The Robotaxi Repo: How Lease Accounting and Robotaxis allowed Tesla to turn collateralized borrowings into sales, overstate revenues by billions and achieve paper profitability. $TSLA $TSLAQ (1/13)

Tesla reaches scale production of Model 3 in mid-2018, leading to huge Model 3 sales as it worked through pre-sale backlog (2/13)

But by 2019, production capacity outstripped domestic demand, leaving Tesla with excess Model 3s it needed to sell - so it started exporting Fremont production despite its own overseas factories already under construction. (3/13)

During this period, two CAOs, one CFO and several GCs were replaced, and Tesla restated its financials based on revised revenue recognition relating to lease sales. Red flags abound. (4/13)

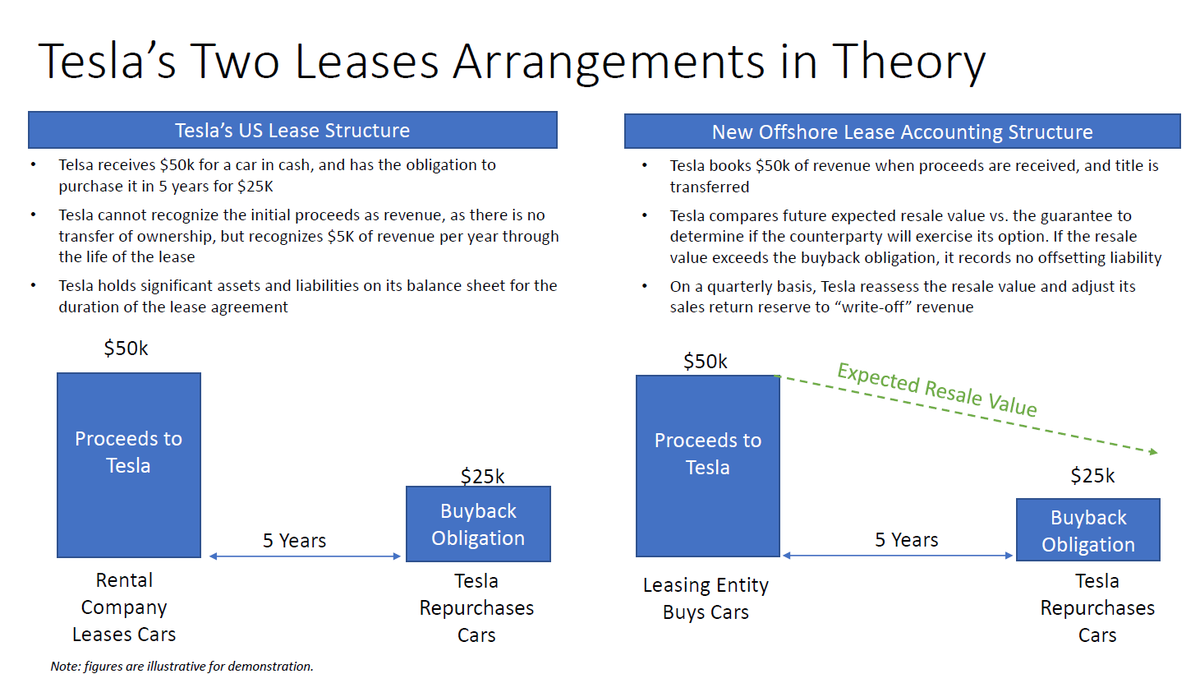

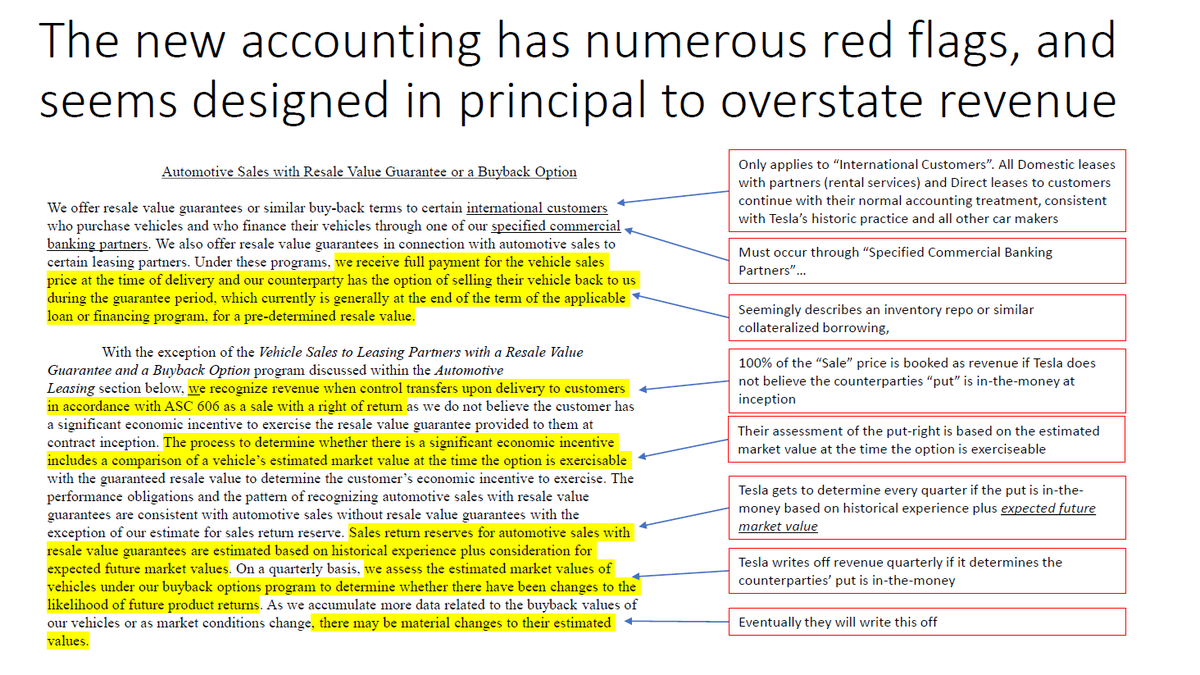

Under new accounting, Tesla could recognize lease sales as regular revenue so long as the expected future fair market value (determined by Tesla) exceeded the guaranteed buyback price. (5/13)

But looking closer at the description of these new leases, it seems tailor made to overestimate sales via financing agreements (repos) with offshore entities. (6/13)

Only problem is that cars depreciate. In a repo, you pay a higher price at the end of the term than you receive in initially, therefore any sales would have to be written off as the counterparty's "put" is in the money - indeed 1Q19 TSLA wrote off $500M in sales. (7/13)

