The more I sit with the 25-page overview of the Biden #Infrastructure & #JobsPlan, the more it's clear: the measure of a plan is not the total $ it spends but its impact. There is a lot in this plan that isn't clearly scored w/$ figure. But the total impact looks transformative.

https://twitter.com/JesseJenkins/status/1377270870612279297

This #JobsPlan presents a vision for how to rebuild the U.S. economy. That vision clearly places at its center a set of investments to build a clean energy economy, enhance resilience to climate change & extreme weather, and address persistent environmental injustices.

Why do I say the #JobsPlan's clean energy investments look transformative?

My group at Princeton will be taking a close look at the plan & modeling its impact in coming weeks (as details become clearer), but let's take a first look at this thing together whitehouse.gov/briefing-room/…

My group at Princeton will be taking a close look at the plan & modeling its impact in coming weeks (as details become clearer), but let's take a first look at this thing together whitehouse.gov/briefing-room/…

In this thread, we'll walk through the three biggest sectors for CO2 + air pollution from energy activities:

1. Transportation;

2. Electricity;

3. Industry.

1. Transportation;

2. Electricity;

3. Industry.

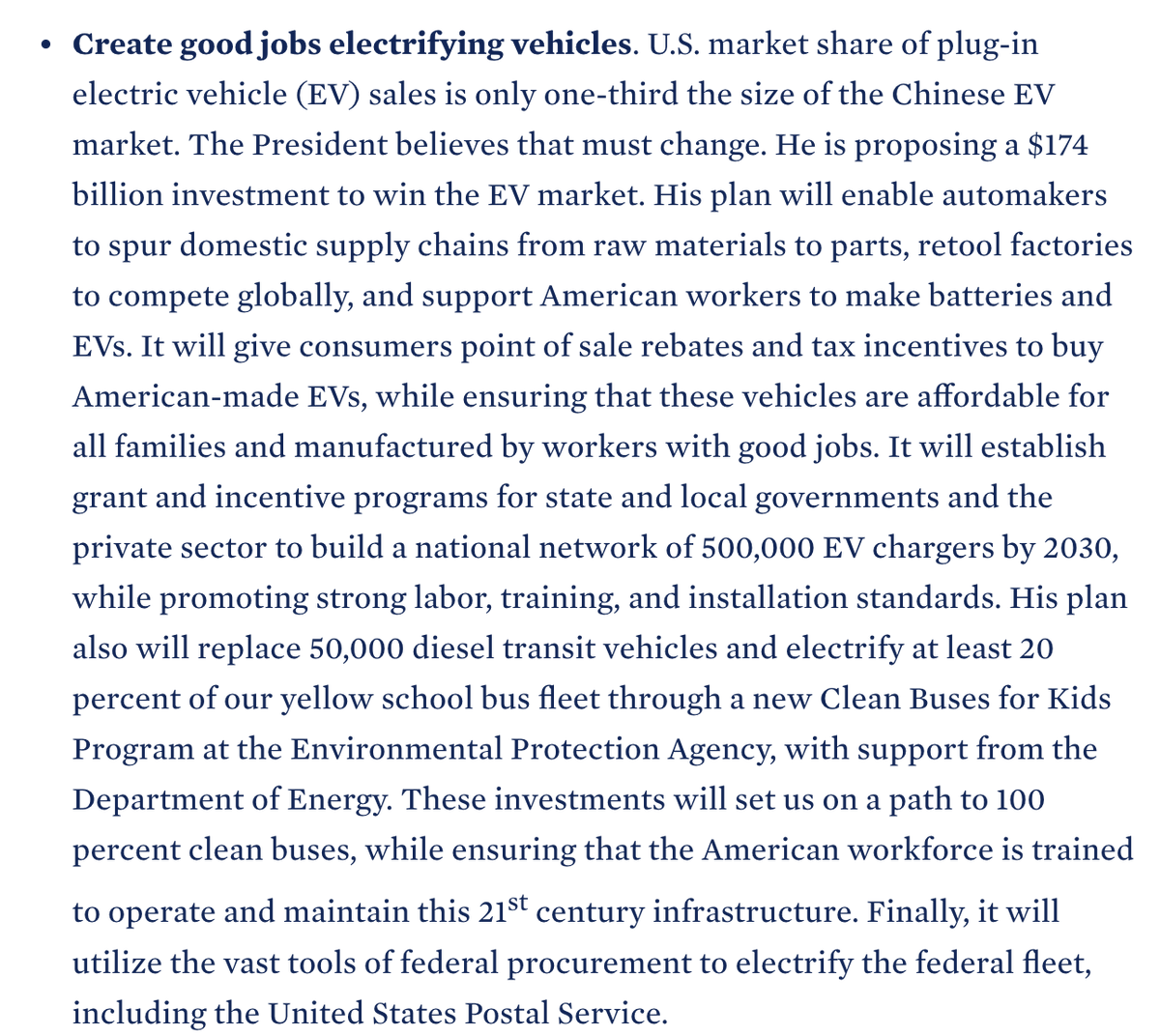

Transportation: $174B could transform auto sector, making upfront cost of EVs dissapear (subsidy initially but driving real cost declines over time), building a US supply chain so more of these EVs & their parts are made in USA, & expanding charger networks to quash range anxiety

