1/ Value Return Predictability Across Asset Classes and Commonalities in Risk Premia (Yara, Boons, Tamoni)

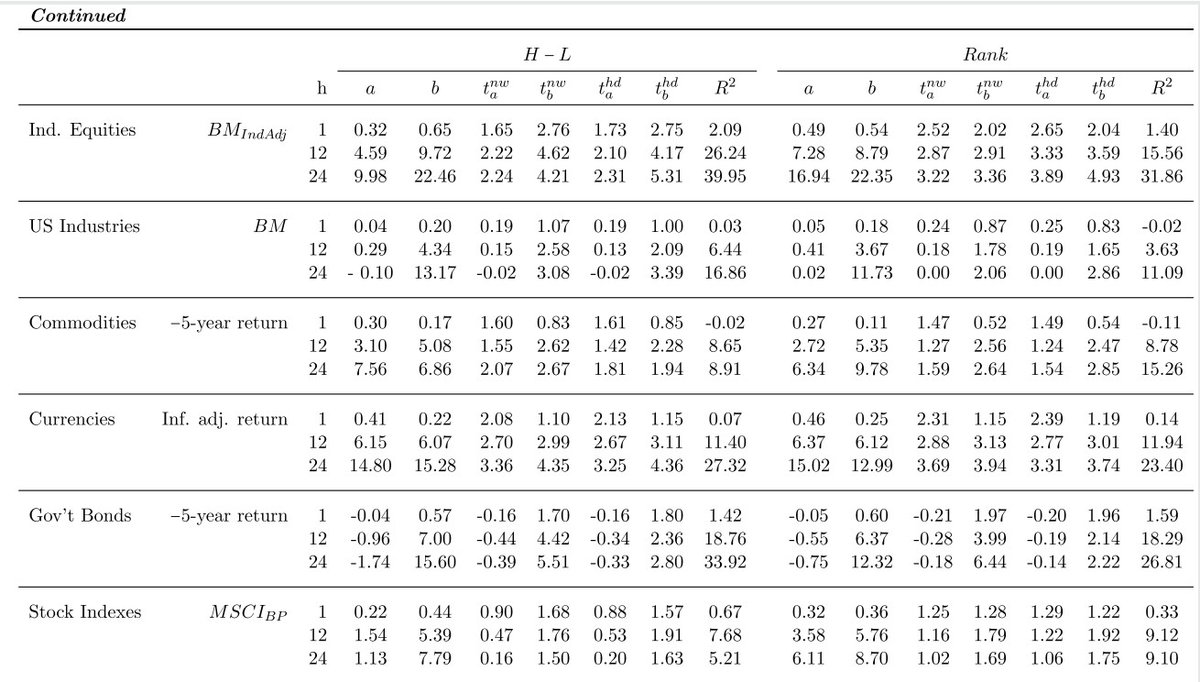

"Returns to value in equities, industries, commodities, currencies, bonds, and stock indexes are predictable by their respective value spreads."

papers.ssrn.com/sol3/papers.cf…

"Returns to value in equities, industries, commodities, currencies, bonds, and stock indexes are predictable by their respective value spreads."

papers.ssrn.com/sol3/papers.cf…

2/ Value measures:

B/M (market values updated monthly; financials and small stocks excluded)

Industry-adjusted B/M

Negative of five-year spot return (commodities, bonds)

Five-year change in ten-year yield (bonds)

Five-year change in relative PPP (currencies)

B/M (market values updated monthly; financials and small stocks excluded)

Industry-adjusted B/M

Negative of five-year spot return (commodities, bonds)

Five-year change in ten-year yield (bonds)

Five-year change in relative PPP (currencies)

3/ "Value spreads in stocks, industries, commodities and equity indexes correlate strongly and positively with each other.

"The first PC explains 51% of total variation. The correlation between a simple across-asset-class average of the value spreads and the first PC is 0.95."

"The first PC explains 51% of total variation. The correlation between a simple across-asset-class average of the value spreads and the first PC is 0.95."