To fix this problem, in 2Q19, Elon Musk and Tesla make the claim that the Model 3 is an "Appreciating Asset" based on its potential future FSD capabilities, providing public corroboration to underpin its accounting claim it was about to make. (8/13)

Setting the stage for the Robotaxi Repo. By claiming Model 3s were appreciating asset, they could recognize 100% of revenue for their excess production, without recognizing any offsetting liability or write downs as the estimated future value would exceed the buyback price (9/13)

Beginning in 2Q19 Tesla's "Other" International Revenue mysteriously exploded, as its inventory dramatically shrank. From 2Q-4Q19 these sales represented 36% of total Tesla revenue. Tesla stopped breaking out this category in 2020. (10/13)

We estimate $2.5bn of Robotaxi Repos took place over three quarters in 2019. Operating cash flow ex. this amount was negative. FCF was -$2.5Bn vs. $0.0bn as reported. This could have included up to ~100k cars or likely 10% - 30% of 2019 deliveries depending on sales price (11/13)

All of Tesla's key metrics rebounded substantially from 1Q19, and have remained strong going forward. (12/13)

BTW - This is as of April 1st 2021 - was too eager to get it out. I have no first hand knowledge, and there is not enough info to have reliable estimate of the impact, but all the evidence is there. If someone can point out why this could NOT be true, please do.

• • •

Missing some Tweet in this thread? You can try to

force a refresh