The sector is already on cusp of major change, with most of the biggest markets in the world planning to phase-out sale of internal combustion vehicles, and auto-makers poised to go all electric. These investments could push the sector over the hill, driving irreversible momentum

The plan also recognizes that decarbonizing transport is about more than cars. The plan would invest about as much in modernizing public transit and rail as it does in electric cars & trucks, $105b for public transit & at least $80b for rail.

Electricity: $100B to build long-distance transmission & harness America's best wind & solar resources & improve grid resilience. If 1 federal $ leverages ~2x private $, that would be on par with ~$350b, 10-year additional investment identified in Princeton Net-Zero America study

In addition to the $100b grid investment, the Biden plan calls for a LOT more that isn't 'scored' in the topline spending totals that are easy to fixate on at first... (guilty as charged here!

https://twitter.com/JesseJenkins/status/1377270870612279297)

-10-year tax credits for clean electricity (direct pay!)

-Clean energy block grants to state/local/tribal govts

-Govt procurement of 24x7 clean electricity (see

-And a Clean Electricity Standard to put whole sector on path to 100% carbon-free electricity

-Clean energy block grants to state/local/tribal govts

-Govt procurement of 24x7 clean electricity (see

https://twitter.com/cleanaircatf/status/1376893573870845953)

-And a Clean Electricity Standard to put whole sector on path to 100% carbon-free electricity

Those measures could add ~$300-400b in additional tax incentives & other measures directed toward building a clean electricity system. That might just be sufficient to induce the $830b in total additional investment in clean electricity envisioned in Net-Zero America paths

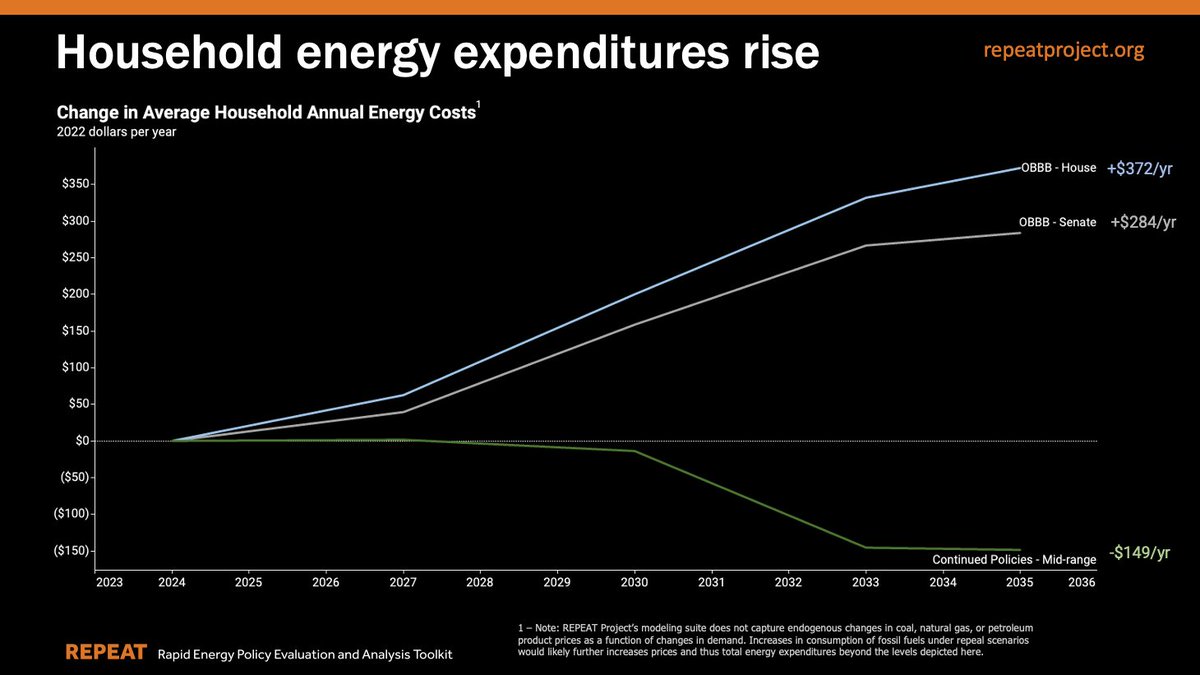

Depending on how all that gets implemented, that could be up to the task of getting the U.S. on track to 70-80% clean electricity by 2030, all while shifting a big chunk of the initial cost of this transition from ratepayer bills to the federal tax base (much more progressive).

