Innovation is what drives societies forward.

People create new ways of doing things. This alters incentives and shifts behaviours. Creative destruction ensues and opportunity creates new players, rules & systems.

Restrict innovation and a jurisdiction will fall behind.

People create new ways of doing things. This alters incentives and shifts behaviours. Creative destruction ensues and opportunity creates new players, rules & systems.

Restrict innovation and a jurisdiction will fall behind.

There are three key markers of a disruptive innovation:

1. Born from a catalyst

2. Perceived as a toy/novelty

3. FUD from incumbents/concerned citizens

Let’s look at how Bitcoin has tracked these over time.

1. Born from a catalyst

2. Perceived as a toy/novelty

3. FUD from incumbents/concerned citizens

Let’s look at how Bitcoin has tracked these over time.

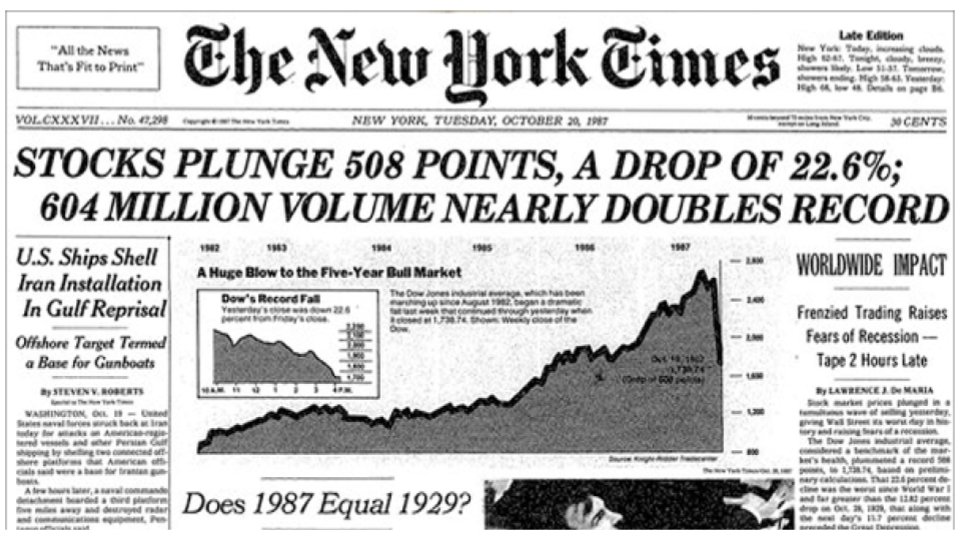

Satoshi’s message in the genesis block points us to the GFC and subsequent bailout of financial institutions.

The architects of the crisis would be protected from the full consequences of their actions.

The architects of the crisis would be protected from the full consequences of their actions.

Everything you consider essential today initially seemed like a novelty:

Automobiles- slow, clunky death traps that get bogged in the mud

Cell Phones- prohibitively expensive giant walkie-talkies with poor coverage

Bitcoin i̵s̵ was no exception.

Automobiles- slow, clunky death traps that get bogged in the mud

Cell Phones- prohibitively expensive giant walkie-talkies with poor coverage

Bitcoin i̵s̵ was no exception.

Opposition to new innovation largely comes from those with the most to lose- incumbents who are invested in the existing systems or dependent on them for their income.

Simply put- people are bad judges at how a technology will be used in the future and no-one wants to look dumb in hindsight by being hyperbolic.

h/t @PoorlyAgedStuff

h/t @PoorlyAgedStuff

Here’s a helpful tool for understanding how people think about new technologies. It’s known as Amara’s Law.

Let’s take a step back and define innovation.

“Innovation is the business of turning a new device into something practical, affordable and reliable that people will want to use and acquire.” @mattwridley

“Innovation is the business of turning a new device into something practical, affordable and reliable that people will want to use and acquire.” @mattwridley

Innovation is an iterative process. It’s the result of lots of tinkering, trial & error, and building on existing ideas/methods.

Bitcoin was 40 years in the making.

h/t @danheld

Bitcoin was 40 years in the making.

h/t @danheld

So what exactly is innovative about Bitcoin?

“the invention of Bitcoin represents the discovery of absolute scarcity, or absolute irreproducibility, which occurred due to a particular sequence of idiosyncratic events that cannot be reproduced.” -@Breedlove22

“the invention of Bitcoin represents the discovery of absolute scarcity, or absolute irreproducibility, which occurred due to a particular sequence of idiosyncratic events that cannot be reproduced.” -@Breedlove22

This takes us to a new paradigm. We now have a digitally-native money that is global, permissionless and operates 24/7.

“technology often changes where business value is derived from.. Digital delivery changed the rules. Information could travel much further and faster, and, as a result, it reduced the value of traditional distribution power.”

@JeffBooth

@JeffBooth

Bitcoin also alters the balance of power in the social contract between individuals and jurisdictions, increasing the leverage of the individual in the negotiation.

Capital and talent will now go to where it’s treated best, inciting jurisdictional competition.

Capital and talent will now go to where it’s treated best, inciting jurisdictional competition.

We should expect this trend to play out faster than previous shifts of such magnitude.

“In order to think about the future correctly, you need to imagine things moving at a much faster rate than they’re moving now.”

@waitbutwhy

“In order to think about the future correctly, you need to imagine things moving at a much faster rate than they’re moving now.”

@waitbutwhy

Each transition has been the result of innovations that fundamentally shifted our behaviour (en masse) by offering new efficiencies and incentives

The current transition that’s underway- from the Industrial Age into the Information Age- is being ushered in as a result of its own set of remarkable innovations.

Once again we’re seeing the process of creative destruction play out as institutions of the past, designed for a different time with different rules, lose relevance.

https://twitter.com/anilsaidso/status/1366885623009669123?s=21

But as mentioned earlier, the speed of change/rate of adoption is exponentially faster when the majority of the world is connected by a ‘network of networks’- the internet.

https://twitter.com/woonomic/status/1356310219215699968?s=21

/END

Some highly recommended books that will improve your understanding of: how innovation develops > how that alters incentives > how that shapes society

The Price of Tomorrow by @JeffBooth

How Innovation Works by @mattwridley

The Almanack of @naval by @EricJorgenson

Some highly recommended books that will improve your understanding of: how innovation develops > how that alters incentives > how that shapes society

The Price of Tomorrow by @JeffBooth

How Innovation Works by @mattwridley

The Almanack of @naval by @EricJorgenson

• • •

Missing some Tweet in this thread? You can try to

force a refresh