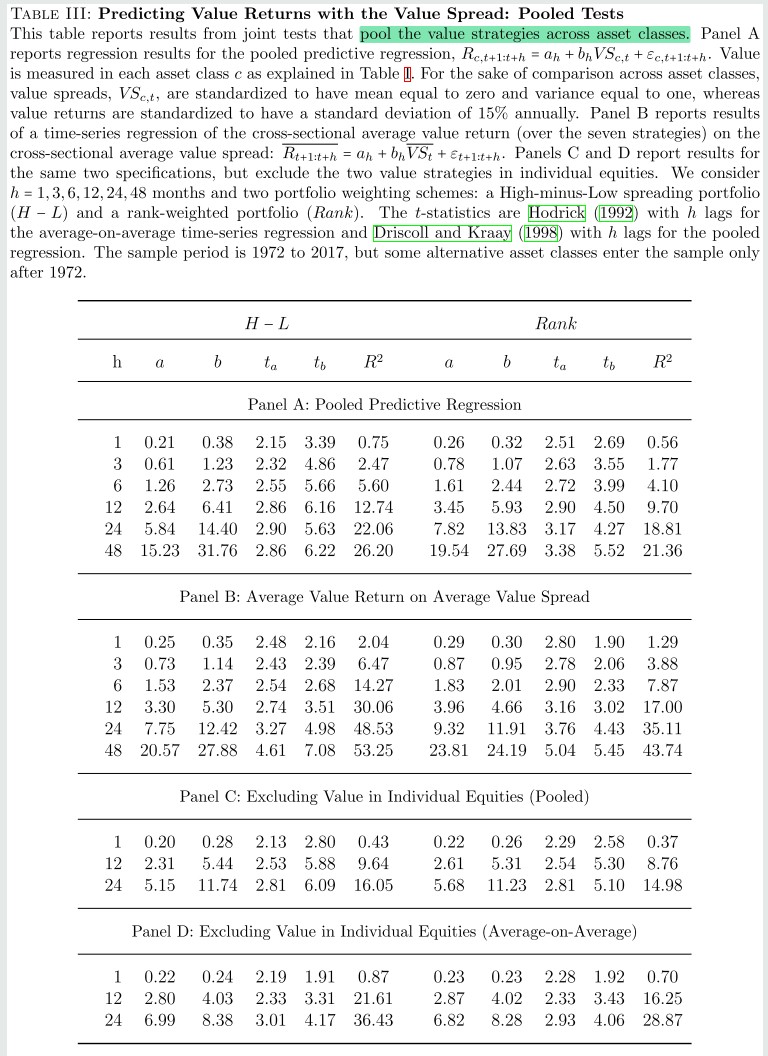

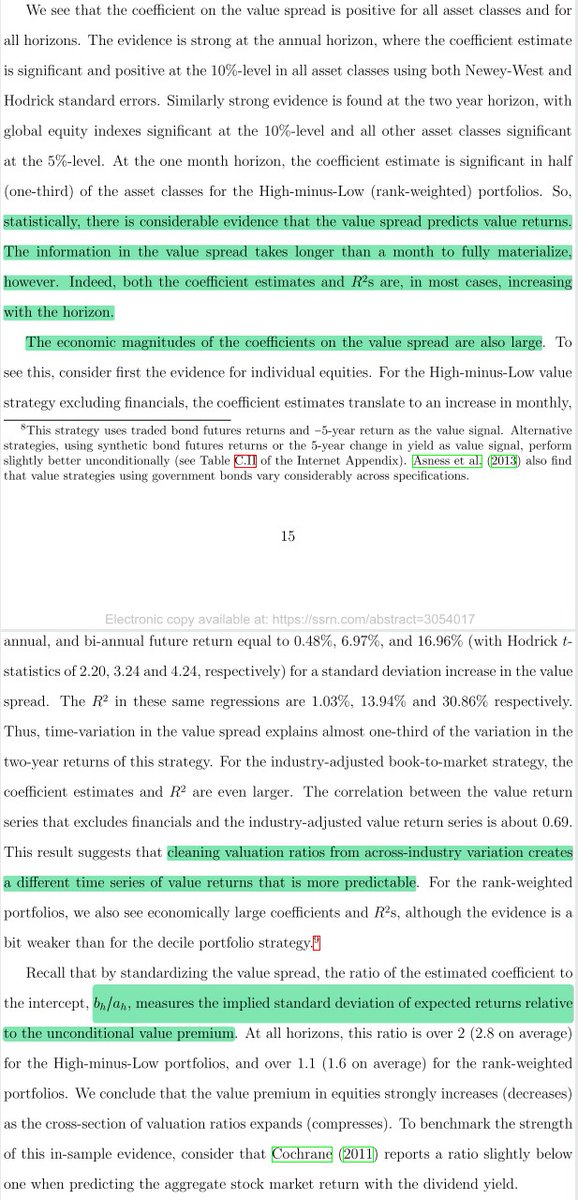

4/ "The value spread seems to predict value returns. The information takes longer than a month to fully materialize.

