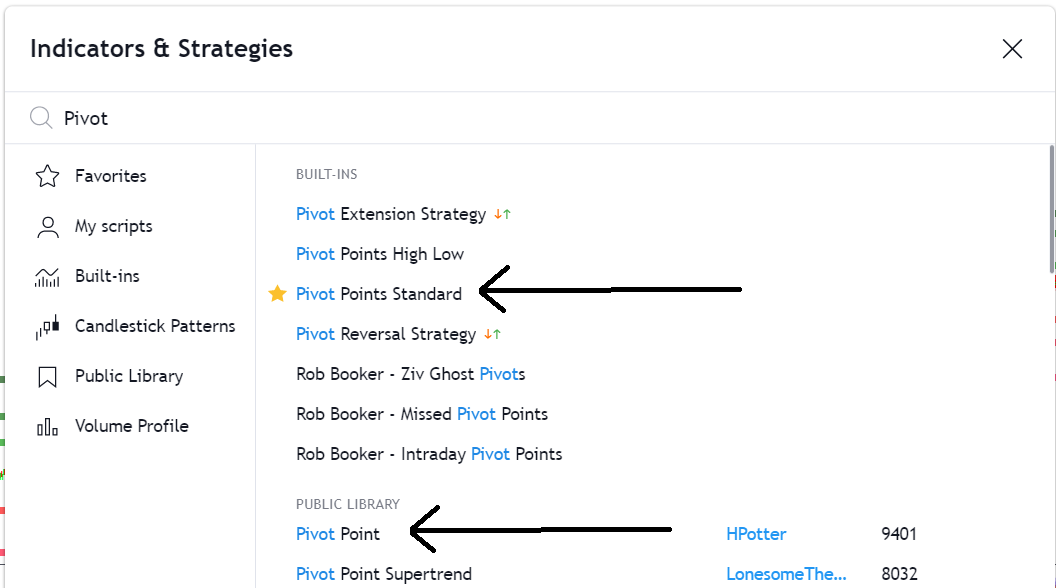

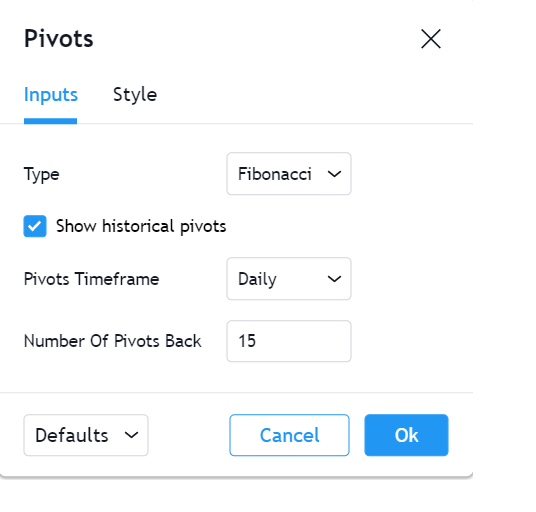

Tool 1- Pivot Points:

They are reversal points based the historical prices.

Go to the indicators tab and type 'Pivot point standard'

The settings to be used have been disclosed in the pic below.

Note- You can choose your own settings but I have disclosed the ones I use.

They are reversal points based the historical prices.

Go to the indicators tab and type 'Pivot point standard'

The settings to be used have been disclosed in the pic below.

Note- You can choose your own settings but I have disclosed the ones I use.

