CAMS: An ignored platform business

A thread 👇

@safiranand @CapitalSapling @suru27 @nid_rockz @aditya_kondawar @abhymurarka

A thread 👇

@safiranand @CapitalSapling @suru27 @nid_rockz @aditya_kondawar @abhymurarka

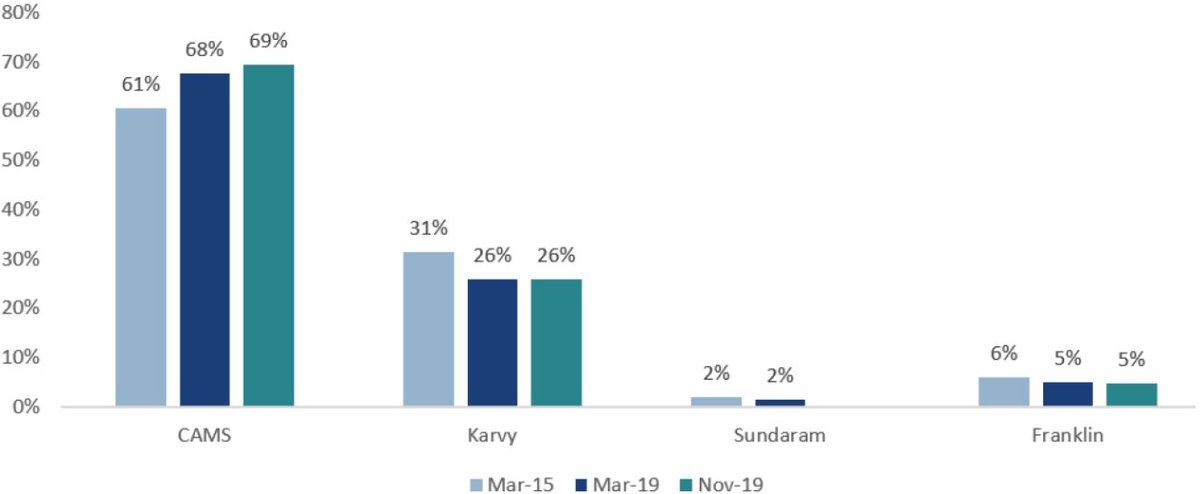

CAMS is India’s largest RTA (Registrar and transfer agent) player having a 70%+ share in MF AUM. The MF industry is poised to grow at a CAGR of 17%-19% wherein Equity MF AUM is expected to grow at a CAGR of 21%-23%

(1/n)

(1/n)

The industry has high entry barriers 🛑

Compliance requirements, Technology intensity, Extensive branch network, High operating leverage, Domain knowledge, Sticky relationships due to integration with MF ecosystem

(3/n)

Compliance requirements, Technology intensity, Extensive branch network, High operating leverage, Domain knowledge, Sticky relationships due to integration with MF ecosystem

(3/n)

CAMS clients include 4 of the top 5 mutual funds in the country and 10 of the top 15 mutual funds such as HDFC Asset Management Company Limited, ICICI Prudential Asset Management Company Limited, SBI Funds Management Private Limited, and Aditya Birla Capital Limited

(4/n)

(4/n)

The AUM of equity-oriented funds grew at a CAGR of 39%, from ₹2.1 trillion in the financial year 2014 to ₹10.7 trillion for the financial year 2019, whereas the debt segment grew at a CAGR of 9% during the same period

(6/n)

(6/n)

RTAs charge higher fees for managing Equity MFs and compared to Debt MFs and the expansion of Equity MFs with retail investors will lead to higher revenues and operating margins for CAMS

(7/n)

(7/n)

The AUM of equity mutual funds serviced by CAMS grew from ₹2,180 billion as of March 31, 2015 to INR 6,643 billion as of March 31, 2019, at a CAGR of 32.1%, and as of September 30, 2019 was INR 6,701 billion

(8/n)

(8/n)

