Write on business with @workweekinc. Building a privacy-first AI research app @bearlyai.

153 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/bearlyai/status/2026008147748655255

18 million views jow, wild

18 million views jow, wild https://twitter.com/citrini7/status/2025653614430023864

On a related note, I wrote on how slot machines make $10B+ a year in Las Vegas (~70% of all casino gaming revenue).

On a related note, I wrote on how slot machines make $10B+ a year in Las Vegas (~70% of all casino gaming revenue).

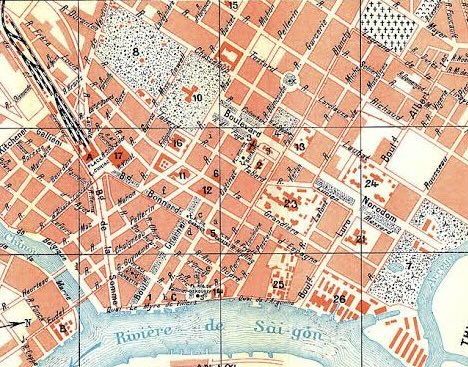

Haven’t lived in Saigon for 10+ years but ate a banh mi every other day when I did.

Haven’t lived in Saigon for 10+ years but ate a banh mi every other day when I did.

The research team is happy to announce that we’ve played our part contributing to Anguilla’s windfall.

The research team is happy to announce that we’ve played our part contributing to Anguilla’s windfall.

Totally forgot Lou Pai got the stripper pregnant.

Totally forgot Lou Pai got the stripper pregnant.

Sorry, called “Deckster”. That excerpt was from this BI piece that also looked at McKinsey and Deloitte AI uses: businessinsider.com/consulting-ai-…

Sorry, called “Deckster”. That excerpt was from this BI piece that also looked at McKinsey and Deloitte AI uses: businessinsider.com/consulting-ai-…

2/ Lynch on ideas

2/ Lynch on ideas https://twitter.com/patrick_oshag/status/1880073459864351151

https://twitter.com/dexerto/status/1836510230378602946

If you are the person that did the un-aligned letters for the previous eBay logo, please contact the research app team. We are huge fans of how un-aligned the “e” is with the “y”.Bearly.AI

If you are the person that did the un-aligned letters for the previous eBay logo, please contact the research app team. We are huge fans of how un-aligned the “e” is with the “y”.Bearly.AI

Anyway, here is something I wrote about Costco’s $9B+ clothing business my affinity for Kirkland-branded socks and Puma gym shirts. readtrung.com/p/costcos-9b-c…

Anyway, here is something I wrote about Costco’s $9B+ clothing business my affinity for Kirkland-branded socks and Puma gym shirts. readtrung.com/p/costcos-9b-c…

Here’s the rest of the post (perfectly formatted to show up in the feed as a shitpost): linkedin.com/feed/update/ur…

Here’s the rest of the post (perfectly formatted to show up in the feed as a shitpost): linkedin.com/feed/update/ur…

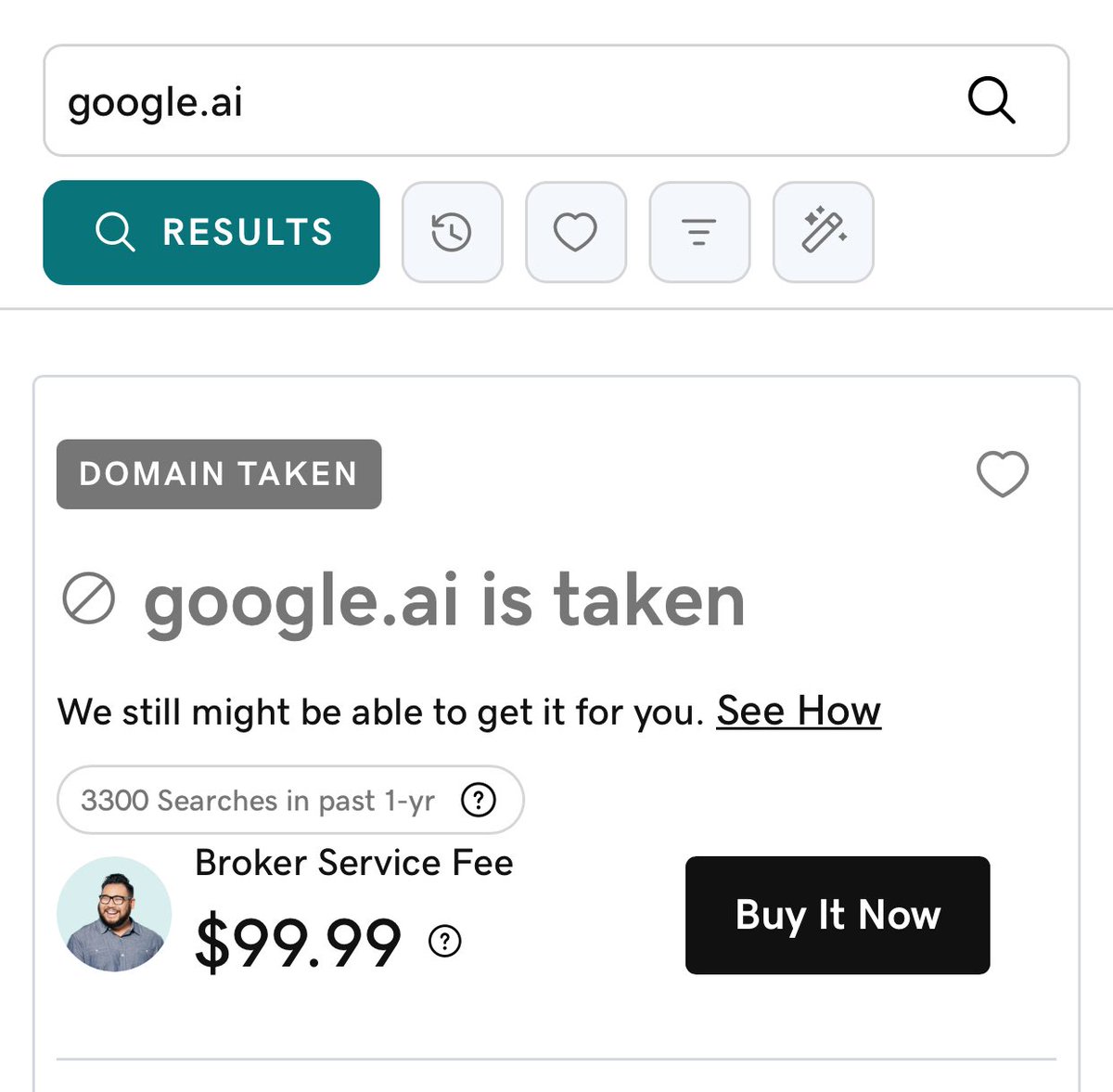

It is actually an interesting deck. Just the thought of a 20-year old newly grad getting billed at an obscene rate to say”rats get to garbage” is kinda funny

It is actually an interesting deck. Just the thought of a 20-year old newly grad getting billed at an obscene rate to say”rats get to garbage” is kinda funny

Obstacles from abundance of solar: economist.com/interactive/es…

Obstacles from abundance of solar: economist.com/interactive/es…