1/ For the past decade, 57-year old investor Bill Hwang (through his fund Archegos Capital) quietly built one of America's largest fortunes.

In late March, Archegos imploded and Hwang personally lost $8 billion over a 10-day span.

**$8B in 10 days**

Here's the insane story🧵

In late March, Archegos imploded and Hwang personally lost $8 billion over a 10-day span.

**$8B in 10 days**

Here's the insane story🧵

2/ Hwang is a true immigrant success tale.

Born Sung Kook Hwang, he moved from S. Korea to America as a child.

Hwang grew up in a religious household (father=pastor, mother=missionary) and to very modest means.

He taught himself English working night shifts at McDonald's.

Born Sung Kook Hwang, he moved from S. Korea to America as a child.

Hwang grew up in a religious household (father=pastor, mother=missionary) and to very modest means.

He taught himself English working night shifts at McDonald's.

3/ Hwang studied at UCLA in the 80s and his first job after graduation was as an equity salesman at Hyundai Securities.

While there, he met (and impressed) investing legend Julian Robertson, who ran Tiger Management hedge fund.

Robertson hired Hwang and taught him the ropes.

While there, he met (and impressed) investing legend Julian Robertson, who ran Tiger Management hedge fund.

Robertson hired Hwang and taught him the ropes.

4/ In 2001, Robertson staked Hwang with $1.2B to start Tiger Asia...an NY-based fund picking Asian stocks.

His investing style later came back to haunt him:

• owning only a handful of stocks

• targeting "heavily shorted" names

• using leverage to juice his returns

His investing style later came back to haunt him:

• owning only a handful of stocks

• targeting "heavily shorted" names

• using leverage to juice his returns

5/ For years, Hwang delivered the goods: notching 40-80% gains per annum..but then:

• 2008: despite managing an Asia fund, Hwang got badly burnt shorting Volkswagen (it jumped 348% in 2 days on a massive short squeeze)

• 2010: Investigated for a Chinese insider trading scheme

• 2008: despite managing an Asia fund, Hwang got badly burnt shorting Volkswagen (it jumped 348% in 2 days on a massive short squeeze)

• 2010: Investigated for a Chinese insider trading scheme

6/ In 2012, Hwang paid $44m to settle the Chinese insider trading scheme and closed his fund.

He returned money to investors and started Archegos Capital. Archegos is Greek for "leader" or "prince of Christ".

The fund (like his childhood) was religious w/ Friday Bible reads.

He returned money to investors and started Archegos Capital. Archegos is Greek for "leader" or "prince of Christ".

The fund (like his childhood) was religious w/ Friday Bible reads.

7/ Archegos began w/ $200m but grew quickly.

