We took a look at PPFAS Flexi Cap Fund today.

You can learn a lot in less than five minutes. We have done the work for you.

You can learn a lot in less than five minutes. We have done the work for you.

Background -

@PPFAS mutual fund was founded in 2013 but its roots go back to early 1980’s when Mr. Parag Parikh, founder of the fund, established Parag Parikh Securities Limited in 1983.

@PPFAS mutual fund was founded in 2013 but its roots go back to early 1980’s when Mr. Parag Parikh, founder of the fund, established Parag Parikh Securities Limited in 1983.

The fund runs three schemes. The Parag Parikh Flexi Cap Fund (Formerly known as Parag Parikh Long Term Equity Fund) was launched at the inception of the fund house, Parag Parikh Tax Saver Fund was launched in 2019 and the Parag Parikh Liquid Fund was launched in 2018.

Fund Managers -

The fund under focus today would be the Parag Parikh Flexi Cap Fund. This fund is managed by Mr. Rajeev Thakkar and Mr. Raunak Onkar, both of whom have been with the fund since inception. @RajeevThakkar @oraunak

The fund under focus today would be the Parag Parikh Flexi Cap Fund. This fund is managed by Mr. Rajeev Thakkar and Mr. Raunak Onkar, both of whom have been with the fund since inception. @RajeevThakkar @oraunak

Fund Investing Philosophy -

Invest in shares – The fund believes that investing in shares i.e. stocks of properly managed business can generate far better returns than other investing avenues like bank deposits, gold, bonds, real estate, commodities etc.

Invest in shares – The fund believes that investing in shares i.e. stocks of properly managed business can generate far better returns than other investing avenues like bank deposits, gold, bonds, real estate, commodities etc.

Invest for the long term – The fund does not subscribe to the philosophy of selling stocks at each rise. Instead, they want to stay invested in a good company for a long period of time.

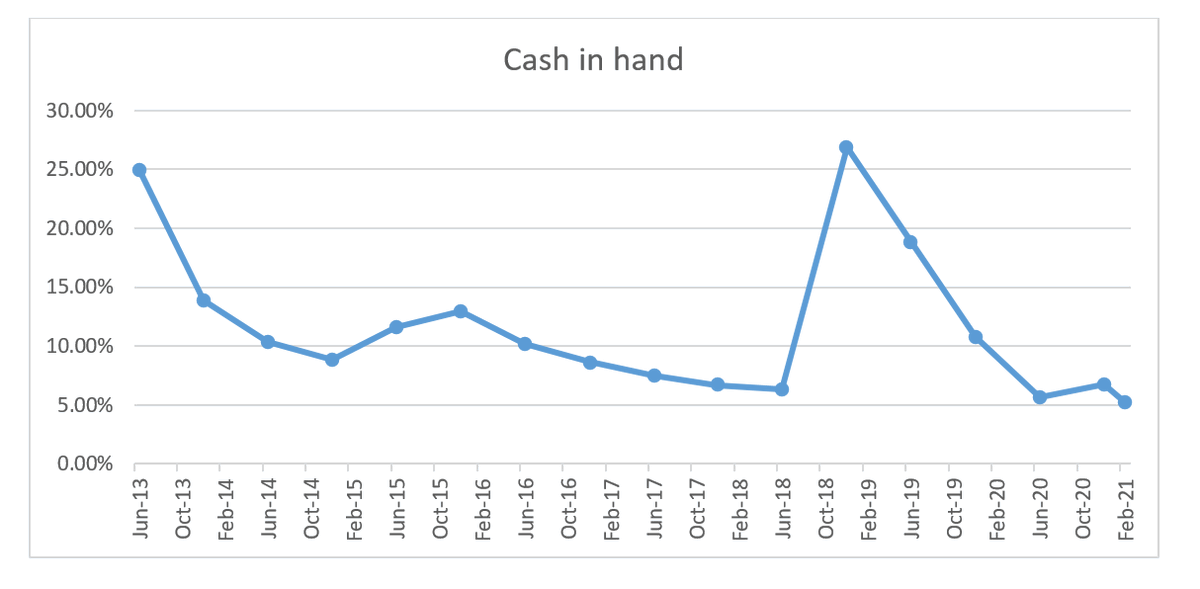

Hold cash and cash equivalents – The funds believes that cash acts as a hedge against the vagaries of the markets and provides liquidity to invest in the right stocks at the right time.

Always focus on the Company – The fund invests in Companies that operate in the most profitable sectors of the economy, have long term growth prospects, are operated by honest and competent people, and are available at an attractive price.

Small and focused portfolio – The fund does not want to invest in more than 10-15 high quality Companies that can provide maximum appreciation in the long run.

Not true today since the fund holds almost 25-27 stocks.

Not true today since the fund holds almost 25-27 stocks.

AUM Growth

AUM has grown by almost 5x in the last five years due to inflows and rise in the NAV of the fund. AUM as of the end of February 2021 stands at ₹7,451 crores.

AUM has grown by almost 5x in the last five years due to inflows and rise in the NAV of the fund. AUM as of the end of February 2021 stands at ₹7,451 crores.

Expense Ratio

Expense ratio is a key monitorable for any mutual fund. PPFAS has done a fantastic job in lowering their expense ratios as the AUM has grown. The expense ratio for direct option is at 0.96% where as for the regular option is at 1.86%.

Expense ratio is a key monitorable for any mutual fund. PPFAS has done a fantastic job in lowering their expense ratios as the AUM has grown. The expense ratio for direct option is at 0.96% where as for the regular option is at 1.86%.

Portfolio Churn

As we understood from the funds philosophy above, the fund wants to hold high quality businesses for long periods of time. Once again, the fund has been able to walk the talk.

As we understood from the funds philosophy above, the fund wants to hold high quality businesses for long periods of time. Once again, the fund has been able to walk the talk.

The total number of stocks held in the fund since inception has been a total of 52 stocks out of which the fund continues to hold 2 stocks bought at inception. 13 stocks have been held for a period of 7 years or more and 18 have been held for more than 5 years.

Returns

The fund has returned a CAGR of 18.53% since inception. It has been able to beat the benchmark S&P BSE 500 handsomely.

The fund has returned a CAGR of 18.53% since inception. It has been able to beat the benchmark S&P BSE 500 handsomely.

Modes of Communication

The fund has a lot of content at their website amc.ppfas.com

They also have a youtube channel with more than 200 recordings - youtube.com/channel/UCmDkU…

The fund has a lot of content at their website amc.ppfas.com

They also have a youtube channel with more than 200 recordings - youtube.com/channel/UCmDkU…

We shared a detailed note with the community members along with our thoughts on what we like and don't about the fund.

• • •

Missing some Tweet in this thread? You can try to

force a refresh