Fund Manager at Singular Asset Management Views my own, it is not an investment advice

5 subscribers

How to get URL link on X (Twitter) App

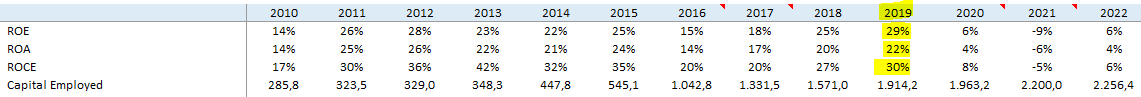

Navios is a unique shipping company with exposure to three segments: tankers, dry bulk, and containerships. Those segments have their own supply/demand dynamics and provide fantastic stability. That means NMM can play spot or take longer charters, depending on the cycle view

Navios is a unique shipping company with exposure to three segments: tankers, dry bulk, and containerships. Those segments have their own supply/demand dynamics and provide fantastic stability. That means NMM can play spot or take longer charters, depending on the cycle view

Moreover, NMM is nearing its leverage target and has recently started buybacks. There is no need to explain how accretive these repurchases are to NAV given the current discounts.

Moreover, NMM is nearing its leverage target and has recently started buybacks. There is no need to explain how accretive these repurchases are to NAV given the current discounts.

Last March, Pax announced an ambitious guidance. They were looking to grow 5%/15% in revenue and maintain a stable operating margin. That was somewhat surprising considering the POS business has a high dependence on the retail sector and the retail environment is very tough

Last March, Pax announced an ambitious guidance. They were looking to grow 5%/15% in revenue and maintain a stable operating margin. That was somewhat surprising considering the POS business has a high dependence on the retail sector and the retail environment is very tough

In 2019, Nagacorp contributed approximately 27% of local GDP tourism growth and approximately 1.2% of the national GDP in Cambodia, therefore, Nagacorp is very correlated with Cambodia's tourism which grew strongly until covid

In 2019, Nagacorp contributed approximately 27% of local GDP tourism growth and approximately 1.2% of the national GDP in Cambodia, therefore, Nagacorp is very correlated with Cambodia's tourism which grew strongly until covid

By the end of September, Naga had $298M cash and 472M debt (bond maturity June 2024). Cash has increased to $324M, but some working capital movements exist. Naga is making 28/29M monthly EBITDA or 342M annual EBITDA. Taxes are included while net interest are 30M.

By the end of September, Naga had $298M cash and 472M debt (bond maturity June 2024). Cash has increased to $324M, but some working capital movements exist. Naga is making 28/29M monthly EBITDA or 342M annual EBITDA. Taxes are included while net interest are 30M.

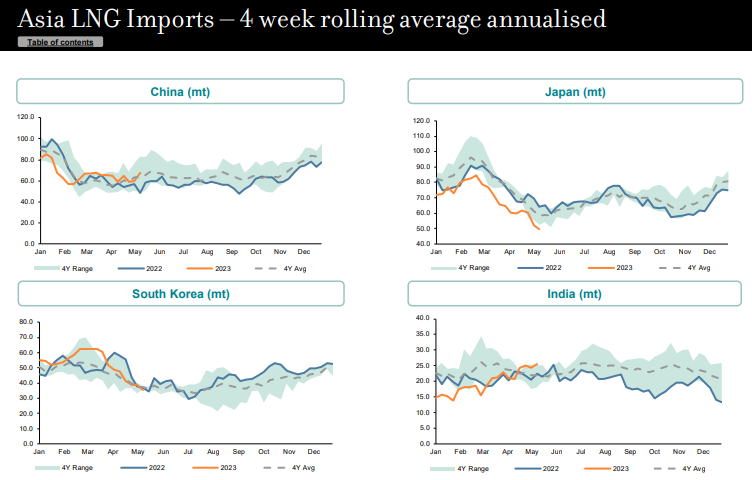

Current TFDE rates are at $45,000/day, but the forward freight market indicates it will rise to $68,000 in June, $76,000 in July, and $102,000 in August. Moreover, Q4 is expected to average $209,000/day!

Current TFDE rates are at $45,000/day, but the forward freight market indicates it will rise to $68,000 in June, $76,000 in July, and $102,000 in August. Moreover, Q4 is expected to average $209,000/day!

