Macro-energy systems engineering, optimization, and policy. Prof. @EPrinceton (MAE) & @AndlingerCenter. Co-host SHIFT KEY pod. See LinkedIn for more.

10 subscribers

How to get URL link on X (Twitter) App

1. The One Big "Beautiful" Bill raises U.S. household and business energy expenditures by $28 billion annually in 2030 and over $50 billion in 2035.

1. The One Big "Beautiful" Bill raises U.S. household and business energy expenditures by $28 billion annually in 2030 and over $50 billion in 2035.

Compared to what Trump can do via executive action alone, if the Senate-passed #OBBB becomes law:

Compared to what Trump can do via executive action alone, if the Senate-passed #OBBB becomes law:

https://twitter.com/curious_founder/status/1841507482771877949And it's not just solar panel manufacturing. After decades of politicians like Vance making empty promises to bring manufacturing back to America, WE'RE ACTUALLY DOING IT! Thanks to clean energy & industrial policy laws passed under Biden & Harris.

https://x.com/JesseJenkins/status/1825548460453671272

In this 2024 update, we've thoroughly refreshed all assumptions, calibrated near-term constraints against real-world trends & announced investments, and accounted for several federal regulations (EPA emissions rules & DOE efficiency standards) finalized by in the last year.

In this 2024 update, we've thoroughly refreshed all assumptions, calibrated near-term constraints against real-world trends & announced investments, and accounted for several federal regulations (EPA emissions rules & DOE efficiency standards) finalized by in the last year.

The Biden-Harris Admin & 117th Congress enacted a trio of laws (IIJA, IRA, CHIPS) that made major public investments to grow & strengthen several key industries of the future: semiconductors, EVs, batteries, solar & wind, hydrogen, clean steel. jackconness.com/ira-chips-inve…

The Biden-Harris Admin & 117th Congress enacted a trio of laws (IIJA, IRA, CHIPS) that made major public investments to grow & strengthen several key industries of the future: semiconductors, EVs, batteries, solar & wind, hydrogen, clean steel. jackconness.com/ira-chips-inve…

At issue: Driftless Area Land Conservancy, National Wildlife Refuge Association & Wisconsin Wildlife Federation sued to block a land swap approved by US Dept of Interior that would add 35 new acres of land to a wildlife refuge in exchange for 20 acres crossed by the line Come on!

At issue: Driftless Area Land Conservancy, National Wildlife Refuge Association & Wisconsin Wildlife Federation sued to block a land swap approved by US Dept of Interior that would add 35 new acres of land to a wildlife refuge in exchange for 20 acres crossed by the line Come on!

https://twitter.com/JesseJenkins/status/1738316869231317084The Biden admin resisted a torrent of intense lobbying from big industrial players like the utilities NextEra & Constellation, oil majors like BP & Exxon, fuel-cell maker Plug Power, & their trade-group proxies, which spent millions on ads & lobbying to weaken the hydrogen rules.

If we take a look at actual sales data (as I did here ), there’s NO sign the growth in EVs is flagging. In fact, sales of battery electric and plug-in hybrid vehicles in the third quarter exhibited the strongest year-on-year growth since the Q4 2021! anl.gov/esia/reference…

If we take a look at actual sales data (as I did here ), there’s NO sign the growth in EVs is flagging. In fact, sales of battery electric and plug-in hybrid vehicles in the third quarter exhibited the strongest year-on-year growth since the Q4 2021! anl.gov/esia/reference…

What does it mean that EV sales are "slowing"? Year-on-year growth rates have been ~60% in each of the last several months. That's a rate fast enough to double sales in about 18 months. It's hard to see growth that fast as "slowing" sales.

What does it mean that EV sales are "slowing"? Year-on-year growth rates have been ~60% in each of the last several months. That's a rate fast enough to double sales in about 18 months. It's hard to see growth that fast as "slowing" sales.

https://twitter.com/duncan__c/status/1719750637317914657Developers tried to pass along costs to states (NY MA NJ) & their electricity consumers, and for the most part were rebuffed. State agencies basically said "No, a contract is a contract and we cant start renegotiating or any future contract wont be worth the ink it's printed on."

https://twitter.com/CoreyBCantor/status/1717951590751940664We risk conflating a *slow down* in incumbent automaker's EV ramp up plans -- GM, Ford, VW & Honda specifically -- with the broader market, which is still growing robustly, about 50% year-on-year according to @CoreyBCantor, despite serious headwinds from high interest rates.

https://twitter.com/CoreyBCantor/status/1717217012408058112Automakers have to be investing NOW with their eye on market 5-7 years from now. Most of the world's largest markets -- China, Europe, and about 60% of the US market & more -- are effectively locked into electric transition and will be dominated by plug-in vehicles by 2030-2035.

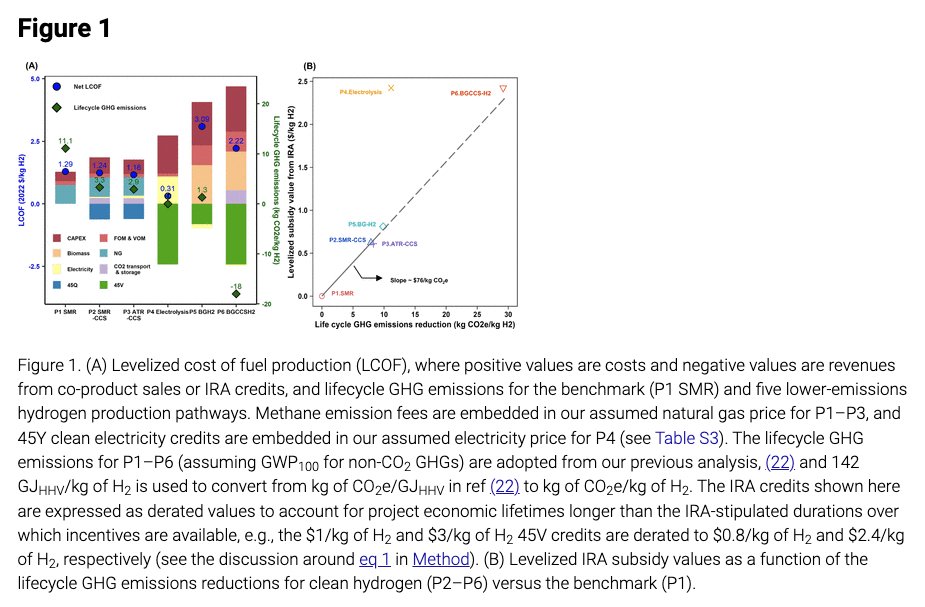

In this paper, we assess the impacts of the Inflation Reduction Act (IRA) on the costs of producing low- and -negative carbon hydrogen and synthetic liquid fuels made from natural gas, electricity, biomass (agricultural residues), and corn-derived ethanol.

In this paper, we assess the impacts of the Inflation Reduction Act (IRA) on the costs of producing low- and -negative carbon hydrogen and synthetic liquid fuels made from natural gas, electricity, biomass (agricultural residues), and corn-derived ethanol.

This is a great profile out today of @PeteWyckoff3, one of one of the many dogged Hill staffers who worked relentlessy to get IRA into law:

This is a great profile out today of @PeteWyckoff3, one of one of the many dogged Hill staffers who worked relentlessy to get IRA into law:

https://twitter.com/JesseJenkins/status/1678915795911430145Key excerpts...