I just sold some UMA call options (UMAc35-0421). Looks like a good trade for a holder of $UMA. You either make 64% annualized picking up premium or you sell UMA 68% above the market. Options weren’t my specialty so let me know if my thinking makes sense. Here’s what I did...

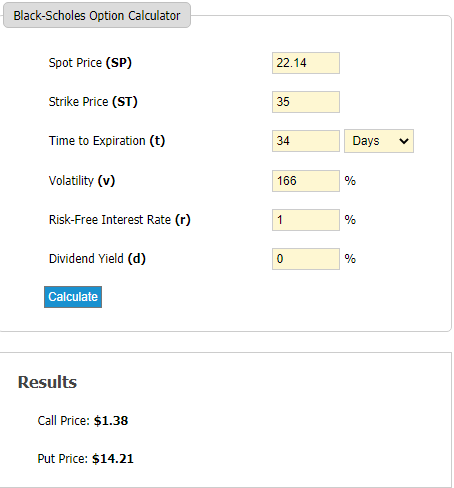

The $35 strike that expires on April 30th trades on SushiSwap at 6.1% of an UMA. Plugging in everything that's known into a Black-Scholes calculator on the web, this implies a 166% annualized implied volatility. (6.1% * $22.14 = $1.35 - I tried my best to match that put price)

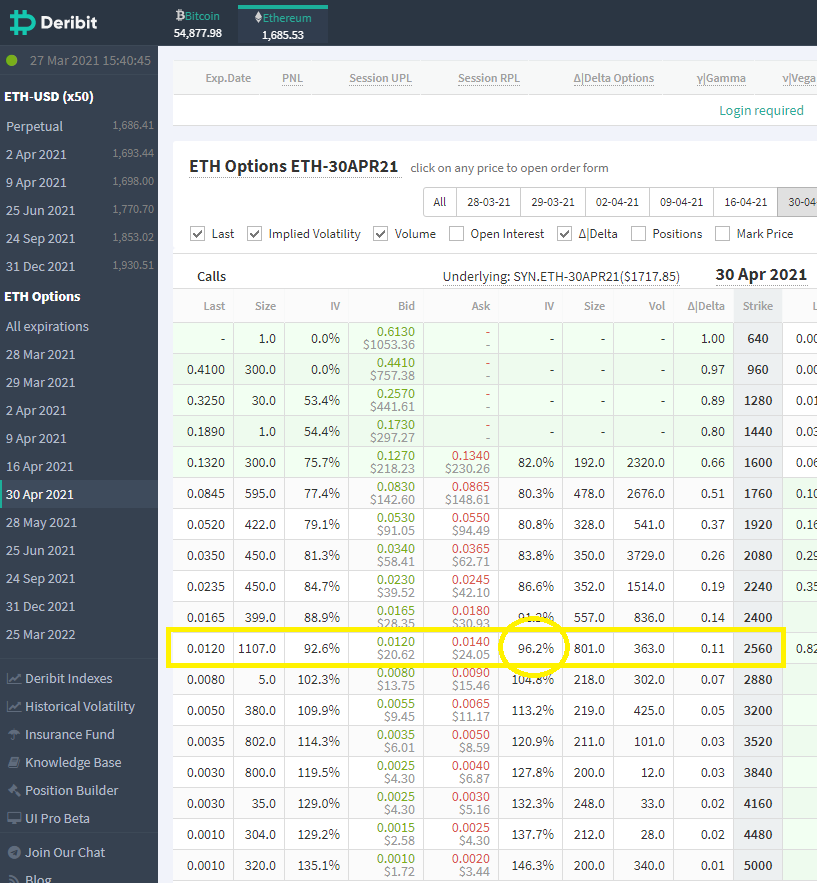

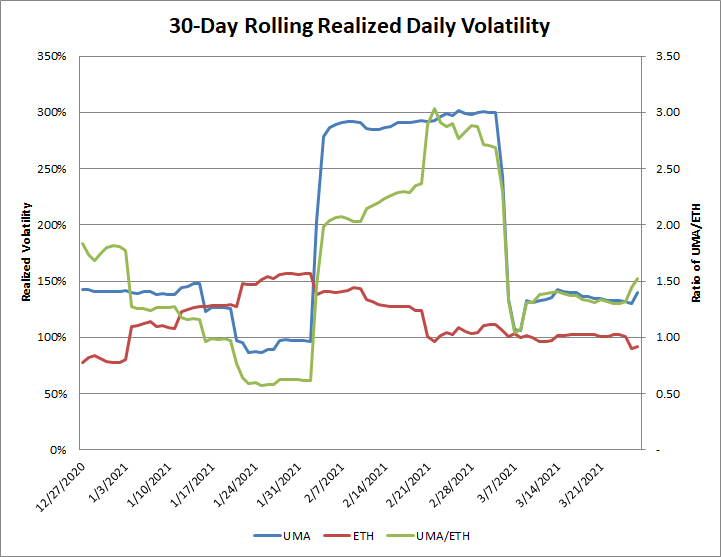

Taking the two implied vols as a ratio that implies $UMA is 1.7x (166/96.2) more volatile than $ETH. I was curious so I also checked UMA and ETH's 30-day rolling daily realized volatility and it seemed in line to a little higher.