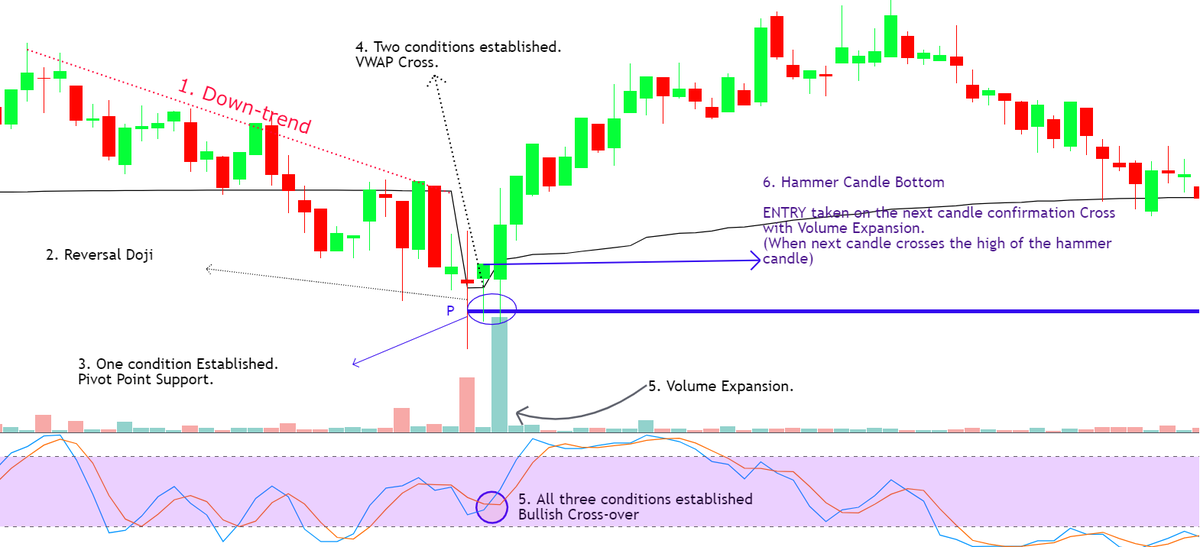

This is what they will Look like.

Ignore All notations and just remember.

ALL the lines are Support or Resistance lines

(Lines of Interest)

It doesn't matter if it's been denoted as P,R or S.

We will learn how to use them below, practically.

Ignore All notations and just remember.

ALL the lines are Support or Resistance lines

(Lines of Interest)

It doesn't matter if it's been denoted as P,R or S.

We will learn how to use them below, practically.

You can also use the custom Indicator for Pivot Point by HPotter.

The settings for this indicator are already tweaked by the author.

Note- I don't know the author hence not able to provide credit.

The settings for this indicator are already tweaked by the author.

Note- I don't know the author hence not able to provide credit.

