HNWI multi-family office focused on high-quality assets at attractive valuations (public businesses, luxury real estate development and alternative lending).

26 subscribers

How to get URL link on X (Twitter) App

2/ US consumers are the most bullish on the market since the @Conferenceboard began tracking their sentiment.

2/ US consumers are the most bullish on the market since the @Conferenceboard began tracking their sentiment.

Alibaba $BABA corporate value creation fundamentals (FCF per share in blue) have completely disconnected from sentiment-driven, market expectations (share price in black).

Alibaba $BABA corporate value creation fundamentals (FCF per share in blue) have completely disconnected from sentiment-driven, market expectations (share price in black).

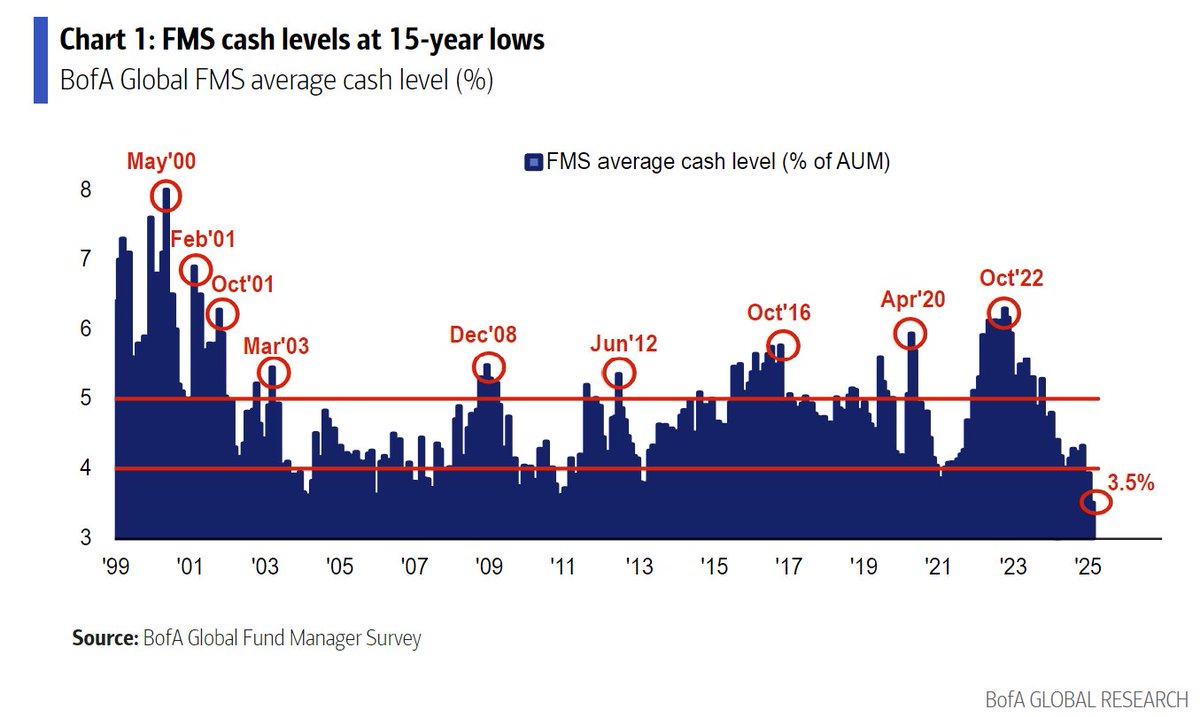

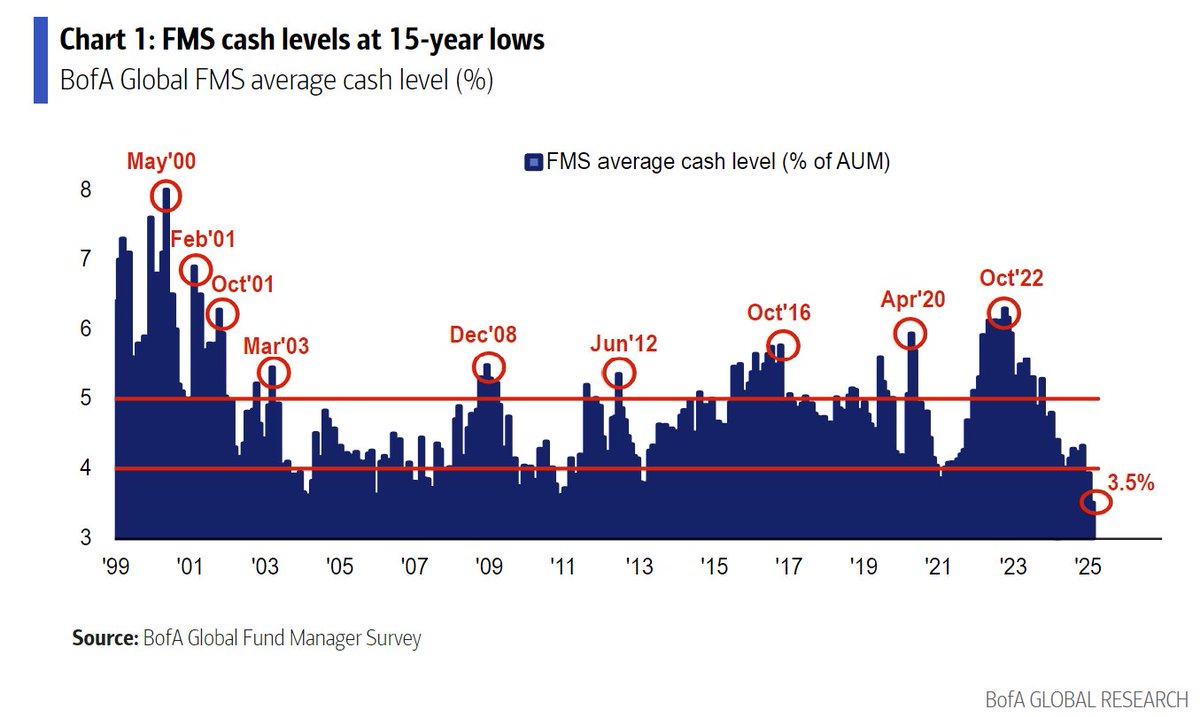

Asset allocation by an average retail investor (AAII) and an average fund manager (BofA).

Asset allocation by an average retail investor (AAII) and an average fund manager (BofA).

https://twitter.com/johnwhi60696884/status/1641985803965407233Talk is cheap; management promises to be delivered in numbers. $PDD + $JD are gaining market share. Even with mismanagement, $BABA should do ok.

Other people are constantly trying to succeed in their "too hard" pile:

Other people are constantly trying to succeed in their "too hard" pile:https://twitter.com/geh168/status/1639456504662171649Firstly, Buffett rarely buys common stock. He is always doing preferred equity or mezzanine financing.

https://twitter.com/MFintwit/status/1614048193070915584...but rather, the goal is to pick flowers instead of weeds. In plain English, be very selective.