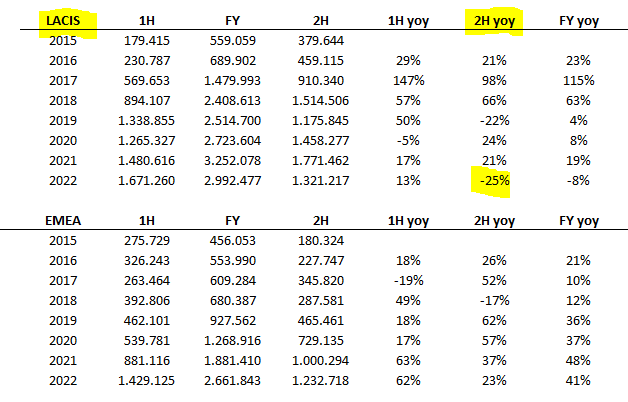

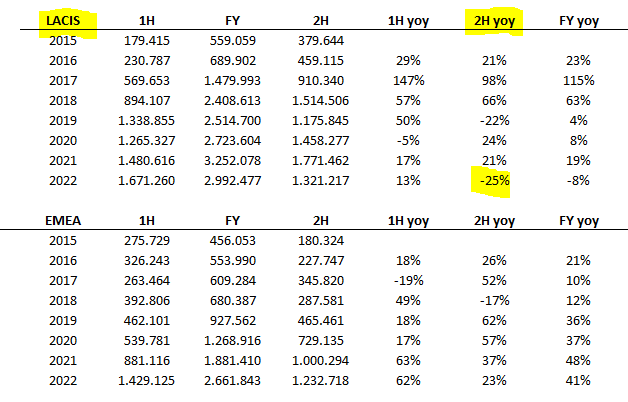

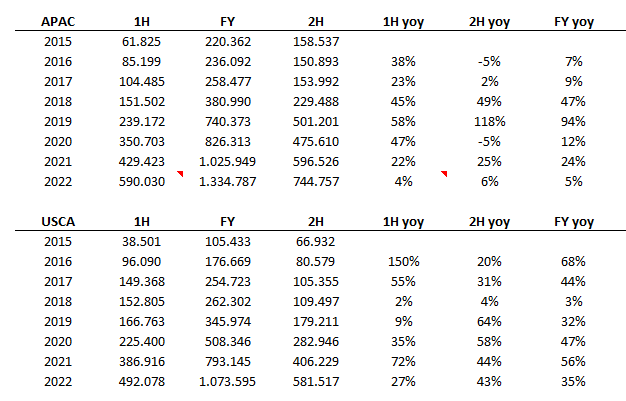

Results were great, although I was a bit more optimistic. EMEA and LACIS come slightly weaker while APAC and USCA in line. Also, Pax invested heavily in R&D, otherwise, EPS would have grown >25%. Be aware R&D expenses are in yuan which depreciated 10%, so that's a huge increase

Results were great, although I was a bit more optimistic. EMEA and LACIS come slightly weaker while APAC and USCA in line. Also, Pax invested heavily in R&D, otherwise, EPS would have grown >25%. Be aware R&D expenses are in yuan which depreciated 10%, so that's a huge increase

Unlike the stock market, where prices are based on discounted future cash flows, gas prices are formed based on current supply and demand. Commodities trade on the basis of the present, while stocks trade based on expectations and sentiment.

Unlike the stock market, where prices are based on discounted future cash flows, gas prices are formed based on current supply and demand. Commodities trade on the basis of the present, while stocks trade based on expectations and sentiment.

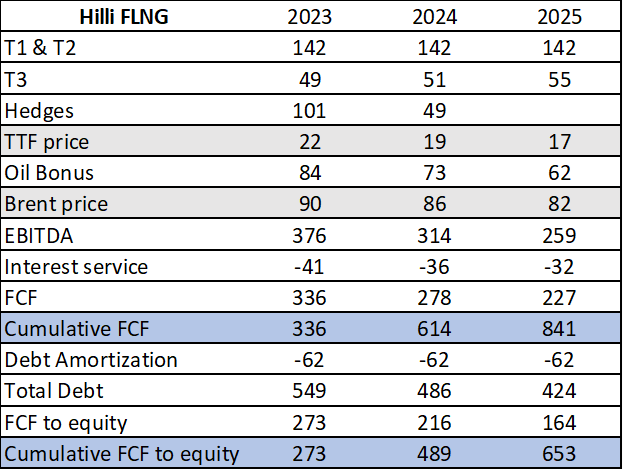

According to the news, Fortuna project will be owned by Golar (30%), NFE (30%), Kosmos and GEPetrol (20% each).I expect Golar to provide the FLNG

According to the news, Fortuna project will be owned by Golar (30%), NFE (30%), Kosmos and GEPetrol (20% each).I expect Golar to provide the FLNG

I expect Pax growing at double digit during the next decade as its market share is still very small and the structural sector growth. Globalization, digitalization, automation and ease and government fighting against fraud are supporting that rapid growth!

I expect Pax growing at double digit during the next decade as its market share is still very small and the structural sector growth. Globalization, digitalization, automation and ease and government fighting against fraud are supporting that rapid growth!

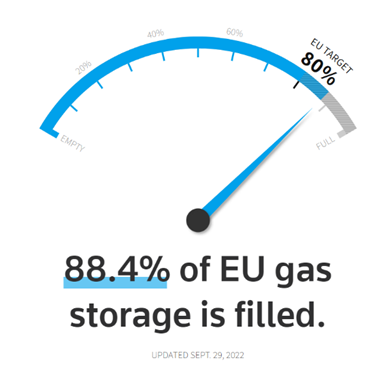

https://twitter.com/gabcasla/status/1546403066135678977?s=20&t=1Usz-2xH1sQmbslNEQOlNwReason 1: TTF hit a new historical record at €340/MWh by late August and dropped to the current €190 killing gas stocks momentum. The correction was because EU positively surprised the market filling the storage faster than expected

European gas prices averaged around €15.5/MWh in 2016-20 versus the current price €200/MWh. That is equivalent to more than $300 oil and, despite demand weakening and storage capacity is in line with the 5y average, nor the current gas price nor forward curve are plummeting!

European gas prices averaged around €15.5/MWh in 2016-20 versus the current price €200/MWh. That is equivalent to more than $300 oil and, despite demand weakening and storage capacity is in line with the 5y average, nor the current gas price nor forward curve are plummeting!

Developed countries (USA and EMEA) drove Pax profits. I'd say Pax has a powerful moat in these regions and strong growth will continue. Unique supply chain capable of fulfilling orders in time, amazing Android product ahead of competitors and unique Android platform

Developed countries (USA and EMEA) drove Pax profits. I'd say Pax has a powerful moat in these regions and strong growth will continue. Unique supply chain capable of fulfilling orders in time, amazing Android product ahead of competitors and unique Android platform