my paper on the new Development as Derisking paradigm, or #WallStreetConsensus, or Washington Consensus updated for age of financial globalisation, is now out!

thanks to @BJMbraun @nssylla @squirrelista @NanCAlexander @clariscap @crystalsimeoni

onlinelibrary.wiley.com/doi/full/10.11…

thanks to @BJMbraun @nssylla @squirrelista @NanCAlexander @clariscap @crystalsimeoni

onlinelibrary.wiley.com/doi/full/10.11…

and many insightful comments @Frauke77487323 @wangkinoti @LoescherAnne @anninak82 @ingridharvold @WarwickCFG @natalyanaqvi

it all started here, a life time ago, when evidence of the portfolio glut chasing development assets in the Global South was not so difficult to come by

https://twitter.com/DanielaGabor/status/1051156947393634304?s=20

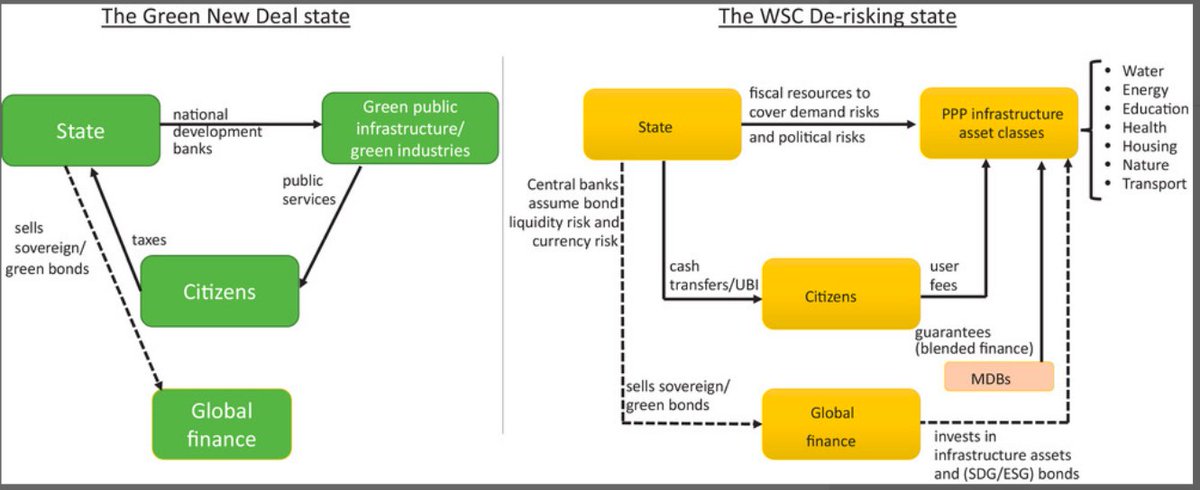

every time you read 'gap' or 'partnership' in climate/development conversations, these are code-words for derisking state

this creates safety net for holders of development assets, protecting their profits from

demand/political/climate/liquidity and currency risks.

this creates safety net for holders of development assets, protecting their profits from

demand/political/climate/liquidity and currency risks.

paper develops the concept of 'green financialization':

1. Financiers as epistemic guardians of green/dirty taxonomies - greenwashing!

2. Strategies to arbitrage dirty finance regulations

3. Strategies to transfer the costs of greenwashing to the state via de‐risking

1. Financiers as epistemic guardians of green/dirty taxonomies - greenwashing!

2. Strategies to arbitrage dirty finance regulations

3. Strategies to transfer the costs of greenwashing to the state via de‐risking

WSC is also a claim to power - @BJMbraun 's infrastructural power - that private finance wields to new areas of social life

https://twitter.com/BJMbraun/status/1376469355840557059?s=20

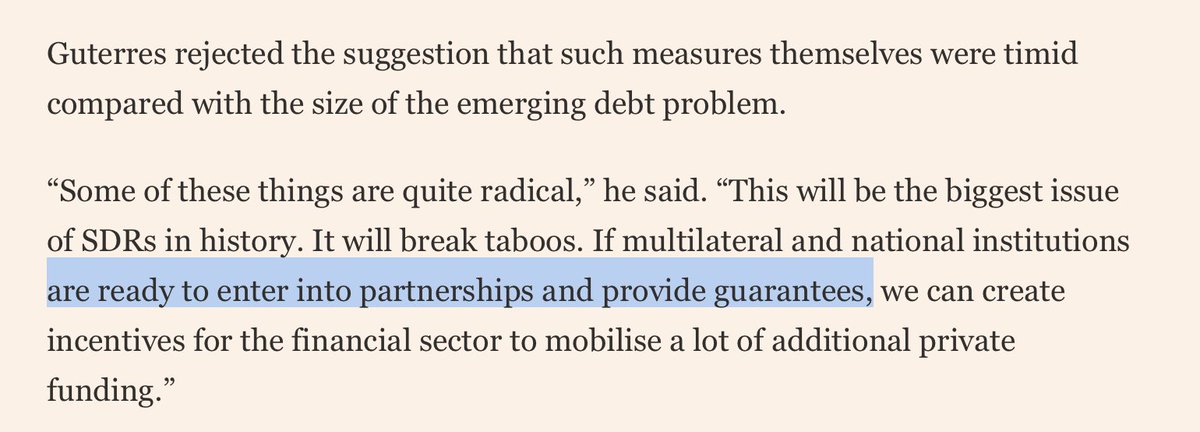

#WallStreetConsensus in @FT today - António Guterres, secretary-general of the UN, calling for Derisking to mobilise private finance for development as a solution to the incoming debt crisis (h/t @AnnPettifor )

ft.com/content/abcd97…

ft.com/content/abcd97…

last December, with @nssylla, we traced how #WallStreetConsensus hides in the Trojan Horse of the Macron Doctrine

https://twitter.com/DanielaGabor/status/1342039164687183873?s=20

the #WallStreetConsensus research agenda is rich:

1. The politics of the derisking state.

we shouldnt assume that ideas baked in Global North travel seamlessly to countries down South - what are local strategies for rolling out derisking state, what role for political elites?

1. The politics of the derisking state.

we shouldnt assume that ideas baked in Global North travel seamlessly to countries down South - what are local strategies for rolling out derisking state, what role for political elites?

It is no coincidence that 'Liquidity' is now at the core of global debates on debt vulnerability and debt relief

https://twitter.com/eurodad/status/1376535916974637063?s=19

and president of @el_BID calls for derisking to mobilise private finance for development

you know we're in post Trump times when WB president calls for G20 countries to push private creditors in their jurisdictions into debt negotiations, as 'voluntary participation doesnt work'

Speaking of varieties of, and resistance to, derisking

https://twitter.com/brettonwoodspr/status/1376561396222197764?s=19

one of the things I learnt early as a political economist is to ask 'works for whom?' instead of 'does it work?'

the #WallStreetConsensus is a political strategy to ensure that the climate crisis works for private finance.

theguardian.com/business/2021/…

the #WallStreetConsensus is a political strategy to ensure that the climate crisis works for private finance.

theguardian.com/business/2021/…

Green(washed) conditionality/structural adjustment is coming soon to a debt distressed country near you, and it will be drawn from the Wall Street Consensus repertoire!

• • •

Missing some Tweet in this thread? You can try to

force a refresh