Pax Global reported amazing results and uploaded the best presentation I've seen since we became shareholders. Market should ease concerns on capital allocation and Long Term prospects from now. As I said many times, despite the huge price increase, the best is yet to come! 👇

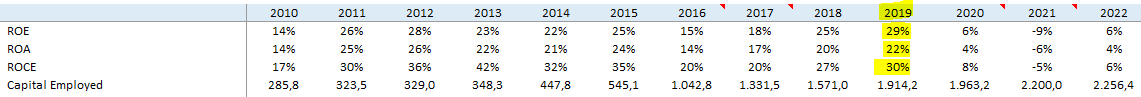

Pax reported 0.83 EPS. It increased 46% due to 44% profit increase and 1.2% share count reduction. The adjusted profit is 0.91 EPS. Minor non-cash impairments due to COVID and the stock option are the differences. Notice that Pax stock option expenses are not recurrent like in US

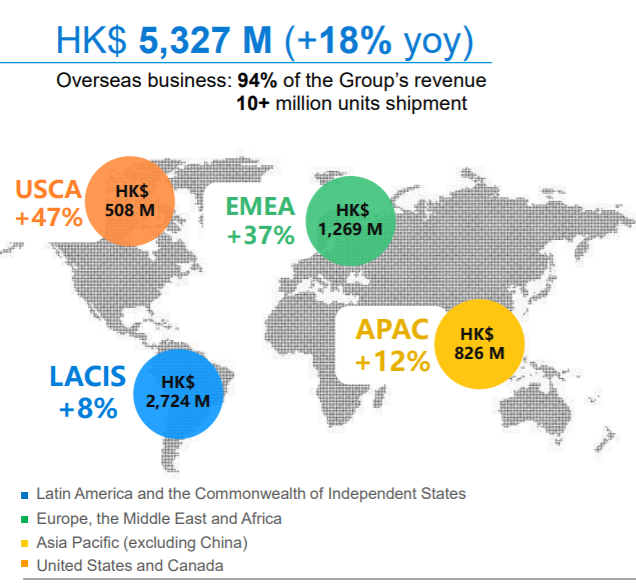

While competitors like Ingenico struggled in 2020, Pax delivered an outstanding growth in all geographies due to its superior Android portfolio and SaaS solution. Moreover,the company didn't rest on their laurels, Pax increased 16% its R&D expenses above of its 15% revenue growth

Despite I've been talking a lot about Pax moat, I feel some investors don't understand it yet. Pax is offering almost for free its amazing SaaS solutions, however, it is an important reason to understand why customers choose Pax before the competitors.

https://twitter.com/gabcasla/status/1365255928682061824?s=20

It is important to highlight that Pax management takes care of its shareholders.Pax increased significantly its dividend during 2020 and initiated a buyback plan for the first time ever. Moreover, Pax is raising 67% is half-year dividend from 6 cents to 10 cents (20 cents annual)

Despite COVID, Pax managed very well its WK and generated an strong FCF. They guided for double digit growth for 2021. You should remember that Pax guided for flatish growth on 2019 and 2020 and delivered 20% and 46% respectively. As I've said many times, the best is yet to come

Summarizing, we can buy Pax that will growth at double digit in the following years at 8x with 45% of its market cap in cash having an aligned and superb management repurchasing shares and increasing the dividend. It is real but I don't expect this inefficiency remains forever

Pax kindly will do an English call at 3pm Spanish time or 9am ET. The company is aware that their shareholder base is international so they do two earning calls. Link for register on tomorrow's call:

us02web.zoom.us/webinar/regist…

us02web.zoom.us/webinar/regist…

• • •

Missing some Tweet in this thread? You can try to

force a refresh