Here is a thread on an Indian Software Product company which is competing with global companies and winning deals against them. Name of the company is Intellect Design Arena #IntellectDesignArena #IDA (1/n)

IDA was of part of the Polaris Consulting & Services Ltd., demerged and listed separately in 2014. Arun Jain, a serial entrepreneur who founded Nucleus software in 1986 and Polaris in 1993 (2/n)

After selling Polaris to Virtusha Corporation, shifted his complete focus to IDA. He has deep domain expertise in BFSI (Banking, Financial Service & Insurance) (3/n)

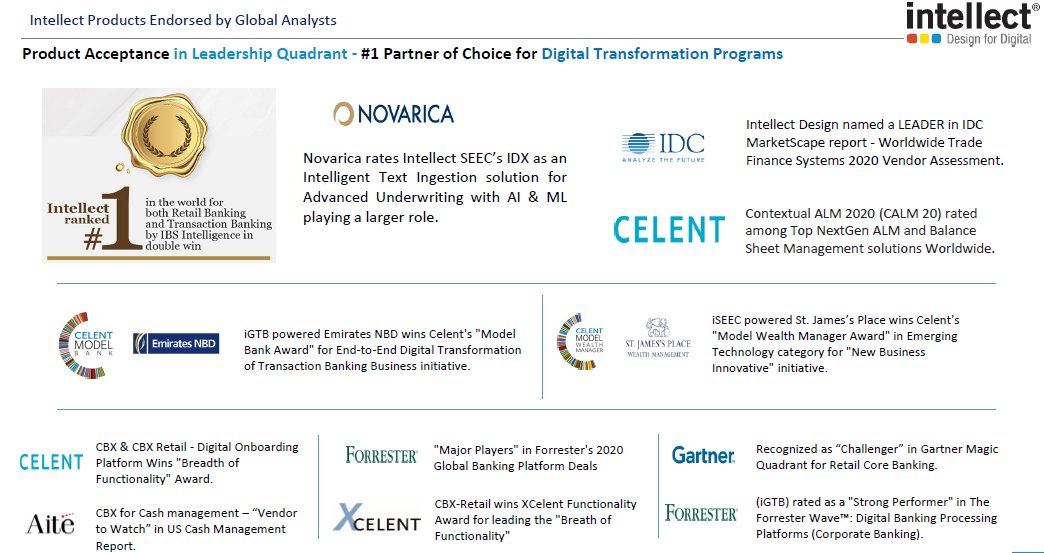

IDA over last few years has built world class products in BFSI segments. They cumulatively spent 1200cr approx for developing the Software products and 1500cr approx on Sales and Marketing. Their products are now top rated by various analysts(likes of Gartner, Noverica etc) (4/n)

Before going to the details of their products, let us understand how they earn revenues and who pays them. Their customers are Banks, Financial service companies and Insurance companies for providing software to efficiently run their operations (5/n)

IDA has 4 revenue segments, they sell their products in two ways

1.License

2.SaaS (Software as a Service) (6/n)

1.License

2.SaaS (Software as a Service) (6/n)

In license model, they sell their product for upfront license fee and collect AMC (Annual Maintenance Charges) every year.

In SaaS (also called as cloud subscription) model they sell products for monthly or annual subscription (7/n)

In SaaS (also called as cloud subscription) model they sell products for monthly or annual subscription (7/n)

SaaS revenue has both fixed and variable parts. Fixed part is a subscription fee and variable part depends on cloud usage, for example each time an Insurance company extracts data from cloud they pay certain amount depends on data packets (8/n)

Final segment of the revenue is Implementation fee paid by customers for implementing the software for ready use by customer (9/n)

So here are the 4 segments of revenue

1.License fee (upfront and one time)

2.AMC (recurring)

3.SaaS / Subscription fee (recurring)

4.Implementation fee (one time)

Clubbing first 3 segments is called as License linked revenue (10/n)

1.License fee (upfront and one time)

2.AMC (recurring)

3.SaaS / Subscription fee (recurring)

4.Implementation fee (one time)

Clubbing first 3 segments is called as License linked revenue (10/n)

As IDA is software product company, not a service company, License linked revenue as a percentage of total revenue is increasing continuously over the past few years (11/n)