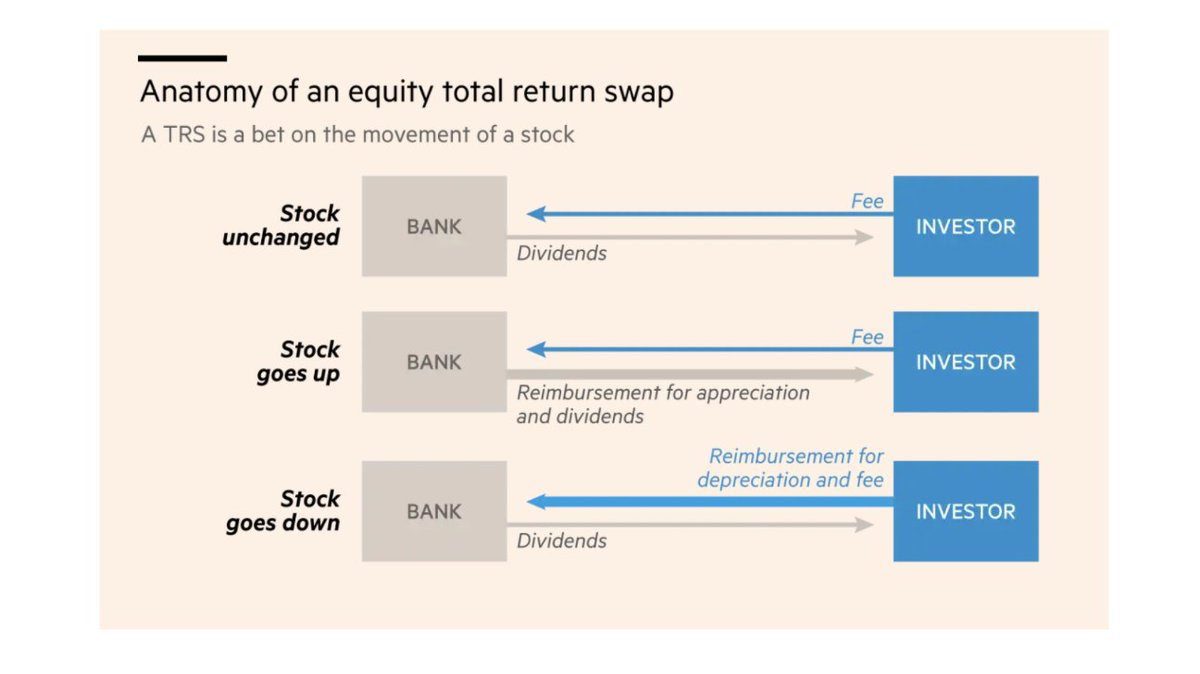

To juice returns, Hwang deployed a financial instrument known as a Total Return Swaps (TRS).

In exchange for a fee, he bet on the direction of a stock and gained exposure w/o paying full price (it effectively created 5x leverage)

To juice returns, Hwang deployed a financial instrument known as a Total Return Swaps (TRS).

In exchange for a fee, he bet on the direction of a stock and gained exposure w/o paying full price (it effectively created 5x leverage)

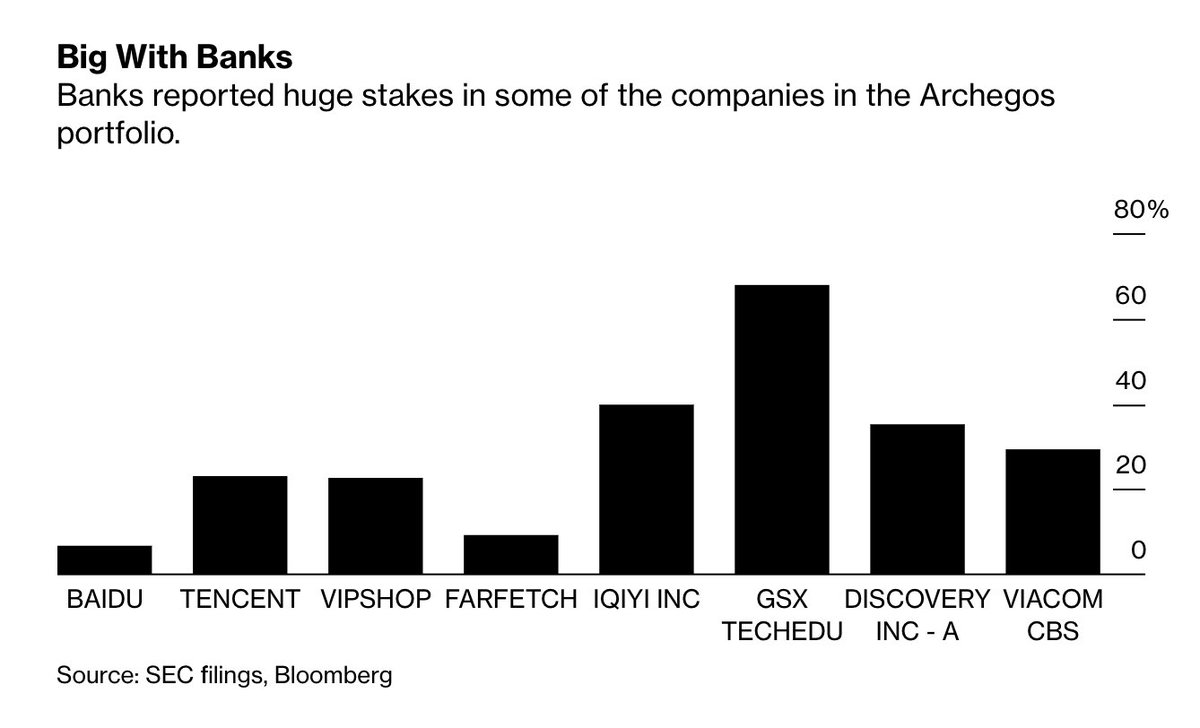

8/ By 2021, he was leaning on 6 prime broker bank partners for his TRSs: Goldman, Morgan Stanley, Credit Suisse, Nomura, Deutsche, UBS.

