How long can a short tail get and can @thorchain_org benefit from economically less significant assets.

Let me break it down for you

👇👇👇

Let me break it down for you

👇👇👇

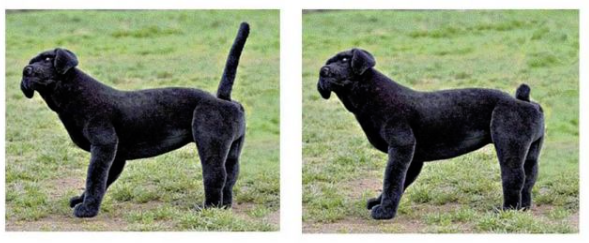

Short tail, in the context of @thorchain_org, means assets that are most economically active (deep pools, lots of large transactions). Because all the assets are actively managed, only the deep pools with lots of activities create significant revenue potential.

👇👇

👇👇

But what does “active management” of assets actually mean? Every swap demands resources and liquidity and neither is infinite. Every asset, once it is in the system, no matter how small and insignificant it is, becomes @thorchain_org's problem to manage, move, account for etc

👇

👇

The assets sit in vaults, the vaults are managed by the nodes. Every churn, all assets migrate from one vault to another. Quoting after Leena: “...what is the cost to put 24 nodes with their CPUs pegged at 100% for 15-20seconds straight just to migrate assets from one vault to 👇

another every 2 days. Plus the chain bloat that comes with these small pools. A pool with $100 in $RUNE that never attracts revenue cannot pay for the TSS compute speeds, let alone the other costs”.

👇👇

https://twitter.com/thorchain_org/status/1367741815051276294?s=20

👇👇

Now, that we understand the motivation behind the short tail assets in the network, lets ponder over another question - how long can a short tail get? Well, this is quite arbitrary now. The Chaosnet will be limited to 20 – 30 pools, but it can easily handle 100 and more pools

👇

👇

It will start with native crypto assets, like $BTC, $ETH, $BNB, $ATOM, $DOT, $XHV leading wrapped tokens, and other chains. In time it will work with any economically significant chain or asset (like tokenized stocks, indexes etc)

👇👇

https://twitter.com/PressieMoonBoy/status/1362086718803968001?s=20

👇👇

The short tail assets are going to be huge for all players @thorchain_org. But what about the long tail? Can @thorchain_org benefit from the less significant assets in any way? The answer is a massive YES and this is where the magic happens.

👇👇

https://twitter.com/Bitcoin_Sage/status/1349368735321239555?s=20

👇👇

To understand how, you need to understand the multi-step swaps a.k.a swap path. See, any decentralized or centralized service can easily connect to @thorchain_org and add it to its swap path. It does not have to ask for any permission - a single line of code does a job.

👇👇

👇👇

Let's examine the following scenario. A user wants to swap eRDLS (ERC20) for JIGG (BEP20). Neither of those assets has a pool on @thorchain_org but both #Sushiswap and #pancakeswap are integrated with @thorchain_org hence the path can easily lead through ETH-RUNE-BNB pools

This will bring a transaction swap and all the arb swaps that will be required to balance the pools @thorchain_org . The benefit for the LPs, nodes and the network is obvious, and the user may not even know that she used @thorchain_org protocol.

👇👇

👇👇

This is yet another example of a genius behind the @thorchain_org design, that makes it possible to swap obscure wrapped assets from different chains in a permissionless, open, decentralized, fully secured and bonded way.

Bullish AF!

/fin

Bullish AF!

/fin

• • •

Missing some Tweet in this thread? You can try to

force a refresh