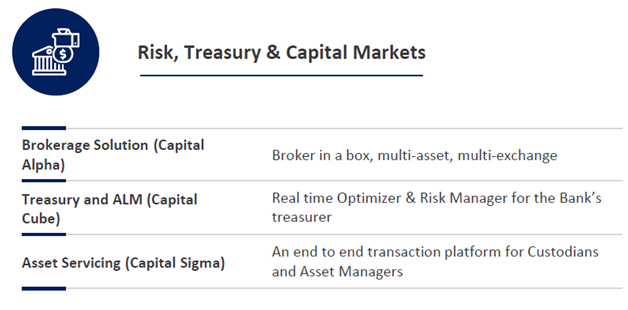

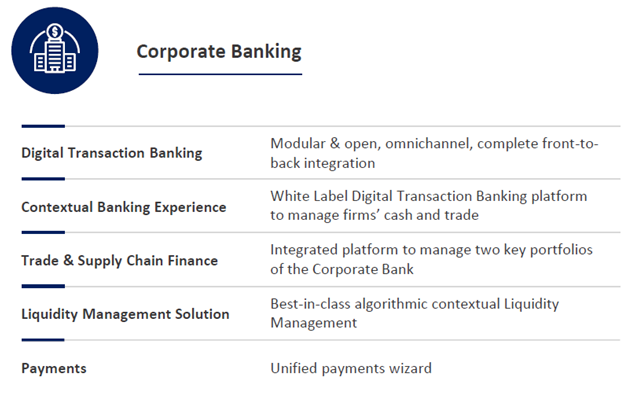

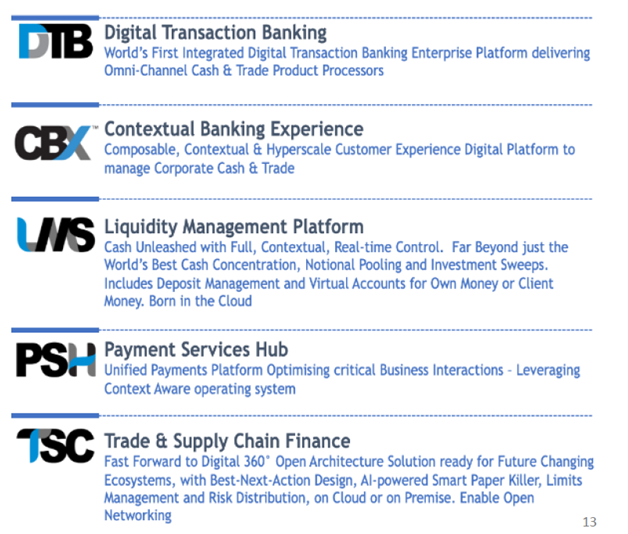

Now lets see the products of IDA. There are total 12 products which are classified under 4 segments (12/n)

1st Segment is Corporate Banking or Global Transaction Banking (iGTB). Under this segment there are 5 products (13/n)

2nd Segment is Retail Banking or Global Consumer Banking (iGCB). Under this segment there are 4 products. One product (CBX) is common for both corporate banking & retail banking (14/n)

4th Segment is Insurance (iSEEC). It is the most interesting segment and has huge scope. It is a complete SaaS based solution. IDA has developed platform called iTurmeric which integrates the data from different cloud data sources, verifies the data (16/n)

and presents in a contextual format (magic submission) using Artificial Intelligence and Machine Learning. This technology (Big Data) can be leveraged beyond Insurance segment and has far bigger potential.(Big data is $200bn market, US Insurance IT spends are about $1.6bn)(17/n)

Apart form above mentioned 4 segments of products, IDA has another small & niche segment iGov. Under this segment IDA is providing back office service for Indian gov’s GEM (Government E-Marketplace). Indian government drastically increasing the procurements through GEM (18/n)

IDA revenues are linked to GMV of procurements. There is high operating leverage in this segment, however management is reluctant to give further details of this business, May be they will share once this segment reaches critical mass (19/n)

A lot of reading (ARs and Con calls) needed to get a sense of IDA products and their technology. IDA recently conducted Technology day webinar explaining technology behind their products. Her is the link to the video (20/n)

Now lets look at why Banks opt IDA products and How IDA is competing with international software products companies.

1.Product Superiority: IDA products are cloud native and built on advanced architecture compared to products of the competitors (21/n)

1.Product Superiority: IDA products are cloud native and built on advanced architecture compared to products of the competitors (21/n)

2.Implementation Cycle: IDA is able reduce the implementation and achieved lowest cycle in the industry which makes it cost effective compared to competitors

3. Domain Expertise: IDA products are built on superior domain expertise of BFSI segment (22/n)

3. Domain Expertise: IDA products are built on superior domain expertise of BFSI segment (22/n)

4. One Stop Vendor: IDA is one stop solution for complete banking needs. Many competitors of IDA are present in one of few products where as IDA has offerings in all the segments. This will help IDA is cross-selling the products (23/n)

5. Customer References: Customer references play important role in brand building. Customers of IDA promotes the products of IDA by giving highest ratings (32 customers has given average 4.4 rating for IDA's retail core banking, highest among the peers)(24/n)

6. Analyst Ratings: Analyst ratings are crucial for the success of the software products. IDA has got various awards and top rakings form various industry analysts like Gartner and Noverica etc. (25/n)

• • •

Missing some Tweet in this thread? You can try to

force a refresh