In my latest note I discuss the seminal decision by the NZ PM to tell their CB to target runaway house prices as well as CPI (see @macro_business below). Others will likely follow. I go on connect high property prices with young men's collapsing sex lives and #wallstreetsbets...

https://twitter.com/macro_business/status/1375231276601331717

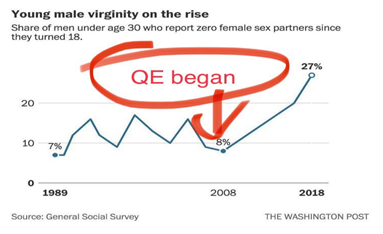

...An WaPo article a little while back highlighted the shock tripling of young men under 30 who are not having sex. This trend was specific to young men. @_cingraham offers some interesting explanations and one of them is that young men, far more than young women...

... are stuck at their parents home as getting their own place is unaffordable - because of the impact of QE on house prices. This makes sex more inopportune. Of course it may be a coincidence that as @jameswhelan42 notes, this surge in chastity started at the same time as QE...

...So what do young men, disproportionally stuck in their bedrooms of their parents homes during the pandemic get up to behind closed doors? Doing nothing is not an option! Psychologists at Virginia Uni found that men will do almost anything to alleviate boredom including ...

.. willingly administering themselves painful electric shocks to distract themselves! This is something peculiar to men!

Maybe the explosion of retail trading by predominantly young men may be the equivalent of giving themselves a release from boredom behind closed doors...

Maybe the explosion of retail trading by predominantly young men may be the equivalent of giving themselves a release from boredom behind closed doors...

... So to the extent CB QE has caused young men to remain in the parental home, destroying their sex lives, maybe #wallstreetsbets is simply a sex substitute to relieve boredom without waking up the parents! I blame the Fed!

theguardian.com/science/2014/j…

theguardian.com/science/2014/j…

• • •

Missing some Tweet in this thread? You can try to

force a refresh