Despite the potential risks, the banks were happy to take fees from such a whale.

Without realizing it, they created a financial time bomb...

Despite the potential risks, the banks were happy to take fees from such a whale.

Without realizing it, they created a financial time bomb...

9/ Due to the nature of the swaps, the prime brokers built up massive long positions in Archegos portfolio companies.

(eg. The banks reported owning 68% of Chinese ed-tech GSX and 29% of ViacomCBS)

While Archegos portfolio swelled to $15-20B, it's total exposure was $100B+.

(eg. The banks reported owning 68% of Chinese ed-tech GSX and 29% of ViacomCBS)

While Archegos portfolio swelled to $15-20B, it's total exposure was $100B+.

10/ ViacomCBS was the trigger for Archegos' collapse.

From the TSRs, Hwang had a $10B stake in the media firm (its share price was up 8x in one year).

One Mar 22, Viacom announced a ~$3B secondary share sale. It led to a 20%+ selloff and put huge pressure on Hwang's portfolio.

From the TSRs, Hwang had a $10B stake in the media firm (its share price was up 8x in one year).

One Mar 22, Viacom announced a ~$3B secondary share sale. It led to a 20%+ selloff and put huge pressure on Hwang's portfolio.

11/ If a portfolio is levered 5x, it only takes a 15-20% sell-off to wipe an investor out.

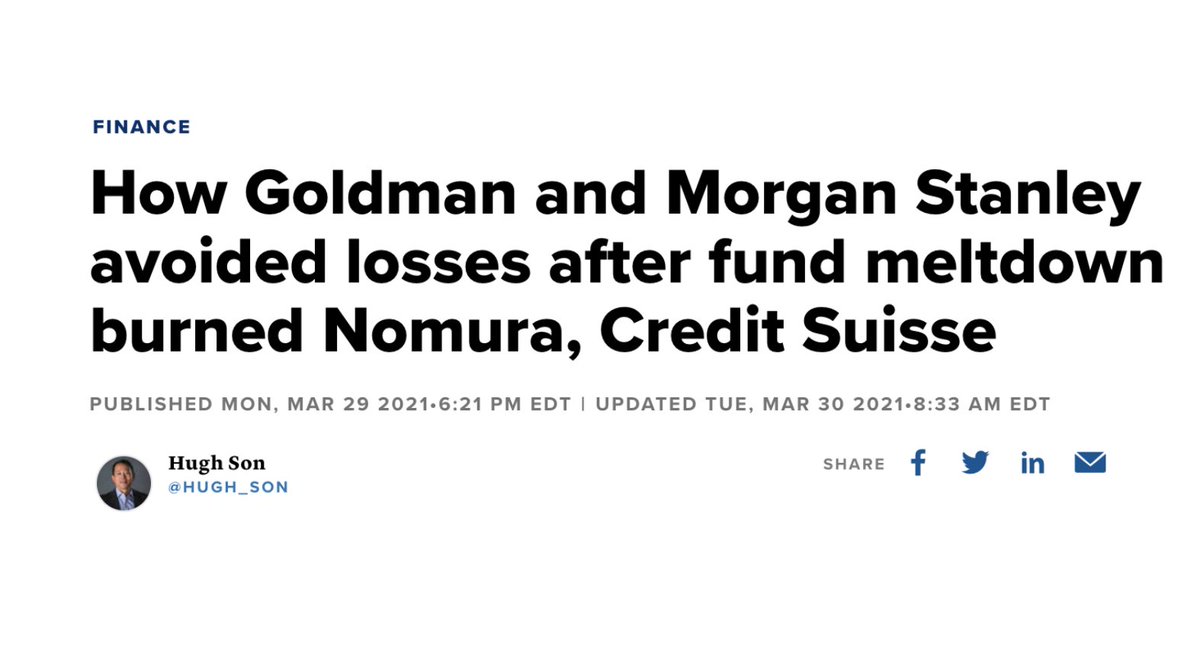

Hwang's banks met and discovered the scale of Archegos' scheme. They could work together to unwind the swaps...or beat each other to the exits.