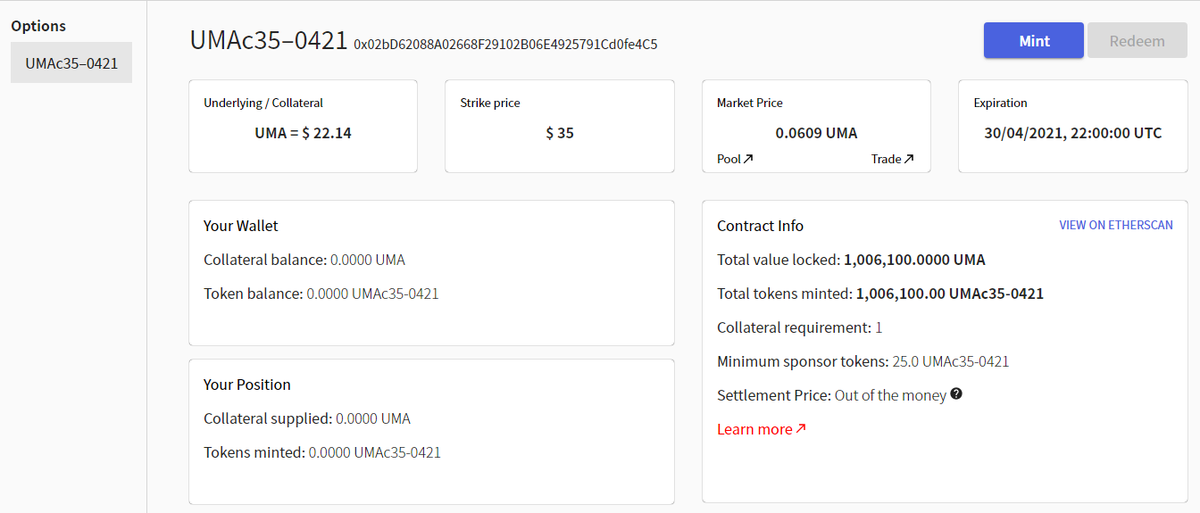

Now what to do... To sell these calls you first need to mint them. Thanks to UMA community member @edsonacala we now have a UI (mysynths.finance) to do this! You deposit 1UMA per call option you wish to mint.

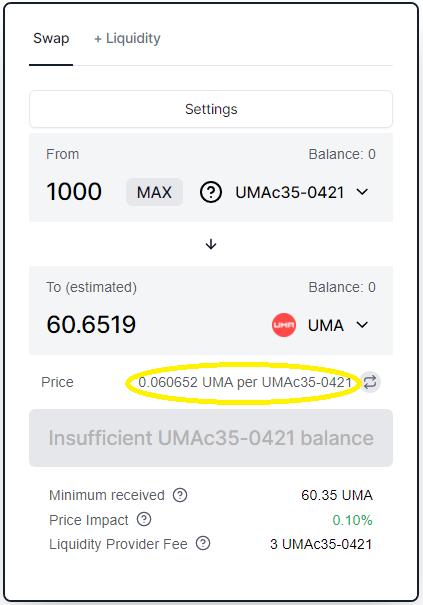

The UI provides a link to the pair on SushiSwap. There is a liquid market for you to swap those calls into UMA. You get 0.061 $UMA per UMAc35-0421 call option token you sell. By selling the calls what kind of risk do you put myself into...

If $UMA stays below $35 you collect the 0.061 $UMA and you can redeem your call options and get all your UMA collateral back. That’s a 6.1% return in about a month or roughly 64% APY.

If $UMA rallies above $35 you effectively sell UMA at $37.14 (35 + 35*0.061). That’s 68% higher than where it is today so not a bad place to take some profits.

The call options are cash settled so what really happens is the difference between 35 and where $UMA settles at expiry is withdrawn from your collateral. The remaining collateral would be worth 37.14 USDC per call option you sold.

For long term holders of $UMA both outcomes are positive and net this seems like an easy way to earn yield or take profits on a decent rally in the token. You can learn more about these call options here.

medium.com/uma-project/um…

medium.com/uma-project/um…

• • •

Missing some Tweet in this thread? You can try to

force a refresh