"Conditional variation in value premia is more similar across asset classes than is the unconditional value premium."

(Sharpe ratios are monthly, not annualized)

"Conditional variation in value premia is more similar across asset classes than is the unconditional value premium."

(Sharpe ratios are monthly, not annualized)

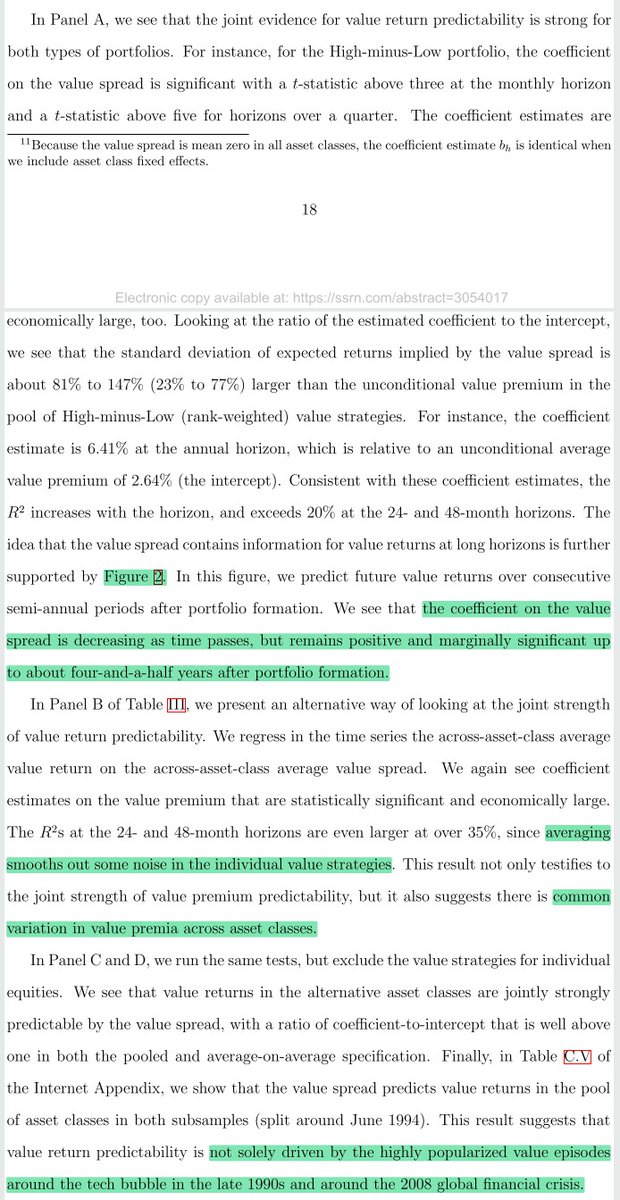

5/ "The coefficient on the value spread decreases as time passes but remains positive and marginally significant up to about four-and-a-half years after portfolio formation.

"Results are not solely driven by the highly popularized value episodes from the late 1990s and 2008."

"Results are not solely driven by the highly popularized value episodes from the late 1990s and 2008."

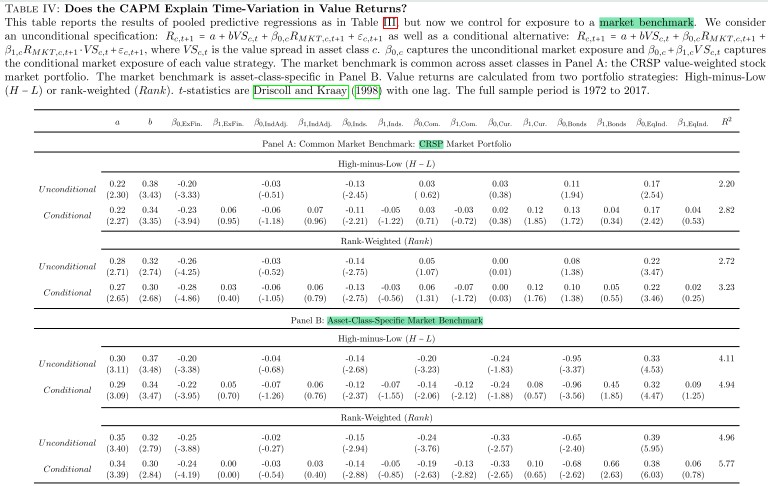

6/ "Our results are not driven by the predictive relation between market returns and the value spread and thus a conditional CAPM.

