1/ 📢 Want to know how Yearn can offer YOU yields as high as 55% APY? 🚀

Enter our “Backscratcher” vault, aka yveCRV.

Enter our “Backscratcher” vault, aka yveCRV.

2/ Many of our vaults rely on @CurveFinance and are earning $CRV rewards as incentives. But @CurveFinance offers additional $CRV rewards as a bonus. These *bonus* 🤑 rewards require you to lock $CRV into their governance staking contract.

@CurveFinance 3/ The $CRV may be locked as long as 4 years in order to get the highest boost. Most people do not have enough $CRV to lock for high boosts, don’t know how, or do not want to deal with the hassle.

But not to worry, Yearn does it for you to make DeFi simple. 😍

But not to worry, Yearn does it for you to make DeFi simple. 😍

@CurveFinance 4/ We lock a portion of the $CRV earned into our “Backscratcher” vault in order to boost the rewards for *all* vaults that have @CurveFinance strategies. This benefits all depositors, at no cost, and is one of our competitive advantages.

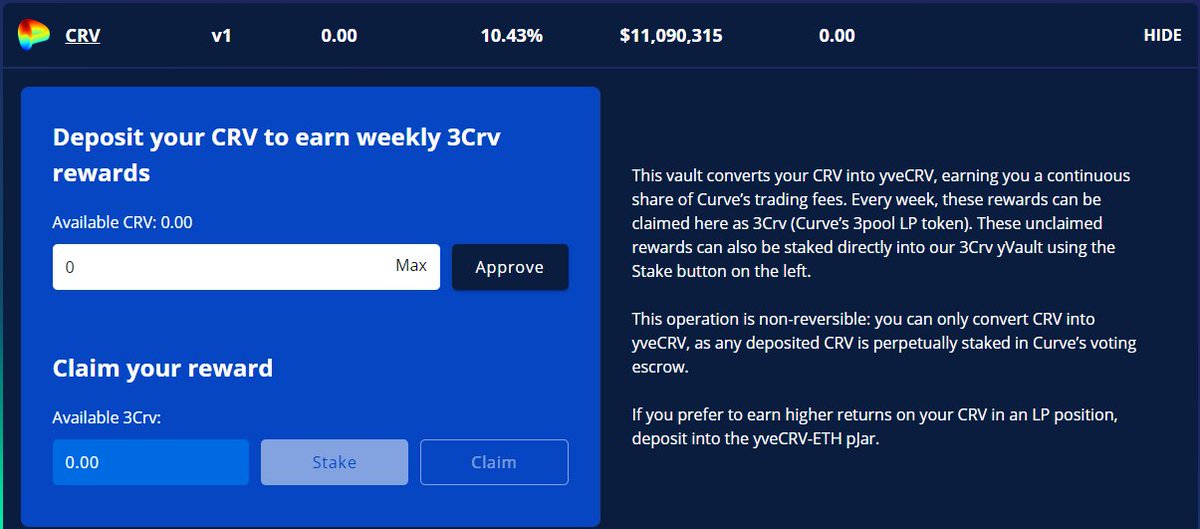

@CurveFinance 5/ You can also lock your $CRV in our “Backscratcher” and that will automatically boost the APY on these vaults.

But wait, it gets better! By locking your $CRV into our “Backscratcher” vault you will receive a portion of the Curve DAO admin fees that are paid weekly. 😲

But wait, it gets better! By locking your $CRV into our “Backscratcher” vault you will receive a portion of the Curve DAO admin fees that are paid weekly. 😲

@CurveFinance 6/ @CurveFinance charges 0.02% fees on every trade made on its protocol. Those fees go to *you* the $CRV voter staked in governance, even if you are in our “Backscratcher”.

@CurveFinance 7/ We have made the “Backscratcher” even more attractive by allowing you to claim the $CRV DAO fees on $CRV we have locked.

That’s right! You can claim the fees 💸 from $CRV Yearn has locked, at no extra cost to you!

That’s right! You can claim the fees 💸 from $CRV Yearn has locked, at no extra cost to you!

@CurveFinance 8/ The APY of $CRV locked in our “Backscratcher” is approximately 10.43%. 💰 Note: You can’t withdraw your $CRV, ever, but in exchange you get something better. Cold hard cash 💵 - paid weekly!

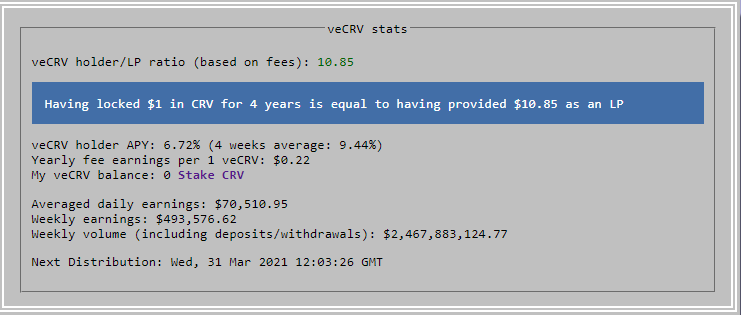

@CurveFinance 9/ Now, you might ask why would you lock your $CRV with Yearn instead of on your own? Simple. It is because you receive the admin fees from Yearn’s share of locked $CRV. Yearn now has over 11m veCRV locked in the “Backscratcher”.

@CurveFinance 10/ The APY of our “Backscratcher” is 10.43% vs. 6.72% with Curve directly. We expect this gap to widen as we lock more and more $CRV in the future, benefiting *you* the depositor.

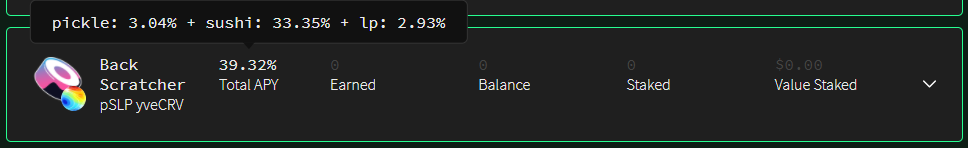

@CurveFinance 11/ To make it easy to get your principal back we have created a yveCRV-ETH pool on @SushiSwap that also earns 🍣 rewards as an incentive.

@CurveFinance @SushiSwap 12/ To further enhance yield, you can use Yearn ecosystem partner @picklefinance to automatically harvest and compound the 🍣 rewards with additional pickle 🥒on top. The Pickle farm is earning 39.32% APY. 🍣 🥒🦙

@CurveFinance @SushiSwap @picklefinance 13/ You can deposit to our “Backscratcher” here

yearn.finance/vaults/0xE625F…

yearn.finance/vaults/0xE625F…

• • •

Missing some Tweet in this thread? You can try to

force a refresh