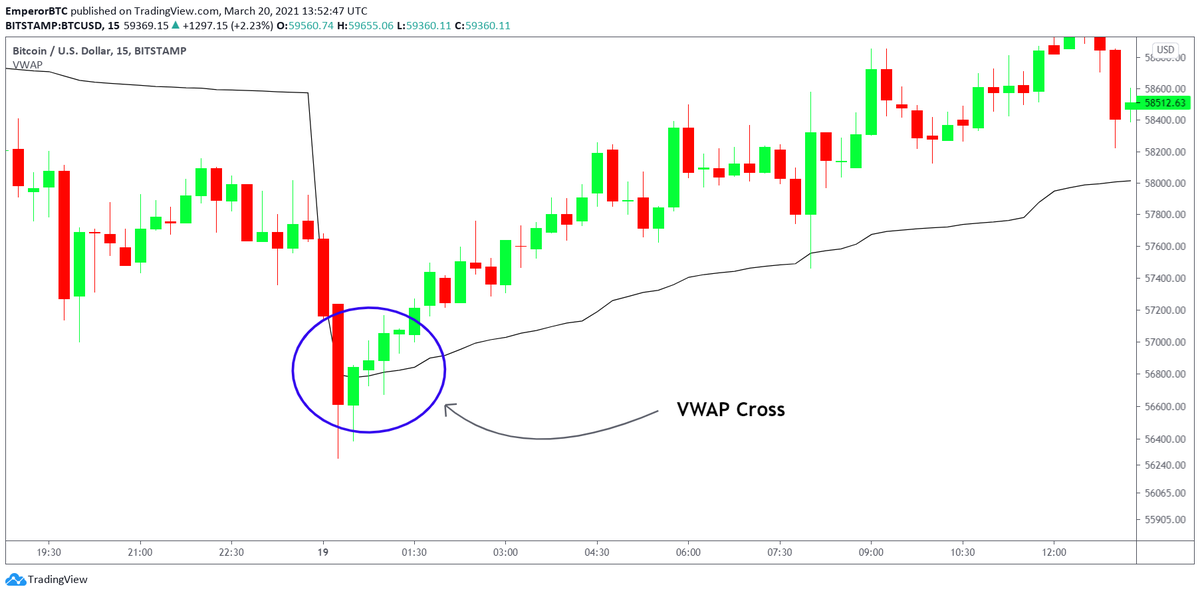

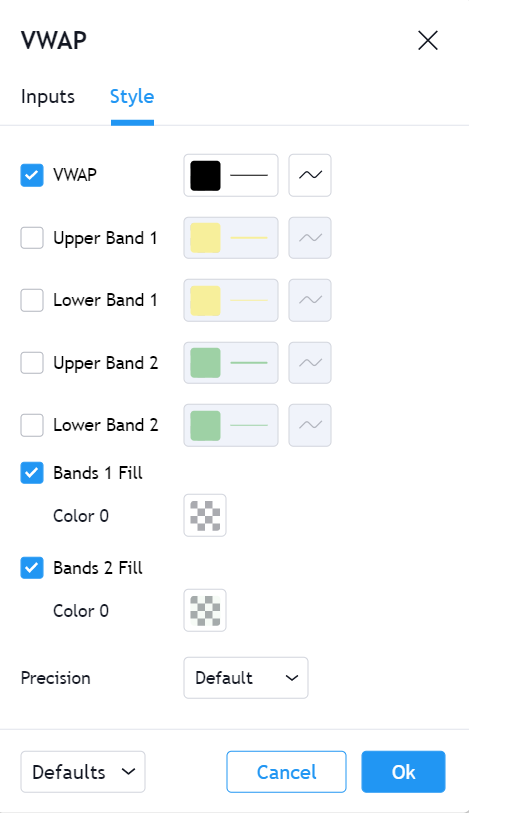

Tool 2- VWAP

Volume Weighted Average Price indicates an overall trend of the market by INCLUDING VOLUME in the average prices.

Sometimes, it filters out fake-outs with low volumes, hence being a powerful indicator.

We are looking for a VWAP Cross.

Volume Weighted Average Price indicates an overall trend of the market by INCLUDING VOLUME in the average prices.

Sometimes, it filters out fake-outs with low volumes, hence being a powerful indicator.

We are looking for a VWAP Cross.

Note on VWAP

- It CANNOT be used on it's own

-It works best on time frame lower than 4 hours.

I have highlighted my VWAP settings below.

- It CANNOT be used on it's own

-It works best on time frame lower than 4 hours.

I have highlighted my VWAP settings below.

Tool 3- Stoch RSI

It is comprised of 2 Lines.

K- The faster line (Blue line in example)

D- The slower Line (Red line in example)

When the Blue line goes above the red line, it's a Bullish cross-over.

Note- We will not deal with the concept of over-bought and over sold here.

It is comprised of 2 Lines.

K- The faster line (Blue line in example)

D- The slower Line (Red line in example)

When the Blue line goes above the red line, it's a Bullish cross-over.

Note- We will not deal with the concept of over-bought and over sold here.

CONDITIONS for LONG entry.

The tools mentioned should give the following signal.

• Bullish Stoch RSI cross-over.

• VWAP Break to the upside.

• Pivot point support established or resistance break.

The sequence of signals doesn't matter.

Note- Exact opposite for Shorting.

The tools mentioned should give the following signal.

• Bullish Stoch RSI cross-over.

• VWAP Break to the upside.

• Pivot point support established or resistance break.

The sequence of signals doesn't matter.

Note- Exact opposite for Shorting.

•Strategy works best for scalping.

•Can be combined with Volume Expansion.

•Occurrence of candle-stick pattern increases probability.

ONLY Enter AFTER all three of the above have taken place.

Entry to be made on candle confirmation

(Next candle above the current candle)

•Can be combined with Volume Expansion.

•Occurrence of candle-stick pattern increases probability.

ONLY Enter AFTER all three of the above have taken place.

Entry to be made on candle confirmation

(Next candle above the current candle)

Understanding of Price actions and practice over time will make this the most successful and Addictive strategy.

Here is an example of Pivot Points acting as support and as resistance on the next target.

Here is an example of Pivot Points acting as support and as resistance on the next target.

Using basic knowledge of

-Volume

-Candlestick Patterns

-Confirmations

Will lead to a higher probability entry.

Note- It will reduce the amount of entry but increase the profitability ration.

Example.

-Volume

-Candlestick Patterns

-Confirmations

Will lead to a higher probability entry.

Note- It will reduce the amount of entry but increase the profitability ration.

Example.

Conclusion-

• Use the strategy for Day-trading

•Don't use the indicators alone

•WAIT FOR ALL the signals.

• This is not a perfect strategy. It will fail.

Follow Risk management. Always.

Combining it with PA, Volume will give magical results.

• Use the strategy for Day-trading

•Don't use the indicators alone

•WAIT FOR ALL the signals.

• This is not a perfect strategy. It will fail.

Follow Risk management. Always.

Combining it with PA, Volume will give magical results.

So this is my secret and now it's yours.

I enter into MANY scalp entries but don't share much because

•It's too fast.

•Needs constant management.

•Is risky if done without Risk Management.

Try is on live charts and PLEASE share it a lot.

Love you guys.

I need to sleep now.

I enter into MANY scalp entries but don't share much because

•It's too fast.

•Needs constant management.

•Is risky if done without Risk Management.

Try is on live charts and PLEASE share it a lot.

Love you guys.

I need to sleep now.

• • •

Missing some Tweet in this thread? You can try to

force a refresh