"In line with this conclusion, the value spread is not a robust predictor of market returns in the pool of asset classes we study."

"In line with this conclusion, the value spread is not a robust predictor of market returns in the pool of asset classes we study."

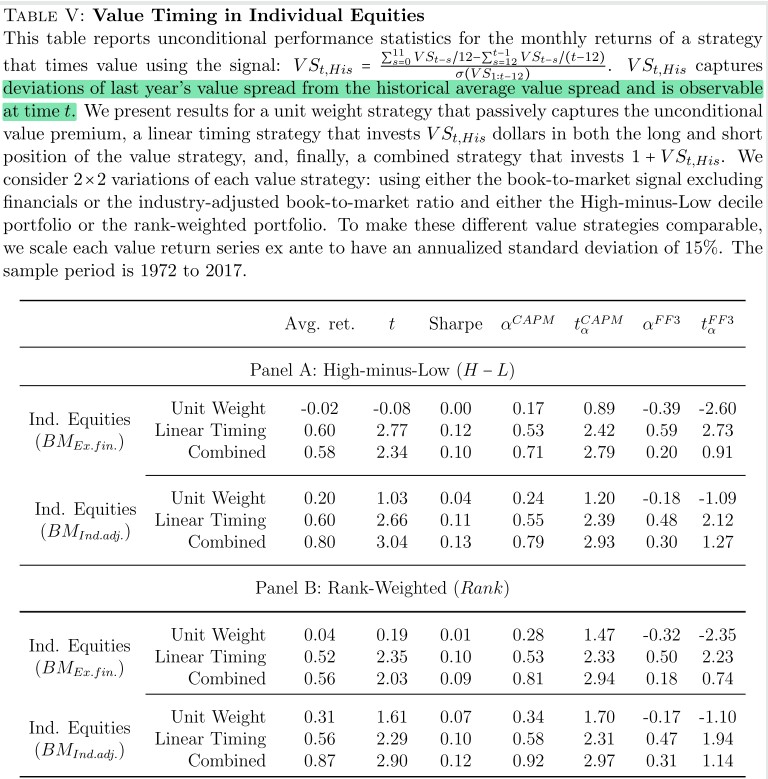

7/ "Results suggest that information in the value spread can be used by investors to time value in the stock market. Moreover, this timing strategy is an attractive complement to an unconditional value strategy."

8/ "Investing in value in a typical asset class is only attractive when the value spread in that asset class is historically large.

"Strategies that rebalance less frequently than monthly are likely more attractive."

"Strategies that rebalance less frequently than monthly are likely more attractive."

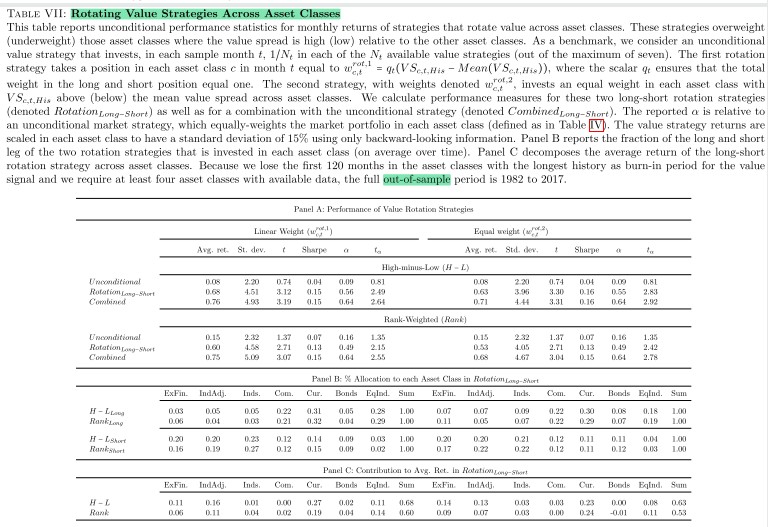

9/ "The value spread can be used to rotate value across asset classes in real time; this is attractive relative to a strategy that invests unconditionally in value in all asset classes. Thus, investing in value is most attractive in asset classes with the largest value spreads."