Strong industry relationship

The term of relationship with HDFC Asset Management Company Limited, ICICI Prudential Asset Management Company Limited, SBI Funds Management Private Limited & Aditya Birla Capital Limited, CAMS four largest mutual fund clients, averages 17 years (9/n)

The term of relationship with HDFC Asset Management Company Limited, ICICI Prudential Asset Management Company Limited, SBI Funds Management Private Limited & Aditya Birla Capital Limited, CAMS four largest mutual fund clients, averages 17 years (9/n)

Scalable Technology: From handling over 98 million transactions in the financial year 2015, CAMS handled over 313 million transactions in the financial year 2019

(10/n)

(10/n)

CAMS serviced funds and CAMS’s assets, stood at INR 19.4 trillion as of 30th September FY21 having YoY growth of 7% and QoQ growth of 11%+

(11/n)

(11/n)

CAMS has the highest revenue in the industry and also witnessed the highest revenue growth in the past three years with a CAGR of 20.4% in between financial years 2016 and 2019

(12/n)

(12/n)

For the financial year 2019, CAMS revenue from operations has grown by 8.1% and its EBITDA margins and RoE are better than its competitors

CAMS is the most productive MF RTA with its AUM per branch of 6154 being the highest in the industry

(13/n)

CAMS is the most productive MF RTA with its AUM per branch of 6154 being the highest in the industry

(13/n)

Valuation:

The company is currently trading at a P/E multiple of 43.7x for FY21E

Higher revenue growth of 17% - 19% combined with EBITDA margins of 37% - 39% puts CAMS in a favorable position supporting the premium valuation

(14/n)

The company is currently trading at a P/E multiple of 43.7x for FY21E

Higher revenue growth of 17% - 19% combined with EBITDA margins of 37% - 39% puts CAMS in a favorable position supporting the premium valuation

(14/n)

Valuation of the company will be driven by its future growth, having greater than 70% market share in a niche growing industry (17%-19% expected industry growth) with high entry barriers, stable EBITDA margins, and low CapEx requirement

(15/n)

(15/n)

CAMS is a high cash-generating business with low CapEx requirements. CAMS has also been regularly paying dividends

Operating leverage expected to improve operating margins with high AUM growth of 17% to 19% which directly impacts the business revenue growth

(16/n)

Operating leverage expected to improve operating margins with high AUM growth of 17% to 19% which directly impacts the business revenue growth

(16/n)

Higher growth in equity MFs going forward as equity markets are performing well. Equity MFs are high margin business for CAMS which are expected to grow at a CAGR of 21% - 23%

The company has zero debt. ROE of 38% and ROCE of 33.4% for FY20

(17/n)

The company has zero debt. ROE of 38% and ROCE of 33.4% for FY20

(17/n)

Interesting dynamics:

Direct plan and regular plan does not have any impact on RTA fees as they impact only on distributors’ fee

Major part of the revenue earned by MF RTAs (over 80%) is by means of fees charged on the AUM managed by the AMCs

(18/n)

Direct plan and regular plan does not have any impact on RTA fees as they impact only on distributors’ fee

Major part of the revenue earned by MF RTAs (over 80%) is by means of fees charged on the AUM managed by the AMCs

(18/n)

Insurance repository, AIF, and NBFC are the future growth drivers for CAMS. Loans against MF have gained traction for which CAMS has a partnership with HDFC bank and ICICI bank. Top tier NBFCs and Banks are expanding now and have started to collaborate

(19/n)

(19/n)

India’s mutual fund penetration (AUM to GDP) of 11% is significantly lower than the world average of 55%

Enhanced availability of information and ease of usage that technology-backed platforms have been providing has aided the mutual fund industry

(20/n)

Enhanced availability of information and ease of usage that technology-backed platforms have been providing has aided the mutual fund industry

(20/n)

Consistent high retail investor participation

The following image shows AUM share by investor classification

(21/n)

The following image shows AUM share by investor classification

(21/n)

Kindly retweet and share for everyone, if you found it useful and of course for good karma :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh