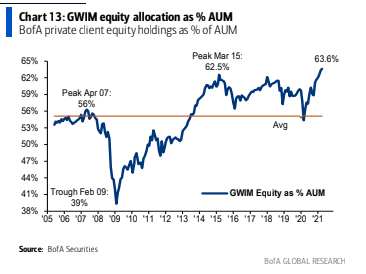

Cash levels have constantly remained low throughout this bull market.

The majority are invested & any turbulence sees central banks step in, saving the day.

However, low cash will eventually be a concern when forced liquidation starts since there will be no marginal buyers.

The majority are invested & any turbulence sees central banks step in, saving the day.

However, low cash will eventually be a concern when forced liquidation starts since there will be no marginal buyers.

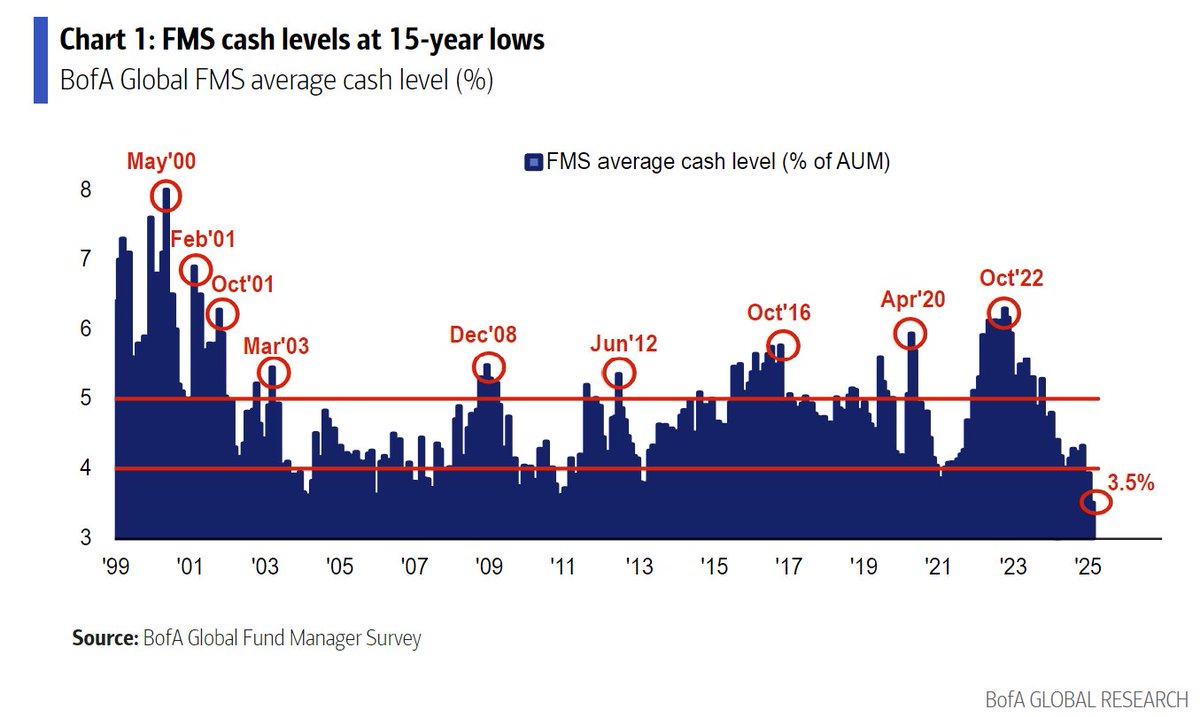

S&P 500 is approaching a record valuation of 3 times forward-looking sales.

Even if the market was to crash by -30%, valuations would be expensive since the market would trade at around 2X revenue — this was a top back in the year 2000.

CBs have created a monster bubble.

Even if the market was to crash by -30%, valuations would be expensive since the market would trade at around 2X revenue — this was a top back in the year 2000.

CBs have created a monster bubble.

Jeff Gundlach is saying the US stock market is incredibly overpriced by any traditional metric and the next crash will be for the history books.

Thinks the $VIX will spike to never-before-seen levels surpassing the crash of 1987 & 2008.

markets.businessinsider.com/news/stocks/bi…

Thinks the $VIX will spike to never-before-seen levels surpassing the crash of 1987 & 2008.

markets.businessinsider.com/news/stocks/bi…

Historical annualized returns since 1979 (ex dividends):

S&P 500 @ 8.3%

Nasdaq 100 @ 13.8%

Russell 2000 @ 9.9%

Markets ebb & flow between the median historical returns as periods of underperformance follow periods of outperformance, and vice versa.

$SPY $QQQ $IWM

S&P 500 @ 8.3%

Nasdaq 100 @ 13.8%

Russell 2000 @ 9.9%

Markets ebb & flow between the median historical returns as periods of underperformance follow periods of outperformance, and vice versa.

$SPY $QQQ $IWM

Growth vs Value chart by @KailashConcepts.

The 3-year performance spreads between Growth & Value reached Tech bubble levels & is now rolling over.

Will be interesting to see how this one plays out...

The 3-year performance spreads between Growth & Value reached Tech bubble levels & is now rolling over.

Will be interesting to see how this one plays out...

US high yield credit spreads continued to tighten in the last days of March.

The spread of just over 3% against similar-maturity Treasuries is reaching the lowest level since September 2018 — just before the QT correction started.

The spread of just over 3% against similar-maturity Treasuries is reaching the lowest level since September 2018 — just before the QT correction started.

While tight credit spreads can persist at times, often spread tightness is associated with too much optimism, which produces complacency — the riskest of all investor behaviors.

Low-quality CCC spreads are now at the tightest level since 2014.

Low-quality CCC spreads are now at the tightest level since 2014.

Within the 12-month time frame, central bank stimulus has made us turn from a "love to a hate relationship" on the US small caps sector.

In March & April 2020, regular followers might recall that is all I tweeted about — these stocks were cheap.

Today?

We want to stay away!

In March & April 2020, regular followers might recall that is all I tweeted about — these stocks were cheap.

Today?

We want to stay away!

In today's public fixed income sector, Junk bonds are trading at investment grade yields, while investment-grade corporate bonds trade at DM sovereign debt yields.

In our opinion, the SUPER low returns don't justify higher levels of risk being taken by yield-hungry investors.

In our opinion, the SUPER low returns don't justify higher levels of risk being taken by yield-hungry investors.

Michael Burry — who successfully shorted the US subprime bubble — warned about gamblers taking on margin debt a couple of months ago.

“People say I didn't warn last time. I did, but no one listened. So I warn this time. And still, no one listens."

— Michael Burry

“People say I didn't warn last time. I did, but no one listened. So I warn this time. And still, no one listens."

— Michael Burry

Things are seriously heating up as margin debt explodes higher than a year ago.

Some of the periods where gamblers took on too much leverage were:

1972*, 1978, 1987*, 2000*, 2007* and today.

The ones with a star went on to crash, in 1978 the market fell around -20%.

Some of the periods where gamblers took on too much leverage were:

1972*, 1978, 1987*, 2000*, 2007* and today.

The ones with a star went on to crash, in 1978 the market fell around -20%.

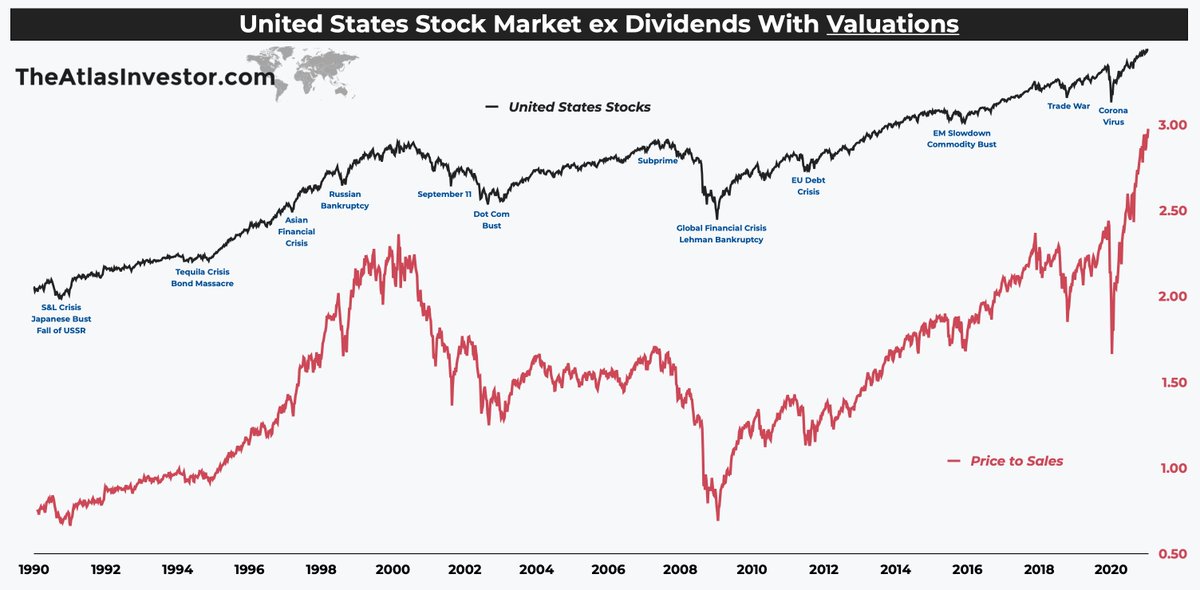

Investing is a "no-common-sense" activity where shoppers panic during a sale/discount and buy as much as they can at premiums.

Here is an example:

No one wanted to touch stocks when they traded below 10X earnings in 2008, but everyone wants them at 22X earnings in 2021.

Here is an example:

No one wanted to touch stocks when they traded below 10X earnings in 2008, but everyone wants them at 22X earnings in 2021.

US household exposure to equities, mutual funds, & other forms of corporate ownership is probably at record highs, according to JP Morgan.

This indicator has over 90% positive correlation factor with future expected returns over the next decade.

Risks continue to increase!

This indicator has over 90% positive correlation factor with future expected returns over the next decade.

Risks continue to increase!

Unlike the majority of the market participants, I was surprised to see Blackrock's CIO says they are holding the highest level of cash in many years while trimming down equity holdings.

• • •

Missing some Tweet in this thread? You can try to

force a refresh