GS and Morgan peaced the F out..

Hwang's banks met and discovered the scale of Archegos' scheme. They could work together to unwind the swaps...or beat each other to the exits.

GS and Morgan peaced the F out..

12/ This meme beautifully describes Goldman's plan for unwinding its Archegos TSRs:

https://twitter.com/KennethDredd/status/1378285887155408901?s=20

13/ On Mar 26, the banks exited the trades by selling large blocks of Archegos-linked companies ($20-30B in total).

ViacomCBS declined ~30% on the day.

Similar block sales in Shopify, Farfetch, Discovery and Chinese tech firms hammered the stocks.

ViacomCBS declined ~30% on the day.

Similar block sales in Shopify, Farfetch, Discovery and Chinese tech firms hammered the stocks.

14/ While Goldman got out in time, Nomura (-$2B) and Credit Suisse (-$3B) both took 9-figure losses.

Archegos saw $100B+ evaporate.

Hwang personally lost $8B in 10 days...some traders called it "the fastest loss of such a large sum they had ever seen."

Archegos saw $100B+ evaporate.

Hwang personally lost $8B in 10 days...some traders called it "the fastest loss of such a large sum they had ever seen."

https://twitter.com/novogratz/status/1376494161856172035?s=20

15/ The suddenness of the collapse is shining light on family offices.

While large pools of money like hedge funds, pensions and endowments are accountable to external parties, family offices operate in secret with few disclosure requirements.

While large pools of money like hedge funds, pensions and endowments are accountable to external parties, family offices operate in secret with few disclosure requirements.

https://twitter.com/TrungTPhan/status/1378415088588124163?s=20

16/ Even though Archegos looks to be contained, family offices (and the banks dealing with them) are prepping for new rules.

After the '08-09 crisis, Dodd-Frank tightened financial regulation.

Archegos could lead to the same for family offices, swaps and prime brokers...

After the '08-09 crisis, Dodd-Frank tightened financial regulation.

Archegos could lead to the same for family offices, swaps and prime brokers...

17/ Prior to the implosion, Hwang lived a modest life in Tenafly, NJ. He is an active philanthropist but largely unknown in the Wall Street scene.

88-year old Robertson (who has seeded the industry's top performers, known as "Tiger Cubs") says he'd still invest with Hwang.

88-year old Robertson (who has seeded the industry's top performers, known as "Tiger Cubs") says he'd still invest with Hwang.

18/ If you enjoyed this breakdown, smash that FOLLOW for other business gold: @TrungTPhan.

For a story about financial engineering that has lead to a POSITIVE outcome, check this thread:

For a story about financial engineering that has lead to a POSITIVE outcome, check this thread:

https://twitter.com/TrungTPhan/status/1358796623149555713?s=20

19/ Sources

NYT: nytimes.com/2021/04/03/bus…

WSJ:wsj.com/articles/insid…

FT:ft.com/content/c31983…

NYT: nytimes.com/2021/04/03/bus…

WSJ:wsj.com/articles/insid…

FT:ft.com/content/c31983…

https://twitter.com/TrungTPhan/status/1378457298054565889?s=20

20/ What’s absurd is that I just wrote about Lex Greensill’s blowup and said “this will be the biggest non-$GME finance scandal this year”.

Couldn’t even last a few weeks at the top of the financial shenanigans board:

Couldn’t even last a few weeks at the top of the financial shenanigans board:

https://twitter.com/trungtphan/status/1372282994845655043

21/ Here is a good explainer thread on TSRs.

They are widely used in the industry, but the way Archegos employed them were a bit sketch:

They are widely used in the industry, but the way Archegos employed them were a bit sketch:

https://twitter.com/macrocephalopod/status/1376431769138913284?s=20

22/ This thread makes the argument for why Archegos could be signalling a systemic issue...namely, banks seem to facilitating highly risky behaviour again without adequate controls in place:

https://twitter.com/INArteCarloDoss/status/1377227481330159619?s=20

23/ Finally, if you’ve made it this far.

Here are investments that did NOT blow up:

Here are investments that did NOT blow up:

https://twitter.com/trungtphan/status/1378008667451129856

• • •

Missing some Tweet in this thread? You can try to

force a refresh