Professor of Economics/MacroFinance. Critical macrofinance, central banks, repos, shadow banking, WallStreetConsensus https://t.co/YGZItchHwL https://t.co/XPNo2sR5Gm

14 subscribers

How to get URL link on X (Twitter) App

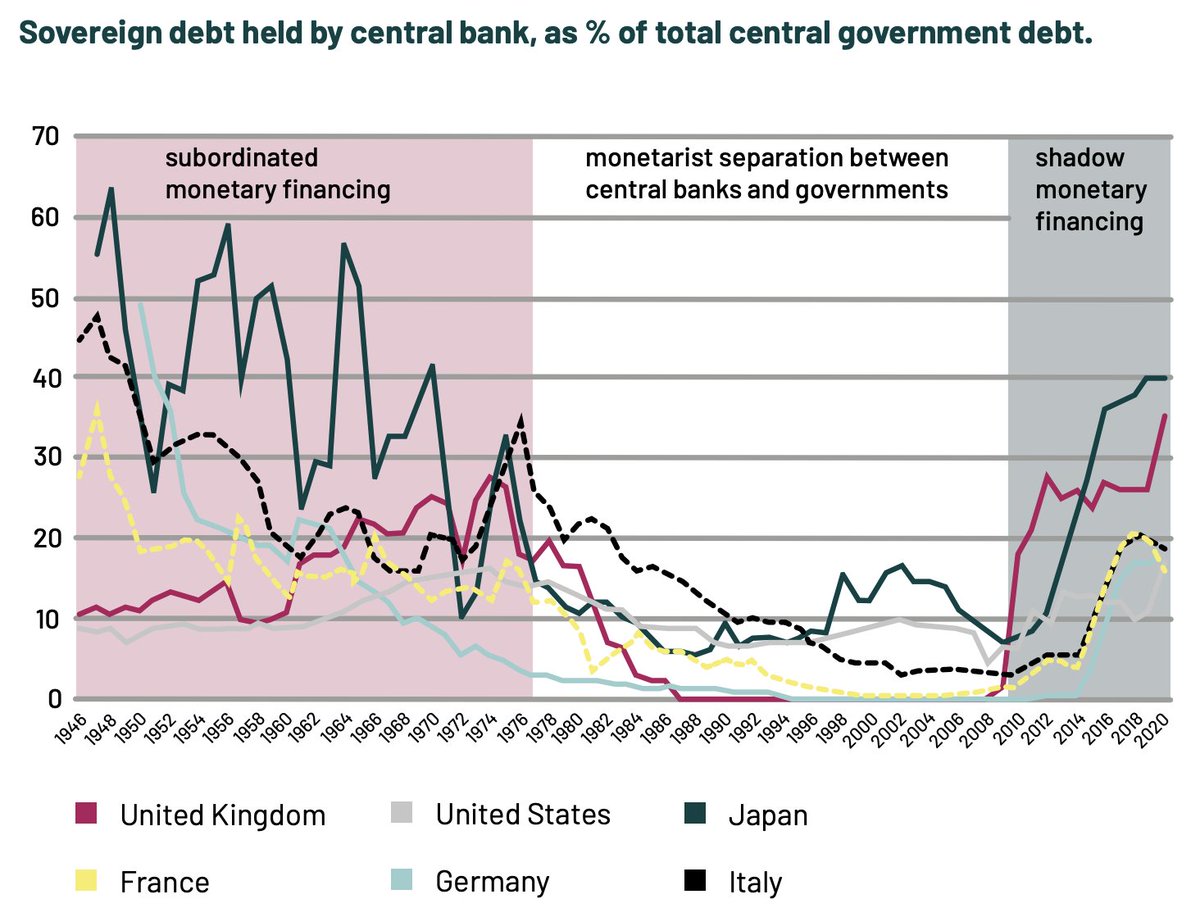

The Fed calls this Reserve Management Purchases but it's central bank support for government debt (and for Trump's policies more broadly), a form of monetary-fiscal coordination pervasive in the age of fiscal dominance after WW2.

The Fed calls this Reserve Management Purchases but it's central bank support for government debt (and for Trump's policies more broadly), a form of monetary-fiscal coordination pervasive in the age of fiscal dominance after WW2.

https://twitter.com/JohnRentoul/status/1992689629380980958Rentoul doesnt know it but his 'good grief' reflects a monetarist choice of Bank - government relationship.

https://twitter.com/missmayn/status/1839728761358397447Institutionally owned nursing homes:

https://x.com/DanielaGabor/status/1820370771480301624

https://twitter.com/DanielaGabor/status/1785675374862438872

no punches pulled on the Commission's Net Zero Industrial Act, the 2022 attempt to respond to Biden's Inflation Reduction Act with a lot of derisking talk but no money (ahem, European Sovereignty Fund)

no punches pulled on the Commission's Net Zero Industrial Act, the 2022 attempt to respond to Biden's Inflation Reduction Act with a lot of derisking talk but no money (ahem, European Sovereignty Fund)

@FT with @BJMbraun we've termed this a weak derisking macrofinancial regime - a set of policies (as in the G20 Infrastructure as an Asset Class agenda, or World Bank Maximising Finance for Development) that seeks to mobilise private capital into infrastructure

@FT with @BJMbraun we've termed this a weak derisking macrofinancial regime - a set of policies (as in the G20 Infrastructure as an Asset Class agenda, or World Bank Maximising Finance for Development) that seeks to mobilise private capital into infrastructure

https://twitter.com/chiaramariotti/status/1726888456872423875it is a strategic and tactical mistake for progressives to centre the superrich in climate politics.

https://twitter.com/petrogustavo/status/1713621633812791383not mincing words

https://twitter.com/PositiveMoneyEU/status/1668942609559977985?s=20s

https://twitter.com/adam_tooze/status/1670064204978479104@adam_tooze we agree that US IRA is not your 'neoliberal derisking' - a concept that I would apply to say German 'markets not industries' Energiewende, incidentally very much alive today in the German Green-SPD coalition approach

https://twitter.com/ecb/status/1669324976472698884@ecb the class struggle ratio lives on in this June conference too

https://twitter.com/DanielaGabor/status/1631338211787038720?s=20

https://twitter.com/ecb/status/1664179981784678402?s=20@ecb the @ecb was born in 1998, just as LTCM was building massive repo leverage. LTCM would collapse three months later, triggering a global margin call, and the first central bank attempts to grapple with question of systemic collateral markets.

https://twitter.com/tiempoarg/status/1660367368021762048Cronica de una crisis anunciada:

this piece is amazing in the rhetorical tricks it performs

this piece is amazing in the rhetorical tricks it performs

https://twitter.com/IsabellaMWeber/status/1658815490486157312'hey, do I care that I confirm all critiques of sexism in economics? Nein.'

derisking has mutated from co-producing investible infrastructure to investible productive capacity;

derisking has mutated from co-producing investible infrastructure to investible productive capacity;