If the US does all that, we could be smashing new records for wind, solar & grid deployment every year for the next decade. If its enough to put US on track to net-zero by 2030, that would mean 0.5-1 million net jobs in energy supply sectors by 2030, according to Net-Zero America

Industry: There are a lot less options available now for large-scale use to decarbonize heavy industry -- steel, cement, chemicals, etc. This plan wants to transform that too. The plan would drive creation of new clean hydrogen hubs, spur industries to capture & store CO2, & more

A decade of policy support for wind, solar, & batteries drove down costs by ~70%, 85% & 90%, respectively, transforming them from expensive "alternative energy" to mainstream energy options. The plan's investments in industry climate solutions could do the same thing this decade.

Plus there's $35 billion more in investment in RD&D for advanced climate technologies, including hydrogen, carbon capture & storage, advanced nuclear, and more. This includes $15b for full-scale demonstration projects, a key role for federal government.

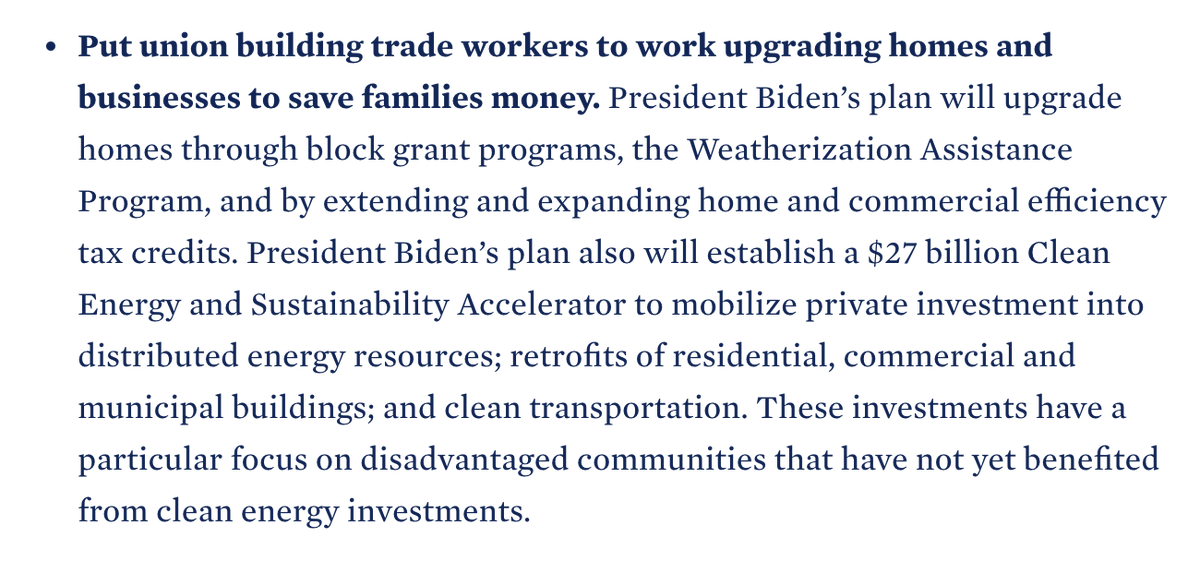

Bonus round: Buildings! If you distribute electricity use across sectors, buildings become #1 source. Good thing the plan also targets investments to upgrade and weatherize homes and businesses, plus a lot will be embeded in the plan's broader investments in housing, schools, etc

But wait there's more: the plan recognizes that one of the biggest levers government has is procurement. The fed govt spends more than $0.5 trillion/yr. That $ can be leveraged to drive economic transformation too. The plan calls for $46b to drive clean energy mfg & innovation.

My group will be doing more to model & assess the impacts as details emerge. I'm sure there are gaps and areas where more is needed. But this #JobsPlan really tries to cover all the bases, and the scale & scope could be on par with what we need to get the US on track to net-zero.

Remember also that this is the start of a critical national debate and discussion. This is the opening of that debate. Congress will ultimately shape what passes. My ZERO Lab at Princeton will be paying close attention as the debate unfolds. /End.

• • •

Missing some Tweet in this thread? You can try to

force a refresh