10/ "Both the common component of the value spread as well as asset-class-specific components contain information about future value returns.

"The common component explains half of the variation in value spreads and an even larger share of the predictability of value returns."

"The common component explains half of the variation in value spreads and an even larger share of the predictability of value returns."

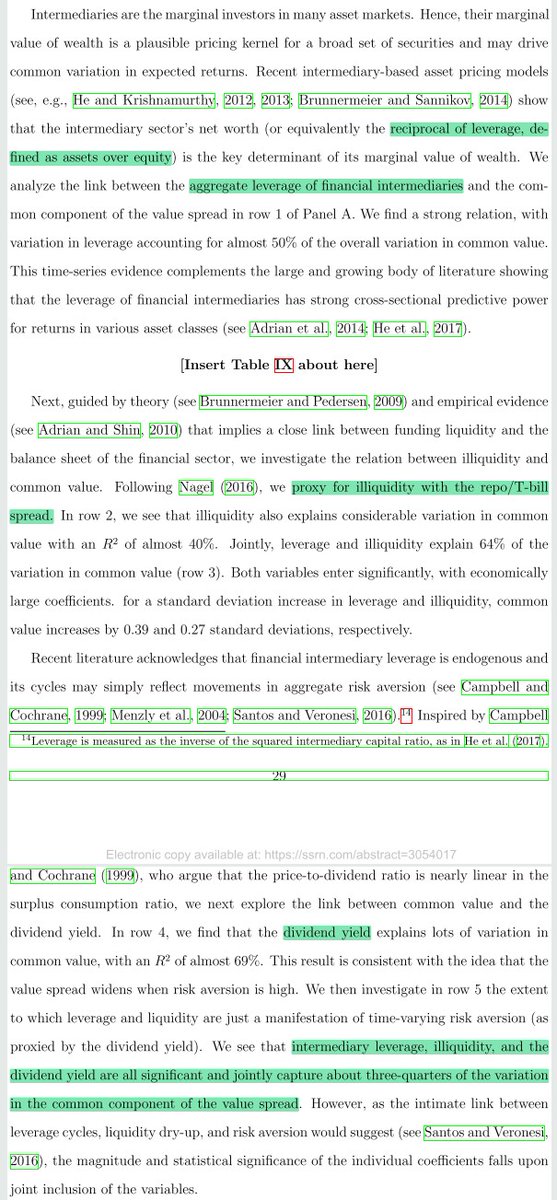

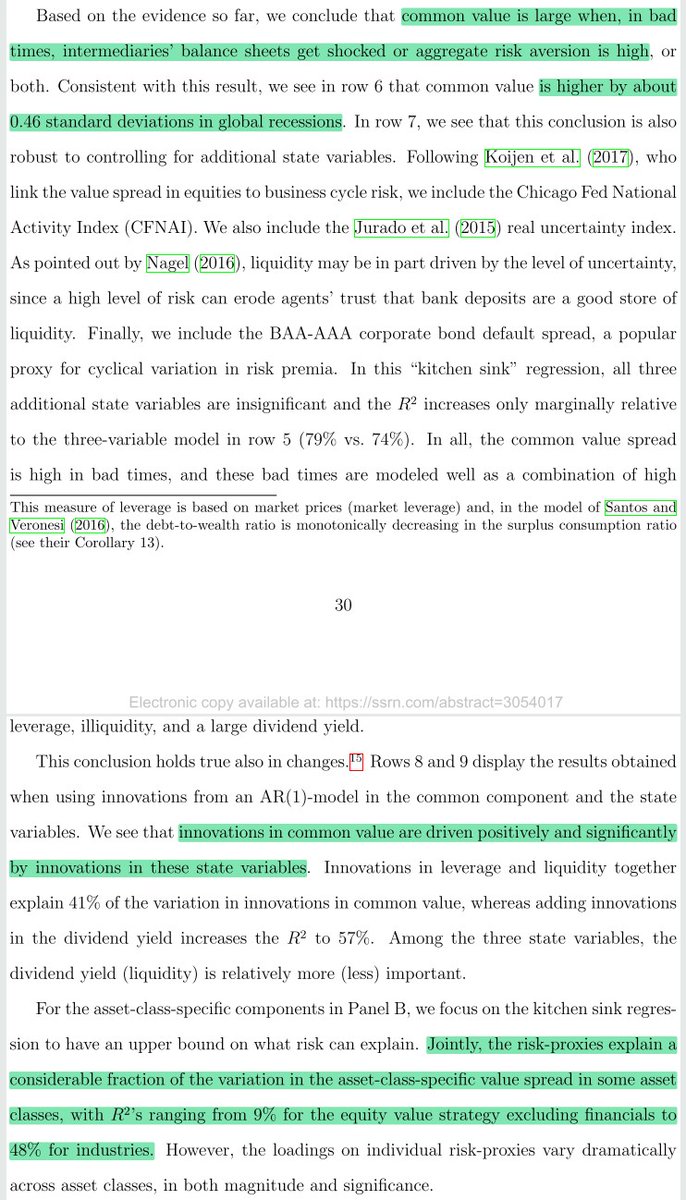

11/ "Common value is large when, in bad times, intermediaries' balance sheets get shocked or aggregate risk aversion is high.

"This conclusion holds true for changes as well: innovations in common value are driven positively by innovations in these state variables."

"This conclusion holds true for changes as well: innovations in common value are driven positively by innovations in these state variables."

12/ "We ask how much of the predictive ability of the common component of the value spread is captured by the part that is correlated with the risk proxies (the predicted value spread in the kitchen sink specification) and how much by the part that is orthogonal (the residual)."

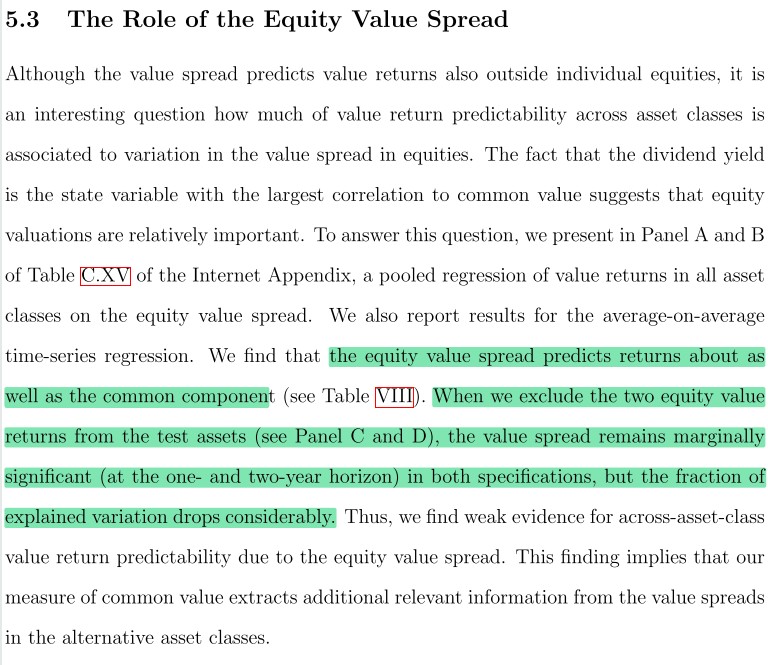

13/ "The equity value spread predicts returns about as well as the common component. When we exclude the two equity value returns from the test assets, the value spread remains marginally significant, but the fraction of explained variation drops considerably."

14/ "Common value is relatively more important in the recent subsample (post-1994). Common value is strongly associated with proxies for the risk of financial intermediaries, and financial intermediation has become progressively more important over time."

15/ "Common value return predictability suggests that expected value returns are countercyclical. Thus, the main source of common variation in value premia may be compensation for risk.

"On the contrary, both risk & mispricing contribute to the asset-class-specific components."

"On the contrary, both risk & mispricing contribute to the asset-class-specific components."

16/ Related research:

Will value survive its long winter?

Resurrecting the Value Premium

Factor Performance 2010-2019: A Lost Decade?

The Long Run Is Lying to You

Will value survive its long winter?

https://twitter.com/ReformedTrader/status/1304557723392962561

Resurrecting the Value Premium

https://twitter.com/ReformedTrader/status/1315820031729496064

Factor Performance 2010-2019: A Lost Decade?

https://twitter.com/ReformedTrader/status/1245559396714729473

The Long Run Is Lying to You

https://twitter.com/ReformedTrader/status/1370526212376850436

• • •

Missing some Tweet in this thread? You can try to

force a refresh